Market Definition

A unified retail commerce platform is a system that connects physical stores, e-commerce, and mobile retail operations through a centralized interface. It allows retailers to manage inventory, orders, customer data, and sales across all channels.

This market includes solutions for point-of-sale systems, order and inventory management, product information handling, customer relationship tools, and analytics. These platforms help businesses streamline operations and maintain consistency across touchpoints.

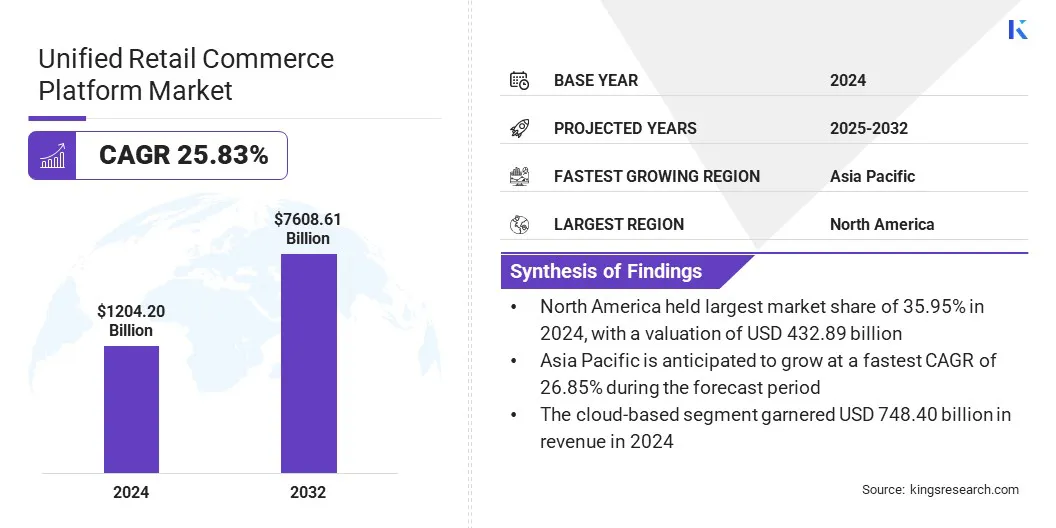

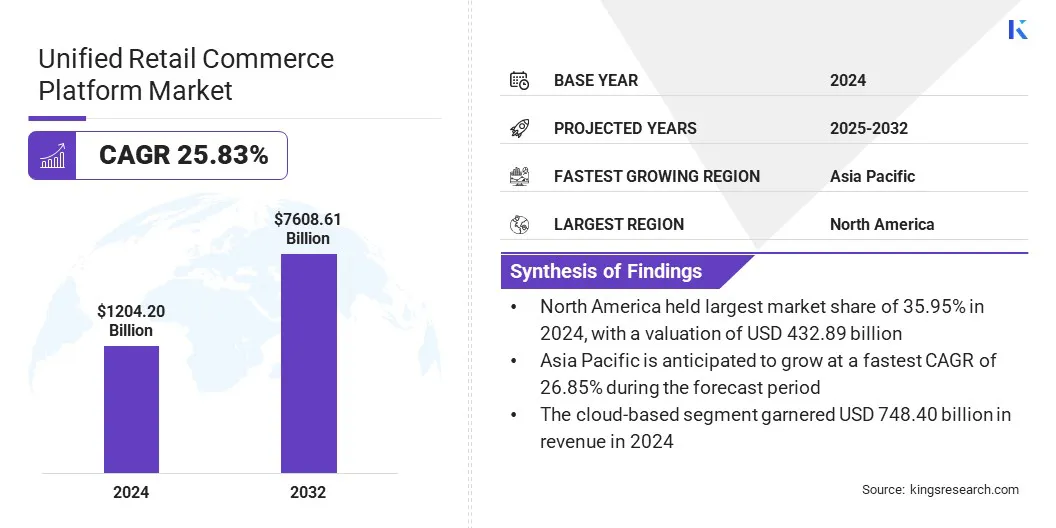

The global unified retail commerce platform market size was valued at USD 1,204.20 billion in 2024 and is projected to grow from USD 1,510.79 billion in 2025 to USD 7,608.61 billion by 2032, exhibiting a CAGR of 25.83% during the forecast period.

