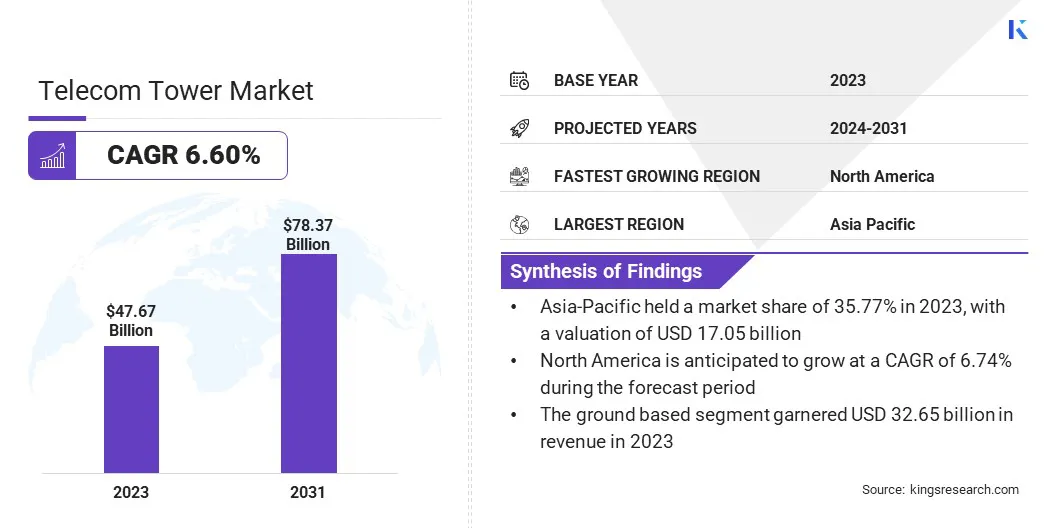

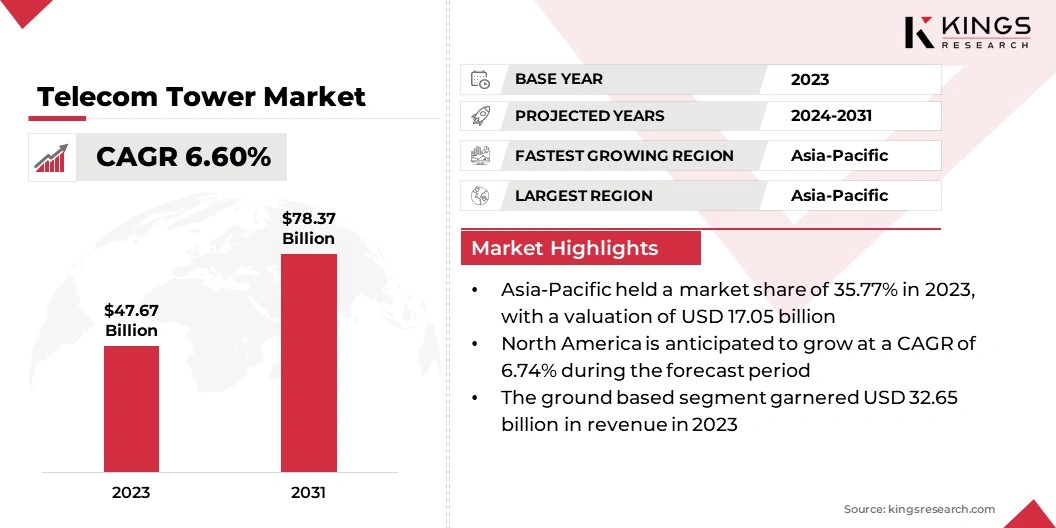

The global Telecom Tower Market size was valued at USD 47.67 billion in 2023 and is projected to grow from USD 50.10 billion in 2024 to USD 78.37 billion by 2031, exhibiting a CAGR of 6.60% during the forecast period. In the scope of work, the report includes solutions offered by companies such as China Tower Corporation Limited., Crown Castle, Deutsche Funkturm, GTL Infrastructure Limited, Helios Towers PLC, IHS Holding Limited, Indus Towers Limited, SBA Communications Corporation., ATC TRS V LLC., TAWAL.COM.SA and others.

Increasing smartphone penetration, expansion of 5G networks, and rising demand for high-speed data and reliable connectivity are key factors driving the expansion of the market. The growth of the telecom tower market is boosted by the rising demand for high-speed data and the need for reliable connectivity in both urban and rural areas. Additionally, favorable government initiatives to improve telecommunications infrastructure and increased investments in rural connectivity projects boost market development.

