Market Definition

Thermoplastic polyurethane (TPU) is a flexible, abrasion-resistant elastomer that combines the properties of rubber and plastic. TPU offers high mechanical strength, chemical resistance, and processability across various molding techniques. It is widely used across automotive, footwear, electronics, and medical sectors for applications such as wire insulation, protective cases, shoe soles, tubing, and seals.

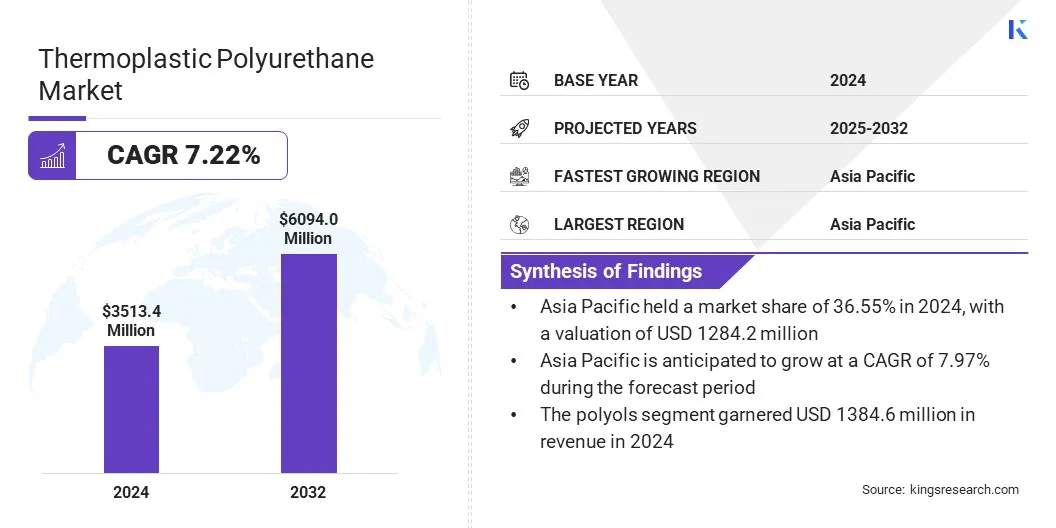

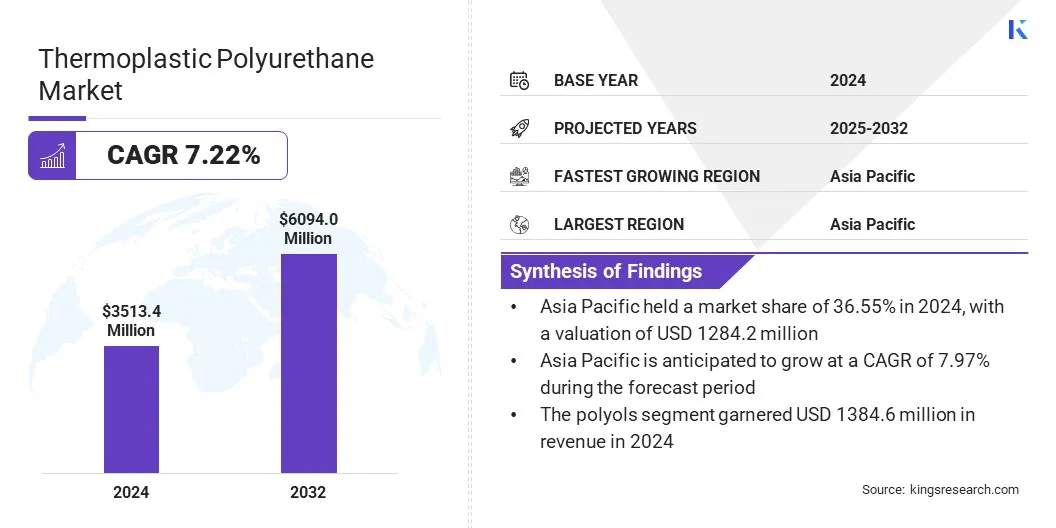

The global thermoplastic polyurethane market size was valued at USD 3,513.4 million in 2024 and is projected to grow from USD 3,740.6 million in 2025 to USD 6,094.0 million by 2032, exhibiting a CAGR of 7.22% during the forecast period. Market growth is driven by the rising demand for lightweight and high-performance materials in the automotive industry.