The market is growing steadily, driven by the rising demand for seamless omnichannel experiences and personalized customer engagement.

Key Market Highlights:

- The unified retail commerce platform industry size was valued at USD 1,204.20 billion in 2024.

- The market is projected to grow at a CAGR of 25.83% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 432.89 billion.

- The cloud-based segment garnered USD 748.40 billion in revenue in 2024.

- The large enterprises segment is expected to reach USD 4,216.69 billion by 2032.

- The inventory management segment is expected to reach USD 1,848.22 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 26.85% during the forecast period.

Businesses are integrating digital and physical retail operations to provide consistent services across various customer touchpoints, such as online stores, mobile apps, physical outlets, and customer service channels.

Major companies operating in the unified retail commerce platform market are Salesforce, Inc., Oracle, SAP SE, Adobe, Microsoft, IBM, Infosys Limited, HCL Technologies Limited, Tata Sons Private Limited, Cegid, Shopify, Stripe, Inc., Block, Inc., VeriFone, Inc., and Lightspeed.

|

Segmentation

|

Details

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Organization Size

|

Large Enterprises, Small and Medium Enterprises

|

|

By Application

|

Inventory Management, Customer Relationship Management, Point-of-Sale (POS), Smart Order Management, Product Information Management, Logistics Management, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for a substantial unified retail commerce platform market share of 35.95% in 2024, with a valuation of USD 432.89 billion. The region’s dominance is attributed to advanced digital infrastructure and high adoption of omnichannel retail strategies in the region.

Retailers in the U.S. and Canada are increasingly integrating online and offline operations to enhance customer experience, leading to strong demand for unified platforms that centralize inventory, order, and customer data.

Consumers are quickly shifting toward shopping experiences that are seamless and personalized across all touchpoints, including websites, mobile apps, and physical stores. This trend is compelling retailers to invest in robust unified commerce solutions to stay competitive and agile.

Additionally, the presence of major technology providers and retail giants in the region accelerates platform innovation and adoption. These dynamics collectively position North America as a leader in the global market.

- In June 2024, Target Corporation partnered with Shopify to expand its Target Plus marketplace. The collaboration allows select Shopify merchants to sell on Target.com and in physical stores, enhancing product variety and reach. This move supports omnichannel retail growth and offers opportunities for direct-to-consumer brands like True Classic and Caden Lane.

Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 26.85% over the forecast period. This growth is attributed to the mobile-first consumer base and expanding internet access across Asia Pacific.

With large populations in countries like China, India, and Indonesia, there is enormous untapped potential for digital commerce. The fragmented retail landscape pushes businesses to adopt unified platforms to integrate physical and digital operations efficiently.

The surge of small and medium enterprises entering e-commerce, combined with widespread use of super apps and digital wallets, accelerates the demand for centralized retail solutions. Additionally, government initiatives like India’s Digital India and China’s smart retail policies are fostering infrastructure for seamless transactions.

These conditions enable rapid digital transformation, which positions Asia Pacific as the fastest-growing region in the unified retail commerce platform market..

- In May 2025, Phi Commerce partnered with DG Financial Technology (DGFT) to introduce its unified digital payment solutions in Japan. The collaboration aims to transform Japan’s payments landscape by integrating Phi Commerce’s omnichannel platform across online, in-store, and mobile channels. DGFT will exclusively distribute these solutions, supporting Japan’s shift toward a seamless, cashless economy.

Growing need for real-time visibility across retail operations is prompting retailers to adopt unified commerce platforms that integrate sales, inventory, and returns data to improve decision-making, reduce inefficiencies, and enhance customer experiences.

