Therapeutic Drug Monitoring Market Size

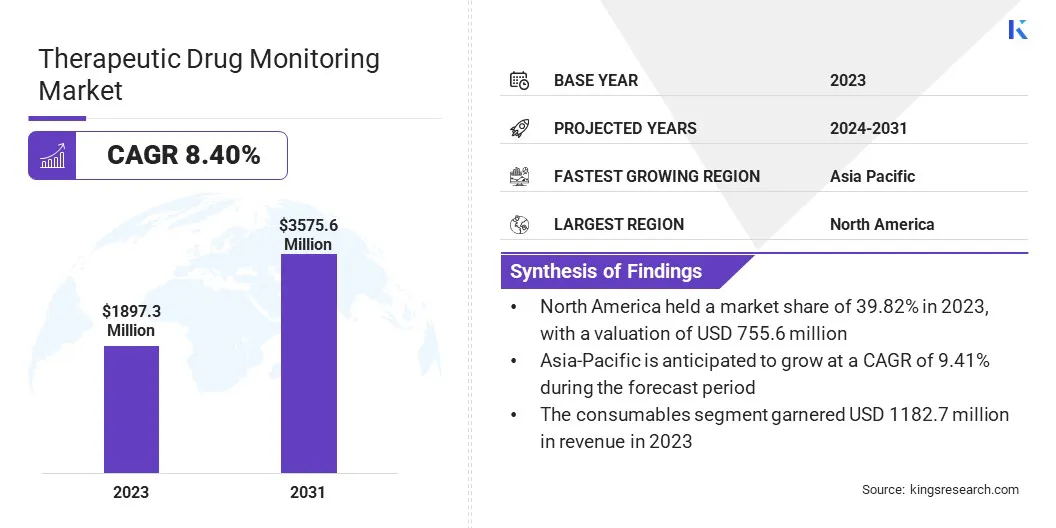

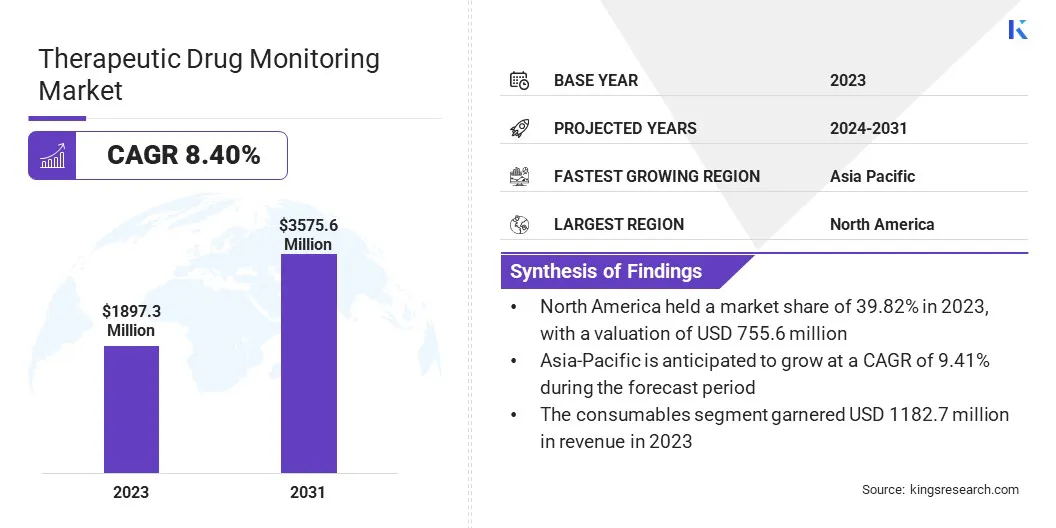

The global Therapeutic Drug Monitoring Market size was valued at USD 1897.3 million in 2023 and is projected to grow from USD 2032.9 million in 2024 to USD USD 3575.6 million by 2031, exhibiting a CAGR of 8.40% during the forecast period. The market is expanding significantly due to advancements in precision medicine and increasing healthcare expenditures.

The rising implementation of patient-specific treatment plans and the growing adoption of advanced diagnostic technologies are driving market growth. Enhanced focus on optimizing medication management and improving patient safety is further boosting the demand for TDM solutions.

In the scope of work, the report includes solutions offered by companies such as Abbott Laboratories, bioMérieux SA, F. Hoffmann-La Roche AG, Siemens Healthineers, Thermo Fisher Scientific Inc., Danaher Corporation, BÜHLMANN Laboratories AG, Sekisui Medical Co., Ltd., Randox Laboratories Ltd., Bio-Rad Laboratories, Inc., and others.