Automakers are increasingly using TPU to improve fuel efficiency without compromising durability. Additionally, the integration of nano-enhanced and functional TPU composites is expanding applications in electronics, footwear, and industrial components, thereby driving market growth.

Major companies operating in the thermoplastic polyurethane industry are BASF, The Lubrizol Corporation, Covestro AG, Huntsman Corporation, Wanhua, COIM Group, Epaflex Polyurethanes SpA, AMERICAN POLYFILM, INC., Mitsui Chemicals, Inc., Avient Corporation, Kuraray Co., Ltd., Townsend Chemicals P/L, Gantrade Corporation, Sumei Chemical Co., Ltd., and Trinseo.

Key Market Highlights:

- The thermoplastic polyurethane market size was USD 3,513.4 million in 2024.

- The market is projected to grow at a CAGR of 7.22% from 2025 to 2032.

- Asia Pacific held a share of 36.55% in 2024, valued at USD 1,284.2 million.

- The polyester-based TPU segment garnered USD 1,690.7 million in revenue in 2024.

- The polyols segment is expected to reach USD 2,437.8 million by 2032.

- The footwear segment secured the largest revenue share of 36.41% in 2024.

- North America is anticipated to grow at a CAGR of 7.19% over the forecast period.

Thermoplastic Polyurethane Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polyester-based TPU, Polyether-based TPU, Polycaprolactone-based TPU

|

|

By Raw Material

|

Diisocyanate, Polyols, Diols, Others

|

|

By End-use Industry

|

Footwear, Automotive, Medical, Industrial Machinery & Engineering, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Thermoplastic Polyurethane Market Regional Analysis

