Superalloys Market Size

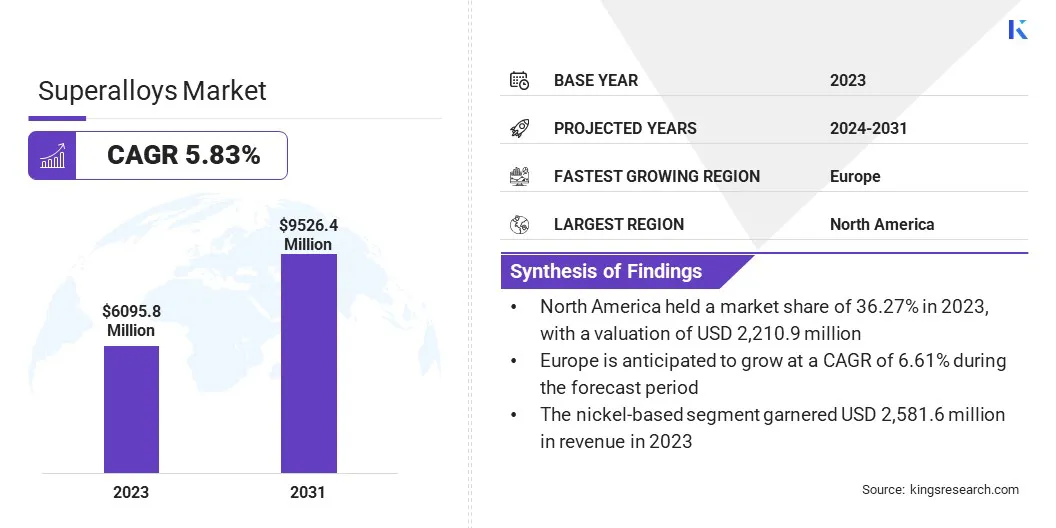

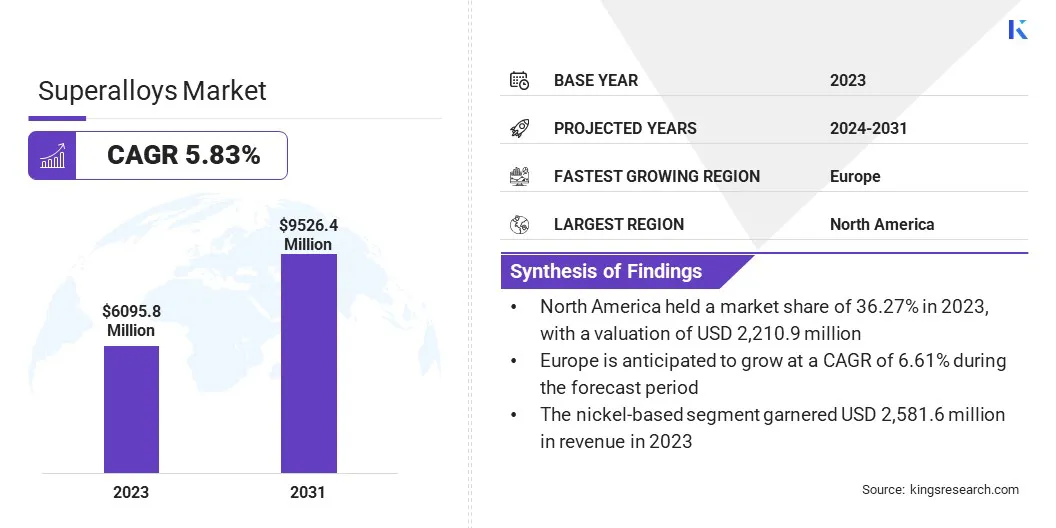

The global Superalloys Market size was valued at USD 6,095.8 million in 2023 and is projected to grow from USD 6,405.6 million in 2024 to USD 9,526.4 million by 2031, exhibiting a CAGR of 5.83% during the forecast period. In the scope of work, the report includes solutions offered by companies such as Allegheny Technologies Incorporated, AMG Chrome Limited, Aperam Alloys Imphy, CRS Holdings, LLC., Hitachi Metals, Ltd., Precision Castparts Corp., ThyssenKrupp Steel AG, HAYNES INTERNATIONAL, KOBE STEEL, LTD., VDM Metals GmbH and others.

The expansion of the market is primarily driven by the increasing demand from industries such as aerospace, automotive, and power generation due to their exceptional high-temperature strength, corrosion resistance, and continual technological advancements. There is growing demand for superalloys in the aerospace and defense sectors as a result of their exceptional high-temperature strength and corrosion resistance.

