Market Definition

Tactical communications refer to specialized systems used by military, defense, emergency response, and security forces to exchange information securely, reliably, and in real time during missions or operations.

It includes voice, data, and video transmission over radios, satellite links, or networks designed to function in challenging environments, ensuring coordination, situational awareness, and mission success. The market encompasses hardware, software solutions, and services that enable voice, data, and video exchange for mission‑critical operations.

Tactical Communications Market Overview

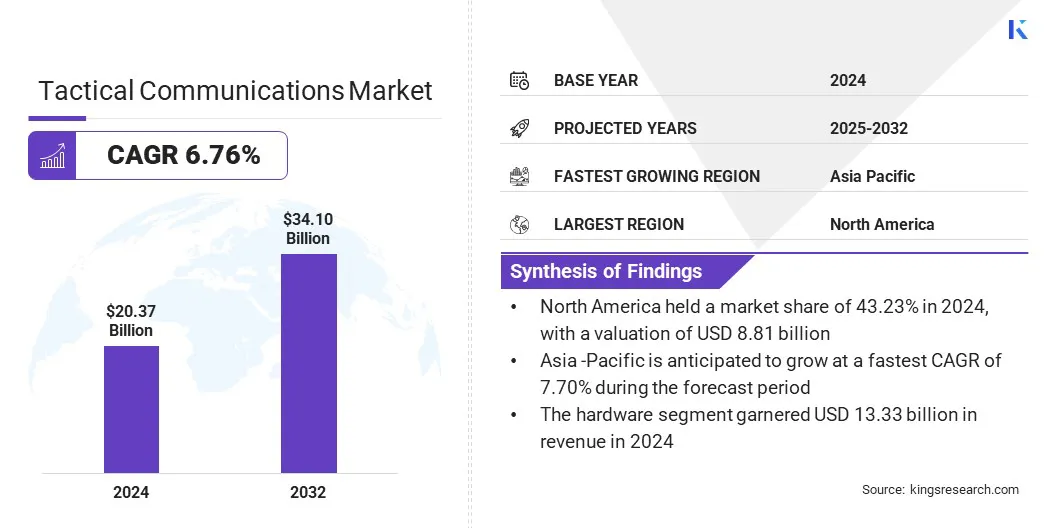

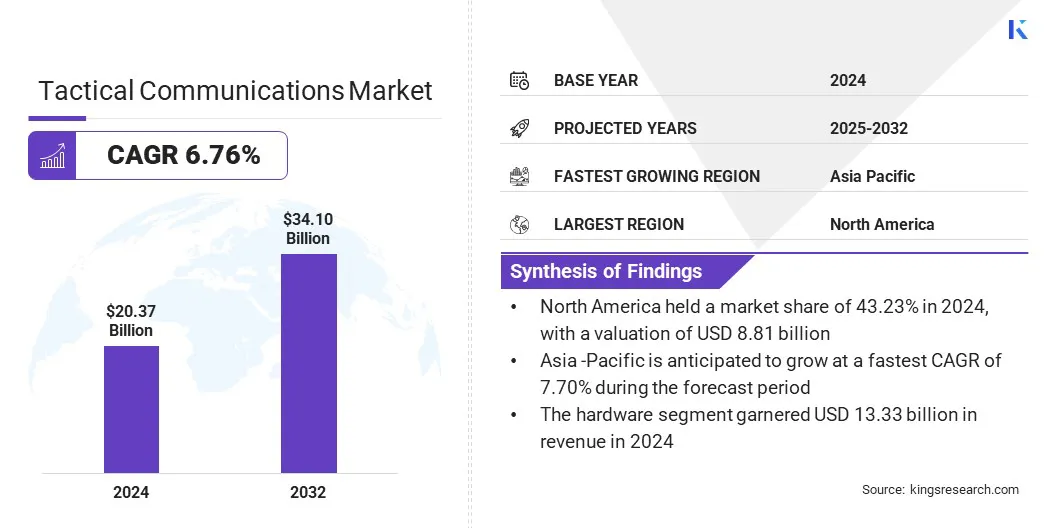

The global tactical communications market size was valued at USD 20.37 billion in 2024 and is projected to grow from USD 21.57 billion in 2025 to USD 34.10 billion by 2032, exhibiting a CAGR of 6.76% over the forecast period.

Market growth is driven by the rising adoption of advanced technologies such as software‑defined radios (SDR) and IP‑based communication. The growing need for secure, interoperable communication in military and emergency operations is further supporting the development and deployment of next‑generation tactical communication solutions.