The therapeutic drug monitoring (TDM) market is experiencing robust growth, mainly fueled by the increasing prevalence of chronic diseases, advancements in analytical technologies, and increased focus on personalized medicine.

- According to WHO, cardiovascular diseases are the leading cause of non-communicable disease (NCD) deaths, with 17.9 million fatalities annually. This is followed by cancers, which result in 9.3 million deaths per year, chronic respiratory diseases with 4.1 million, and diabetes with 2.0 million deaths, including those from kidney disease related to diabetes. These four groups of diseases represents over 80% of all premature deaths attributable to NCD.

As healthcare systems seek to optimize treatment efficacy and minimize adverse effects, the demand for precise and efficient monitoring solutions is rising. Innovations in high-performance liquid chromatography and mass spectrometry are enhancing the accuracy of drug level assessments. Additionally, the growing adoption of point-of-care testing (POCT) and strategic initiatives by key players, including product launches and collaborations, are propelling market expansion.

Therapeutic drug monitoring (TDM) is a clinical practice that involves measuring specific drug levels in a patient's bloodstream at designated intervals to maintain an optimal concentration. The primary goal is to optimize individual dosage regimens, ensuring maximum therapeutic efficacy while minimizing the risk of toxicity or adverse effects.

TDM is especially crucial for medications with narrow therapeutic ranges, significant variability in metabolism, or a high potential for drug interactions. By carefully monitoring drug levels, healthcare providers make informed adjustments to dosing, leading to improved patient outcomes and ensuring safer, more effective treatment plans tailored to individual patient needs.

Analyst’s Review

The growth of the market is expected to be fueled by the implementation of strategic initiatives such as new product launches and mergers and acquisitions by key players. These initiatives contribute to ongoing technological advancements and sustained market expansion.

- For instance, in May 2022, THERADIAG, a company specializing in vitro diagnostics and theragnostics, launched ez-Track1, a precise point-of-care testing (POCT) solution designed for therapeutic drug monitoring.

Key players' continuous innovation and strategic collaborations are expected to augment market growth in the coming years. By developing advanced technologies and forming partnerships, these companies are enhancing therapeutic drug monitoring solutions, while improving accuracy and efficiency, thereby expanding market opportunities.

Therapeutic Drug Monitoring Market Growth Factors

The increasing prevalence of chronic conditions, such as cancer and cardiovascular diseases, is boosting the demand for therapeutic drug monitoring (TDM). As these conditions often require long-term medication regimens with precise dosing, TDM plays a crucial role in optimizing treatment efficacy and minimizing potential adverse effects.

By regularly measuring drug levels in the bloodstream, healthcare providers are tailoring treatments to meet individual patient needs, allowing for precise adjustment of dosages to achieve the desired therapeutic effects while minimizing the risk of toxicity. This personalized approach helps improve patient outcomes, enhance the effectiveness of treatments, and reduce the risk of drug-related complications, thereby fueling the growth of the TDM market.

- For instance, in 2023, Lifespin, a leading healthcare technology company, launched advanced software designed for therapeutic drug monitoring laboratories. This software significantly improved the accuracy, efficiency, and productivity of laboratory operations, leading to enhanced patient outcomes. It offered comprehensive data management and analysis tools, simplifying the monitoring process and enabling healthcare professionals to make informed decisions. Laboratory technicians used Lifespin’s new software to track and monitor drug levels in patients' blood, facilitating precise adjustments to medication dosages as needed.

A significant challenge hampering the progress of the therapeutic drug monitoring market is the high cost associated with advanced analytical technologies, which can be prohibitive for smaller healthcare facilities. The complexity of TDM procedures requires specialized training and expertise, limiting its widespread adoption.

Additionally, regulatory hurdles and the rising need for stringent quality control measures add to the complexity to the implementation of TDM practices. To mitigate these challenges, key players are actively focusing on continuous innovation and strategic initiatives. They are developing cost-effective, user-friendly TDM solutions, forming partnerships to enhance research and development, and offering extensive training programs to healthcare providers. These efforts improve accessibility, affordability, and efficiency, thereby propelling market expansion.

Therapeutic Drug Monitoring Market Trends

Technological innovations in analytical methods, including high-performance liquid chromatography (HPLC) and mass spectrometry (MS), are significantly enhancing the accuracy and efficiency of therapeutic drug monitoring (TDM). HPLC allows for precise separation and quantification of drug compounds in complex biological samples, while mass spectrometry provides detailed molecular analysis and identification.

These advancements improve the reliability of drug level measurements, facilitating more accurate dose adjustments and better patient management. The enhanced precision and speed of these technologies support more effective monitoring of therapeutic drugs, thereby contributing significantly to the growth of the market.

