Tire Vulcanizer Market Size

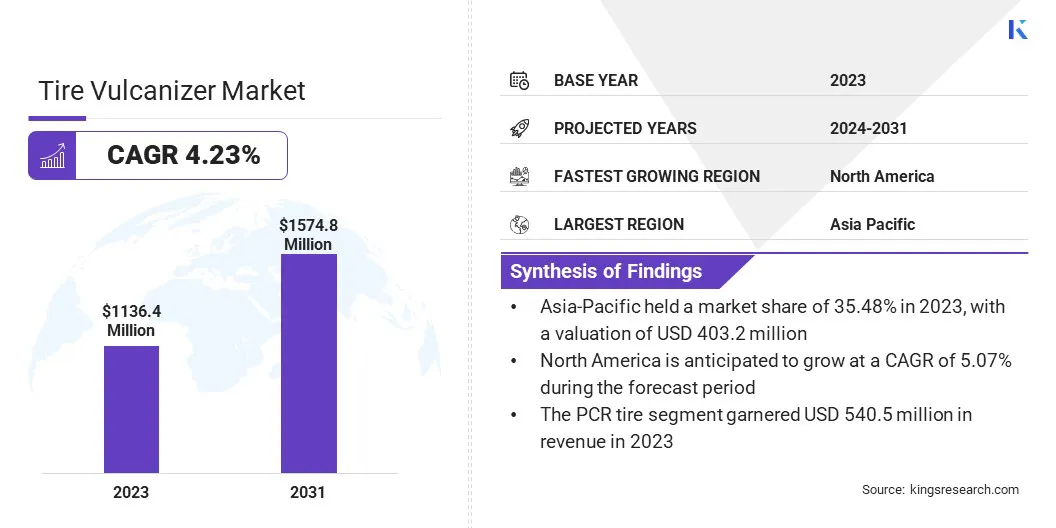

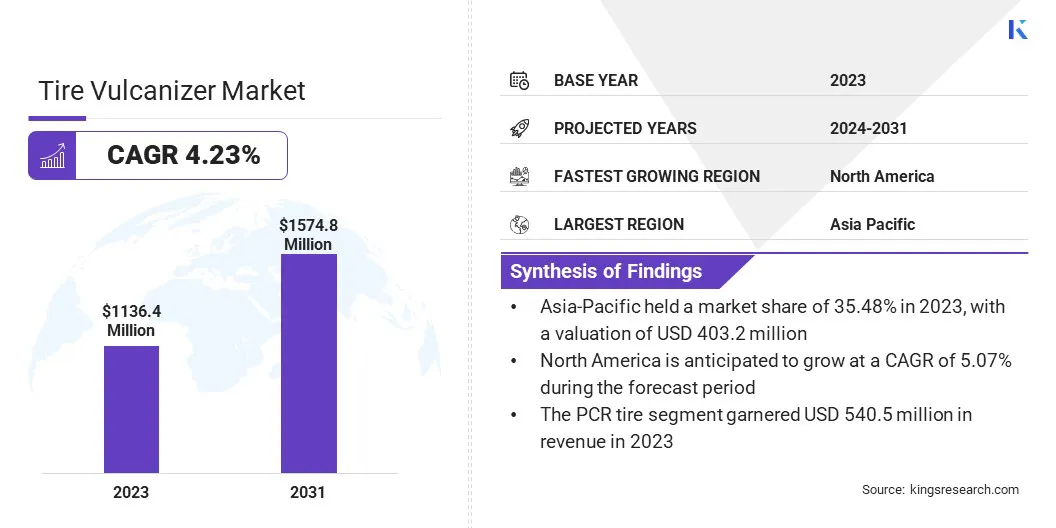

The global Tire Vulcanizer Market size was valued at USD 1,136.4 million in 2023 and is projected to grow from USD 1,178.7 million in 2024 to USD 1,574.8 million by 2031, exhibiting a CAGR of 4.23% during the forecast period. Increasing demand for high-performance tires and growing emphasis on sustainability are contributing to the growth of the market.

In the scope of work, the report includes products offered by companies such as HF TireTech Group, Larsen & Toubro Limited, Alfred Herbert (India) Ltd., Buhler India Pvt. Ltd., Guilin Rubber Machinery Factory Co., Ltd., MESNAC, Kobe Steel, Ltd., Beijing BAMTRI Dingsheng Technology Co., Ltd., Qingdao Yadong Rubber Machinery Group Co., Ltd., HARBURG-FREUDENBERGER, and others.

The surge in global automotive production in emerging markets is spurring the demand for tire vulcanizers. Emerging economies such as China, India, and Brazil are witnessing substantial growth in automobile manufacturing due to increasing incomes, rapid urbanization, and infrastructural enhancements.

This uptick in automotive output leads to higher demand for tires, thereby emphasizing the necessity for efficient and dependable tire vulcanization processes.

