Market Definition

The market refers to the industry focused on technologies and services that enable real-time processing and analysis of data streams. These data streams are continuously generated by various sources such as sensors, social media, financial transactions, and connected devices.

Streaming analytics solutions allow organizations to derive immediate insights, enabling timely decision-making, anomaly detection, and operational responsiveness. This market encompasses software platforms, services, and infrastructure designed to ingest, process, and visualize data as it flows in, without the need for traditional batch processing.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Streaming Analytics Market Overview

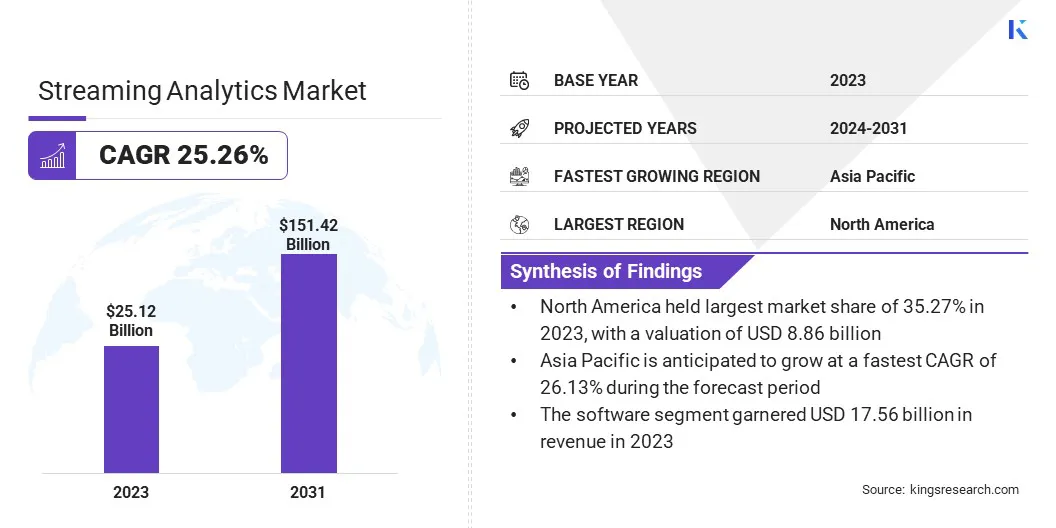

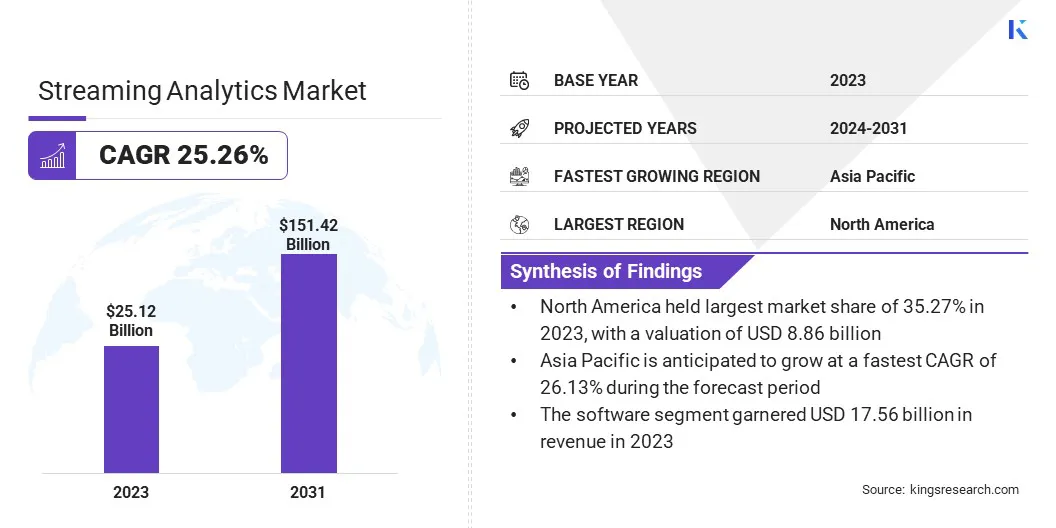

Global streaming analytics Market size was valued at USD 25.12 billion in 2023, which is estimated to be valued at USD 31.29 billion in 2024 and reach USD 151.42 billion by 2031, growing at a CAGR of 25.26% from 2024 to 2031.

The growing need for real-time insights is driving the market. Businesses in sectors such as finance, retail, and healthcare require instant data analysis to support quick, informed decisions and improve operational efficiency.

Key Market Highlights:

- The streaming analytics industry size was recorded at USD 25.12 billion in 2023.

