Market Definition

The market refers to the industry focused on technologies designed to prevent unauthorized vehicle access, use, or theft. It includes physical devices like steering locks and alarms, as well as advanced electronic and cybersecurity systems such as immobilizers, GPS tracking, biometric authentication, and anti-hacking software, all aimed at enhancing vehicle security and reducing theft incidents.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Vehicle Anti Theft System Market Overview

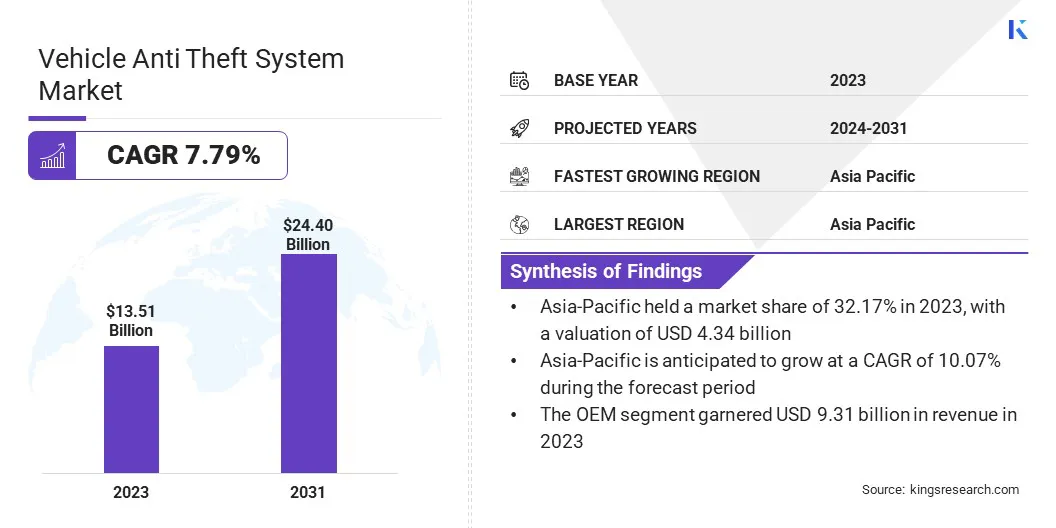

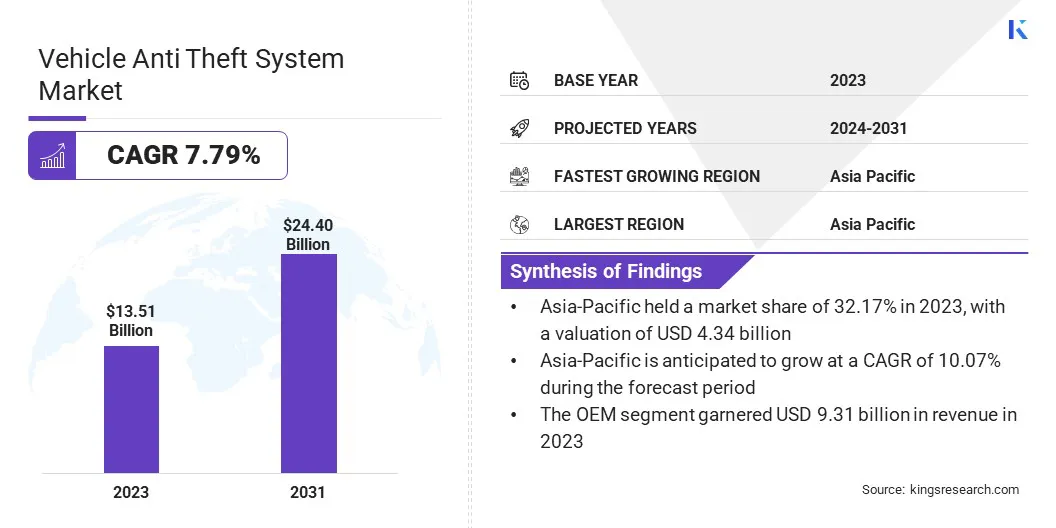

Global vehicle anti theft System Market size was valued at USD 13.51 billion in 2023, which is estimated to be valued at USD 14.44 billion in 2024 and reach USD 24.40 billion by 2031, growing at a CAGR of 7.79% from 2024 to 2031.

Advancements in biometric technology, particularly facial and eye recognition, are driving the growth of the market by offering more precise, secure, and tamper-proof security features for vehicles.

Major companies operating in the vehicle anti theft System industry are Continental Engineering Services, Asahi Denso Co., Ltd., Robert Bosch GmbH, AUTHOR, VOXX Electronics, TOGO, Monimoto, UAB, Onelap Telematics Pvt. Ltd., Rolls-Royce Motor Cars, TELTONIKA, Visage Technologies, BMW AG, KIA MOTORS, HYUNDAI MOTOR COMPANY, and RAVELCO.