The automotive industry’s increasing preference for superalloys, aimed at enhancing fuel efficiency and reducing emissions, further propels the progress of the market. Moreover, the power generation sector’s notable shift toward gas turbines that require high-performance materials boosts demand.

Technological advancements in material science, significantly foster the development of more efficient and durable superalloys, playing a crucial role in their enhancement. Additionally, the rising investments in industrial gas turbines for power generation, especially in emerging economies, support the expansion of the market.

The superalloys market is experiencing robust growth, characterized by increased utilization across various industries, notably aerospace, automotive, and power generation. The Asia-Pacific region is witnessing rapid growth, mainly fueled by expanding industrialization and increasing investments in power infrastructure. Major market players are focusing on research and development to innovate and improve superalloy performance.

Superalloys, also known as high-performance alloys, are a group of materials designed to withstand extreme conditions, particularly high temperatures, and stress. They exhibit exceptional mechanical strength, resistance to thermal creep deformation, and superior surface stability, making them indispensable in demanding applications.

These alloys are primarily composed of nickel, cobalt, and iron, with various other elements added to enhance specific properties. Superalloys are critical in diverse industries that require materials that maintain performance in extreme environments, such as aerospace, automotive, and power generation. Their development and utilization are pivotal in advancing technologies that demand high reliability and efficiency under challenging conditions.

Analyst’s Review

Manufacturers are making efforts to innovate and meet evolving industry demands. Continuous research and development initiatives are leading to the introduction of new products with enhanced properties, catering to diverse application requirements.

Efforts are focused on improving material performance, optimizing manufacturing processes, and reducing production costs. Strategic collaborations and partnerships are prevalent, facilitating knowledge exchange and technological advancements.

- In February 2024, PTC Industries and HAL's accessories division in Lucknow entered into an MoU to localize diverse aviation-grade raw materials, including titanium and nickel-based superalloys. This collaboration focused on manufacturing spare parts and assemblies crucial for aircraft production. It aimed to enhance expertise in aerospace manufacturing and support India's self-reliance goals. PTC Industries, renowned for its precision-engineered metal components, strengthened its aerospace footprint, complementing recent partnerships such as supplying titanium parts for Dassault Aviation's Rafale jets.

To maintain a competitive edge, manufacturers should prioritize investment in sustainable practices and explore opportunities in emerging markets. Recommendations include fostering innovation, leveraging technology for efficiency gains, and maintaining a customer-centric approach to bolster market growth and sustainability.

Superalloys Market Growth Factors

Superalloys are essential for manufacturing components that must withstand high temperatures and stress, such as jet engine parts. This is resulting in higher demand from the aerospace sector. The continued expansion of the aerospace sector, fueled by increasing air travel and the need for more efficient aircraft, is resulting in rising demand for superalloys.

This is further supported by the industry's shift toward more fuel-efficient engines, which require materials that operate under higher temperatures. The aerospace industry's growth directly correlates with increased superalloy usage, making it a significant superalloys market growth factor.

- In 2022, U.S. airlines witnessed a significant increase in passenger traffic, with 194 million more passengers carried compared to 2021, marking a 30% year-to-year growth. Throughout the entire year, from January to December, U.S. airlines transported a total of 853 million passengers, up from 658 million in 2021 and 388 million in 2020.

Complex manufacturing processes driven by expensive raw materials result in high production costs of superalloys. This could potentially impact market expansion and affect profit margins. To overcome this challenge, the industry is focusing on research and development to discover cost-effective manufacturing techniques and alternative raw materials.

Advancements in additive manufacturing (3D printing) are proving beneficial, as they reduce material waste and allow for the production of complex shapes with higher precision and lower costs. Adoption of these innovative methods helps market players mitigate the impact of high production costs and sustain growth.

Superalloys Market Trends

The increasing adoption of additive manufacturing (AM) techniques is a prominent trend in the market. AM, commonly known as 3D printing, is revolutionizing the production of superalloys. This method allows for the precise fabrication of complex components, significantly reducing material waste and production time.

Industries such as aerospace and automotive are increasingly integrating AM to produce lightweight, high-performance parts that meet stringent specifications. The ability to customize components quickly and efficiently is fueling this trend. Advancements in technologies result in cost-effective additive manufacturing that further boosts its adoption in the market.

Another significant trend in the superalloys market is the growing emphasis on recycling and sustainability. Increasing environmental concerns and regulatory pressures are prompting industries to seek ways to reduce their carbon footprint. The recycling of superalloys, which involves reclaiming valuable metals such as nickel, cobalt, and chromium, is gaining traction.

