Market Definition

Tartaric acid is a crystalline, white organic compound known for its strong taste and lack of odor. Naturally occurring in tamarinds, grapes, and bananas, it serves as the source of wine diamonds. This versatile acid has extensive applications across industries, functioning as a preservative, pH control agent, acidulant, stabilizer, chelating agent, and firming agent.

Tartaric Acid Market Overview

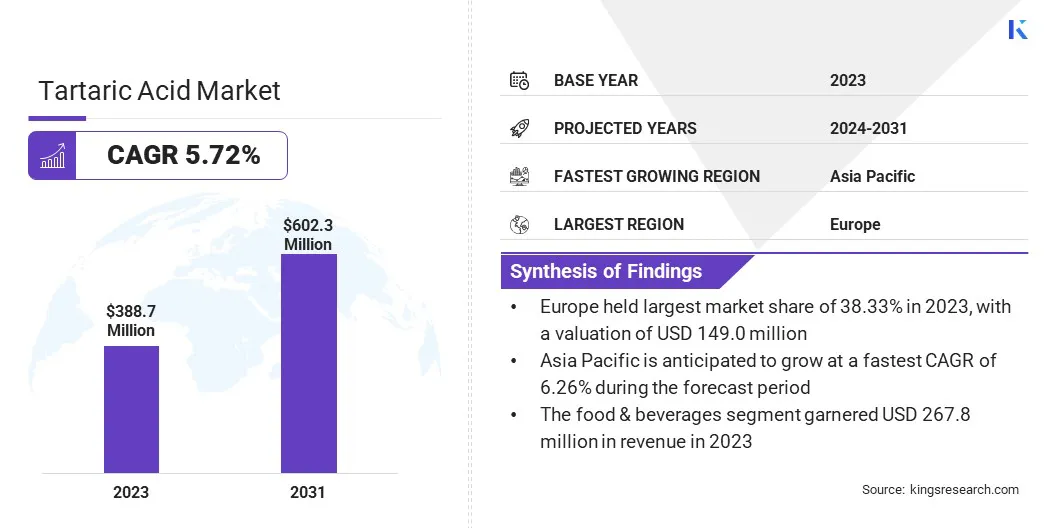

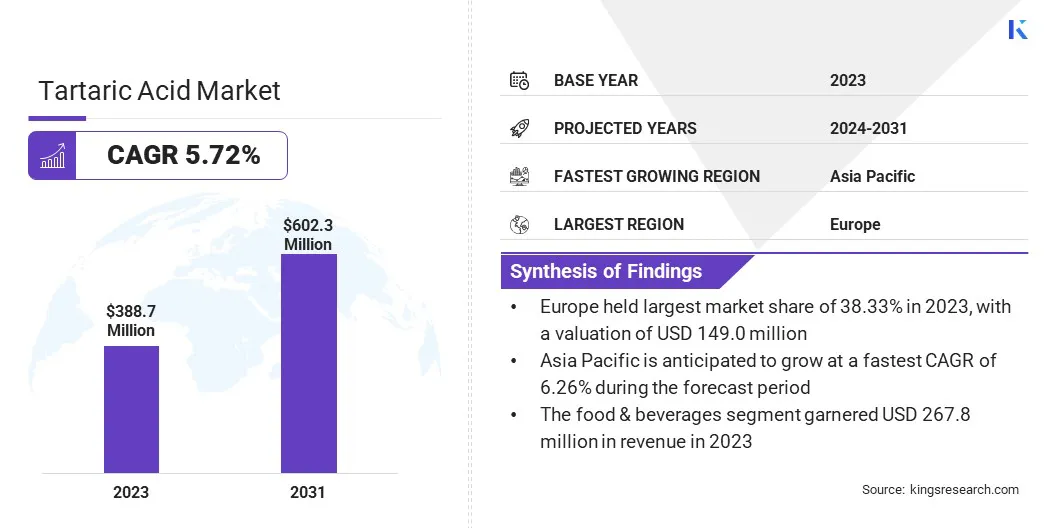

The global tartaric acid market size was valued at USD 388.7 million in 2023 and is projected to grow from USD 408.2 million in 2024 to USD 602.3 million by 2031, exhibiting a CAGR of 5.72% during the forecast period.

The market is expanding rapidly, due to the expansion of wine industry and pharmaceutical sector. In the culinary industry, tartaric acid used as cream of tartar is employed to stabilize egg whites, prevent sugar crystallization, and enhance the texture & volume of baked products. In addition, enhanced regulatory frameworks such as FDA, FSSAI, and EFSA are accelerating the market growth.

