Market Definition

The market encompasses the global ecosystem of medical devices, suppliers, and healthcare providers involved in the development, manufacturing, distribution, and clinical use of stents designed to treat vascular conditions.

This includes coronary, peripheral, and neurovascular segments across hospital settings, ambulatory surgical centers, and specialty clinics, covering bare-metal, drug-eluting, and bioresorbable stent technologies. The report offers a thorough assessment of the main factors driving market expansion, along with a detailed regional analysis and the competitive landscape influencing industry dynamics.

Vascular Stent Market Overview

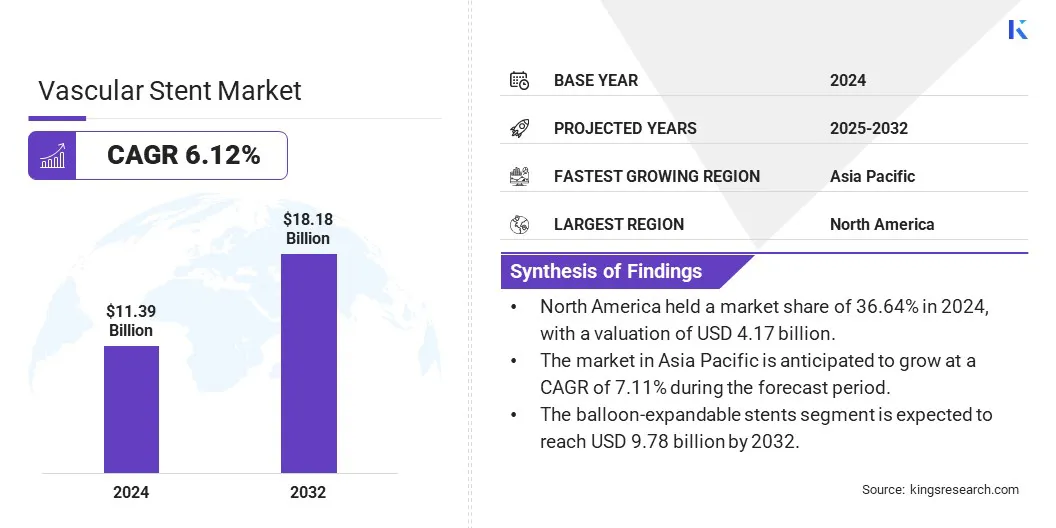

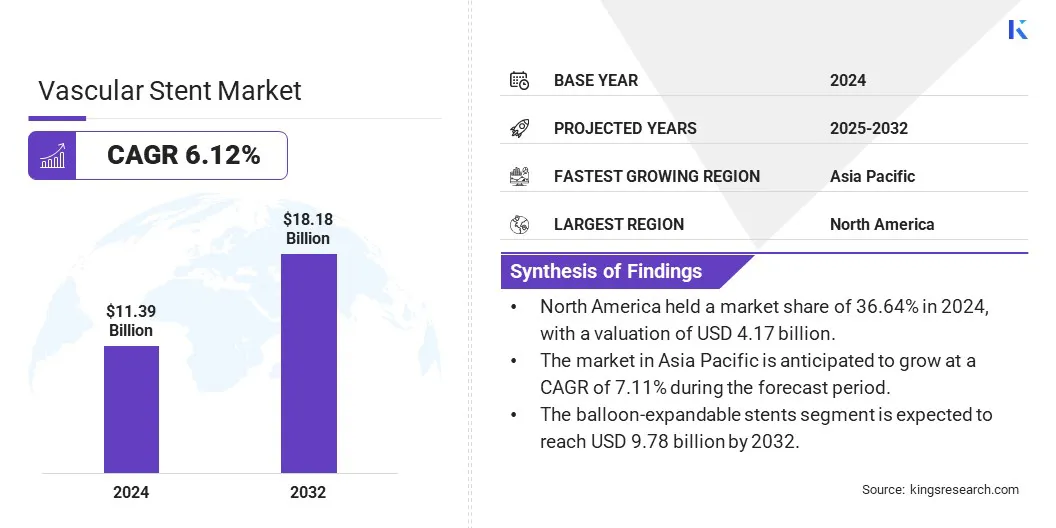

The global vascular stent market size was valued at USD 11.39 billion in 2024 and is projected to grow from USD 12.00 billion in 2025 to USD 18.18 billion by 2032, exhibiting a CAGR of 6.12% during the forecast period.

The market continues to expand, driven by the rising prevalence of cardiovascular diseases, the growing aging population, and the increasing adoption of minimally invasive procedures. Technological advancements, including the development of bioresorbable and drug-eluting stents, are enhancing clinical outcomes and expanding their application. Improved diagnostic capabilities and growing awareness of early intervention further support market expansion.