Vulcanization plays a crucial role in producing top-notch tires by improving their durability, elasticity, and resistance to heat. The imperative for advanced vulcanization technology becomes increasingly evident as automotive manufacturers are striving to meet the increasing demand.

Furthermore, the transition towards electric and hybrid vehicles, which require specialized tires, propels the need for sophisticated vulcanization equipment.

- The International Energy Agency's Global EV Outlook 2023 reported a notable surge in electric car sales, which reached 3.5 million in 2023, marking a remarkable 35% year-on-year increase from the previous year. This growth signifies a substantial expansion in the automotive sector, with electric car sales surpassing more than six times higher than in 2018, demonstrating the accelerating pace of market development. This surge in electric vehicle adoption directly correlates with increased demand for tires, underscoring significant growth opportunities for tire vulcanizer manufacturers, particularly in emerging markets.

A tire vulcanizer is a machine utilized in the tire manufacturing process to chemically treat rubber, enhancing its strength, elasticity, and durability. This procedure entails incorporating sulfur or other curatives into raw rubber under heat and pressure to facilitate the formation of cross-links between polymer chains.

Tire vulcanizers play a pivotal role in producing various tire types, encompassing passenger car radial (PCR), truck and bus radial (TBR), and off-the-road (OTR) tires. Their utility extends beyond new tire production to encompass tire retreading and repair, which are essential for prolonging tire lifespan and mitigating environmental impact.

Technological advancements in tire vulcanizers, including automation, AI integration, and digital controls, are rapidly evolving to enhance efficiency, precision, and consistency in the vulcanization process. However, the industry confronts stringent environmental regulations aimed at curbing emissions and managing waste from vulcanization processes.

Given these considerations, manufacturers are utilizing greener technologies to align with these regulations to ensure sustainability while upholding product quality.

Analyst’s Review

Manufacturers in the tire vulcanizer market employ robust strategies to maintain competitiveness. These tactics encompass technological innovation, strategic partnerships, and market expansion. The integration of automation and AI into vulcanizers amplifies production rates and ensures meeting the rigorous standards of the automotive industry.

Key players are forming strategic partnerships with raw material suppliers, technology providers, and automotive manufacturers to gain competitive advantages by securing a reliable supply chain, accessing cutting-edge technologies, and aligning with market demands.

Furthermore, venturing into emerging markets with burgeoning automotive growth potentials, such as Asia-Pacific and Latin America, helps catalyze substantial revenue generation. These regions are undergoing rapid industrialization and urbanization, leading to an increased demand for tires and vulcanization equipment.

Tire Vulcanizer Market Growth Factors

The expansion of transportation and logistics sectors significantly amplifies the demand for truck and bus radial (TBR) tires, thereby escalating the requirement for effective tire vulcanization processes. As global trade and e-commerce continue to grow, the necessity for dependable and robust TBR tires becomes paramount to support the heavy loads and extensive mileage of commercial fleets. Moreover, the upsurge in retreading activities results in the widespread adoption of advanced vulcanization technologies.

Retreading, which entails the refurbishment of used tires, emerges as an eco-friendly and cost-efficient solution. This mandates sophisticated vulcanization processes to safeguard the durability and performance of retreaded tires.

Moreover, technological strides in vulcanization, including automation and AI integration, are revolutionizing the industry by enhancing production efficiency, quality control, and operational consistency. These innovations empower manufacturers to produce high-caliber tires while minimizing waste and reducing energy consumption, aligning with both economic and environmental objectives.

Moreover, the growing preference for high-performance tires presents avenue for manufacturers to innovate and develop advanced vulcanization technologies. However, the tire vulcanizer market faces a significant challenge due to high initial investment costs, particularly impacting new entrants and small-scale manufacturers.

The substantial capital required to establish advanced vulcanization facilities, acquire cutting-edge machinery, and provide specialized training for operations poses a considerable barrier. Additionally, stringent environmental regulations concerning emissions and waste disposal from vulcanization processes present another critical challenge.

Adhering to these regulations necessitates adopting cleaner technologies and sustainable practices, which may incur additional costs and substantial modifications to existing processes. To address these challenges, industry stakeholders are increasingly investing in research and development to devise more efficient and environmentally friendly vulcanization methods.

Partnerships and collaborations with technology providers offer avenues for sharing the financial burden and accessing advanced technologies. Furthermore, numerous firms are exploring government incentives and subsidies aimed at fostering sustainable manufacturing practices.

By proactively tackling these challenges, manufacturers ensure regulatory compliance, reduce long-term operational costs, and bolster their competitive standing in the tire vulcanizer market.

Tire Vulcanizer Industry Trends

The incorporation of digital technologies such as IoT and AI into vulcanization processes is revolutionizing the tire manufacturing industry. IoT-enabled sensors and AI algorithms monitor and optimize various parameters in real time, ensuring consistent product quality and minimizing downtime.

