Urea Market Size

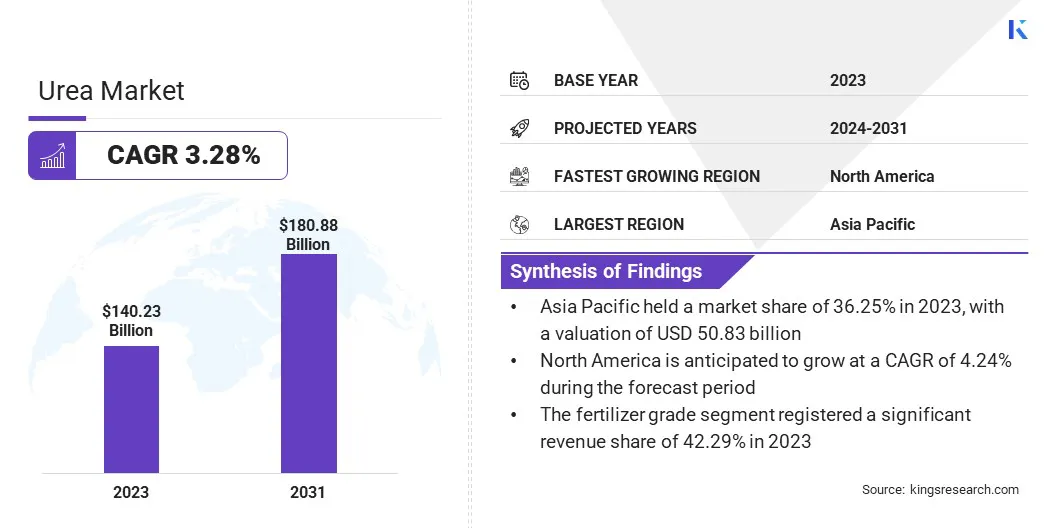

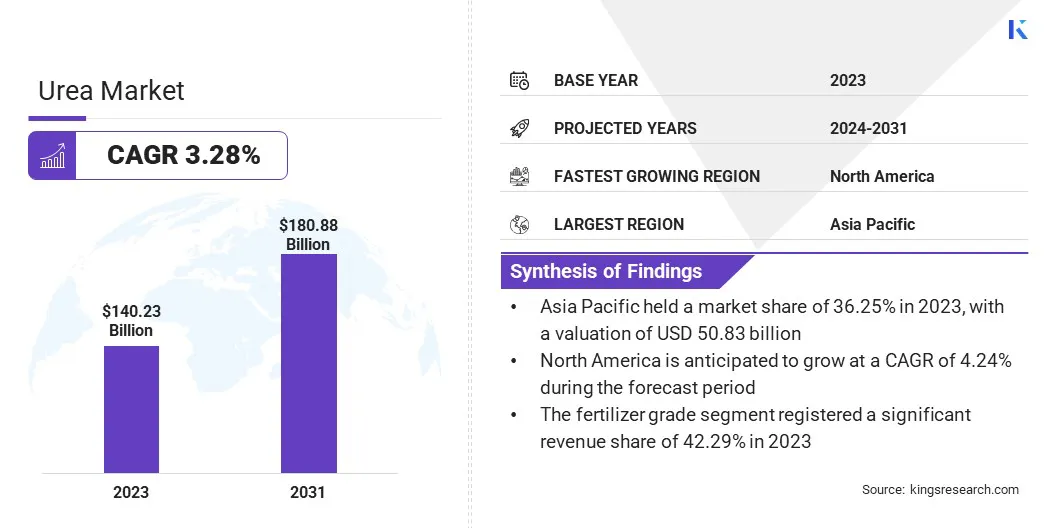

The global Urea Market size was valued at USD 140.23 billion in 2023 and is projected to reach USD 180.88 billion by 2031, growing at a CAGR of 3.28% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Yara International ASA, CF Industries Holdings, Inc., Nutrien Ltd, OCI Nitrogen, QAFCO (Qatar Fertiliser Company), EuroChem Group AG, Sinochem Corporation, BASF SE and Others.