The market is growing rapidly, driven by the increasing incidence of vehicle theft, the rise of connected and smart vehicles, and the implementation of global cybersecurity regulations.

As reported by the National Highway Traffic Safety Administration, over 850,000 vehicles are expected to be stolen in the United States in 2024. As vehicles become more software-dependent, there is a rising demand for integrated security technologies that protect against both physical intrusion and cyber threats throughout the entire vehicle lifecycle.

- In January 2024, Panasonic expanded its VERZEUSE series, offering advanced cybersecurity solutions across the entire vehicle lifecycle. This expansion aimed to address rising threats in connected and autonomous vehicles by integrating real-time threat detection, secure OTA updates, and end-to-end encryption.

Key Highlights

- The Vehicle anti theft System market size was recorded at USD 13.51 billion in 2023.

- The market is projected to grow at a CAGR of 7.79% from 2024 to 2031.

- Asia Pacific held a market share of 32.17% in 2023, with a valuation of USD 4.34 billion.

- The immobilizer segment garnered USD 3.34 billion in revenue in 2023.

- The automotive biometric technology segment is expected to reach USD 6.82 billion by 2031.

- The passenger car segment had a market of 58.32% in 2023.

- The aftermarket segment is anticipated to grow at a CAGR of 13% during the forecast period.

- North America is anticipated to grow at a CAGR of 6.26% during the forecast period.

Market Driver

Advancements in Biometric Technology

The increasing reliance on advanced biometric technologies, such as facial and eye recognition systems, is transforming vehicle security. These innovations offer higher levels of accuracy and personalization in authentication, making it harder to bypass traditional security measures.

By integrating biometric solutions, vehicles can ensure that only authorized individuals gain access, significantly reducing the risk of theft. As consumer demand for robust security features grows, the implementation of biometric technology is becoming a key driver in the vehicle anti theft system market.

- In April 2023, BMW Motorrad introduced BMW iFace, the world’s first integrated face and eye recognition system for motorcycles, enhancing biometric theft protection. It is developed with leading ophthalmology experts to offer advanced rider authentication and theft deterrence.

Market Challenge

False Alarms and System Reliability

False alarms and system reliability remain significant challenges in the vehicle anti-theft system market. Frequent false alerts or system malfunctions can lead to user dissatisfaction and reduced trust in the technology.

To address this, manufacturers are investing in robust testing, advanced AI algorithms, and adaptive learning systems that improve accuracy over time. Enhanced user interfaces for quick control and customization can also reduce inconvenience, improving consumer confidence and overall system performance.

Market Trend

Investment in Aftermarket Anti-Theft Solutions

Increased investment in aftermarket anti-theft solutions has emerged as a significant trend in the market. As older vehicle models lack advanced built-in security systems, OEMs and third-party providers are focusing on developing retrofit devices to bridge this technological gap.

These solutions extend protection to legacy vehicles and demonstrate a proactive response to evolving theft techniques. This trend reflects growing industry recognition of the need to secure the entire vehicle ecosystem, enhancing consumer confidence and broadening market reach.

- In December 2023, Kia America introduced a theft deterrent ignition cylinder protector for models ineligible for prior software upgrades. This physical anti-theft solution was developed in response to increasing vehicle thefts targeting older models lacking immobilizer systems.

Vehicle Anti Theft System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Steering Lock, Alarm, Biometric Capture Device, Immobilizer, Remote Keyless Entry, Central Locking

|

|

By Technology

|

Global Positioning System (GPS), Global System for Communication (GSM), Face Detection System, Global Radio Frequency Identification, Real Time Location System (RTLS), Automotive Biometric Technology

|

|

By Vehicle Type

|

Passenger Car, Commercial Vehicle, Off-Highway Vehicle

|

|

By Sales Channel

|

OEM, Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Steering Lock, Alarm, Biometric Capture Device, Immobilizer, Remote Keyless Entry, Central Locking): The immobilizer segment earned USD 3.34 billion in 2023 driven by increased vehicle theft incidents and growing adoption of embedded engine-lock technologies across OEM models worldwide.

- By Technology [Global Positioning System (GPS), Global System for Communication (GSM), Face Detection System, Global Radio Frequency Identification, Real Time Location System (RTLS), Automotive Biometric Technology]: The automotive biometric technology segment held 23.54% of the market in 2023, due to rising demand for advanced driver authentication systems offering enhanced, user-specific anti-theft security solutions.

