Market Definition

The sulphur pastilles market encompasses the production, distribution, and application of sulphur in pastille form across various industries, including agriculture, pharmaceuticals, chemicals, and rubber manufacturing.

These solid granules, produced through pastillation, offer benefits in handling, storage, and controlled dissolution. Key factors influencing the market include supply chain dynamics, raw material availability, regulatory policies, and environmental considerations.

Sulphur Pastilles Market Overview

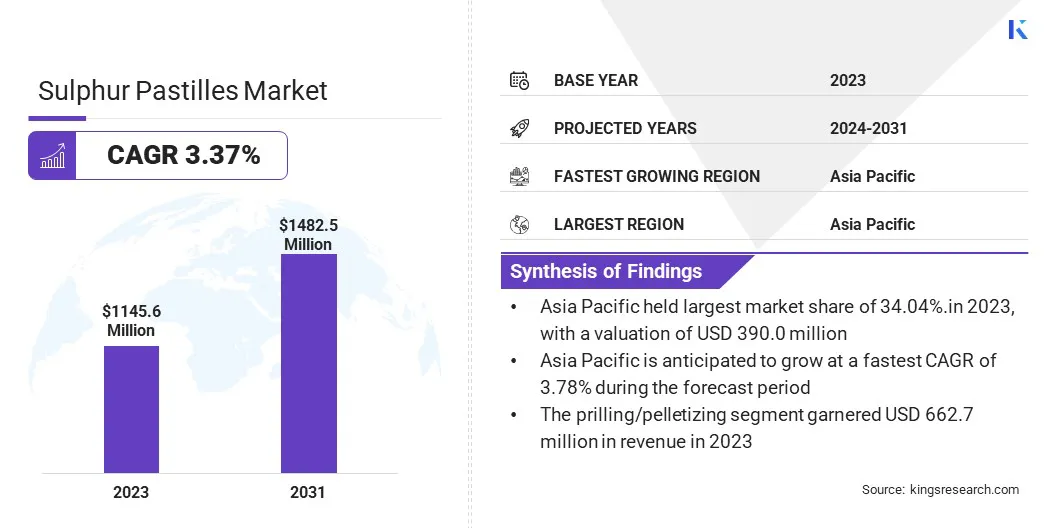

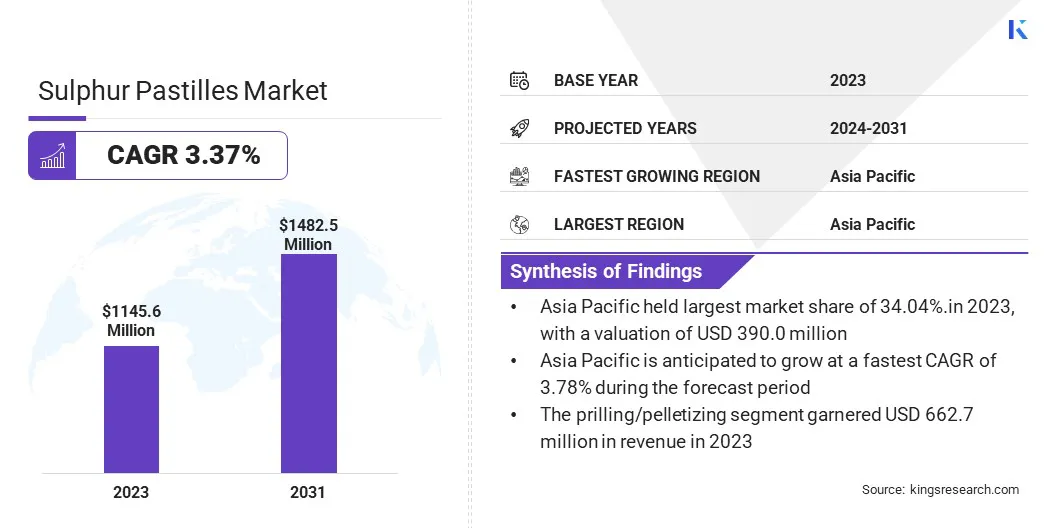

The global sulphur pastilles market size was valued at USD 1145.6 million in 2023 and is projected to grow from USD 1175.3 million in 2024 to USD 1482.5 million by 2031, exhibiting a CAGR of 3.37% during the forecast period.

This growth is fueled by increasing demand across various industries, including agriculture, chemicals, pharmaceuticals, and rubber manufacturing. The expanding agricultural sector, supported by the need for high-quality sulphur-based fertilizers to enhance crop yield and soil health, is further propelling market expansion.

Major companies operating in the global sulphur pastilles industry are Coogee, Martin Midstream Partners L.P., Swancorp, Grupa Azoty S.A., Tessenderlo Kerley, Inc., SAEED GHODRAN GROUP, Devco Australia Holdings Pty Ltd, Brimfert Corporate, Parramore and Griffin Seed Company, Balaji Impex, Nayara Energy, Bapco Refining, Passion Ag Holdings Ltd, Unitrak Corporation, and ZAFARAN Industrial Group.

