Market Definition

The market focuses on sensors that detect changes in magnetic reluctance, caused by the movement of ferromagnetic objects. These sensors are built using coil windings and magnetic cores, offering simple construction and high durability.

They are widely used in automotive systems for crankshaft and wheel speed sensing and in industrial automation for position and motion detection. Their non-contact operation and ability to function in harsh environments expand their use across various mechanical monitoring systems.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Variable Reluctance Sensor Market Overview

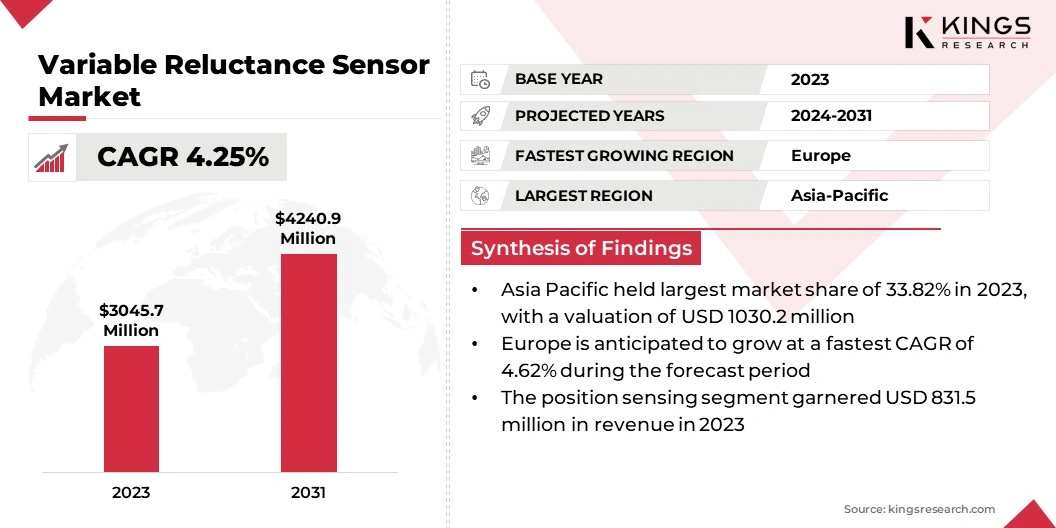

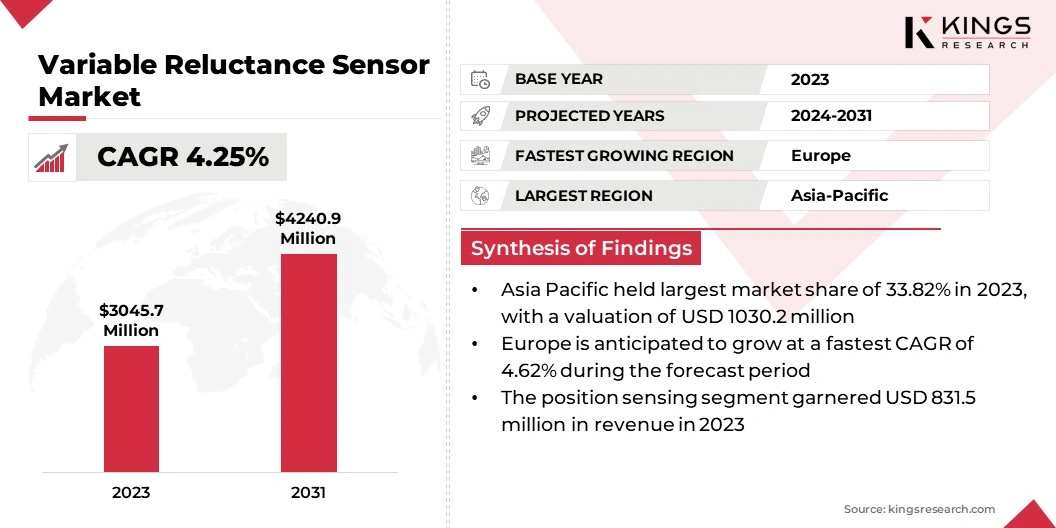

The global variable reluctance sensor market size was valued at USD 3045.7 million in 2023 and is projected to grow from USD 3169.1 million in 2024 to USD 4240.9 million by 2031, exhibiting a CAGR of 4.25% during the forecast period.