Key Highlights:

- The tactical communications industry size was recorded at USD 20.37 billion in 2024.

- The market is projected to grow at a CAGR of 6.76% from 2024 to 2032.

- North America held a share of 43.23% in 2024, valued at USD 8.81 billion.

- The hardware segment garnered USD 13.33 billion in revenue in 2024.

- The land segment is expected to reach USD 16.93 billion by 2032.

- The next-generation network segment is anticipated to witness the fastest CAGR of 7.96% over the forecast period.

- The defense forces segment held a share of 64.32% in 2024

- Asia Pacific is anticipated to grow at a CAGR of 7.70% over the forecast period.

Major companies operating in the tactical communications market are BAE Systems, Motorola Solutions, Inc, Bittium Corporation, CODAN Limited, EFJohnson Technologies, Elbit Systems Ltd, General Dynamics Mission Systems, Inc, Indra Sistemas S.A., Iridium Communications Inc, L3Harris Technologies, Inc, Leonardo DRS, Inc, Northrop Grumman Corporation, QinetiQ Group, Rohde & Schwarz GmbH & Co. KG, and Thales Defense & Security, Inc.

The growing focus of market players on developing deployable tactical defense networks is accelerating the adoption of advanced communication solutions. Additionally, integrating high-performance technologies with digitalization expertise is enhancing secure and resilient network capabilities.

- In May 2025, Nokia and blackned GmbH signed a memorandum of understanding to jointly develop deployable tactical defence networks. The partnership combines Nokia’s 5G technology with Blackned’s digitalization expertise in the defense sector to create mobile communication systems for military battlefield operations.

Market Driver

Rising Global Defense Spending

Rising global defense spending is a major factor driving the growth of the tactical communications market. Increasing budgets are allowing governments to modernize command, control, and communication (C3) infrastructure and adopt next-generation systems that enhance battlefield connectivity.

Defense forces are prioritizing secure, real-time information exchange to support network-centric warfare, joint operations, and rapid decision-making. This growing investment is accelerating the deployment of software-defined radios, satellite-based communication links, and encrypted data networks across land, air, and naval platforms.

- According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure reached USD 2,718 billion in 2024, marking a 9.4% real-terms increase from 2023.

Market Challenge

Rising Cybersecurity Threats in Tactical Networks

A key challenge impeding the growth of the tactical communications market is the rising cybersecurity threats targeting tactical communication networks. These networks transmit critical and sensitive data during military and emergency operations, making them vulnerable to hacking, jamming, interception, and malware attacks. Advanced persistent threats and electronic warfare tactics can disrupt communications and compromise mission success.

To address this challenge, market players are investing in advanced security solutions and resilient network architectures. They are integrating end‑to‑end encryption, multi‑factor authentication, and secure software‑defined radio (SDR) platforms. Companies are also developing AI‑driven threat detection systems and intrusion prevention tools to identify and mitigate attacks in real time.

Market Trend

Increasing Use of Mobile Ad‑Hoc Networks (MANET) for Resilient Communications

A key trend influencing the tactical communications market is the increasing use of mobile ad-hoc networks (MANET) for resilient connectivity. These decentralized systems enable secure, self-healing, and scalable communication that adapts to changing battlefield conditions.

MANET supports seamless real-time data exchange and interoperability across diverse platforms, ensuring reliable performance in infrastructure-limited and contested environments. These advancements are driving the adoption of advanced tactical communication solutions to strengthen military operations in modern defense.

- In September 2025, Creomagic launched CreoEdge Dome, a tactical broadband communications solution, at DSEI 2025 to expand its tactical communications ecosystem. The platform delivers full, 360-degree coverage by combining MANET resilience with tactical cellular efficiency. It also enables secure, high capacity connectivity in infrastructure limited and contested environments.

Tactical Communications Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware (Radios, Antennas & Terminals, Ruggedized Devices), Software (Network management software, Secure communication platforms, Maintenance & support services)

|

|

By Platform

|

Land, Airborne, Naval, Space

|

|

By Technology

|

Radio Communication, Satellite Communication, Time-Division Multiplexing, Next-Generation Network

|

|

By End-User

|

Defense Forces, Homeland Security, Law Enforcement, Disaster Relief

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware and Software): The hardware segment earned USD 13.33 billion in 2024 due to rising demand for rugged and mission-critical communication devices.

