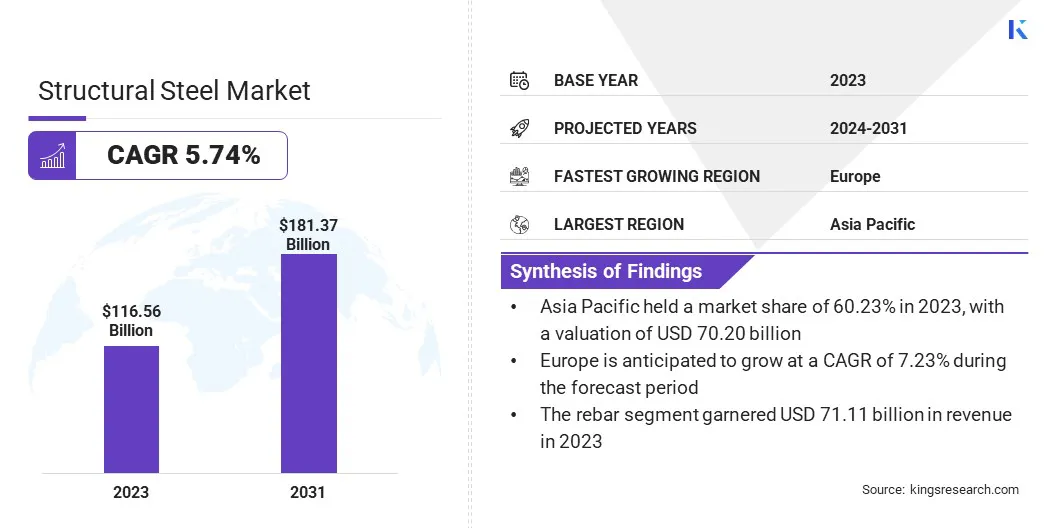

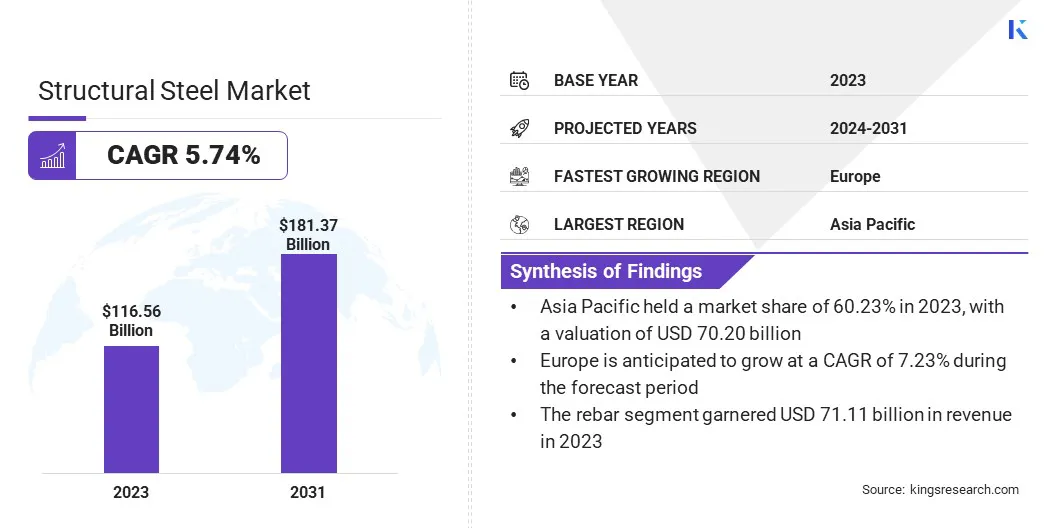

Structural Steel Market Size

Global Structural Steel Market size was valued at USD 116.56 billion in 2023 and is projected to grow from USD 122.69 billion in 2024 to USD 181.37 billion by 2031, exhibiting a CAGR of 5.74% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Arcelor Mittal S.A., Gerdau S/A, Tata Steel, voestalpine Stahl GmbH, EVRAZ plc, JFE Steel Corporation, JSW Ltd, NIPPON STEEL CORPORATION, SAIL, SSAB and others.

The market is experiencing substantial growth due to rapid urbanization and industrialization, particularly in emerging economies. The expansion of the construction industry, fueled by increasing infrastructure investments and residential projects, significantly boosts demand for structural steel. Technological advancements in steel production enhance efficiency and reduce costs, further impacting market growth.

Additionally, the global shift towards sustainable building practices, emphasizing recyclable and durable materials, supports the adoption of structural steel.

Government initiatives and policies promoting infrastructure development, along with the rising need for energy-efficient buildings, further contribute to market expansion. The automotive and manufacturing sectors' robust growth further augments demand, as structural steel is crucial in vehicle and machinery production.