Predictive maintenance anticipates equipment failures, minimizes disruptions, and extends the lifespan of vulcanization machinery. This digital transformation boosts operational efficiency and provides invaluable data insights for continuous improvement.

Additionally, there is a noticeable shift toward adopting sustainable manufacturing practices and materials in tire vulcanization, propelled by stringent environmental regulations and growing consumer demand for eco-friendly products.

Utilizing renewable energy sources, waste reduction, and the development of green vulcanization techniques, are integral to the industry's growth strategy. These trends are shaping the tire vulcanizer market landscape by streamlining production processes and promoting environmental responsibility.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the market is segmented into hydraulic, mechanical, and others. The mechanical segment led the tire vulcanizer market in 2023, attaining a revenue share of 52.45% in 2023. Mechanical tire vulcanizers use mechanical pressure and heat to cure rubber, typically at a lower cost compared to their hydraulic counterparts, thus making them accessible to a broader range of manufacturers.

Their robust and straightforward design ensures reliability and facilitates maintenance, thereby reducing both operational costs and downtime. This cost advantage is particularly significant in price-sensitive markets, where manufacturers seek affordable yet efficient solutions to meet production demands.

Moreover, mechanical vulcanizers are well-suited for various applications, including the production of PCR and TBR tires, catering to diverse industry needs.

By Application

Based on application, the tire vulcanizer market is classified into PCR tire, TBR tire, and OTR tire. The PCR tire segment garnered the highest revenue of USD 540.5 million in 2023.

Rapid urbanization, rising disposable incomes, and improving road infrastructure in emerging markets have significantly boosted passenger car sales. Furthermore, the demand for high-quality, durable PCR tires has surged, driving the need for advanced tire vulcanization processes. PCR tires require precise vulcanization to ensure safety, performance, and longevity, making them a critical focus area for tire manufacturers.

Additionally, technological advancements and consumer preferences for high-performance and eco-friendly tires have propelled segmental growth. The continuous development of new rubber compounds and vulcanization techniques to meet stringent safety and environmental standards has further contributed to the expansion of the segment.

Tire Vulcanizer Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific Tire Vulcanizer Market share stood around 35.48% in 2023 in the global market, with a valuation of USD 403.2 million. This growth can be attributed to the flourishing automotive sector in the region, propelled by rapid industrialization, urbanization, and increasing consumer purchasing power.

Key countries such as China, India, and Japan serve as pivotal automotive manufacturing hubs, thereby significantly bolstering global vehicle demand.

In addition, the necessity for top-tier tires and efficient vulcanization processes has surged. Additionally, conducive economic policies, substantial investments in infrastructure, and robust supply chain networks facilitate domestic market growth. Furthermore, the presence of major tire manufacturers and continuous technological advancements in tire production processes have propelled regional market expansion.

North America is poised to grow rapidly, depicting a CAGR of 5.07% over the forecast period. This notable growth is mainly attributed to the robust automotive industry, characterized by a substantial demand for both new and replacement tires. The U.S. emerges as a major automotive market, exhibiting consistent demand for high-quality tires, thereby requiring advanced vulcanization processes to meet this demand.

A growing emphasis on vehicle maintenance and safety awareness is leading to an increased demand for tire retreading and repair services in the region. The implementation of stringent environmental regulations and rising focus on sustainability are compelling tire local manufacturers to utilize greener vulcanization technologies, thus fostering opportunities for innovation and domestic market expansion.

Additionally, favorable government policies and increased investments in infrastructure development support the expansion of the automotive and tire industries, thereby contributing to the growth of the North America market.

Competitive Landscape

The global tire vulcanizer market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Tire Vulcanizer Market

- HF TireTech Group

- Larsen & Toubro Limited

- Alfred Herbert (India) Ltd.

- Buhler India Pvt. Ltd.

- Guilin Rubber Machinery Factory Co., Ltd.

- MESNAC

- Kobe Steel, Ltd.

- Beijing BAMTRI Dingsheng Technology Co., Ltd.

- Qingdao Yadong Rubber Machinery Group Co., Ltd.

- HARBURG-FREUDENBERGER

Key Industry Development

- March 2024 (Expansion): Continental Tire inaugurated a new Retread Solutions Development Center in Rock Hill, S.C., aimed at advancing retread technologies and processes. The facility focused on innovation and process improvements, offering virtual and augmented reality training for retread partners. It emphasized sustainability by enhancing the efficiency and lifespan of retreaded tires. This initiative supported Continental’s commitment to delivering the Lowest Overall Driving Cost (LODC) while addressing environmental concerns through the implementation of improved retreading practices.

The Global Tire Vulcanizer Market is Segmented as:

By Type

- Hydraulic

- Mechanical

- Others

By Application

- PCR Tire

- TBR Tire

- OTR Tire

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America