- The market is projected to grow at a CAGR of 25.26% from 2024 to 2031.

- North America held a market share of 35.27% in 2023, with a valuation of USD 8.86 billion.

- The software segment garnered USD 17.56 billion in revenue in 2023.

- The large enterprises segment is expected to reach USD 95.57 billion by 2031.

- The cloud-based segment is having a market share of 53.65% in 2023

- The supply chain management segment is anticipated to have a CAGR of 26.93% during the forecast period.

- The BFSI segment is anticipated to have a market share of 27.65% in 2031.

- Asia Pacific is anticipated to grow at a CAGR of 26.13% during the forecast period.

Major companies operating in the streaming analytics market are IBM, Amazon Web Services, Inc., Cloudera, Inc., Software GmbH, Mphasis, INETCO Systems Ltd, Materialize, Inc., Imply Data, Inc., KX, Microsoft, Striim, StarTree Inc., Coralogix Inc., Confluent, Inc., and Alphabet Inc.

The market is driven by the growing need for real-time data processing across industries. Businesses increasingly rely on immediate insights from continuous data streams, including those generated by IoT devices, social media, and financial transactions. This enables faster decision-making, enhanced automation, and improved customer experiences, driving operational efficiency and competitive advantage.

- In Nov 2024, Workday partnered with Compa to integrate real-time compensation data into its platform, enabling customers to make data-driven hiring decisions, improve internal mobility, and promote pay equity replacing outdated annual surveys with dynamic, actionable market intelligence.

Increasing Demand for Real-Time Insights

The growing need for real-time insights is a key driver of growth in the market. Industries like finance, retail, and healthcare face increasing pressure to make rapid, data-driven decisions to maintain a competitive edge.

Real-time analytics allows businesses to instantly access critical information, enabling them to respond swiftly to changing conditions, optimize operations, and enhance customer experiences. As a result, organizations are increasingly adopting streaming analytics solutions to accelerate decision-making and adapt effectively to dynamic market conditions, thereby driving market growth.

- In September 2024, StarTree showcased its real-time analytics capabilities at Current 2024, demonstrating how StarTree Cloud, powered by Apache Pinot, integrates with observability tools like Grafana and Prometheus. This innovation empowers businesses to manage both operational and business data in real-time, enhancing performance and scalability.

Scalability Issues

Scalability issues are a significant challenge in the streaming analytics market as data volumes continue to grow. Maintaining the performance of real-time analytics platforms becomes difficult without continuous infrastructure updates to handle the increased load. Without proper scalability, data processing can slow down, leading to delayed insights.

To address this, key players are adopting cloud-based platforms that offer elastic scaling, allowing businesses to automatically adjust resources based on demand. Leveraging distributed systems and optimized data storage methods can also help improve scalability and ensure seamless performance during high data influx.

Integration of Generative AI

The integration of Generative AI into streaming analytics platforms is a key trend shaping the market. Generative AI, which refers to AI systems capable of creating new content, such as text, images, or predictions, is being leveraged to enhance real-time analytics.

This allows businesses to generate personalized recommendations, automate content creation, and perform advanced predictive modeling. By incorporating Generative AI, streaming analytics platforms can provide more dynamic, actionable insights, enabling companies to better respond to customer needs and market changes in real-time.

- In October 2024, SingleStore acquired BryteFlow to enhance real-time analytics and GenAI adoption. This acquisition strengthens SingleStore’s ability to ingest data from a wide range of sources, offering seamless real-time data integration. With SingleStore Flow, customers can now operationalize CRM and ERP data at scale, enabling faster insights and broader enterprise applications.

Streaming Analytics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Managed Services

|

|

By Enterprise Type

|

Large Enterprises, Small & Medium Enterprises

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Application

|

Supply Chain Management, Sales & Marketing, Fraud Detection, Predictive Asset Management, Risk Management, Others

|

|

By Industry

|

BFSI, IT & Telecom, Healthcare, Retail & Ecommerce, Media & Entertainment, Energy & Utilities, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Software, Managed Services): The software segment earned USD 17.56 billion in 2023 due to the increasing demand for real-time data processing and analytics solutions for various industries and business needs.

- By Enterprise Type (Large Enterprises, Small & Medium Enterprises): The large enterprises segment held 63.92% of the market in 2023, due to their superior infrastructure and a higher need for complex, scalable streaming analytics solutions for large-scale operations.

- By Deployment (Cloud-based, On-premises): The cloud-based segment is projected to reach USD 83.13 billion by 2031, owing to the growing preference for scalable, flexible, and cost-effective solutions that support real-time data processing and storage.