Major companies operating in the vascular stent industry are Abbott, Medtronic, Boston Scientific Corporation, Terumo Europe NV, B. Braun SE, Biotronik, MicroPort Scientific Corporation, Cook, BD, W. L. Gore & Associates, Inc., Cordis, Lepu Medical Technology(Beijing)Co.,Ltd., Koninklijke Philips N.V., Biosensors International Group, Ltd., and Artivion, Inc.

Additionally, innovations in advanced stent-graft systems provide precise placement, improved sealing, and adaptability to complex anatomies. These advancements enhance long-term outcomes and reduce complications, boosting adoption and addressing the increasing demand for safe and effective vascular treatments.

- In August 2024, Terumo India launched the TREO Abdominal Stent-Graft System, an advanced endovascular solution for treating infrarenal abdominal aortic aneurysms. The device offers both suprarenal and infrarenal active fixation and features a three-piece design with in situ limb adjustability. Designed for anatomical precision and long-term performance, TREO provides enhanced proximal sealing, robust fixation, and adaptability to complex anatomies.

Key Highlights

- The vascular stent market size was valued at USD 11.39 billion in 2024.

- The market is projected to grow at a CAGR of 6.12% from 2025 to 2032.

- North America held a market share of 36.64% in 2024, with a valuation of USD 4.17 billion.

- The coronary stents segment garnered USD 5.53 billion in revenue in 2024.

- The drug-eluting stents (DES) segment is expected to reach USD 7.88 billion by 2032.

- The balloon-expandable stents segment is expected to reach USD 9.78 billion by 2032.

- The hospitals segment is expected to reach USD 6.84 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.11% during the forecast period.

Market Driver

Advancements in Stent Technology Enhancing Treatment of Complex Vascular Conditions

The market is witnessing significant growth driven by continuous product innovations, particularly in the design of stents tailored for complex venous anatomies.

Advancements such as the integration of hybrid and extendable stent systems are expanding the clinical applicability of vascular stents, enabling more precise and effective treatment of conditions like venous outflow obstruction. These innovative designs enhance flexibility, support varied anatomical structures, and improve long-term clinical outcomes.

As manufacturers focus on engineering stents that combine durability, adaptability, and performance, the market is expected to benefit from rising demand for next-generation vascular intervention solutions.

- In June 2024, Philips launched the Duo Venous Stent System following U.S. FDA premarket approval. The system is designed to treat the symptomatic venous outflow obstruction in patients with chronic venous insufficiency (CVI). The device combines two stents, Duo Hybrid and Duo Extend, to address complex venous anatomies and enhance treatment outcomes.

Market Challenge

Challenge of Biocompatibility and Inflammatory Responses in Vascular Stents

A significant challenge in the vascular stent market is managing biocompatibility issues that can trigger the body's immune system, which leads to inflammation around the stent. This inflammation can cause complications such as the blood vessel re-narrowing or the formation of blood clots.

These issues often result in the need for additional treatments or procedures, reducing the long-term success of stent implantations and negatively impacting patient outcomes. To address this challenge, research is focused on developing advanced stent coatings and materials that reduce immune reactions and promote smoother healing of the vessel wall.

Innovations like drug-releasing coatings and biodegradable materials aim to lower inflammation and prevent complications, improving the safety and effectiveness of vascular stents.

Market Trend

Innovative Covered Stents Enhancing Treatment Outcomes and Accessibility

The market is witnessing a growing trend toward the adoption of cost-effective covered stent solutions aimed at improving accessibility and treatment outcomes in peripheral vascular diseases. These stents enhance safety by creating a protective barrier that reduces the re-narrowing of blood vessels and complications, ensuring long-term vessel openness and durability.

Along with affordability, there is an increasing focus on developing specialized covered stents for treating complex narrowing and blockages, further improving clinical effectiveness. This combined focus on affordability and innovative design is fueling market growth by providing better treatment options for a wide range of patients while helping them control healthcare expenses worldwide.

- In January 2025, Bentley launched the BeFlow iliac covered stent system, designed to treat iliac occlusive and stenotic diseases with enhanced safety, long-term patency, and durability. The device offers a cost-effective covered stent solution, aimed at improving outcomes for patients with complex aorto-iliac occlusive disease, complementing Bentley’s existing peripheral vascular portfolio.

Vascular Stent Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Coronary Stents, Peripheral Stents, Endovascular Aortic Repair (EVAR) Stent Grafts

|

|

By Technology

|

Drug-eluting Stents (DES), Bare-metal Stents (BMS), Covered Stents, Bioresorbable Stents (BRS)

|

|

By Mode of Delivery

|

Balloon-expandable Stents, Self-expanding Stents

|

|

By End User

|

Hospitals, Cardiac Centers, Ambulatory Surgery Centers (ASCs), Catheterization Labs (Cath Labs)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Coronary Stents, Peripheral Stents and Endovascular Aortic Repair (EVAR) Stent Grafts): The coronary stents segment earned USD 5.53 billion in 2024, owing to the high prevalence of coronary artery diseases and the widespread use of stents in percutaneous coronary interventions.