The market is a major sector of the global agricultural industry, serving as one of the most widely used nitrogen fertilizers worldwide. Urea is essential for crop production as it provides plants with the necessary nitrogen to grow and thrive. Its popularity in the agricultural industry is boosted by its high nitrogen content, affordability, and ease of application. As the global population continues to grow, the demand for urea and other fertilizers is expected to increase, making the market even more critical for sustaining food production on a global scale.

The demand for urea is primarily driven by agricultural needs, with farmers relying heavily on it to supply essential nitrogen to their crops. As population growth and changing dietary preferences increase, the demand for food is expected to rise, leading to a corresponding increase in the need for fertilizers such as urea. Emerging economies, in particular, are significant contributors to this growth as they seek to modernize their agricultural practices and increase productivity. As these economies continue to develop and urbanize, the pressure on agricultural lands intensifies, necessitating higher yields and increased fertilizer usage.

Global trade patterns further influence the urea market. Major urea-producing countries, such as China, Russia, and the Middle Eastern nations, often export significant quantities to meet surging demand in other regions. Trade agreements, tariffs, and transportation costs all affect the flow of urea across borders, influencing market dynamics. Additionally, advancements in technology and innovation have played a crucial role in shaping the urea market. The introduction of precision agriculture techniques, such as soil testing and variable rate application, has allowed farmers to optimize their fertilizer usage and reduce waste. This has led to a shift toward more sustainable farming practices and a greater focus on environmental stewardship.

Analyst’s Review

Technological advancements play a significant role in the development of the urea market. Innovations in fertilizer formulations and application techniques aim to improve efficiency, reduce environmental impact, and enhance overall agricultural sustainability. These advancements drive changes in consumer preferences and regulatory standards, influencing the market trends. Additionally, advancements in precision farming techniques, such as variable rate application, enable farmers to apply urea fertilizers in a more targeted and precise manner, reducing waste and optimizing nutrient uptake by crops. These technological advancements not only benefit farmers by increasing their yields and profitability but also contribute to the global effort of sustainable agriculture and environmental conservation.

Market Definition

Urea is a chemical compound with the molecular formula CO (NH2)2. It is an organic compound and is considered the simplest form of carbamide, with two amine (NH2) groups attached to a carbonyl (C=O) group. Urea is highly soluble in water and is odorless and colorless in its pure form. In agriculture, urea is primarily used as a nitrogen fertilizer due to its high nitrogen content, which makes it an essential nutrient for plant growth. When applied to soil, urea undergoes hydrolysis, breaking down into ammonium and carbonate ions, eventually converting to ammonium, which can be absorbed by plants as a nitrogen source.

Apart from its use in agriculture, urea has various industrial applications. It is used in the production of plastics, adhesives, resins, and cosmetics. In addition, urea is widely used in medical and laboratory settings as a component of urine tests and in the synthesis of pharmaceuticals and other organic compounds.

Urea Market Dynamics

The demand for urea is primarily driven by its use as a nitrogen fertilizer in agriculture. As the global population grows and dietary habits change, there is an increasing need for higher crop yields to ensure food security. Urea, being a rich source of nitrogen, is essential for promoting plant growth and productivity.

For instance, in countries such as India, where agriculture is a crucial sector, the demand for urea has been steadily increasing due to the need to feed a growing population. Farmers rely heavily on urea to enhance soil fertility and maximize crop production, especially for staple crops such as rice and wheat. The availability and affordability of urea directly impact food security and the overall economy of such countries.

The urea market is prone to price volatility due to several factors such as fluctuations in energy prices, changes in demand-supply dynamics, and geopolitical tensions. Price volatility can pose challenges for both producers and consumers in planning and managing their operations effectively. Producers may face difficulties in setting production levels and making long-term investment decisions, as they need to constantly adjust to changing market conditions. On the other hand, consumers may struggle to procure urea at stable prices, which can impact their budgeting and procurement strategies. As a result, both producers and consumers need to closely monitor the market and implement effective risk management strategies to mitigate the impact of price volatility.

For instance, a fertilizer producer that relies on urea as a key input may struggle to accurately forecast demand and set production levels due to unpredictable market conditions. This could result in excess inventory or shortages, leading to financial losses and inefficiencies in the production process. Similarly, a farmer who relies on urea for crop cultivation may find it challenging to budget for their agricultural activities if the price of urea fluctuates significantly.