Additionally, the chemical industry benefits from sulphur pastilles as a key raw material in the production of industrial chemicals and specialized compounds. The rubber and plastics sector relies on sulphur pastilles for vulcanization processes, improving product durability and performance. Advancements in pastillation technology have further enhanced the efficiency of sulphur pastille production, ensuring uniformity and ease of handling.

Key Highlights

- The global sulphur pastilles market size was valued at USD 1145.6 million in 2023.

- The market is projected to grow at a CAGR of 3.37% from 2024 to 2031.

- Asia Pacific held a share of 34.04% in 2023, valued at USD 390.0 million.

- The sulphur 85% segment garnered USD 622.6 million in revenue in 2023.

- The prilling/pelletizing segment is expected to reach USD 854.9 million by 2031.

- The agriculture segment is expected to reach USD 397.3 million by 2031.

- Europe is anticipated to grow at a CAGR of 3.39% over the forecast period.

Market Driver

"Rising Agricultural Demand and Industrial Applications"

The sulphur pastilles market is witnessing strong growth, primarily bolstered by the rising demand for sulphur-based fertilizers and expanding industrial applications of sulphur. With increasing global agricultural activity, soil sulphur depletion has become a significant concern, necessitating the use of sulphur-enriched fertilizers.

Sulphur pastilles offer a slow-release, plant-available form of sulphur, improving soil fertility, enhancing nitrogen efficiency, and boosting overall crop yields. Farmers are increasingly adopting these fertilizers to address sulphur deficiencies in soils, particularly in regions where intensive farming depletes essential nutrients.

- In March 2025, Grupa Azoty announced the production of POLIFOSKA Multi S, a new multi-component fertilizer containing 23% sulfur. Sulfur in the fertilizer plays a key role in nitrogen assimilation, protein biosynthesis, and plant development.

Additionally, the demand for sulphur pastilles is increasing in rubber manufacturing, mining, and petroleum refining industries. In the rubber industry, sulphur pastilles are widely used for vulcanization, a process that enhances the strength and elasticity of rubber products.

In oil and gas refining, sulphur plays a crucial role in desulfurization, reducing harmful emissions and improving fuel quality. The mining sector utilizes sulphur in metal extraction and processing. As these industries continue to expand, the demand for sulphur pastilles is expected to rise.

Market Challenge

"Storage and Handling of Sulphur Pastilles"

A significant challenge hampering the development of the sulphur pastilles market is storage and handling complexities, which can impact product quality and efficiency. Despite being more convenient than sulphur powder or flakes, sulphur pastilles remain vulnerable to moisture absorption, degradation, and dust formation, necessitating proper storage and transportation.

Moisture absorption, in particular, can cause clumping, structural degradation, and reduced effectiveness, particularly in high-humidity environments, leading to application difficulties and potential product wastage.

Additionally, temperature fluctuations during storage and transit can compromise the integrity of sulphur pastilles, affecting their solubility and usability in agricultural and industrial applications. Another major issue is dust formation, resulting from pastille degradation during handling and transportation.

Fine sulphur dust poses safety risks, including fire and explosion hazards in enclosed storage areas, while also leading to product loss and increased costs for manufacturers and end users.

Advanced packaging solutions, such as moisture-resistant bags and sealed containers, can mitigate these issues by protecting sulphur pastilles from environmental exposure. Additionally, applying protective coatings or additives can improve the structural integrity of pastilles and reduce dust formation.

Market Trend

"Growing Adoption of Sulphur Bentonite and Advancements in Pastillation Technology"

The rising demand for sulphur bentonite pastilles in soil fertility management is emerging as a notable trend in the sulphur pastilles market. Sulphur bentonite pastilles are gaining popularity as an efficient, degradable sulfur fertilizer that replenishes soil sulfur deficiencies.

With increasing awareness of soil nutrient balance and crop yield optimization, farmers are shifting toward slow-release fertilizers such as sulphur bentonite to improve sulfur availability over time. This trend is particularly strong in regions where intensive farming has led to sulfur depletion in soils, making it essential to restore nutrient levels of the soil.

Another major trend influencing the market is the advancement in sulphur pastillation technology, improving product quality, consistency, and ease of application. Innovations in automated pastillation systems and cooling technologies are enabling manufacturers to produce uniform, dust-free sulphur pastilles with higher purity levels.

These advancements reduce handling hazards, improve storage stability, and enhance dissolution rates in soil, making it a preferred choice over traditional sulphur forms. As technology advances, manufacturers are expanding their production capacities and optimizing processes.