The structural steel market is witnessing steady growth, underpinned by its extensive use in construction and manufacturing industries. Structural steel, known for its high strength, versatility, and durability, is pivotal in building frameworks, bridges, and industrial structures. The market benefits from advancements in steel fabrication technologies, that improve product quality and reduce production time.

Asia-Pacific dominates the market, fueled by rising infrastructure projects and industrial expansion in countries such as China and India.

Furthermore, North America and Europe hold significant market shares, with ongoing investments in commercial and residential construction. However, the market faces several challenges such as fluctuating raw material prices and stringent environmental regulations impacting production processes.

Structural steel refers to a category of steel used for making construction materials in various shapes. Its composition includes iron, carbon, and other elements that enhance its mechanical properties.

Structural steel finds extensive applications in building frameworks, bridges, towers, and heavy equipment, owing to its strength, ductility, and resilience. It is divided into various types such as heavy structural steel, light structural steel, and rebars.

It is produced in various forms, including beams, columns, bars, and plates, tailored to meet specific engineering and architectural requirements. The material is integral to modern construction due to its recyclability and ability to withstand significant loads. The market encompasses activities ranging from the extraction and processing of raw material to the fabrication and distribution of finished products.

Analyst’s Review

The structural steel market is experiencing substantial growth due to efforts by manufacturers to enhance product quality and production efficiency. Companies are investing heavily in advanced technologies such as automation and AI to streamline fabrication processes and reduce costs. New products, including high-strength and lightweight steel variants, are being introduced to meet the increasing demand from the construction and automotive sectors.

Manufacturers are further focusing on sustainable practices, incorporating recycled materials to align with global environmental standards. To capitalize on market opportunities, businesses should prioritize innovation in production methods and expand their portfolios to include eco-friendly options. Strengthening supply chain resilience and forming strategic partnerships further enhances brand presence and market competitiveness.

What factors contribute to the growth of Structural Steel Market?

The rapid urbanization and industrialization in developing countries are aiding the growth of the structural steel market. The expansion of cities highlights the increasing demand for high-rise buildings, commercial complexes, and infrastructure projects such as bridges and highways. Structural steel is preferred for these projects due to its high strength, flexibility, and cost-effectiveness.

Governments in emerging economies are investing heavily in infrastructure to support economic growth, further boosting the demand for structural steel. Additionally, advancements in steel production technologies are enhancing the quality and availability of structural steel, making it a highly favored material for modern construction needs.

The fluctuation in the prices of raw materials poses a significant challenge to market development, impacting both production costs and profit margins. Overcoming this challenge involves adopting strategies such as long-term contracts with suppliers to lock in prices and reduce volatility. Companies are increasingly investing in advanced recycling technologies to reuse scrap steel, thereby reducing dependency on raw materials.

Diversifying the supply chain to include multiple suppliers from different regions helps mitigate risks associated with price fluctuations. Additionally, innovations in production processes to increase efficiency and reduce waste contributes to stabilizing costs, thus ensuring sustainable growth of the market.

- As per the Galvanizers Association, approximately 86% was recycled as scrap for furnaces, with an additional 13% used directly in new construction projects. Notably, only 1% of the total steel output ended up in landfills or rusted. Unlike concrete, steel demolition left no residual material, thus mitigating potential future contamination concerns. Research has indicated a significant 19% reduction in CO2 emissions when steel is employed instead of concrete in construction and demolition processes.

What does growth in sustainability efforts mean for this market?

The structural steel market is witnessing a growing trend toward sustainability and green building practices. Construction companies are increasingly using structural steel due to its recyclability and lower environmental impact compared to traditional materials. The adoption of green building certifications, such as leadership in energy and environmental design (LEED), promotes the use of sustainable materials.

Manufacturers are investing heavily in eco-friendly production processes to reduce carbon emissions and energy consumption. This trend is impacted by regulatory requirements, along with a rising awareness among consumers and businesses regarding environmental responsibility, leading to an increased demand for structural steel in sustainable construction projects.

- In January 2024, Tata Steel, after extensive discussions with the UK Steel Committee, agreed to certain aspects of their proposal for emission reduction. However, the company determined that maintaining continuous blast furnace production was not feasible. This is likely to result in the gradual closure of Port Talbot's blast furnaces, and a £1.25 billion investment in Electric Arc Furnace technology to ensure long-term production sustainability, backed by UK Government support. This transformation sought to cut carbon emissions significantly while maintaining steel quality and competitiveness.

The integration of advanced technologies such as building information modeling (BIM) is transforming the structural steel market landscape.

BIM is facilitating more precise design, planning, and execution of construction projects, thereby improving efficiency and reducing costs. Structural steel manufacturers and fabricators are increasingly adopting BIM to enhance collaboration with architects and contractors, leading to better project outcomes.

This trend is resulting in more accurate and efficient fabrication processes, thus minimizing material waste and errors. The use of BIM further enables predictive maintenance and lifecycle management of structures, contributing to market growth by ensuring the longevity and durability of steel structures in various construction projects.

