Market Definition

Strategic sourcing applications are software tools that streamline procurement processes, supplier evaluation, and sourcing strategies execution. These platforms support supplier selections, contract management, spend analysis, and sourcing event management. Companies adopt these applications to enhance transparency, maintain compliance, and improve procurement workflows. The market includes both cloud-based and on-premise models, serving industries such as manufacturing, healthcare, retail, and financial services.

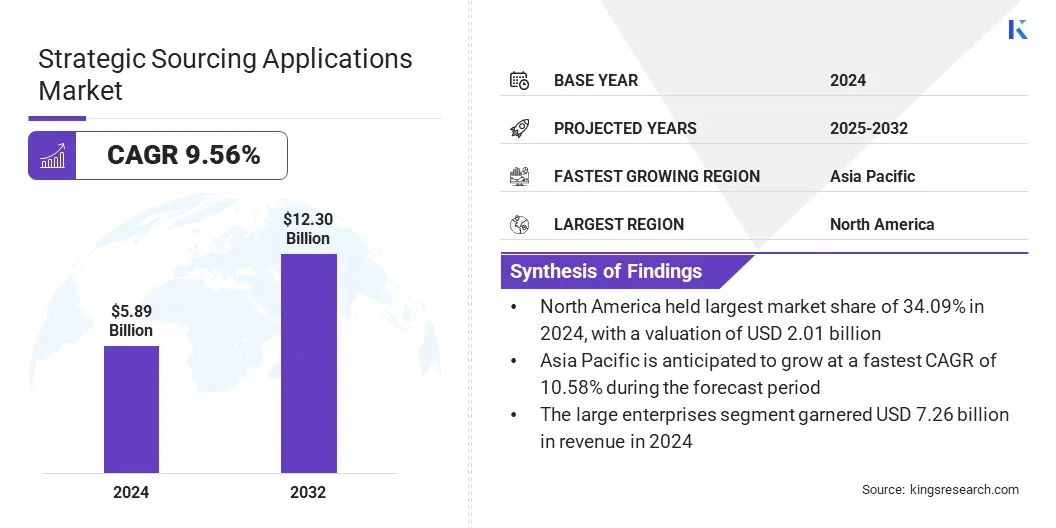

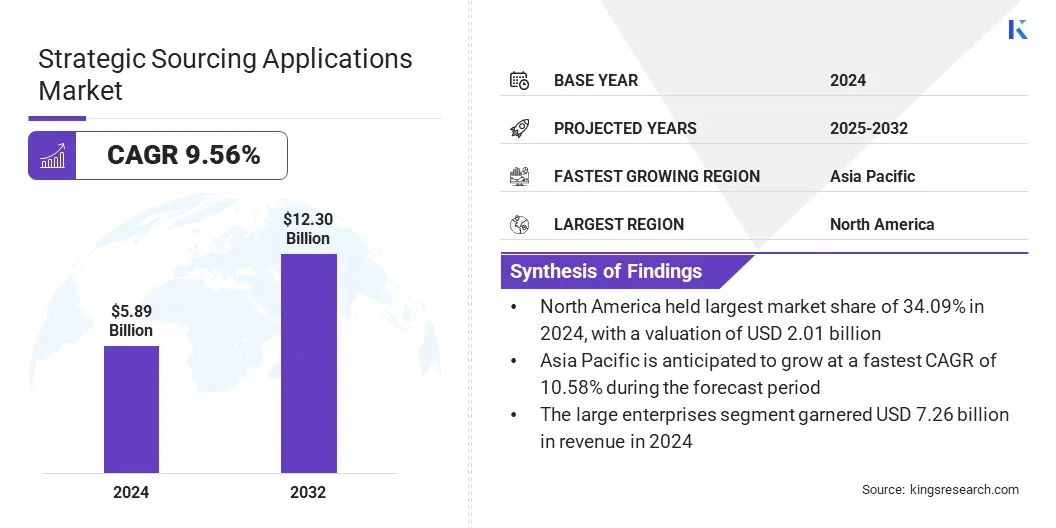

The global strategic sourcing applications market size was valued at USD 5.89 billion in 2024 and is projected to grow from USD 6.43 billion in 2025 to USD 12.30 billion by 2032, exhibiting a CAGR of 9.56% during the forecast period.

The strategic sourcing applications market continues to experience robust growth driven by organizations' increasing focus on digital transformation and cost optimization initiatives. Market growth is also driven by the increasing need for procurement process automation, improved supplier collaboration, and enhanced cost-efficiency across enterprises. Companies are adopting these solutions to gain real-time visibility into sourcing activities, streamline contract management, and achieve better spend analysis.

Key Highlights

- The strategic sourcing applications industry size was valued at USD 5.89 billion in 2024.

- The market is projected to grow at a CAGR of 9.56% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 2.01 billion.

- The on-premises segment garnered USD 2.27 billion in revenue in 2024.