Sulphur Pastilles Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Sulphur 90%, Sulphur 85

|

|

By Process

|

Prilling/Pelletizing, Extrusion

|

|

By Application

|

Agriculture, Chemical Processing, Rubber Processing, Pharmaceuticals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Sulphur 90% and Sulphur 85): The sulphur 85% segment earned USD 622.6 million in 2023 due to its high solubility and effectiveness in soil enrichment for agriculture.

- By Process (Prilling/Pelletizing and Extrusion): The prilling/pelletizing segment held a share of 57.85% in 2023, largely attributed to its cost-effectiveness and ability to produce uniform, easily transportable sulphur pastilles.

- By Application (Agriculture, Chemical Processing, Rubber Processing, Pharmaceuticals, and Others): The agriculture segment is projected to reach USD 397.3 million by 2031, owing to the rising demand for sulphur fertilizers to enhance soil fertility and crop yield.

Sulphur Pastilles Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific sulphur pastilles market accounted for a substantial share of 34.04% in 2023, valued at USD 390.0 million. This dominance is reinforced by the large-scale agricultural sector, particularly in countries such as China, India, and Indonesia, where sulphur-based fertilizers are widely used to enhance soil fertility and crop yields.

Additionally, a strong presence of chemical and rubber industries create a robust demand for sulphur pastilles for manufacturing processes. Rapid industrialization, infrastructure development, and increasing investments in fertilizer production is further strengthening regional market dominance. Moreover, the presence of leading sulphur suppliers and refineries ensures a stable supply chain, addressiong the growing demand for sulphur pastilles.

Europe sulphur pastilles industry is expected to register a CAGR of 3.39% over the forecast period. This growth is attributed to the rising emphasis on sustainable agricultural practices and stringent environmental regulations promoting the use of sulphur-based fertilizers to improve soil health.

Additionally, the region's well-established chemical processing and rubber industries contribute significantly to the increasing demand for sulphur pastilles. Countries such as Germany, France, and the UK are witnessing a surge in industrial applicationsn.

The transition to cleaner energy solutions has led to higher sulphur recovery from refineries, ensuring a steady supply for various industries. Advancements in sulphur pastillation technologies and increasing R&D investments in innovative applications are expected to further boost domestic market growth.

Regulatory Frameworks

- In the United States, the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) regulate the production, handling, and environmental impact of sulfur pastilles. The Food and Drug Administration (FDA) oversees its use in food and pharmaceutical applications, ensuring compliance with safety standards.

- In Europe, the European Chemicals Agency (ECHA) regulates sulfur pastilles under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework to ensure environmental and human safety. Additionally, the European Food Safety Authority (EFSA) monitors its use in food and agricultural applications.

- In China, the Ministry of Ecology and Environment (MEE) oversee the production, safety, and environmental compliance of sulfur pastilles.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and the Pharmaceuticals and Medical Devices Agency (PMDA) regulate sulfur pastilles, ensuring compliance with industrial safety and pharmaceutical applications. The Ministry of the Environment (MOE) monitors its environmental impact.

- In India, the Central Pollution Control Board (CPCB) under the Ministry of Environment, Forest and Climate Change (MoEFCC) regulates emissions and environmental safety in sulfur pastille production. The Food Safety and Standards Authority of India (FSSAI) oversee its use in food-related applications, ensuring compliance with safety standards.

Competitive Landscape

The global sulphur pastilles market is experiencing continuous advancements in production technologies, supply chain strategies, and product innovation to meet the evolving demands of various industries, including agriculture, chemicals, and manufacturing.

Technological progress in sulphur pastillation processes is a key factor shaping the competitive landscape. Manufacturers are adopting automated and energy-efficient systems to improve product uniformity, minimize waste, and enhance sulphur purity.

The integration of advanced cooling methods and dust-suppressant coatings has become increasingly important to ensure better storage stability and safer handling. Expansion of production capacity and regional market penetration is influencing market dynamics.

Companies are establishing new manufacturing units and optimizing supply chains to strengthen their presence in key markets. Securing reliable sulphur feedstock sources from refineries and natural gas processing plants is essential for maintaining stable consistent production and competitive pricing.

- In November 2024, Tessenderlo Kerley, Inc. acquired Tiger-Sul Products, LLC, a North American provider of sulphur-based fertilizer products, from Platte River Equity. The acquisition strengthens TKI’s specialty fertilizer portfolio, enhancing crop yield and soil health. Tiger-Sul will continue operating under its existing brand names.

List of Key Companies in Sulphur Pastilles Market:

- Coogee

- Martin Midstream Partners L.P.

- Swancorp

- Grupa Azoty S.A.

- Tessenderlo Kerley, Inc.

- SAEED GHODRAN GROUP

- Devco Australia Holdings Pty Ltd

- Brimfert Corporate

- Parramore and Griffin Seed Company

- Balaji Impex

- Nayara Energy

- Bapco Refining

- Passion Ag Holdings Ltd

- Unitrak Corporation

- ZAFARAN Industrial Group