Travel Retail Market Size

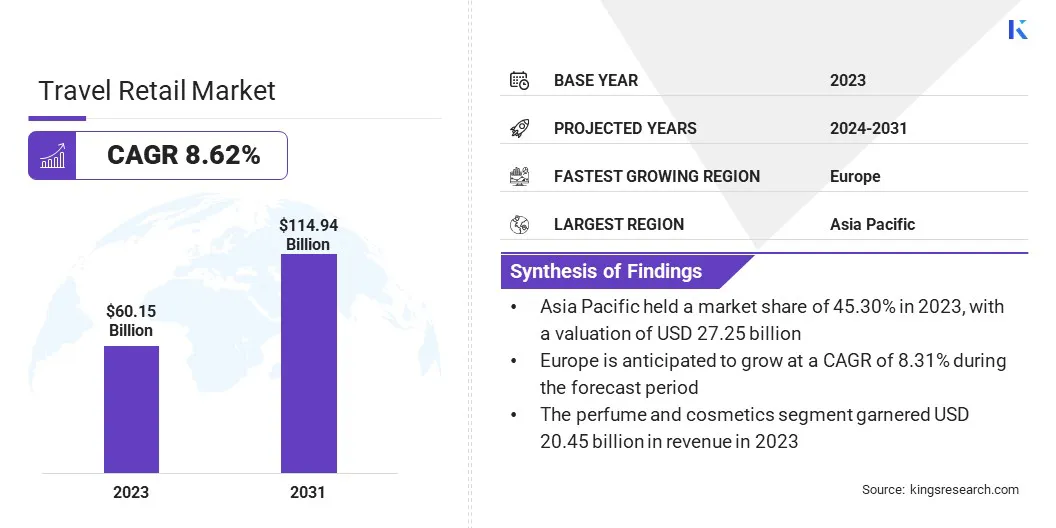

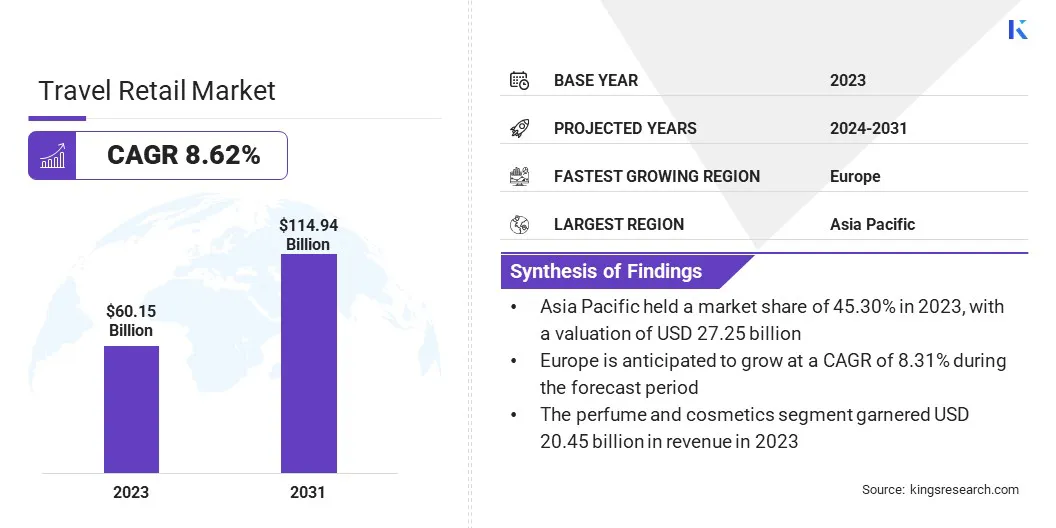

Global Travel Retail Market size was recorded at USD 60.15 billion in 2023, which is estimated to be valued at USD 64.43 billion in 2024 and is projected to reach USD 114.94 billion by 2031, growing at a CAGR of 8.62% from 2024 to 2031.

The market is growing rapidly, driven by rising consumer interest in premium and exclusive products, increased retail space in airports, and innovations in digital payment systems. Additionally, the expansion of duty-free shopping options and the rise of personalized retail experiences are contributing to market growth.

In the scope of work, the report includes solutions offered by companies such as Avolta, LOTTE., China tourism group, Gebr. Heinemann SE & Co. KG, Lagardere Travel Retail, KING POWER CORPORATION, Aer Rianta International, WH Smith PLC, EVERRICH., Flemingo., and others.

The travel retail market is expanding significantly, fueled by a surge in global travel and evolving consumer expectations. The increasing number of international and domestic travelers is increasing foot traffic in airports and travel hubs, creating significant growth opportunities for retail sales.