The growing adoption of point-of-care testing (POCT) is a notable trend influencing the therapeutic drug monitoring market. POCT solutions are gaining preference due to their portability and capacity to deliver immediate, real-time data on drug levels. This capability allows for prompt therapeutic adjustments, thereby enhancing the efficacy of treatment and improving patient outcomes.

As healthcare providers actively seek more efficient and accessible monitoring solutions, the demand for POCT is expected to rise. The growing shift toward these advanced, user-friendly technologies reflects the industry's major focus on optimizing patient care and streamlining drug monitoring processes.

Segmentation Analysis

The global market is segmented based on product, technology, drug class, end-user, and geography.

By Product

Based on product, the market is categorized into consumables and equipment. The consumables segment led the therapeutic drug monitoring market in 2023, reaching a valuation of USD 1182.7 million. As the healthcare and diagnostic sectors continue to expand, there is a rising demand for consumables such as reagents, test kits, and disposables. These consumables are essential for routine testing, diagnostic procedures, and laboratory operations, leading to their widespread use.

Technological advancements and innovations in consumable products enhance their performance and reliability, thereby boosting their adoption. Additionally, the rising emphasis on personalized medicine and precision diagnostics highlights the pressing need for specialized consumables. The expnasion of the consumables segment is attributed to its ability to enhance the efficiency and effectiveness of various medical and diagnostic processes.

By Drug Class

Based on drug class, the market is categorized into antiepileptic drugs, antibiotics, immunosuppressants, psychiatric drugs, analgesics, and others. The antiepileptic drugs segment captured the largest therapeutic drug monitoring market share of 24.83% in 2023. The increasing prevalence of epilepsy and other seizure disorders is leading to a higher demand for effective AEDs to manage these conditions.

- According to WHO, approximately 50 million people worldwide are affected by epilepsy, making it one of the most common neurological diseases globally. It is estimated that up to 70% of those living with epilepsy could live seizure-free with appropriate diagnosis and treatment.

Advances in drug development have resulted in the introduction of new, more effective AEDs with fewer side effects, thereby enhancing treatment options for patients. Additionally, the growing awareness of epilepsy and improved diagnostic capabilities are resulting in higher treatment rates, thus boosting demand. The rising focus on personalized medicine and targeted therapies is further contributing to the expansion of the segment, as tailored treatments improve patient outcomes.

By End-User

Based on end-user, the market is categorized into hospital laboratories, commercial and private laboratories, and research & academic laboratories. The hospital laboratories segment is expected to garner the highest revenue of USD 1875.4 million by 2031. These laboratories are equipped with advanced analytical technologies, such as high-performance liquid chromatography (HPLC) and mass spectrometry, ensuring accurate and efficient drug monitoring.

The integration of hospital laboratories with electronic health records (EHR) systems enhances data management and facilitates real-time decision-making. Additionally, the increasing prevalence of chronic diseases and the rising demand for personalized medicine are increasing the reliance on hospital laboratories for TDM, thereby propelling segmental growth.