- By Platform (Land, Airborne, Naval, and Space): The land segment held 51.21% of the market in 2024, due to extensive deployment of tactical systems by ground forces.

- By Technology (Radio Communication, Satellite Communication, Time-Division Multiplexing, and Next-Generation Network): The radio communication segment is projected to reach USD 17.80 billion by 2032, owing to its widespread adoption and reliability in battlefield operations.

- By End-User (Defense Forces, Homeland Security, Law Enforcement, and Disaster Relief): The disaster relief segment is anticipated to witness the fastest CAGR of 7.88% over the forecast period, driven by increasing reliance on resilient communication networks for emergency response operations.

Tactical Communications Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America tactical communications market share stood at 43.23% in 2024 in the global market, with a valuation of USD 8.81 billion. This dominance is attributed to rising defense budgets that support the modernization of military infrastructure and the adoption of advanced communication systems.

Increasing demand for secure, reliable, and interoperable connectivity to enable mission-critical military and emergency operations is driving market growth. Moreover, the presence of regional market players that are actively expanding their portfolios and capabilities through strategic acquisitions is further driving the market growth across North America.

- In September 2024, Codan Group acquired U.S.‑based Kägwerks to enhance its tactical communications offering. The acquisition adds battle‑proven, radio‑agnostic soldier systems and proprietary hardware and software solutions to Codan’s portfolio, enabling full‑spectrum tactical military connectivity.

Asia Pacific is set to grow at a CAGR of 7.70% over the forecast period. This growth is due to the rising geopolitical tensions and defense modernization across the Asia Pacific.

Increasing investments by governments and defense organizations in indigenous defense manufacturing are reducing reliance on imports to develop tailored communication solutions. Additionally, rapid adoption of advanced communication technologies, including AI‑assisted networks and software‑defined radios, is driving innovation and growth in the region.

- In February 2025, Kalyani Strategic Systems Limited (KSSL) partnered with L3Harris Technologies to develop next‑generation tactical solutions for military communication under the U.S.-India Defence Industrial Cooperation framework. The collaboration focuses on advanced C4ISR technologies and establishing robust tactical communication networks for the Indian Armed Forces.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates spectrum allocation, licensing, and technical standards for tactical communications. It oversees radio frequency usage to prevent interference, ensures compliance with communication protocols, and enforces security standards. The FCC also monitors emerging technologies like software‑defined radios and MANET to maintain safe, interoperable, and mission‑critical military communications.

- In the UK, the Office of Communications (Ofcom) regulates spectrum allocation, licensing, and technical compliance for tactical communications. It oversees interference management, ensures interoperability, and enforces security standards for military and emergency networks. Ofcom evaluates emerging communication technologies, facilitating innovation while safeguarding critical infrastructure and supporting resilient, mission‑critical operations.

- In India, the Wireless Planning & Coordination (WPC) Wing regulates spectrum management, licensing, and technical standards for tactical communications. It oversees frequency allocation, interference control, and compliance with security protocols.

Competitive Landscape

Companies operating in the tactical communications industry are expanding their portfolios by integrating advanced hardware and software solutions to offer secure and interoperable systems. They are investing in research and development to enhance capabilities in AI‑assisted networks, software‑defined radios, and resilient communication platforms.

Market players are also focusing on strategic partnerships and collaborations to accelerate innovation, improve deployment speed, and extend their reach in key regions. Additionally, they are enhancing product offerings to address evolving battlefield requirements, ensuring mission‑critical connectivity in urban and remote areas.

- In May 2024, Nokia completed the acquisition of Fenix Group to strengthen its tactical communications portfolio. The acquisition enables Nokia to deliver secure, interoperable, and mission critical communication solutions for defense customers in the U.S.

Top Key Companies in Tactical Communications Market:

- BAE Systems

- Motorola Solutions, Inc

- Bittium Corporation

- CODAN Limited

- EFJohnson Technologies

- Elbit Systems Ltd

- General Dynamics Mission Systems, Inc

- Indra Sistemas S.A.

- Iridium Communications Inc

- L3Harris Technologies, Inc

- Leonardo DRS, Inc

- Northrop Grumman Corporation

- QinetiQ Group

- Rohde & Schwarz GmbH & Co. KG

- Thales Defense & Security, Inc.

Recent Developments

- In May 2025, Anduril Industries signed an agreement to acquire Klas to strengthen its connected warfare capabilities. The acquisition enables Anduril to integrate rugged compute and networking systems with its autonomous platforms for faster and resilient communication solutions.