Major companies operating in the global tartaric acid Industry are Alvinesa Natural Ingredients, Comercial Química Sarasa S.L., THE CHEMICAL COMPANY, Tartaros Gonzalo Castello, Caviro Extra , Omkar Speciality Chemicals Ltd., PAHI, S.L., Changmao Biochemical Engineering Co. Ltd. , Industria Chimica Valenzana I.C.V. SpA , Anhui Hailan Bio-technology Co., Ltd. , Hangzhou Regin Bio-tech Co. Ltd., Ningbo Jinzhan Biotechnology Co. Ltd. , RANDI GROUP, BioCrick BioTech., and SHILPA CHEMSPEC INTERNATIONAL PVT LTD.

Rising consumer preference for natural and organic ingredients is driving the use of tartaric acid sourced from grapes and tamarinds. Additionally, advancements in production technologies and increasing demand for cosmetics & personal care products are fostering the growth of the market.

- According to Cosmetic Europe, the personal care and cosmetics industry generates USD 34 billion revenue annually.

Key Highlights:

- The global tartaric acid market size was valued at USD 388.7 million in 2023.

- The market is projected to grow at a CAGR of 5.72% from 2024 to 2031.

- Europe held a market share of 38.33% in 2023, with a valuation of USD 149.0 million.

- The food & beverages segment garnered USD 267.8 million in revenue in 2023.

- The grapes & sun-dried raisins segment is expected to reach USD 256.3 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.26% during the forecast period.

Market Driver

"Rising Application in Food & Beverage Industry"

The rising applications of tartaric acid in the food & beverage industry is driving the tartaric acid market. Tartaric acid is widely utilized in the global food industry, due to its versatility in enhancing the flavor and texture of various products, including sauces, jams, cakes, jellies, bread, and other food items.

Its distinct sour taste makes it a preferred ingredient in savory applications. Additionally, tartaric acid is one of the most prevalent acids found in wines, contributing a pronounced tartness that enhances fruit flavors, particularly lime and grape. While the natural form of tartaric acid is commonly used, the availability of synthetic tartaric acid has made it a practical choice for winemaking.

Tartaric acid is widely used in the production of dairy products, canned fruits and vegetables, baked goods, confectioneries, edible oils, and fats, due to its high antioxidant content, which strengthens immunity, aids digestion, reduces flatulence, improves intestinal absorption, and supports diabetes management.

As a natural acidulant and flavoring agent, it enhances the flavor of fruits. Additionally, both organic and synthetic tartaric acids are extensively employed in personal care products such as toothpaste, mouthwash, chewing gum, and dental floss, owing to their antibacterial properties.

Market Challenge

"Fluctuation in Raw Material Prices"

The tartaric acid market encounters significant challenges, due to fluctuations in raw material prices. Tartaric acid, widely used in food, beverages, pharmaceuticals, and industrial applications, is primarily derived from natural sources such as grapes and other agricultural products.

Variability in agricultural yields, due to climate change, pests, or natural disasters, can lead to inconsistent availability and pricing of raw materials. Additionally, geopolitical tensions and supply chain disruptions may further exacerbate price volatility. Manufacturers can adopt strategies like diversifying their raw material sources to reduce dependence on a single supplier or region.

Investing in advanced extraction and synthesis technologies can enhance production efficiency, lowering reliance on high-cost raw materials. Additionally, collaborations with farmers and suppliers for stable, long-term contracts and promoting the use of alternative synthetic production methods can mitigate these challenges.

Market Trend

"Increasing Construction Activities"

The increasing construction activities is driving the demand for tartaric acid, an essential component in building materials, particularly cement additives. Tartaric acid serves as a setting retardant in cement, allowing for slower concrete hardening. This characteristic is especially advantageous for large-scale, time-sensitive construction projects, improving their feasibility and operational efficiency.

With the growing infrastructure development, especially in developing nations, the rising need for construction materials has led to higher cement consumption, thereby amplifying the demand for tartaric acid. Its role in improving the workability and durability of cement-based products highlights its importance in contemporary construction practices.

Tartaric Acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Source

|

Grapes & Sun-dried Raisins, Maleic Anhydride

|

|

By Type

|

Natural, Synthetic/Artificial

|

|

By End User

|

Food & Beverages (Bakery & Confectionery , Beverages, Dairy & Desserts, Snacks & Savoury, Others), Pharmaceuticals, Cosmetic & Personal Care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Source (Grapes & Sun-dried Raisins, Maleic Anhydride): The maleic anhydride segment earned USD 227.6 million in 2023, due to its availability and cost-effectiveness. Maleic anhydride serves as the key component in the production of synthetic tartaric acid, which is in high demand globally across industries such as food, beverages, and pharmaceuticals.

- By Type (Natural, Synthetic/Artificial): The synthetic/artificial segment held 67.55% share of the market in 2023. It is extensively utilized in food & beverages, pharmaceutical, and cosmetics & personal care industries, owing to its quality and availability. It enhances the flavor of various products, such as ice-creams, jellies, jams, candies, and fruit nectars.