Therapeutic Drug Monitoring Market Regional Analysis

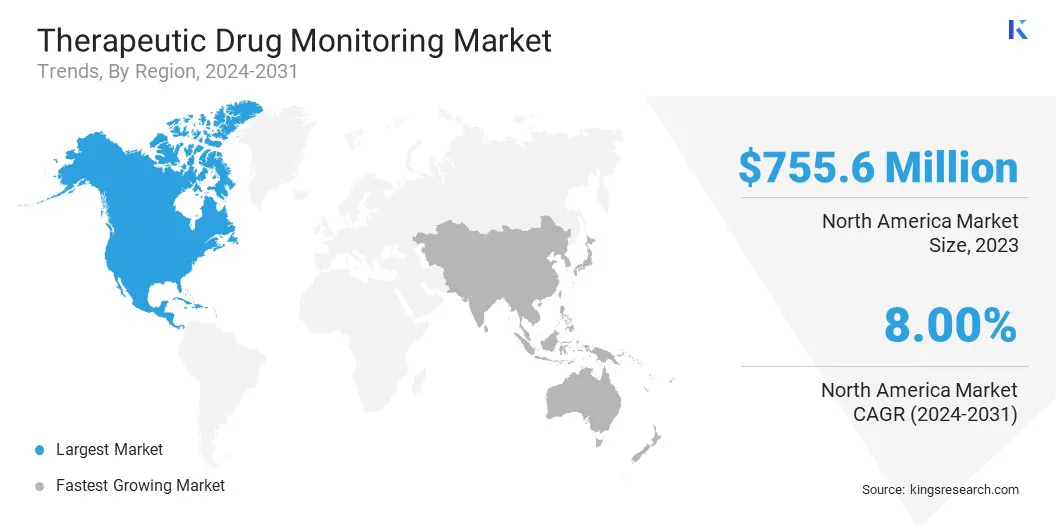

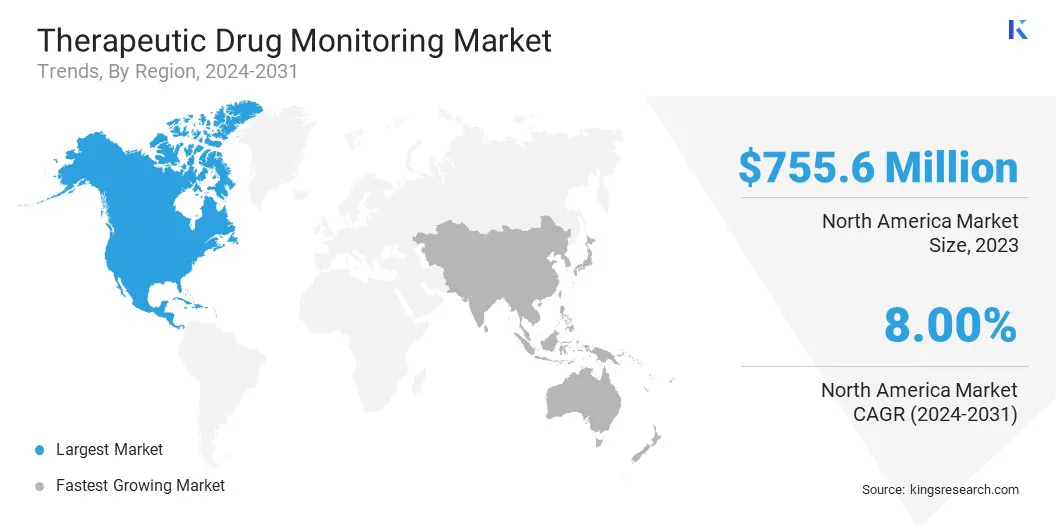

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America therapeutic drug monitoring market share stood around 39.82% in 2023 in the global market, with a valuation of USD 755.6 million, owing to advancements in healthcare infrastructure and increasing investments in research and development. Key product launches, a high concentration of market players, acquisitions and partnerships among significant players, and the rising incidence of chronic diseases in the United States are contributing to regional market growth.

- For instance, in May 2022, Bamboo Health, formerly known as Appriss Health and PatientPing, announced a partnership with the Wyoming Board of Pharmacy to develop a solution for its Prescription Drug Monitoring Program (PDMP).

These combined factors are expected to bolster the growth of the North America TDM market.

Asia-Pacific is anticipated to witness substantial growth at a robust CAGR of 9.41% over the forecast period, largely attributed to the increasing healthcare expenditure and a rising focus on personalized medicine. The expansion of the pharmaceutical industry and the surging demand for advanced diagnostic technologies are fostering this considerable expansion.

Government initiatives to enhance healthcare infrastructure and the prevalence of chronic diseases further contribute to regional market growth. Additionally, increased awareness of the benefits of TDM in optimizing treatment regimens and improving patient outcomes is supporting its adoption in the Asia Pacific region.

Competitive Landscape

The global therapeutic drug monitoring market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Therapeutic Drug Monitoring Market

- Abbott Laboratories

- bioMérieux SA

- Hoffmann-La Roche AG

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- BÜHLMANN Laboratories AG

- Sekisui Medical Co., Ltd.

- Randox Laboratories Ltd.

- Bio-Rad Laboratories, Inc.

Key Industry Development

- October 2023 (Approval): ProciseDx, a leading provider of advanced diagnostic solutions, announced a significant breakthrough in therapeutic drug monitoring. The company received FDA clearance for its innovative tests, specifically designed to monitor the levels of biologic drugs, including Humira, Remicade, and their biosimilars. These drugs are commonly used to treat chronic conditions such as rheumatoid arthritis, Crohn's disease, and psoriasis. This FDA clearance marks a major achievement for ProciseDx, positioning it as the first company to receive approval for therapeutic drug monitoring tests for these specific drugs.

The global therapeutic drug monitoring market is segmented as:

By Product

- Consumables

- Equipment

- Immunoassay Analyzers

- Chromatography & MS Equipment

- Others

By Technology

- Immunoassays

- Chemiluminescence Immunoassays

- Colorimetric Immunoassays

- Fluorescence Immunoassays

- Radioimmunoassay

- Others

- Chromatography

- LC-MS

- GC-MS

By Drug Class

- Antiepileptic Drugs

- Antibiotics

- Immunosuppressants

- Psychiatric Drugs

- Analgesics

- Others

By End-User

- Hospital Laboratories

- Commercial and Private Laboratories

- Research & Academic Laboratories

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America