This demand for centralized data and seamless operational control is pushing businesses to invest in scalable platforms that connect physical and digital retail environments.

- In January 2025, NewStore announced the availability of its unified commerce platform on SAP Store. Integrated with SAP Omnichannel Sales Transfer and Audit, the platform enables real-time retail data sharing with SAP S/4HANA Cloud, supporting capabilities such as endless aisle, flexible fulfillment, unified returns, and advanced inventory optimization for enterprise retailers.

Market Driver

Cloud-native Infrastructure and Composable Architecture Driving Retail Agility

The unified retail commerce platform market is expanding, due to the adoption of cloud-based and composable commerce technologies. Retailers choose cloud-native platforms, as they enable faster deployment, reduce operational costs, and simplify system-wide updates.

These platforms also provide the scalability needed to manage large transaction volumes and rapid changes in consumer demand. Composable commerce allows businesses to manage functions such as checkout, inventory, and order processing independently through modular services.

This architecture supports continuous improvement and helps retailers respond quickly to market changes. As businesses aim to modernize their infrastructure and deliver consistent service across all channels, these technologies offer the flexibility and integration capabilities required to support long-term growth and digital transformation.

- In May 2025, Cloudflight partnered with VTEX to accelerate the deployment of composable commerce solutions across Europe. The collaboration combines Cloudflight’s expertise in cloud-native technologies with VTEX’s enterprise digital commerce platform to deliver agile, scalable, and personalized commerce experiences for clients in retail, B2B, and D2C sectors.

Market Challenge

Integration Barriers Between Modern and Legacy Retail Systems

Retailers face a significant challenge in unifying modern digital platforms with legacy systems that were not designed for omnichannel commerce. These outdated infrastructures often operate in silos, managing inventory, customer data, and order processing separately.

As a result, retailers experience inefficiencies, inconsistent customer experiences, and increased operational costs. The lack of real-time data visibility further complicates decision-making and slows innovation. Companies are adopting API integration strategies.

APIs act as communication bridges between legacy systems and new unified commerce platforms. This enables seamless data exchange, real-time synchronization, and operational flexibility without completely overhauling existing systems.

API integration reduces implementation time, enhances system interoperability, and allows retailers to modernize their infrastructure incrementally while maintaining business continuity and minimizing disruption.

- In May 2025, KIBO Commerce introduced a unified Marketplace and Dropship solution to help retailers expand product assortments, reduce operational costs, and improve fulfillment accuracy. The platform integrates API and EDI capabilities, enabling real-time inventory sync and seamless onboarding of third-party sellers while supporting both B2C and B2B commerce models.

Market Trend

AI-driven Personalization Enhancing Customer Engagement in Unified Commerce

The market is growing, due to the increased integration of artificial intelligence and real-time personalization. Businesses use AI to analyze customer data, identify trends, and generate insights. These insights help retailers deliver targeted product recommendations and personalized offers across multiple channels.

Real-time personalization adjusts content, promotions, and pricing based on customer behavior and preferences. This improves engagement and supports consistent shopping experiences. Retailers gain better operational control as AI-driven systems respond to customer needs with speed and accuracy.

As expectations for seamless, individualized interactions rise, companies rely on these technologies to stay competitive and meet demand.

- In May 2025, Alteryx, Inc. launched Alteryx One, a unified platform that integrates AI-powered analytics, real-time data access, and enterprise governance. The platform combines low-code data preparation, AI orchestration, and cloud connectivity to help organizations scale analytics, automate workflows, and deliver personalized insights across enterprise environments.

Market Segmentation

- By Deployment (Cloud-based, On-premises): The cloud-based segment earned USD 748.40 billion in 2024, due to to its scalability, lower upfront costs, and ease of integration with modern commerce tools.

- By Organization Size (Large Enterprises, Small and Medium Enterprises): The large enterprises segment held 54.42% share of the market in 2024, due to their greater capacity to invest in advanced unified commerce solutions and digital infrastructure.