Segmentation Analysis

The global market is segmented based on product type, type, application, and geography.

How big is the rebar segment in this market?

Based on product type, the market is categorized into heavy structural steel, light structural steel, and rebar. The rebar segment led the structural steel market in 2023, reaching a valuation of USD 71.11 billion.

This growth is attributed to its critical role in reinforcing concrete structures, which is essential for both residential and non-residential construction. Rebar's ability to improve the tensile strength of concrete makes it indispensable in modern construction projects.

The surge in infrastructure development, particularly in emerging economies, is significantly boosting the demand for rebar. Additionally, government investments in large-scale projects, such as highways, bridges, and commercial buildings, are bolstering the growth of the segment.

Technological advancements in rebar production, which enhances its strength and durability, are significant factor contributing to the growth of the segment.

What is the expected growth of cold-rolled steel segment?

Based on type, the market is classified into hot-rolled steel and cold-rolled steel. The cold-rolled steel segment is poised to witness significant growth at a CAGR of 6.73% through the forecast period (2024-2031).

This growth is fueled by its superior surface finish, strength, and dimensional accuracy compared to hot-rolled steel. This makes it highly suitable for applications that require precision and high-quality finishes, such as automotive and appliance manufacturing.

Additionally, advancements in cold-rolling technologies improve production efficiency and expand the range of applications. The growing demand for high-strength, lightweight materials in the automotive sector, along with the increasing emphasis on energy-efficient buildings, are key factors stimulating the expansion of the cold-rolled steel segment.

How big is the non-residential segment in this market?

Based on application, the market is segmented into residential and non-residential. The non-residential segment secured the largest structural steel market share of 76.78% in 2023 due to its extensive use in commercial, industrial, and infrastructure projects. The demand for structural steel in non-residential applications is propelled by continuous investments in public infrastructure, including transportation networks, healthcare facilities, and educational institutions.

The rise in commercial real estate developments, such as office buildings, retail spaces, and hotels, further supports the expansion of the segment. Moreover, the growing trend towards urbanization and smart city initiatives is bolstering the construction of advanced, sustainable non-residential structures. These factors are collectively ensuring the robust growth and expansion of the non-residential segment in the market.

What is the market scenario in Europe and Asia-Pacific region?

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific structural steel market held a significant share of around 60.23% in 2023, with a valuation of USD 70.20 billion. This dominance is attributed to rapid urbanization and industrialization in countries such as China and India. Massive infrastructure projects, such as the Belt and Road Initiative, have significantly increased the demand for structural steel.

Additionally, government investments in residential and commercial construction are further propelling the growth of the regional market. The region's robust manufacturing sector, which produces a wide range of consumer and industrial goods, positively impacts the requirement for structural steel.

Moreover, technological advancements and cost-effective labor in Asia-Pacific enhance steel production efficiency, reinforcing the region's leading position in the market.

Europe is projected to grow at a robust CAGR of 7.23% through the projection period. This rapid growth is stimulated by substantial investments in sustainable infrastructure and green building practices. European countries are increasingly adopting advanced construction technologies and materials to meet stringent environmental regulations and carbon reduction goals.

The region's focus on renovating and modernizing aging infrastructure, including transportation networks and public buildings, is boosting demand for high-quality structural steel. Additionally, the growth of the automotive and aerospace industries in Europe, which require lightweight and strong materials, is aiding regional market expansion.

Competitive Landscape

The structural steel market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Structural Steel Market

- Arcelor Mittal S.A.

- Gerdau S/A

- Tata Steel

- voestalpine Stahl GmbH

- EVRAZ plc

- JFE Steel Corporation

- JSW Ltd

- NIPPON STEEL CORPORATION

- SAIL

- SSAB

Key Industry Developments

- May 2024 (Expansion): Nucor Steel Berkeley expanded its presence in the market by constructing a USD 425 million automotive-grade continuous galvanizing line to boost its market share in the automotive and consumer durables sectors. The new line, supplied by Primetals, was developed with an annual capacity of 500,000 tons, aimed at producing various high-grade sheet metals. This expansion supported Nucor’s sustainable steelmaking process, which used recycling to lower carbon emissions. REW further provided comprehensive engineering and construction administration services.

- November 2023 (Investment): Pipe & Steel Industrial Fabricators Inc. announced a USD 4.3 million investment to expand its Livingston Parish manufacturing facilities. This project aimed to improve efficiency, job safety, and cost-effectiveness for clients. It included equipment and technology upgrades, adding 14,000 square feet to the pipe fabrication facility, 8,000 square feet to the structural steel shop, and a new covered painting and blasting area. The state provided a competitive incentive package to support this expansion initiative.

The global structural steel market is segmented as:

By Product Type

- Heavy Structural Steel

- Light Structural Steel

- Rebar

By Type

- Hot-Rolled Steel

- Cold-Rolled Steel

By Application

- Residential

- Non-Residential

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America