- According to the Bureau of Transportation Statistics, passenger enplanements in the U.S. reached 82.4 million in February 2024, an 8.6% increase from the 75.9 million in February 2023.

This rise in passenger numbers has significantly boosted foot traffic through airports and travel hubs, positively impacting the travel retail sector. Additionally, digitalization is enhancing convenience through pre-order and pick-up services, while sustainability trends are prompting retailers to adopt eco-friendly practices. These factors are expected to fuel travel retailmarket expansion in the forthcoming years.

Travel retail encompasses the sale of goods and services to consumers during their journeys, typically at airports, train stations, and other transit hubs. This sector includes duty-free shops, specialty stores, and concessions that cater to passengers' needs before departure and upon arrival.

It capitalizes on the high foot traffic of travelers to offer a range of products such as luxury goods, souvenirs, and essentials. Travel retail leverages the unique environment of transit points to provide a convenient shopping experience, often featuring exclusive or discounted items not available in regular retail settings. This market benefits from increased global travel and evolving consumer behaviors.

Analyst’s Review

Key players in the travel retail market are fostering growth by forming strategic partnerships and launching new stores featuring branded items across major airports. Collaborations between retailers and technology providers enhance the shopping experience and bolster consumer engagement.

- In June 2023, Qatar Duty Free (QDF) introduced a new Coach Boutique at Hamad International Airport, expanding its brand offerings for travelers. This boutique featured a selection of products from the New York-based brand, including totes, handbags, small leather goods, crossbody bags, and clutches for both men and women.

- In June 2023, Pangaia, a U.K.-based lifestyle brand, opened a new retail store at Dubai International Airport's Terminal 3 in collaboration with Lagardère Travel Retail, a French retail company.

The introduction of new, branded outlets at high-traffic airports increases product visibility and attracts a broader customer base. This expansion boosts sales and strengthens brand presence. These factors are expected to stimulate market growth by improving the overall travel retail experience and catering to the evolving preferences of global travelers over the forecast period.

Travel Retail Market Growth Factors

The travel retail market is experiencing robust growth due to the rising number of international travelers, supported by higher disposable incomes and the availability of more affordable travel options. This surge in global travel has expanded the customer base for travel retail, creating a strong demand for duty-free and luxury products at airports, seaports, and other transit hubs.

- In July 2023, Lotte Duty-Free, a retailer based in South Korea, launched an online liquor store featuring a diverse range of products, including brandy, wine, and Cognac, as well as exclusive limited-edition items from over 100 brands.

Retailers are capitalizing on this trend by expanding their offerings and enhancing the shopping experience to attract and engage these travelers, thereby propelling market expansion.

The market faces challenges from fluctuating passenger traffic and stringent regulatory requirements. Variations in travel patterns due to economic conditions and health crises can impact sales, while complex customs regulations and varying compliance standards across regions complicate operations. Key players are addressing these challenges by enhancing flexibility and adapting to shifting market conditions.

For instance, companies are investing in technology to streamline compliance and improve operational efficiency. Additionally, partnerships with local authorities and global travel networks help navigate regulatory complexities. Expanding digital and omnichannel strategies further enables retailers to capture sales despite fluctuating foot traffic, thereby ensuring sustained market growth.

Travel Retail Market Trends

The rise of digitalization and e-commerce is augmenting travel retail market growth by enhancing customer convenience and expanding shopping options. Pre-order and pick-up services streamline the purchasing process, attracting travelers who prioritize efficiency and flexibility.

- In July 2023, Lagardère Travel Retail and Inflyter strengthened their partnership to enhance the digital Duty-Free shopping experience for a wider range of travelers. This collaboration focuses on increasing opportunities for pre-travel browsing and purchasing, aligning with Lagardère Travel Retail’s strategy to enhance digital sales channels and create various customer touchpoints throughout their travel journey.

By offering a seamless online-to-offline shopping experience, retailers are able to increase engagement and capture sales from a broader customer base. This shift to digital platforms enables retailers to enhance inventory management and personalize offerings, thereby boosting sales and market expansion.

Sustainability is emerging as a pivotal trend in the travel retail industry, supported by the growing demand for eco-friendly products and practices among environmentally-conscious consumers. Retailers are increasingly incorporating sustainable solutions into their offerings, such as products made from recycled materials, biodegradable packaging, and ethically sourced goods.

- In May 2024, Dufry AG introduced new sustainability initiatives designed to significantly lower its carbon footprint and boost the promotion of eco-friendly products across its global retail network. These measures involve adopting energy-efficient technologies in stores, optimizing logistics to cut emissions, and expanding the range of sustainable offerings, including organic food, recyclable packaging, and eco-friendly personal care products.