- By Application (Inventory Management, Customer Relationship Management, Point-of-Sale (POS), Smart Order Management, and Product Information Management, Logistics Management, Others): The inventory management segment is projected to reach USD 1,848.22 billion by 2032, owing to the rising demand for real-time stock visibility and automation across omnichannel retail networks.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates e-commerce practices, including data privacy, advertising, and consumer protection. Additionally, the Federal Communications Commission (FCC) oversees telecommunications infrastructure relevant to digital platforms.

- In Europe, the European Data Protection Board (EDPB) enforces the General Data Protection Regulation (GDPR), which governs data usage, privacy, and digital interactions across commerce platforms. The Digital Services Act (DSA) and Digital Markets Act (DMA) further regulate online marketplaces and digital platform operations.

- In China, the Cyberspace Administration of China (CAC) oversees data governance, cybersecurity, and digital business practices. The State Administration for Market Regulation (SAMR) manages fair competition and online commerce standards.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates e-commerce and digital platform operations, including guidelines under the Act on Improving Transparency and Fairness of Digital Platforms.

Competitive Landscape

The unified retail commerce platform market is characterized by companies heavily investing in product innovation to enhance platform capabilities such as real-time inventory visibility, AI-driven personalization, and seamless integration across multiple channels.

Strategic acquisitions are also being pursued to expand technological capabilities, enter new geographic markets, and accelerate time-to-market.

These acquisitions often involve technology providers, analytics firms, or regional platform specialists, enabling companies to broaden their service portfolios and respond to the growing demand for integrated and scalable commerce solutions. These strategies continue to shape the competitive landscape of the market.

- In January 2025, commercetools introduced InStore, a unified commerce application that integrates online and physical retail operations. The solution enables AI-driven personalization, real-time inventory updates, and seamless cross-channel workflows, allowing retailers to deploy modern unified retail systems and enhance customer experience within just six weeks.

Key Companies in Unified Retail Commerce Platform Market:

- Salesforce, Inc.

- Oracle

- SAP SE

- Adobe

- Microsoft

- IBM

- Infosys Limited

- HCL Technologies Limited

- Tata Sons Private Limited

- Cegid

- Shopify

- Stripe, Inc.

- Block, Inc.

- VeriFone, Inc.

- Lightspeed

Recent Developments (Partnerships/Acquisitions/Product Launches)

- In July 2025, eGrowcery partnered with Red Pepper Digital to enhance customer engagement through its unified commerce platform. The collaboration combines eGrowcery’s customizable e-commerce ecosystem with Red Pepper’s shopper engagement technology, enabling retailers to offer personalized, omnichannel experiences using real-time data, interactive digital flyers, and unified marketing tools across online and in-store channels.

- In July 2025, Shift4 acquired Global Blue to enhance its unified commerce capabilities. The integration adds tax-free shopping, dynamic currency conversion, and payment processing to Shift4’s platform, expanding its global reach across retail and hospitality. The companies plan to launch an all-in-one terminal combining VAT refund, DCC, and payments in a single device.

- In May 2025, Verifone partnered with Stripe to deliver unified commerce by integrating Stripe services into Verifone payment devices. The collaboration enables merchants to support in-person payments with enterprise-grade hardware, offering features such as self-service checkout, digital wallets, and loyalty programs, while expanding Verifone’s reach to Stripe’s customer base in the U.S. and beyond.

- In April 2025, AnyMind Group partnered with Shopify to launch the Commerce DX Project in Japan. The collaboration aims to unify D2C, cross-border e-commerce, and physical stores by integrating Shopify’s commerce platform with AnyMind’s marketing and logistics solutions, enabling centralized management of sales channels, real-time data visibility, and support for global expansion.

- In September 2024, Salesforce introduced the next generation of Commerce Cloud, unifying B2C, DTC, and B2B commerce, order management, and payments on a single platform. The update includes Agentforce AI agents, in-store inventory planning, Amazon Buy with Prime integration, and enhanced checkout features to deliver personalized, seamless experiences across digital and physical channels.