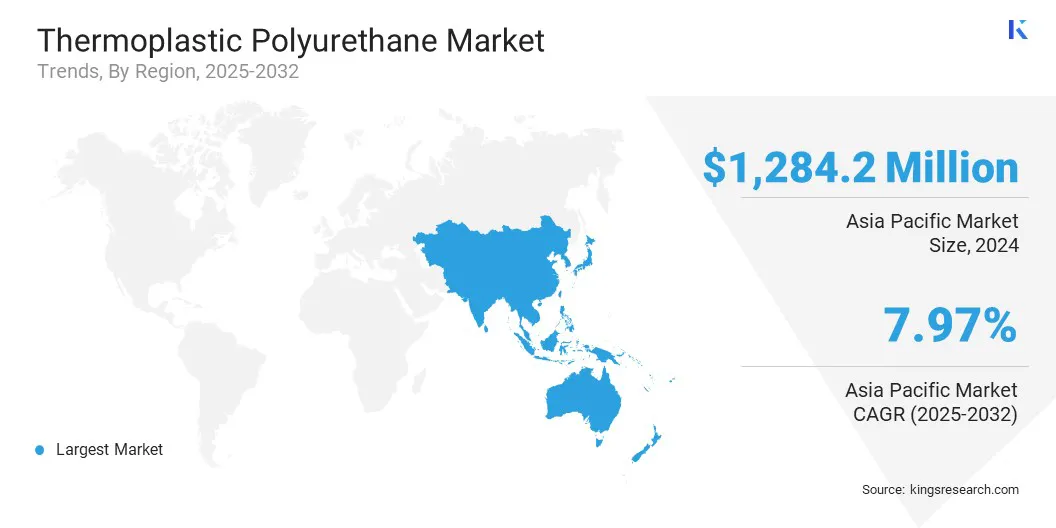

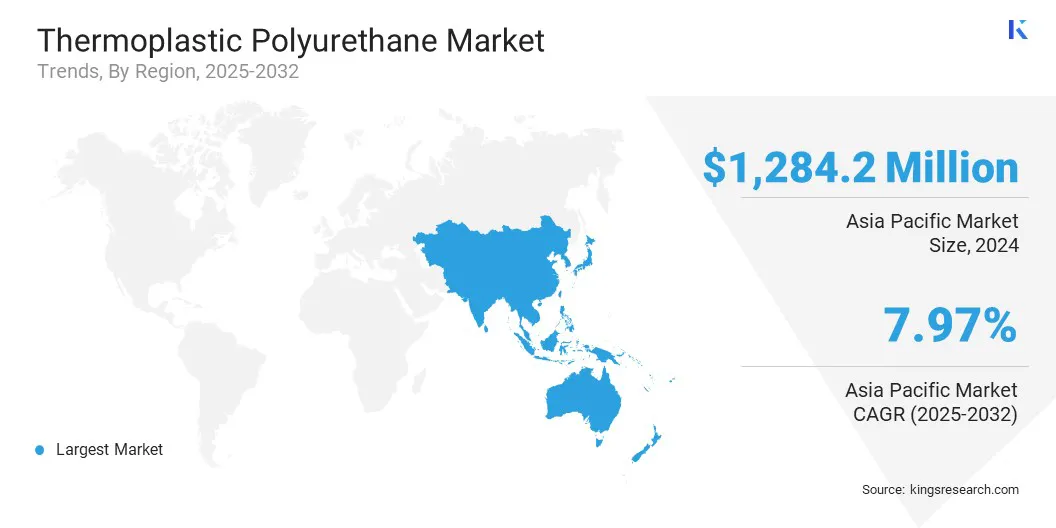

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific thermoplastic polyurethane market share stood at 36.55% in 2024, valued at USD 1,284.2 million. This dominance is reinforced by the region’s large concentration of global footwear manufacturing facilities that cater to both domestic demand and international brands.

TPU is widely used in midsoles, outsoles, and upper components of sports and casual footwear due to its excellent elasticity, durability, and comfort. Moreover, the rising production of performance-focused footwear is boosting the consumption of TPU.

- In September 2024, Covestro announced plans to establish a new TPU Application Development Center in Guangzhou, China, set to be operational by 2025. The facility aims to include key applications such as footwear, electronics, and specialty extrusion, complementing Covestro’s largest TPU plant in Zhuhai and existing R&D hub in Changhua. The initiative underscores the company’s commitment to localized innovation and production support for regional shoe manufacturers.

The North America thermoplastic polyurethane industry is poised to grow at a CAGR of 7.19% over the forecast period. This growth is propelled by North America's position as a leading innovation hub in 3D printing technologies.

TPU-based flexible filaments are being increasingly utilized for prototyping and low-volume production in industries such as aerospace, healthcare, and sports equipment. As more companies adopt flexible, impact-resistant materials for customized applications, this trend is significantly boosting the demand for TPU across the region.

- In June 2025, Amolen launched two new S-Series TPU filaments at the RAPID + TCT conference in Detroit, a Glow‑in‑the‑Dark TPU and a Transparent TPU filament. The glow variant is formulated with a non‑toxic UV-reactive compound for visual and safety uses. The transparent option delivers high optical clarity and abrasion resistance, suitable for functional components such as soft seals, light diffusers, and protective casings.

Thermoplastic Polyurethane Market Overview

Rapid growth in the footwear and apparel industries is fueling the demand for thermoplastic polyurethane materials due to their superior flexibility, abrasion resistance, and shock-absorbing properties.

Sportswear and performance gear manufacturers are adopting TPU to enhance comfort, durability, and design innovation in athletic products. The material supports lightweight construction and complex geometries, making it ideal for advanced footwear and apparel applications.