- By End User (Food & Beverages, Pharmaceuticals, Cosmetic & Personal Care, Others): The food & beverages segment is projected to reach USD 430.4 million by 2031. Tartaric acid is used as a natural preservative for vegetables, fruits, and wines, leveraging its antioxidant properties. Additionally, it is utilized as an additive in the production of stabilizers, emulsifiers, and agents for calcium remineralization.

Tartaric Acid Market Regional Analysis

Europe accounted for a significant market share of around 38.33% in 2023, valued at USD 149.0 million. The dominance of Europe in the tartaric acid market is attributed to increasing wine production.

Europe boasts a growing food and beverage (F&B) industry that extensively utilizes tartaric acid as an acidulant, preservative, and stabilizer in various products, fostering the growth of the market.

The region's focus on high-quality, natural ingredients aligns with the use of tartaric acid, derived from natural sources such as grapes. Additionally, leading industry players in the region are prioritizing collaborations, partnerships, and mergers and acquisitions (M&A) to enhance their market reach and expand their customer base.

- For instance, in March 2023, Azelis formed a strategic partnership with Alvinesa Natural Ingredients, a prominent European supplier of sustainable, plant-based ingredients designed to support healthy living.

However, the tartaric acid Industry in Asia Pacific is anticipated to register the fastest growth at a projected CAGR of 6.26%. The expanding food & beverage industry in countries like China, India, and Japan is boosting the demand for tartaric acid as a natural acidulant in products such as wine, fruit juices, and confectioneries, fueling its consumption in these countries.

Additionally, the rise in consumer preference for organic and plant-based food products has bolstered the demand for naturally sourced tartaric acid. Rapid industrialization and the flourishing pharmaceutical and cosmetics sectors in the region further propel the market.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. Food and Drug Administration (FDA) has classified tartaric acid as a Generally Recognized as Safe (GRAS) substance for direct addition to food.

- The European Food Safety Authority issued a scientific opinion on the re-evaluation of tartaric acid (L (+)-) (E 334), sodium tartrates (E 335), potassium tartrates (E 336), potassium sodium tartrate (E 337), and calcium tartrate (E 354) as food additives (3). A group acceptable daily intake (ADI) was established for tartaric acid-tartrates (E 334–337 and E 354) of 240 mg/kg bw per day, expressed as tartaric acid.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) published regulations in 2020 that added tartaric acid to the Ordinance for Enforcement of the Food Sanitation Act.

- Manufacturers/Suppliers of foods containing tartaric acid and tartrates (E 334–337 and E 354) must comply with the new maximum levels set for each food category, and ensure that these additives are not used in food categories for which their use is no longer authorised.

Competitive Landscape:

The tartaric acid market is characterized by a number of participants, including both established corporations and rising organisations. Companies in the market invest in research and development (R&D) to expand their production capacity.

Companies aggressively pursue a variety of strategic initiatives to achieve a competitive advantage in this dynamic market. Major strategies include new product launches, collaborations and alliances, corporate expansions, and mergers and acquisitions.

Companies in the market are investing in eco-friendly and sustainable production methods, such as electrochemical reduction and electrodialysis extraction, to meet the rising demand for natural products. These companies are optimizing their production processes to enhance cost efficiency and comply with stringent regulations.

List of Key Companies in Tartaric Acid Market:

- Alvinesa Natural Ingredients

- Comercial Química Sarasa S.L.

- THE CHEMICAL COMPANY

- Tartaros Gonzalo Castello

- Caviro Extra

- Omkar Speciality Chemicals Ltd.

- PAHI, S.L.

- Changmao Biochemical Engineering Co. Ltd.

- Industria Chimica Valenzana I.C.V. SpA

- Anhui Hailan Bio-technology Co., Ltd.

- Hangzhou Regin Bio-tech Co. Ltd.

- Ningbo Jinzhan Biotechnology Co. Ltd.

- RANDI GROUP

- BioCrick BioTech.

- SHILPA CHEMSPEC INTERNATIONAL PVT LTD.

- Others

Recent Developments (M&A/Expansion)

- In July 2024, Alvinesa Natural Ingredients, a specialist in grape and olive-based functional ingredients, acquired two companies in Chile and Argentina focused on the valorization of grape and olive by-products. This acquisition strengthens the group's position as a global leader in grape seed oil, tartaric acid, and cream of tartar.

- In March 2023, SPI Pharma, Inc. secured exclusive distribution rights for CELLETS MCC pellets and TAP tartaric acid pellets from ingredientpharm. This agreement provides SPI with exclusive distribution rights across North America, Latin America, New Zealand, and Australia. SPI plans to market and distribute the MCC pellets under the brand name ACTILLETS MCC pellets within these regions.