The growth of the market is driven by its increasing use in monitoring rotational speed and position in automotive systems and factory machinery. Expansion of industrial automation and the shift toward electrification in transportation are creating consistent demand, especially for cost-effective and rugged sensors suited for harsh operational environments.

Major companies operating in the variable reluctance sensor industry are Honeywell International Inc., Texas Instruments Inc., Infineon Technologies AG, STMicroelectronics N.V., Allegro MicroSystems, LLC, TE Connectivity Ltd., Delphi Technologies, General Motors, Walker Products Inc., Magnetic Sensors Corporation, Diamond Electric Manufacturing Corp., ON Semiconductor Corporation, Emerson Electric Co., Marlin Crawler, Inc., and ACDelco.

The growth of the market is influenced by its widespread use in engine control modules. These sensors offer a reliable way to monitor crankshaft and camshaft positions, which helps optimize fuel injection and ignition timing.

With modern vehicles integrating more advanced electronic control units, the demand for high-precision rotational sensing continues to rise. Their durability in high-temperature environments makes them suitable for both gasoline and diesel engines.

- At Electronica 2024, Allegro MicroSystems introduced the A17802 and A17803 inductive position sensors. These sensors provide high-resolution position sensing, suitable for electric vehicle traction motors and industrial automation. Their compact design and integrated diagnostics offer a modern alternative to traditional VR sensors in various applications across industrial, automotive and consumer electronics.

Key Highlights

Key Highlights

- The variable reluctance sensor industry size was valued at USD 3045.7 million in 2023.

- The market is projected to grow at a CAGR of 4.25% from 2024 to 2031.