- In August 2024, Huntsman Corporation launched AVALON GECKO TPU, a high-performance thermoplastic polyurethane portfolio designed for footwear outsoles. The portfolio includes three grades, including a transparent extrusion grade (AVALON 6053 AG), a transparent injectable grade (AVALON 6055 AG), and an opaque injectable grade (AVALON 6044 AG). One grade allows outsoles up to 50% thinner and lighter than conventional designs, offering excellent grip in wet and dry conditions and enabling adhesive-free bonding and mechanical recyclability.

Market Driver

Surging Focus on Vehicle Light Weighting and Performance Improvement

Rising focus on vehicle light weighting and performance enhancement is propelling demand for thermoplastic polyurethane (TPU) in the automotive sector. TPU is being increasingly used in interior trims, hoses, sealing systems, and insulation due to its flexibility, wear resistance, and vibration-damping properties.

Automakers are adopting TPU to reduce overall vehicle weight, improve fuel efficiency, and enhance passenger comfort. The material’s ability to withstand mechanical stress and extreme temperatures makes it suitable for both structural and aesthetic applications.

Additionally, collaborations between chemical producers and automotive OEMs are supporting the development of advanced TPU formulations tailored to evolving mobility needs.

- In March 2024, BASF SE launched Elastollan N, a 50% bio-based thermoplastic polyurethane (TPU) designed for broad industrial and automotive applications. The material maintains identical durability, flexibility, and processability to conventional Elastollan TPU. It targets components such as hoses, cable jackets, EV charging parts, and interior trims, delivering high mechanical performance while reducing reliance on fossil-derived feedstocks.

Market Challenge

High Production Costs and Raw Material Volatility Pressuring Margins

A key challenge impeding the growth of the market is its higher production cost compared to alternative polymers, limiting its use in cost-sensitive applications.

The reliance on raw materials such as diisocyanates and polyols, which are subject to price fluctuations, further impacts manufacturers’ profit margins. These cost dynamics are making it difficult for producers to maintain stable pricing and competitiveness across diverse end-use industries.

To address this challenge, market players are improving process efficiency, exploring alternative raw material sources, and securing long-term supply agreements to manage input costs. They are also investing in advanced formulation to deliver performance benefits while minimizing material expenses.

Market Trend

Integration of Nano‑Enhanced & Functional TPU Composites

A key trend influencing the thermoplastic polyurethane market is the development of nano-enhanced and functional TPU composites. Manufacturers are integrating nanomaterials such as graphene and titanium nitride to improve mechanical strength, abrasion resistance, and thermal performance.

These composites also offer functionalities such as electromagnetic interference (EMI) shielding and photothermal responsiveness, expanding TPU applications in electronics, automotive, and wearable devices. Ongoing research is focused on scalable production methods to ensure consistency and compatibility with existing processing techniques.

- In April 2025, researchers at the Hefei Institutes of Physical Science (Chinese Academy of Sciences) introduced a high-performance double-layer graphene–TPU composite for efficient ice control. The 3D-printed structure, comprising a graphene-enhanced TPU layer and a neat TPU substrate, demonstrated an in-plane thermal conductivity of 4.54 W/(m·K) and an anisotropic thermal conductivity ratio of 9.1.

Market Segmentation

- By Type (Polyester-based TPU, Polyether-based TPU, and Polycaprolactone-based TPU): The polyester-based TPU segment earned USD 1,690.7 million in 2024, mainly due to its high mechanical strength, abrasion resistance, and cost-effectiveness.

- By Raw Material (Diisocyanate, Polyols, Diols, and Others): The polyols segment held a share of 39.41% in 2024, fueled by its critical role in determining the flexibility, durability, and mechanical performance of TPU across applications such as automotive parts, footwear, and industrial goods.