- By Vehicle Type (Passenger Car, Commercial Vehicle, Off-Highway Vehicle): The passenger car segment is projected to reach USD 13.84 billion by 2031, fueled by mass production, urban vehicle ownership rise, and emphasis on integrated in-vehicle security systems.

- By Sales Channel (OEM, Aftermarket): The aftermarket segment is anticipated to have a CAGR of 8.13% during the forecast period, and is gaining momentum as consumers seek affordable, retrofittable anti-theft devices for aging vehicle fleets lacking OEM systems.

Vehicle Anti Theft System Market Regional Analysis

Based on region, the global anti theft system market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific anti theft system share stood around 32.17% in 2023 in the global market, with a valuation of USD 4.34 million. The Asia Pacific region is dominating the vehicle anti theft system market due to rapid urbanization, increasing vehicle ownership, and heightened awareness of vehicle security.

The region's growing demand for advanced safety technologies, combined with the expansion of the automotive industry, further drives market growth. Additionally, increasing disposable incomes, rising theft rates, and a shift towards more sophisticated security solutions contribute to the region's leadership in adopting innovative anti-theft technologies.

- In November 2024, AVL Software and Functions partnered with PlaxidityX, an Israeli company to integrate advanced in-vehicle cyber protection into ECU systems. The collaboration focuses on embedding AI-driven threat detection and response mechanisms directly within vehicle control units to ensure real-time cybersecurity.

Middle East & Africa is poised for significant growth at a robust CAGR of 9.21% over the forecast period. The Middle East & Africa region is emerging as a rapidly growing market for vehicle anti theft system industry, driven by increasing vehicle ownership, rising concerns over automotive security, and growing investments in smart transportation infrastructure.

Growing enforcement of vehicle safety regulations, along with rising consumer awareness of advanced anti-theft technologies, is further driving the market. The rise of premium and connected vehicles is boosting demand for biometric and IoT-based security systems, making the region a key growth area in the global anti theft system market.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) mandates vehicle security systems, including anti-theft mechanisms, to comply with established safety and quality standards. These regulations ensure that all vehicles meet the required security criteria, enhancing protection against theft and promoting the safety of consumers.

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) establishes guidelines and safety standards for vehicle security systems, ensuring that manufacturers comply with regulations to enhance safety features and reduce theft risks across all vehicles.

- In the EU, UN Regulation No. 163 establishes uniform provisions for the approval of vehicle alarm systems, ensuring that vehicles meet specific safety standards regarding their alarm systems. This regulation aims to enhance vehicle security and reduce theft by setting clear criteria for alarm system effectiveness.

Competitive Landscape

Companies in the vehicle anti-theft system market are increasingly focusing on developing advanced technologies such as biometric authentication, GPS tracking, and smart keyless entry systems to enhance vehicle security. Key players are integrating artificial intelligence and machine learning to detect unusual activities and prevent theft.

They are also collaborating with automotive manufacturers to offer seamless and robust security solutions. Additionally, there is a significant push toward incorporating software-based upgrades to address evolving security threats and regulatory requirements.

- In April 2024, Continental introduced its CoSmA smart device-based access system for vehicles, allowing smartphones and smartwatches to function as digital car keys. This technology ensures secure, hands-free vehicle access with ultra-wideband (UWB) technology, providing precise location tracking and preventing unauthorized use, thus enhancing vehicle security and safety. This innovative solution highlights Continental's commitment to advancing digital automotive technologies and improving vehicle anti-theft systems.

List of Key Companies in Vehicle Anti Theft System Market:

- Continental Engineering Services

- Asahi Denso Co., Ltd.

- Robert Bosch GmbH

- AUTHOR

- VOXX Electronics

- TOGO

- Monimoto, UAB

- Onelap Telematics Pvt. Ltd.

- Rolls-Royce Motor Cars

- TELTONIKA

- Visage Technologies

- BMW AG

- KIA MOTORS

- HYUNDAI MOTOR COMPANY

- RAVELCO

Recent Developments (Partnerships/Product Launch)

- In January 2024, Continental unveiled the "Face Authentication Display," integrating biometric facial recognition for secure vehicle access. The system ensures safe vehicle unlocking and digital payments using cameras mounted invisibly behind the driver display and on the B-pillar. The advanced liveness detection prevents fraud, enhancing vehicle security and user convenience with a seamless design.

- In February 2023, Continental and trinamiX introduced the Driver Identification Display, a world-first biometric solution that prevents car theft by authenticating the driver via facial recognition. In addition to enhancing vehicle security, the system enhances security and convenience by enabling secure digital payments and monitoring driver attention, setting new standards for automotive security and user experience.

, the system ensures safe vehicle unlocking and digital payments