Market Definition

A submersible pump is a sealed, electric pump designed to operate fully submerged in liquids, primarily water or wastewater. It integrates the motor and pumping mechanism within a waterproof casing, allowing efficient fluid transfer by converting electrical energy into mechanical energy.

Submersible pumps are commonly used in water wells, sewage treatment, oil extraction, irrigation systems, and drainage applications.

Submersible Pump Market Overview

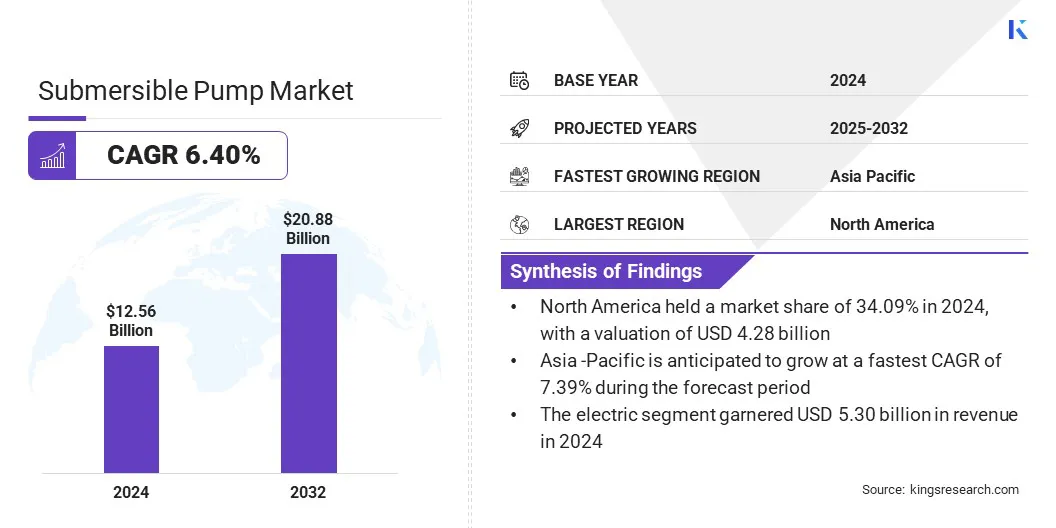

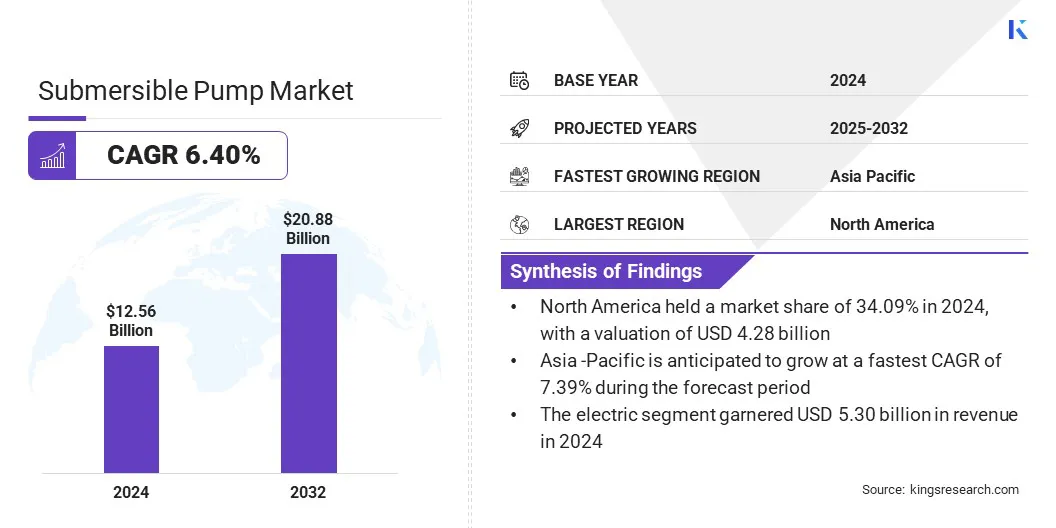

The global submersible pump market size was valued at USD 12.56 billion in 2024 and is projected to grow from USD 13.27 billion in 2025 to USD 20.88 billion by 2032, exhibiting a CAGR of 6.40% during the forecast period.

This growth is driven by government-led urban development initiatives, creating substantial demand for advanced pumping systems in water supply and sewage infrastructure. This growth is further supported by the rising adoption of energy-efficient pumping technologies that reduce operational costs and support sustainability goals.

Key Market Highlights:

- The submersible pump industry size was recorded at USD 12.56 billion in 2024.

- The market is projected to grow at a CAGR of 6.40% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 4.28 billion.

- The borewell segment garnered USD 4.83 billion in revenue in 2024.

- The electric segment is expected to reach USD 8.71 billion by 2032.

- The chemical segment is anticipated to witness the fastest CAGR of 6.68% through the projection period.

- Asia Pacific is estimated to grow at a CAGR of 7.39% over the forecast period.