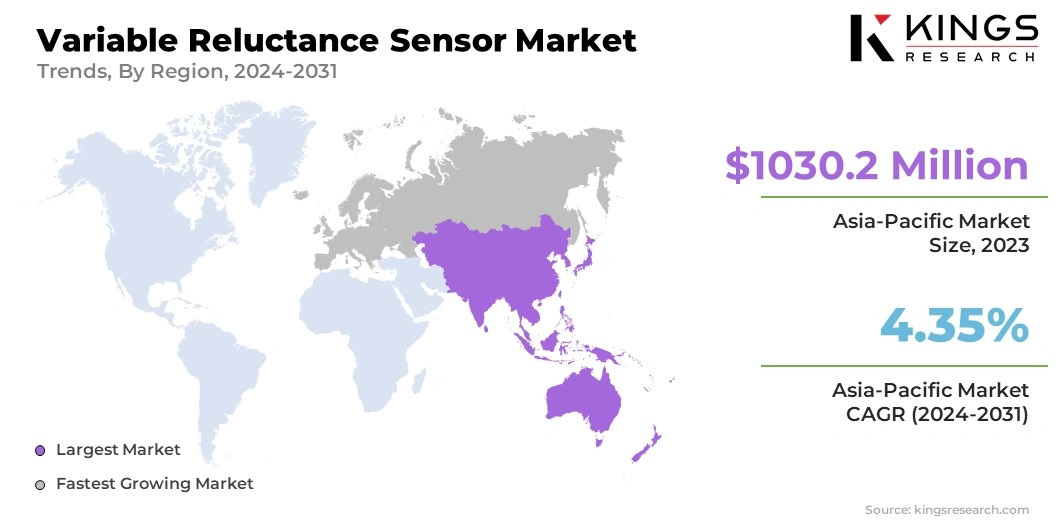

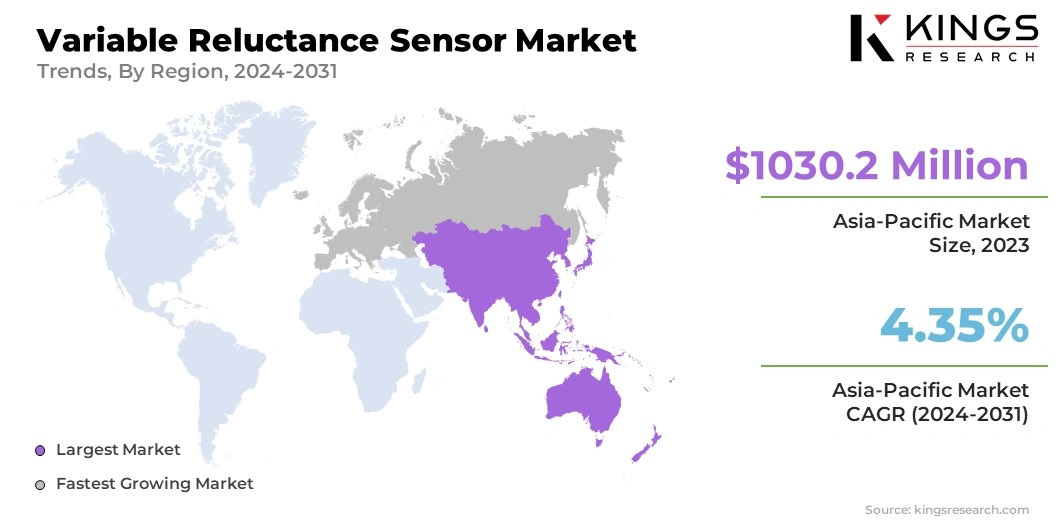

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 1030.2 million.

- The position sensing segment garnered USD 831.5 million in revenue in 2023.

- The automotive segment is expected to reach USD 1532.1 million by 2031.

- Europe is anticipated to grow at a CAGR of 4.62% during the forecast period.

Market Driver

Expansion of Industrial Automation

Industrial automation systems require dependable sensing mechanisms to manage motion control and equipment health monitoring. The market is gaining momentum from factories investing in real-time feedback tools that can endure harsh operational environments.

These sensors deliver consistent performance where dust, oil, and mechanical wear may affect optical alternatives. Their simple construction and rugged build make them well-suited for assembly lines, conveyor systems, and rotating machinery.

- In October 2024, Mencom introduced a new range of magnetic sensors, designed to address the varied demands of modern industrial sectors, including automation, manufacturing, process control, automotive, medical, and aerospace. These sensors offer dependable and flexible performance across multiple applications. Engineered for durability, they are rated IP67 for protection, ensuring resistance to dust and water in harsh industrial environments.

Market Challenge

Ensuring Accuracy and Reliability in Harsh Environments

A significant challenge for the growth of the variable reluctance sensor market is ensuring consistent accuracy and reliability in harsh environments, such as extreme temperatures, vibration, and moisture. These conditions can affect sensor performance, leading to system failures.

To address this, key players are developing more robust sensors with improved materials and designs. They are also focusing on enhancing their sensors' resistance to electromagnetic interference (EMI) and environmental stress. Additionally, manufacturers are investing in advanced testing procedures to ensure that sensors meet stringent industry standards for durability and reliability in diverse applications.

Market Trend

Shift Toward Electrification in Transportation

Electric vehicles and hybrid systems require precise speed and position sensing to optimize motor control and energy efficiency. This is contributing to the expansion of the market. These sensors are increasingly integrated into electric drivetrains for monitoring rotor position and managing regenerative braking.

Their ability to perform without an external power supply and withstand high electromagnetic fields makes them well-suited for next-generation electric mobility platforms, especially in commercial vehicle segments.

Variable Reluctance Sensor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Position Sensing, Pulse Counting, Flow Meters, Speedometers, Others

|

|

By End-Use

|

Automotive, Aerospace, Energy & Power, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Position Sensing, Pulse Counting, Flow Meters, Speedometers, and Others): The position sensing segment earned USD 831.5 million in 2023, on account of its role in providing precise and reliable measurements for critical applications in automotive, industrial automation, and robotics.

- By End-use (Automotive, Aerospace, Energy & Power, and Others): The automotive segment held 36.22% of the market in 2023, owing to the widespread use of these sensors in critical applications such as engine control, speed detection, and position sensing.

Variable Reluctance Sensor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific variable reluctance sensor market share stood at around 33.82% in 2023 in the global market, with a valuation of USD 1030.2 million. Asia Pacific's rapid industrial growth, particularly in manufacturing, automotive, and energy sectors, is driving the adoption of variable reluctance sensors.

The Asia Pacific variable reluctance sensor market share stood at around 33.82% in 2023 in the global market, with a valuation of USD 1030.2 million. Asia Pacific's rapid industrial growth, particularly in manufacturing, automotive, and energy sectors, is driving the adoption of variable reluctance sensors.