- By Technology (Drug-eluting Stents (DES), Bare-metal Stents (BMS), Covered Stents, and Bioresorbable Stents (BRS)): The drug-eluting stents (DES) segment held 42.33% of the market in 2024, due to their superior efficacy in reducing restenosis and a growing preference for advanced stent technologies.

- By Mode of Delivery (Balloon-expandable Stents and Self-expanding Stents): The balloon-expandable stents segment is projected to reach USD 9.78 billion by 2032, on account of their precision placement capabilities and strong clinical outcomes in complex vascular procedures.

- By End User (Hospitals, Cardiac Centers, Ambulatory Surgery Centers (ASCs) and Catheterization Labs (Cath Labs): The hospitals segment is projected to reach USD 6.84 billion by 2032, due to the high volume of cardiovascular procedures performed in hospital settings and the availability of advanced infrastructure.

Vascular Stent Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America vascular stent market accounted for a substantial market share of 36.64% in 2024 in the global market, with a valuation of USD 4.17 billion. This dominance is largely attributed to the high burden of cardiovascular diseases in the U.S., where sedentary lifestyles, obesity, and diabetes are prevalent.

A strong presence of leading medical device manufacturers, coupled with robust clinical research infrastructure and the early adoption of next-generation stent technologies, has significantly fueled market growth.

Additionally, the widespread availability of catheterization labs and advanced interventional cardiology services in both urban and suburban healthcare systems has ensured broad patient access to vascular procedures.

- In October 2024, the U.S. Centers for Disease Control and Prevention (CDC) reported heart disease as the leading cause of death in the United States, accounting for 1 in 5 deaths in 2022, including 371,506 from coronary artery disease.

The vascular stent industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 7.11% over the forecast period. The growth in Asia Pacific is fueled by the rising awareness of cardiovascular health and a shift toward less invasive treatment options.

Expanding urban populations and improved healthcare accessibility are enabling more patients to undergo timely vascular procedures. Furthermore, on-going skill development for interventional cardiologists and strengthened partnerships between global and regional device manufacturers are enhancing treatment outcomes.

The region’s varied patient profiles and continuously advancing healthcare systems are driving strong demand across multiple stent types, fostering sustained market growth.

Regulatory Frameworks

- In the U.S., the regulatory authority for vascular stents is the Food and Drug Administration (FDA). The FDA ensures the safety and effectiveness of medical devices, including vascular stents, through a pre-market approval process.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) is the regulatory body responsible for overseeing the approval and post-marketing surveillance of vascular stents and other medical devices.

- In India, the Central Drugs Standard Control Organisation (CDSCO) is the regulatory authority for medical devices, including vascular stents, and is responsible for regulating their import, production, and sale.

Competitive Landscape

The vascular stent market is characterized by key players adopting diverse strategies to strengthen their positions. Innovation is a primary focus, with companies investing heavily in developing advanced stent technologies that offer improved safety and efficacy.

Strategic alliances with healthcare institutions and research organizations help in accelerating product development and clinical adoption. Expanding presence in emerging markets through local manufacturing and tailored distribution networks is also a common approach.

Additionally, mergers and acquisitions are frequently used to enhance product portfolios and gain a competitive advantage. Companies also emphasize on extensive clinical trials and regulatory approvals to validate the effectiveness of their products and facilitate faster market entry.

- In March 2025, Abbott initiated a clinical trial under FDA IDE approval to evaluate its Coronary Intravascular Lithotripsy (IVL) System for treating severe calcification in coronary artery disease, aiming to enhance vessel preparation before stenting.

List of Key Companies in Vascular Stent Market:

- Abbott

- Medtronic

- Boston Scientific Corporation

- Terumo Europe NV

- B. Braun SE

- Biotronik

- MicroPort Scientific Corporation

- Cook

- BD

- W. L. Gore & Associates, Inc.

- Cordis

- Lepu Medical Technology(Beijing)Co.,Ltd.

- Koninklijke Philips N.V.

- Biosensors International Group, Ltd.

- Artivion, Inc

Recent Developments (Acquisition)

- In February 2025, Teleflex agreed to acquire BIOTRONIK’s Vascular Intervention business. The acquisition is set to expand Teleflex’s Interventional portfolio with a global suite of coronary and peripheral vascular devices, including drug-coated balloons, drug-eluting stents, and resorbable scaffold technology.