Major companies operating in the submersible pump market are Grundfos Pumps India Private Ltd, Franklin Electric Co., Inc., EBARA CORPORATION, Sulzer Ltd, Pentair, KIRLOSKAR BROTHERS LIMITED, C.R.I. Pumps Private Limited, SHAKTI PUMPS INDIA LIMITED, Dab Pumps Spa, Tsurumi, inc., Zoeller Company, Liberty Pumps, Wacker Neuson SE, Atlas Copco, and SPP Pumps Limited.

Rising global investment in water infrastructure projects is propelling market expansion by expanding water supply, irrigation, and wastewater management systems.

Large-scale funding from governments and development banks promotes the construction of treatment plants, distribution networks, and flood control systems, boosting demand for efficient and durable pumps, ensuring reliable fluid handling across diverse applications such as municipal water supply, agricultural irrigation, sewage treatment, and industrial water management.

- In July 2025, the European Investment Bank reported that ten multilateral development banks invested USD 19.6 billion in global water projects during 2024, with nearly three-quarters allocated to low- and middle-income countries to support water supply, irrigation, sanitation, and wastewater management infrastructure.

Market Driver

Significant Government Investment in Urban Development

A major factor driving the expansion of the market is the government’s focus on urban development. Large-scale investments in city modernization, redevelopment, and water and sanitation projects are increasing infrastructure capacity, highlighting the need for efficient pumping solutions to manage water supply, sewage treatment, and flood control.

The focus on municipal infrastructure upgrades and resilient systems is fueling the demand for durable, energy-efficient submersible pumps. These pumps ensure reliable fluid handling, enhance operational efficiency, and support sustainable urban growth across residential, commercial, and industrial sectors.

- In February 2025, India’s Ministry of Housing and Urban Affairs highlighted the Union Budget 2025-26’s approximately USD 12.00 billion allocation to initiatives, including Cities as Growth Hubs, Creative Redevelopment of Cities, and Water and Sanitation. These efforts are boosting investments in urban infrastructure, increasing the demand for submersible pumps in cities.

Market Challenge

High Initial Investment and Maintenance Costs

A significant challenge impeding the progress of the submersible pump market is the high initial investment and maintenance costs. Small and medium-sized companies struggle to manage these upfront expenses due to limited budgets.

Advanced submersible pumps require durable materials and specialized technology that raise purchase prices and increase ongoing maintenance expenses. This financial barrier delays adoption or prompts users to opt for less efficient alternatives, impacting operational reliability and long-term cost savings in water management.

To address this challenge, market players are focusing on developing cost-effective and energy-efficient pump models that lower total ownership expenses. They are offering flexible financing options and after-sales service packages to ease financial burdens. Companies are also investing in research to improve pump durability and reduce maintenance frequency.

Additionally, they are expanding service networks to provide timely support and spare parts, minimizing downtime and enhancing customer confidence in adopting advanced submersible pumping solutions.

Market Trend

Shift Toward Energy-Efficient and Sustainable Pumping Solutions

A key trend influencing the submersible pumps market is the notable shift toward energy-efficient and sustainable pumping solutions. Manufacturers are developing pumps with lower power consumption, solar compatibility, and advanced motor technologies to reduce energy use and environmental impact.

These innovations enable operators to cut electricity costs, improve reliability in varied voltage conditions, and extend equipment lifespan. This shift is leading to the widespread adoption of eco-friendly solutions that deliver long-term operational savings while supporting global sustainability objectives.

- In March 2025, Kirloskar Brothers Limited launched the advanced borewell submersible pumps LEHR and KU7P for agricultural and domestic use. The KU7P is a 17.5 CM oil-filled pump designed for low power consumption, solar compatibility, and improved oil lubrication.

Submersible Pump Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Borewell, Openwell, Non-clog

|

|

By Drive

|

Electric, Hydraulic, Others

|

|

By End Use

|

Agriculture, Water & Wastewater, Oil & Gas, Chemical, Construction, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Borewell, Openwell, and Non-clog): The borewell segment earned USD 4.83 billion in 2024, mainly due to its widespread use in groundwater extraction for irrigation and domestic applications.

- By Drive (Electric, Hydraulic, and Others): The electric segment held a share of 42.17% in 2024, attributed to its energy efficiency, lower maintenance needs, and adaptability across multiple pumping applications.

- By End Use (Agriculture, Water & Wastewater, Oil & Gas, Chemical, Construction, and Others): The agriculture segment is projected to reach USD 5.21 billion by 2032, owing to the growing demand for efficient irrigation systems and reliable water supply in farming.

Submersible Pump Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America submersible pump market share stood at 34.09% in 2024, valued at USD 4.28 billion. This dominance is reinforced by the expansion of distribution networks and service capabilities that are supporting a stronger supply framework.

Market players are integrating specialized engineering expertise into their operations to improve product performance and extend service reach across industrial and municipal applications. The regional market is further benefiting from acquisitions that are enhancing operational coverage and enabling access to a wider customer base.