The trend toward digitalization in various sectors, including healthcare, education, and finance, further contributes to the growing need for robust telecom infrastructure. Furthermore, the emergence of the Internet of Things (IoT) and smart cities requires extensive network coverage, leading to increased demand for telecom towers.

- For instance, according to the FCC's mobile broadband data as of December 2023, 96% of the US population has access to 4G LTE coverage. This highlights the ongoing efforts aimed at expanding network availability.

The telecom tower market is experiencing substantial growth, fueled by ongoing technological advancements and increasing data consumption. Telecom towers are essential for wireless communication and facilitate the transmission of signals for mobile phones, radio, and television broadcasting. ,

Asia-Pacific dominates the market due to the rapid urbanization and extensive mobile subscriber base in countries such as China and India. North America and Europe present significant growth opportunities, facilitated by the deployment of advanced technologies and infrastructure upgrades.

A telecom tower is a tall structure specifically designed to support antennas used in telecommunications and broadcasting, thereby ensuring effective signal transmission. These towers are categorized into lattice towers, guyed towers, monopole towers, and stealth towers, each serving distinct purposes based on structural and locational requirements.

They are vital components of the telecommunication infrastructure, enabling seamless connectivity for voice and data transmission. The market encompasses the construction, maintenance, and leasing of these towers, catering to the surging demand for reliable and high-speed communication networks globally.

Analyst’s Review

Manufacturers in the telecom tower market are focusing on innovative solutions and sustainable practices. Companies are increasingly investing in the development of multi-tenant towers and integrating renewable energy sources to reduce operational costs and environmental impact. Emerging products, such as modular and lightweight towers, are being introduced to facilitate quicker deployment and adaptability across various terrains.

Market players are enhancing strategic partnerships to share infrastructure and reduce costs. Additionally, they are investing heavily in research and development for energy-efficient technologies. Expanding into underserved rural areas and collaborating with governments for regulatory support is projected to further strengthen their market presence and foster market growth.

- For instance, in India, the government's ambitious BharatNet project aims to provide high-speed broadband connectivity (around 100 Mbps bandwidth) to 250,000 gram panchayats (GPs). This signifies a strong commitment to narrowing the urban-rural digital divide, thereby creating a substantial demand for telecom towers in these areas.

The rapid deployment of 5G networks is stimulating the growth of the market. As telecommunications companies are continuously expanding their 5G infrastructure, the demand for new towers is increasing. 5G technology requires a higher density of small cells and towers compared to previous generations, thereby necessitating extensive infrastructure development.

This expansion supports higher data speeds, lower latency, and the capacity to connect more devices simultaneously. Additionally, 5G is pivotal for the development of emerging technologies such as autonomous vehicles, smart cities, and advanced IoT applications, which depend heavily on robust and widespread network coverage, thus increasing the global demand for additional telecom towers.

A significant challenge impeding the growth of the telecom tower market is the regulatory and zoning restrictions that obstruct the construction of new towers. These regulations vary widely by region and often involve lengthy approval processes and stringent compliance requirements. To overcome this challenge, telecom companies are adopting innovative solutions such as tower sharing and adopting stealth tower designs that blend with the environment, thereby reducing visual impact and gaining easier approval from local authorities.

Collaborating with governments to streamline regulatory frameworks and incentivize infrastructure investments helps mitigate these barriers, facilitating smoother and faster deployment of essential telecom infrastructure.

Tower sharing is a significant trend in the market, with operators and independent tower companies increasingly adopting this model. Sharing tower infrastructure allows telecom companies to reduce operational costs and minimize their environmental impact. This trend is particularly prominent in densely populated urban areas where space for new tower construction is limited.

Moreover, tower sharing enables faster network expansion and improves coverage without the need for extensive capital expenditure. It is promoting collaborations between telecom operators and fostering a more sustainable and efficient use of resources. This collaborative approach is reshaping the market landscape, making it more cost-effective and environmentally friendly.

The integration of renewable energy sources is another key trend in the telecom tower market. Companies are continuously exploring solar and wind energy to power telecom towers, aiming to reduce operational costs and carbon footprints. This trend is particularly relevant in remote and off-grid locations where traditional power sources are unreliable or unavailable.

Using renewable energy enhances the sustainability of telecom operations and aligns with global efforts toward combating climate change. Innovations in energy storage solutions and the decreasing cost of renewable technologies are making this transition more feasible and attractive for telecom tower operators, fostering a shift toward greener solutions.