The increasing shift towards industrial automation across the region contributes to the growth of the market. Moreover, with the continued adoption of Industry 4.0 in Asia Pacific, the region is seeing a surge in automation technologies that rely heavily on sensors for monitoring and control. The need for high-precision feedback and low maintenance in automated systems drives market growth in the region.

- Delta Electronics India presented a range of industrial automation products at INTEC 2024, including the VP3000 variable-torque drive and the MSI Motor, a Permanent Magnet Synchronous Reluctance Motor. These innovations aim to improve energy efficiency and motion accuracy in various applications such as HVAC systems, water treatment, and manufacturing processes. The integration of such technologies underscores the region's commitment to adopting advanced automation solutions that rely on precise sensing and control mechanisms.

The variable reluctance sensor industry in Europe is poised for significant growth at a robust CAGR of 4.62% over the forecast period. Europe is focusing on digital transformation in infrastructure projects, including transportation networks, energy grids, and public services.

This shift toward smart infrastructure integrates advanced sensor systems for monitoring and control purposes, boosting the expansion of the variable reluctance sensors market. In addition, Europe enforces stringent environmental and safety regulations, particularly in the automotive, aerospace, and manufacturing industries.

These regulations require the adoption of sensors that maintain performance under harsh conditions. Variable reluctance sensors offer durability and resistance to temperature extremes, dust, and moisture, are well-suited for these applications. Their reliability under demanding environments continues to fuel their adoption, contributing to market growth across the region.

Regulatory Frameworks

- The European Union's Electromagnetic Compatibility (EMC) Directive 2014/30/EU mandates that electronic equipment, including sensors, must not emit or be affected by electromagnetic interference. Compliance with this directive ensures that VRS devices operate reliably within the electromagnetic environment of vehicles and industrial equipment.

- China has established specific standards for VRS, notably GB/T 31996-2015, which outlines general specifications for variable reluctance multipolar resolvers. This standard covers aspects such as types, shapes, operating conditions, technical requirements, and test methods, ensuring that VRS products meet national quality and safety benchmarks.

- In Japan, the Japanese Industrial Standards (JIS), developed by the Japanese Industrial Standards Committee (JISC) regulates the performance and safety of sensors, including VRS. These standards ensure that sensors used in automotive and industrial applications meet the country's stringent quality and reliability requirements.

Competitive Landscape

Market players in the variable reluctance sensors industry are focusing on expanding their product lines and investing in new technologies. These strategies help them meet the growing demand for precise and energy-efficient sensing solutions. By offering smaller, smarter, and more reliable sensors, companies are supporting advancements in electric vehicles, automation, and power systems.

- In January 2025, Allegro MicroSystems launched two new current sensor ICs—ACS37030MY and ACS37220MZ. These sensors offer higher isolation in a 40% smaller footprint compared to existing products, delivering exceptional power density. They are designed for precise current sensing in automotive, industrial, and consumer applications.

List of Key Companies in Variable Reluctance Sensor Market:

- Honeywell International Inc.

- Texas Instruments Inc.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Allegro MicroSystems, LLC

- TE Connectivity Ltd.

- Delphi Technologies

- General Motors

- Walker Products Inc.

- Magnetic Sensors Corporation

- Diamond Electric Manufacturing Corp.

- ON Semiconductor Corporation

- Emerson Electric Co.

- Marlin Crawler, Inc.

- ACDelco

Recent Developments (Product Launch)

- In October 2023, Renesas developed a cost-effective inductive position sensor technology for high-speed motor applications. Operating at speeds up to 600 krpm with 19-bit resolution, this technology targets robotics, industrial, and medical systems, offering a robust alternative to traditional encoders.

best

Key Highlights

Key Highlights The Asia Pacific variable reluctance sensor market share stood at around 33.82% in 2023 in the global market, with a valuation of USD 1030.2 million. Asia Pacific's rapid industrial growth, particularly in manufacturing, automotive, and energy sectors, is driving the adoption of variable reluctance sensors.

The Asia Pacific variable reluctance sensor market share stood at around 33.82% in 2023 in the global market, with a valuation of USD 1030.2 million. Asia Pacific's rapid industrial growth, particularly in manufacturing, automotive, and energy sectors, is driving the adoption of variable reluctance sensors.