Additionally, the widespread adoption of comprehensive product ranges that address varied pumping requirements is supporting domestic market expansion.

Businesses are expanding their geographical presence and strengthening technical support infrastructure to meet evolving demand. Regional market players are reinforcing their market leadership by delivering reliable submersible pumping solutions through strategically integrated, engineering-focused sales teams.

- In January 2025, Tencarva Machinery Company acquired Michigan-based Detroit Pump & Mfg. Co., a distributor and service provider of process pumping and fluid handling equipment, including submersible pumps. The acquisition aims to expand Tencarva’s presence in Michigan and strengthen its industrial and municipal pump distribution network, enhancing its engineering-focused sales and service capabilities.

The Asia-Pacific submersible pump industry is set to grow at a CAGR of 7.39% over the forecast period. This growth is attributed to the expansion of operations by leading manufacturers and the integration of specialized dewatering solutions in mining activities.

Regional market progress is further propelled by increased production capacity through advanced manufacturing facilities that meet international quality and safety certifications. Players are addressing mining demand by developing pump technologies engineered to operate reliably in demanding conditions.

Moreover, the region is witnessing strengthened distribution networks supported by strategic acquisitions that expand product availability in key mining hubs. The market is benefiting from the addition of established product portfolios that address diverse operational needs in mineral extraction sites.

Enhanced technical capabilities are enabling the market to deliver reliable submersible pump solutions that improve efficiency in large-scale industrial applications.

- In February 2025, Franklin Electric Co., Inc. acquired Australia-based PumpEng Pty Ltd., a manufacturer of submersible dewatering pumps for the mining sector. The acquisition strengthens Franklin Electric’s presence in Australia, incorporates established brands such as JetGuard, Guardian, and Raptor, and expands its capabilities with ISO 9001/14001 and ATEX-certified manufacturing facilities.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates submersible pumps primarily through water quality and energy efficiency standards. EPA oversees compliance with the Safe Drinking Water Act and energy conservation standards under the Energy Policy and Conservation Act, ensuring that pumps minimize environmental impact, reduce energy consumption, and maintain safe water supply practices across industries.

- In the UK, the Environment Agency (EA) regulates submersible pumps. The EA monitors compliance with water abstraction licenses, effluent discharge standards, and energy efficiency mandates, ensuring that submersible pumps operate sustainably to protect aquatic ecosystems and support responsible water use across sectors.

- In China, the Ministry of Ecology and Environment (MEE) regulates submersible pumps, focusing on environmental protection and pollution control. MEE enforces standards on energy efficiency, water resource conservation, and waste discharge limits, mandating compliance with China’s stringent environmental laws to promote sustainable industrial and agricultural water management.

- In India, the Central Pollution Control Board (CPCB) oversees regulations related to submersible pumps, focusing on environmental compliance. CPCB regulates water pollution control, energy efficiency, and the sustainable usage of water resources in industrial and agricultural sectors.

Competitive Landscape

Major players operating in the submersible pump market are focusing on strategic acquisitions to broaden product portfolios and extend market presence. They are incorporating a wider range of pump types, including submersible, booster, jet, and sump pumps, to address diverse application needs.

They are also targeting residential and agricultural sectors to strengthen their customer base, enhance distribution capabilities, and expand geographical reach by integrating new product lines into existing operations. Additionally, players are leveraging expanded offerings to capture greater market share and improving service coverage and operational efficiency to support long-term growth.

- In November 2024, Baker Manufacturing Company acquired the Pump Division of A.Y. McDonald Mfg. Co., which includes submersible pumps and booster pumps for residential and agricultural markets. This acquisition expands Baker’s Water Systems' product portfolio and strengthens its regional market presence and share.

Top Companies in Submersible Pump Market:

- Grundfos Pumps India Private Ltd

- Franklin Electric Co., Inc.

- EBARA CORPORATION

- Sulzer Ltd

- Pentair

- KIRLOSKAR BROTHERS LIMITED

- R.I. Pumps Private Limited

- SHAKTI PUMPS INDIA LIMITED

- Dab Pumps Spa

- Tsurumi, inc

- Zoeller Company

- Liberty Pumps

- Wacker Neuson SE

- Atlas Copco

- SPP Pumps Limited.

Recent Developments (Product Launch)

- In November 2024, Franklin Electric’s Pioneer Pump brand launched the Minetuff Series Electric Submersible Pumps, its first electric submersible line, offering 8–140 hp models capable of operating in wells up to 245 feet deep.

- In April 2024, Grundfos introduced the SE range 48 1.5–15-hp wastewater submersible pumps, designed for high-volume wastewater and process water applications in heavy-duty municipal, utility, and industrial sectors.

- In February 2024, Roto Pumps established Roto Energy Systems Ltd. to develop and manufacture solar-powered pumping solutions, including solar submersible pumps, surface pumps, and helical rotor submersible pumps with a 10-pole unique design motor.