Segmentation Analysis

The global market is segmented based on installation type, tower type, application, and geography.

By Installation Type

Based on installation type, the market is categorized into rooftop and ground based. The ground based segment led the telecom tower market in 2023, reaching a valuation of USD 32.65 billion due to its versatility and capacity to support heavy equipment. These towers are ideal for rural and suburban areas where land availability is less constrained. They offer greater stability and accommodate multiple tenants, making them cost-effective for telecom operators.

Additionally, ground-based towers support a wider range of antennas and are easier to maintain and upgrade, thereby enhancing their appeal. Their ability to provide extensive coverage in diverse geographic conditions contributes to their dominance in the market.

By Tower Type

Based on tower type, the market is classified into lattice tower, guyed tower, monopole tower, and stealth tower. The monopole tower segment is poised to witness significant growth, registering a CAGR of 7.40% through the forecast period (2024-2031). This notable expansion is attributable to their compact design and ease of installation.

These towers require less space and can be quickly deployed, making them ideal for urban areas with limited real estate. The growing demand for efficient network expansion in cities and the surging need for aesthetically pleasing structures boost the preference for monopole towers. Their versatility in supporting various telecommunications applications, along with lower maintenance costs, adds to their attractiveness.

By Application

Based on application, the market is segmented into communication, radio, and radar. The communication segment secured the largest telecom tower market share of 70.52% in 2023, primarily propelled by the increasing demand for mobile and internet connectivity. As digitalization progresses and more devices become interconnected, the need for robust communication networks intensifies.

Telecom towers play a critical role in supporting voice, data, and video transmission, essential for both personal and professional use. The surge in smartphone usage, along with the expansion of 4G and 5G networks, is contributing significantly to the expansion of the segment.

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific telecom tower market held a significant share of around 35.77% in 2023, with a valuation of USD 17.05 billion. This dominance is fostered by rapid urbanization, a massive and growing population, and the widespread adoption of smartphones. Countries such as China and India are leading in mobile subscriber growth, highlighting the need for extensive telecom infrastructure.

Additionally, government initiatives to boost digital connectivity and substantial investments in 5G network deployment are fueling regional market expansion. The increasing demand for high-speed internet and enhanced mobile coverage in both urban and rural areas further solidfies the region's leading position in the global telecom tower market.

North America is poised to experience significant growth, registering a CAGR of 6.74% through the projection period. This growth is primarily due to the ongoing deployment of 5G networks and the increasing demand for high-speed internet services. The region's advanced technological infrastructure and strong investment in telecommunications boost this expansion.

Additionally, the rising adoption of IoT devices and smart city projects necessitates robust network coverage, thus boosting the demand for telecom towers. Regulatory support for infrastructure development and a competitive landscape among telecom operators further contribute to North America's rapid growth.

Competitive Landscape

The telecom tower market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Telecom Tower Market

- China Tower Corporation Limited.

- Crown Castle

- Deutsche Funkturm

- GTL Infrastructure Limited

- Helios Towers PLC

- IHS Holding Limited

- Indus Towers Limited

- SBA Communications Corporation.

- ATC TRS V LLC.

- COM.SA

Key Industry Developments

- June 2024 (Partnership): China Tower Corporation Limited, a prominent telecommunications infrastructure service provider, signed a new strategic cooperation agreement with China State Railway Group Co., Ltd. The agreement aimed to leverage mutual resource advantages for integrated railway development and national infrastructure projects. Initiatives included enhancing digital capabilities along railway lines, upgrading to 5G, and exploring cooperation in disaster response and new energy applications. This collaboration covered over 9,000 km of railway coverage, emphasizing safety and technological innovation.

- May 2023 (Partnership): TAWAL extended its managed services partnership with Ericsson where the latter oversaw operations for approximately 16,000 sites in Saudi Arabia, ensuring high-quality standards and operational visibility. The partnership aimed to enhance site efficiency and supported TAWAL's sustainability goals by upgrading infrastructure for increased energy efficiency and reduced greenhouse gas emissions. The collaboration further expanded automation capabilities and operational efficiencies, maintaining uninterrupted infrastructure services for TAWAL's customers.

The global telecom tower market is segmented as:

By Installation Type

By Tower Type

- Lattice Tower

- Guyed Tower

- Monopole Tower

- Stealth Tower

By Application

- Communication

- Radio

- Radar

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America