- By End-use Industry (Footwear, Automotive, Medical, Industrial Machinery & Engineering, and Others): The footwear segment is projected to reach USD 2,118.2 million by 2032, owing to the material’s flexibility, abrasion resistance, and ability to meet design and durability requirements in both athletic and casual shoes.

Regulatory Frameworks

- In the U.S., TPU used in medical applications must comply with the Food and Drug Administration (FDA) regulations, including 510(k) premarket notification or Premarket Approval (PMA), along with biocompatibility testing under ISO 10993 and United States Pharmacopeia (USP) Class VI standards. The Environmental Protection Agency (EPA) also mandates control of volatile organic compounds (VOCs), while California’s Proposition 65 requires labeling for TPU products containing listed hazardous chemicals.

- The European Union enforces Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulations for TPU and its chemical components, requiring registration for volumes over one tonne per year. Medical-grade TPU must comply with the Medical Device Regulation (EU MDR 2017/745), which includes strict chemical disclosure and CE-marking requirements. Additionally, EU Regulation 2020/1149 mandates certified safety training for handlers of free diisocyanates used in TPU manufacturing, effective from August 2023.

- China regulates TPU under national GB/T standards such as GB/T 42918.1 and 42918.2 for processing and performance evaluation. TPU used in medical devices must meet YY/T 1557-2017 requirements for safety and functionality. Products used in cables or electronics may require China Compulsory Certification (CCC). Regulatory oversight falls under the Ministry of Industry and Information Technology (MIIT) and the National Medical Products Administration (NMPA), ensuring safety and quality across both industrial and healthcare applications.

- India mandates TPU quality compliance through the Bureau of Indian Standards (BIS) under the Quality Control Order (QCO), requiring adherence to IS 17397 (Part 1):2020 or ISO 16365-1:2014 from March 19, 2025. The Directorate General of Trade Remedies (DGTR) imposed anti-dumping duties on TPU imports from China starting in 2023. For medical-grade TPU, the Central Drugs Standard Control Organization (CDSCO) governs biocompatibility and product safety as per international norms.

Competitive Landscape

Major players in the thermoplastic polyurethane market are adopting strategies such as targeted research and development, product innovation, and customization for high-growth applications to maintain market competitiveness.

Companies are focusing on developing TPU materials that meet the performance needs of electronics and smart devices. Investments in thermal management properties and device-specific formulations are helping them align with evolving industry requirements.

- In May 2025, Covestro presented its Desmopan XHR and IT series TPU solutions for AI-enabled smart devices at a technical symposium in Taipei. These materials address key demands of modern electronics by offering thermal management, durability, and performance improvements for components such as laptop chassis, smart routers, wearables, and robotics systems.

Key Companies in Thermoplastic Polyurethane Market:

- BASF

- The Lubrizol Corporation

- Covestro AG

- Huntsman Corporation

- Wanhua

- COIM Group

- Epaflex Polyurethanes SpA

- AMERICAN POLYFILM, INC.

- Mitsui Chemicals, Inc.

- Avient Corporation

- Kuraray Co., Ltd.

- Townsend Chemicals P/L

- Gantrade Corporation

- Sumei Chemical Co., Ltd.

- Trinseo

Recent Developments (Product Launches)

- In October 2024, Cookiecad introduced TPU 95A, a flexible, durable filament available in vibrant color options. The filament is compatible with standard TPU-capable FFF 3D printers and supports applications in clothing, shoe prototypes, accessories, robotics, and custom gears.

- In September 2024, Trinseo introduced APILON 52 XB‑75A CRISTALLO, a transparent, ester-based TPU grade for footwear. It offers high clarity with mechanical strength, making it suitable for both athletic and casual shoes, and enhances Trinseo’s premium TPU product line.

- In September 2023, Huntsman Corporation introduced a liquid thermoplastic polyurethane (LTPU) for the rapid manufacturing of high-performance midsoles. This innovation enables the efficient production of lightweight, durable, and customizable footwear components, addressing the growing demand for advanced materials in the footwear industry.

TPU