Segmentation Analysis

The global market is segmented based on grade, end use industry, and geography.

By Grade

By grade, the market is bifurcated into fertilizer grade, feed grade, and technical grade. The fertilizer grade segment registered a significant revenue share of 42.29% in 2023. This growth can be attributed to the increasing demand for urea fertilizers in the agriculture and horticulture sectors. The fertilizer grade urea is widely used to improve soil fertility and promote healthy plant growth. Additionally, the rising population and the growing need for higher crop yields are driving the demand for urea fertilizers, thereby contributing to the growth of the fertilizer grade segment.

By Application

By application, the market is bifurcated into agriculture, the chemical industry, construction and building materials, and animal feed. The agriculture segment accounted for a substantial revenue share of 40.19% in 2023, majorly driven by the increasing demand for urea in the agricultural sector for fertilizers. The use of urea as a nitrogenous fertilizer helps in enhancing crop productivity and improving soil fertility.

With the rising global population and the need to ensure food security, the agriculture segment is expected to continue dominating the urea market in the forthcoming years. To cite an instance, in India, where agriculture plays a crucial role in the economy, the demand for urea has been increasing consistently. Farmers rely heavily on urea fertilizers to meet the nutrient requirements of their crops and achieve higher yields.

As a result, the agriculture sector in India has become one of the major consumers of urea, driving the growth of the market in the country. Additionally, government subsidies and initiatives aimed at promoting agricultural productivity further contribute to the dominance of the segment.

Urea Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia Pacific Urea Market share stood around 36.25% in 2023 in the global market, with a valuation of USD 50.83 billion, attributed to the increasing demand for urea in countries such as China and India, which are major agricultural producers. Additionally, the growing population and rising disposable income in these regions have led to higher consumption of agricultural products, thereby driving the demand for urea fertilizers. Moreover, government initiatives and subsidies to promote sustainable agriculture practices have contributed to the growth of the market in the Asia Pacific region.

For instance, in China, the government has implemented policies aimed at encouraging farmers to use urea fertilizers in order to increase crop yields and improve food security. These initiatives include subsidies for purchasing urea fertilizers and promoting efficient usage through educational programs. As a result, the demand for urea in China has been steadily increasing, thereby augmenting market growth in Asia Pacific.

However, North America is projected to experience a rapid growth rate of 4.24% over the forecast period. The primary factor boosting the growth is the increasing demand for urea in the agricultural sector, particularly in the United States and Canada. The use of urea as a nitrogen fertilizer has been steadily rising in North America due to its effectiveness in promoting crop growth and improving soil quality. Additionally, the region's favorable government policies and initiatives to enhance agricultural productivity are expected to drive regional urea market growth.

To cite an instance, in the United States, the government's rising focus on promoting sustainable agriculture practices and increasing food production has led to a significant increase in the use of urea as a nitrogen fertilizer. Farmers are extensively adopting advanced farming techniques and utilizing urea to maximize crop yields and meet the growing demand for food. Similarly, in Canada, the government's investments in agricultural research and development have encouraged farmers to incorporate urea into their farming practices, thereby leading to improved soil fertility and higher agricultural productivity.

Competitive Landscape

The urea market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Urea Market

- Yara International ASA

- CF Industries Holdings, Inc.

- Nutrien Ltd

- OCI Nitrogen

- QAFCO (Qatar Fertiliser Company)

- EuroChem Group AG

- Sinochem Corporation

- Indorama Ventures Public Company Limited

- BASF SE

- PTT Global Chemical Public Company Limited

Key Industry Developments

- December 2023 (Acquisition) - Yara International ASA acquired the organic-based fertilizer business of Agribios Italiana in a strategic move to expand its presence in the organic fertilizer market. This acquisition aligns with Yara's commitment to sustainable agriculture and supports its goal of providing farmers with innovative and environmentally friendly solutions. The addition of Agribios Italiana's organic-based fertilizer business intended to enhance Yara's product portfolio further, allowing the company to offer a wider range of options to farmers seeking organic alternatives to conventional fertilizers.

The global Urea Market is segmented as:

By Grade

- Fertilizer Grade

- Feed Grade

- Technical Grade

By End Use Industry

- Agriculture

- Chemical Industry

- Construction and Building Materials

- Animal Feed

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.