By adopting these practices, travel retailers are differentiating themselves in a competitive market, enhance their brand reputation, and attract environmentally conscious consumers. This focus on sustainability is contributing to market growth by fostering long-term loyalty among consumers.

Segmentation Analysis

The global market has been segmented based on travel retail, distribution channel, and geography.

By Travel Retail

Based on travel retail, the market has been categorized into perfume and cosmetics, wines and spirits, fashion and accessories, tobacco products, electronics and gifts, and others. The perfume and cosmetics segment garnered the highest revenue of USD 20.45 billion in 2023.

This growth is propelled by rising consumer demand for luxury and high-quality beauty products. Increased disposable incomes and a growing focus on personal grooming and aesthetics are fueling this trend. Additionally, the expansion of travel retail outlets and the introduction of exclusive product lines and limited-edition fragrances are attracting a diverse range of customers.

- In January 2023, Lotte Duty-Free, a South Korean company, opened a store for NONFICTION, a Korean beauty brand,

Technological advancements in product formulation and packaging, along with sustainable practices, are increasing consumer appeal and contributing to the growth of the segment.

By Distribution Channel

Based on distribution channel, the market has been categorized into airport and airlines, train stations, ferries, and others. The airport and airlines segment captured the largest market share of 62.74% in 2023.

Rising global travel demand, characterized by economic recovery and expanding middle-class populations, is propelling the expansion of airport facilities and airline services. Enhanced passenger experience initiatives, including improved amenities and streamlined processes, are further contributing to this growth. For instance, the implementation of automated check-in systems and advanced baggage handling solutions are improving operational efficiency.

Additionally, airlines are investing in fleet modernization and sustainable practices to meet evolving consumer expectations and regulatory standards. The segmental expansion is further supported by strategic partnerships between airports and airlines to optimize connectivity and service offerings.

Travel Retail Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific travel retail market accounted for the largest share of 45.30% in 2023, with a valuation of USD 27.25 billion. The region's diverse and rapidly expanding middle-class population, coupled with significant investments in airport infrastructure, is enhancing travel experiences and increasing retail opportunities.

Major airports such as Beijing Capital and Singapore Changi are undergoing extensive upgrades, thereby improving passenger experiences and retail spaces. Additionally, the rise of e-commerce and digital payment systems is transforming the retail landscape.

- In September 2023 Shilla Duty-Free's strategic partnership with Naver highlights the commitment to digital transformation by offering enhanced integrated benefits to shoppers.

Strategic collaborations between local retailers and international brands are further fostering regional market growth.

Europe is anticipated to witness significant growth at a CAGR of 8.31% over the forecast period. This growth is propelled by the region's strong tourism sector and robust consumer spending. Major airports are enhancing their retail offerings to cater to increasing passenger volumes, with a major focus on premium and luxury products. Investments in airport infrastructure and the growth of digital shopping options are further fueling this expansion.

- In November 2023, Lagardère Travel Retail announced its plans to open three new Tech2go stores at Frankfurt Airport, specializing in electronics.

- Additionally, in July 2023, Coty Travel Retail Europe launched Burberry Goddess Eau De Parfum in collaboration with Dufry at London Heathrow Airport. This initiative highlights the growing emphasis on exclusive product offerings and partnerships.

These developments reflect the ongoing growth and evolution of the Europe travel retail sector.

Competitive Landscape

The global travel retail market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Travel Retail Market

- Avolta

- LOTTE

- China tourism group

- Heinemann SE & Co. KG

- Lagardere Travel Retail

- KING POWER CORPORATION

- Aer Rianta International

- WH Smith PLC

- EVERRICH.

- Flemingo.

Key Industry Developments

- June 2023 (Acquisition): Ritter Sport, the German chocolate brand, launched the limited-edition Mini Rainbow Crunchies Tower, available exclusively at Dufry, a Switzerland-based retailer.

- March 2024 (Partnership): Lagardère Travel Retail announced a partnership with RaiseLab, an innovative firm dedicated to fostering open innovation. This collaboration highlights Lagardère Travel Retail's dedication to advancing the travel retail industry through innovation and accelerating the introduction of advanced solutions.

The global travel retail market is segmented as:

By Travel Retail

- Perfume and Cosmetics

- Wines and Spirits

- Fashion and Accessories

- Tobacco Products

- Electronics and Gifts

- Others

By Distribution Channel

- Airport and Airlines

- Train Stations

- Ferries

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America