This facilitates cost reduction and aligns with global sustainability goals. Companies are investing heavily in advanced recycling technologies to improve efficiency and quality. The superalloys market is responding to environmental challenges by promoting recycling practices that align with industry demands for sustainable solutions.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the market is categorized into nickel-based, iron-based, cobalt-based, and others. The nickel-based segment led the superalloys market in 2023, reaching a valuation of USD 2,581.6 million. This expansion is propelled by nickel-based superalloys' superior properties, including high-temperature strength, corrosion resistance, and excellent mechanical performance. These characteristics make them indispensable in demanding applications, especially in the aerospace and power generation industries.

Nickel-based superalloys are extensively used in turbine blades, exhaust valves, and other components that require durability and reliability under extreme conditions. Continuous advancements in alloy compositions and manufacturing techniques further enhance their performance, solidifying their dominance in the market.

By Application

Based on application, the superalloys market is classified into medical devices, automotive industry, power generation, aerospace industry and others. The aerospace industry segment is poised to witness significant growth at a CAGR of 6.97% through the forecast period (2024-2031). This expansion is largely attributed to the increasing demand for high-performance materials that possess the ability to withstand extreme temperatures and mechanical stress in aerospace applications.

Superalloys are essential in manufacturing critical components such as jet engine parts, turbine blades, and exhaust systems. The continuous growth of the aerospace sector due to rising air travel and advancements in aircraft technology, is further fueling this demand. Additionally, the industry's growing focus on fuel efficiency and emission reduction is leading to the widespread adoption of superalloys, thereby contributing to the progress of the segment.

Superalloys Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America superalloys market accounted for a significant share of around 36.27% in 2023, with a valuation of USD 2,210.9 million. This dominance is boosted by the region's advanced aerospace and defense industries, which are the largest consumers of superalloys. North America houses major aerospace manufacturers and defense contractors that demand high-performance materials for aircraft engines and military applications.

Additionally, the region's well-established automotive industry is increasingly adopting superalloys to enhance vehicle efficiency and performance. Robust research and development activities, supported by significant investments in technological advancements, further support regional market expansion.

Asia-Pacific is poised to record a robust CAGR of 6.61% through the projection period. This rapid expansion is fueled by the region's burgeoning industrialization and increasing investments in infrastructure development. The aerospace sector in countries such as China and India is growing rapidly, leading to a strong demand for superalloys in aircraft manufacturing.

Additionally, the expanding automotive industry, coupled with rising power generation projects, is boosting the need for high-performance materials. Government initiatives to support industrial growth and technological advancements are further propelling the regional market development. The region's focus on sustainable development and modernization is accelerating superalloy adoption, making Asia-Pacific a key region.

- In 2022, India witnessed significant growth in its civil aviation sector, with domestic passenger traffic increasing by nearly 50% and international traffic by over 150%. The Directorate General of Civil Aviation reported a record of over 76 million domestic passengers carried by airlines in the first half of 2023, marking a notable annual growth of over 32%. India's airport count also surged from 74 in 2014 to 147 in 2022, projected to reach 220 by 2025. This growth in the aerospace sector is likely to increase the demand for superalloys.

Competitive Landscape

The global superalloys market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Superalloys Market

- Allegheny Technologies Incorporated

- AMG Chrome Limited

- Aperam Alloys Imphy

- CRS Holdings, LLC.

- Hitachi Metals, Ltd.

- Precision Castparts Corp.

- ThyssenKrupp Steel AG

- HAYNES INTERNATIONAL

- KOBE STEEL, LTD.

- VDM Metals GmbH

Key Industry Developments

- March 2024 (Expansion): ICD Group, a global leader in recycling and specialty materials, announced the formation of a new subsidiary, ICD Superalloys Australia Pty Ltd. This expansion marked the company's commitment to sustainable solutions and served the growing demand for superalloys in the Asia-Pacific region. Located in Western Australia, the subsidiary sourced and recycled minor metals, thereby enhancing operational efficiency and localizing supply chains for improved customer service.

- November 2023 (Launch): Mitsubishi Materials Co., Ltd. launched a new grade, MV9005, specifically designed for turning heat-resistant superalloys. This grade incorporated a newly developed Al-Rich coating technology that improved wear resistance and oxidation resistance during high-speed machining. The products are available in Japan and have garnered favorable feedback, prompting the company to expand sales to overseas markets, offering 52 different types of inserts, mainly ISO denomination.

The global superalloys market is segmented as:

By Type

- Nickel-Based

- Iron-Based

- Cobalt-Based

- Others

By Application

- Medical devices

- Automotive Industry

- Power Generation

- Aerospace Industry

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America