- By Application (Supply Chain Management, Sales & Marketing, Fraud Detection, Predictive Asset Management, Risk Management, Others): The supply chain management segment is anticipated to have a CAGR of 26.93% during the forecast period, due to the need for real-time insights to optimize logistics and improve operational efficiency.

- By Industry (BFSI, IT & Telecom, Healthcare, Retail & E-commerce, Media & Entertainment, Energy & Utilities, Manufacturing, Others): The BFSI segment is anticipated to have a market share of 27.65% in 2031, due to the increasing reliance on real-time analytics for fraud detection, risk management, and customer service in the financial sector.

Streaming Analytics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and South America.

The North America streaming analytics market share stood around 35.27% in 2023 in the global market, with a valuation of USD 8.86 billion. This dominance is attributed to the widespread enterprise-level adoption of real-time analytics, driven by a strong emphasis on operational intelligence and customer experience optimization.

The presence of key technology providers and growing demand across industries such as finance, healthcare, and retail further support regional growth. Additionally, the region’s advanced cloud infrastructure and high digital readiness enable seamless implementation and scaling of streaming analytics solutions, thereby driving market growth in this region.

- In November 2024, MongoDB partnered with Microsoft to integrate its cloud database platform, MongoDB Atlas, with Microsoft Azure AI Foundry and Microsoft Fabric. This collaboration aims to streamline real-time data synchronization, enabling organizations to seamlessly feed operational data into Azure’s AI and analytics tools. As a result, customers can unlock faster, AI-driven insights and improve data workflows across cloud environments.

Asia Pacific is poised for significant growth over the forecast period at a CAGR of 26.13%. The Asia Pacific region is expected to be the fastest-growing market for streaming analytics, driven by rapid digital transformation, increasing internet penetration, and growing demand for real-time data processing across industries.

Countries like China, India, and Japan are embracing advanced technologies like IoT, AI, and cloud computing, creating significant opportunities for streaming analytics solutions. The rising adoption of e-commerce, fintech, and smart manufacturing further fuels the demand for real-time insights, making Asia-Pacific a key region for market growth.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) prevents fraudulent practices, offering guidance to consumers on avoiding scams, while focusing on transparency, privacy, and data security in AI deployments.

- The EU General Data Protection Regulation (GDPR) governs how the personal data of individuals in the EU may be processed and transferred. It also includes guidelines on consent and data usage for AI models.

- In India, the Digital Personal Data Protection Bill, 2023 ensures lawful data processing, individuals' rights, data fiduciary obligations, and penalties for breaches. It emphasizes transparency, consent, security, and safeguards for children's data.

Competitive Landscape

Companies in the streaming analytics industry are increasingly focusing on integrating advanced technologies like artificial intelligence and machine learning to enhance real-time data processing and analysis. By offering scalable solutions, they are enabling businesses to gain immediate insights, optimize operations, and make data-driven decisions across various sectors.

Moreover, companies are expanding their platforms to support complex data sources, improving personalization, and streamlining the user experience. These innovations are driving the adoption of real-time analytics in industries such as finance, healthcare, and retail.

- In May 2024, Aprimo acquired Personify XP to strengthen Aprimo’s digital asset management (DAM) capabilities by integrating real-time content decisioning and AI-powered personalization. This will enable brands to enhance omnichannel experiences and optimize content strategies for improved customer engagement and conversions.

Key Companies in Streaming Analytics Market:

- IBM

- Amazon Web Services, Inc.

- Cloudera, Inc.

- Software GmbH

- Mphasis

- INETCO Systems Ltd

- Materialize, Inc.

- Imply Data, Inc.

- KX

- Microsoft

- Striim

- StarTree Inc.

- Coralogix Inc.

- Confluent, Inc.

- Alphabet Inc.

Recent Developments (M&A/Partnerships/Product Launch)

- In October 2024, Parrot Analytics introduced its Streaming Metrics Dashboard, offering unprecedented access to global and market-specific streaming data. The platform provides key insights into metrics like subscriber growth, revenue, and churn, enabling streaming services to optimize performance, forecast trends, and make data-driven investment decisions.

- In July 2024, IBM announced the acquisition of StreamSets, a leading real-time data integration company. This acquisition strengthens IBM Data Fabric’s capabilities, enabling real-time data pipelines and enhanced integration. StreamSets' tools help businesses efficiently process diverse data types across hybrid multicloud environments, supporting AI and analytics applications.

- In February 2024, SAS partnered with Carahsoft to distribute its AI, analytics, and data management solutions to U.S. government agencies. This strategic collaboration will enhance data-driven decision-making and support public sector challenges, including fraud detection, streaming analytics, and predictive maintenance, through SAS Viya’s cloud-based platform.

, a leader in content personalization and real-time analytics. This acquisition