- The large enterprises segment is expected to reach USD 7.26 billion by 2032.

- The BFSI segment is projected to generate a revenue of USD 2.74 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 10.58% over the forecast period.

Major companies operating in the global strategic sourcing applications industry are Coupa, SAP SE, Ivalua Inc., JAGGAER, GEP, Oracle, Basware Oy, Zycus Inc., Workday, Inc., Proactis Holdings Limited, Market Dojo, Procurify Technologies Inc., Vendorful, IBM, and e2open, LLC.

Strategic Sourcing Applications Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Cloud-based, On-premises, Hybrid

|

|

By Organization

|

Small & Medium Enterprises, Large Enterprises

|

|

By Vertical

|

BFSI, Government, Retail, IT & Telecommunications, Manufacturing, Energy & Utilities, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Strategic Sourcing Applications Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America strategic sourcing applications market share stood at around 34.09% in 2024, valued at USD 2.01 billion. This dominance is reinforced by the region’s rapid adoption of AI-powered sourcing platforms.

Companies across the U.S. and Canada are leveraging advanced analytics and intelligent automation to streamline procurement workflows, reduce cycle times, and gain real-time visibility into spend and supplier performance. These platforms provide modular, cloud-based capabilities that align with enterprise-wide digital transformation agendas.

The presence of major software providers and a highly digitized supply chain ecosystem further supports this growth. This expansion is further aided by the increasing investment in sourcing platforms that integrate artificial intelligence with predictive analytics. This technological sophistication helps organizations better anticipate supply risks, optimize supplier selection, and enable data-driven decision-making at scale, contributing to regional market growth.

- In December 2024, United States Steel Corporation partnered with GEP SOFTWARE to transform its source-to-contract process in North America. The partnership focuses on streamlining procurement operations, increasing visibility, and automating tasks using GEP’s AI-driven, low-code platform to support sourcing, contract, and supplier management across direct and indirect procurement.

The Asia-Pacific strategic sourcing applications industry is expected to register the fastest CAGR of 10.58% over the forecast period. This growth is propelled by the rapid expansion of manufacturing, technology, and retail sectors. This expansion is further fueled by rising emphasis on supplier diversification and the adoption of localized sourcing platforms that support complex, multi-tier supplier networks.

Platforms tailored to regional languages and procurement practices help firms manage diverse supplier bases and navigate local supplier engagement. This specificity supports workflow automation and risk assessment across countries such as India, China, and Australia.

Regional procurement teams gain improved visibility into supplier performance and smoother cross-border sourcing operations. The focus on supplier localization empowers these businesses to reduce lead times and respond swiftly to market shifts. This enhances market relevance and adoption of strategic sourcing applications within Asia Pacific’s dynamic supply chain landscape.

- In July 2024, JAGGAER expanded its Amplify Partner Program in APAC by partnering with BearingPoint. This collaboration aims to deploy JAGGAER’s intelligent Source-to-Pay platform with local systems integrator support to streamline procurement, supplier collaboration, and AI-enabled sourcing for APAC clients.

Strategic Sourcing Applications Market Overview

The growing adoption of cloud-based sourcing platforms supports scalability and seamless integration with existing systems. These platforms enable rapid deployment, real-time collaboration, and continuous updates, making them highly suitable for modern procurement workflows.

- In June 2025, Euna Solutions launched a free cloud-based supplier network to simplify public procurement in the U.S. and Canada. The platform aims to enhance supplier discovery and engagement, supporting more efficient sourcing processes for public sector organizations.

These platforms support the digital transformation of sourcing operations and help improve efficiency across both public and private sectors. This shift increases demand for advanced sourcing solutions, which is fueling market expansion and fostering innovation among solution providers. As organizations prioritize agility and cost control, the adoption of flexible, cloud-based sourcing applications is expected to aid market expansion.

As businesses navigate an increasingly complex global marketplace, the demand for sophisticated sourcing solutions that enhance supply chain resilience has become paramount. The market's expansion is further accelerated by widespread industry adoption of advanced technologies and the growing preference for cloud-based deployment models.

Market Driver

AI and Analytics Integration Reshaping Sourcing Strategies

The strategic sourcing applications market is experiencing significant growth, mainly driven by the integration of artificial intelligence (AI) and advanced analytics into procurement processes. Companies are adopting AI-native platforms to streamline sourcing operations, improve supplier evaluation, and accelerate decision-making.

Cost optimization remains a critical driver as organizations seek to maximize procurement value while minimizing operational expenses. The integration of advanced technologies enables sophisticated spend analysis and strategic decision-making capabilities that deliver measurable cost reductions.

These technologies automate time-consuming procurement tasks, leading to improved operational efficiency and cost savings. Advanced analytics offer real-time insights into supplier performance, risk exposure, and market dynamics, enabling faster, data-driven sourcing decisions. Organizations are increasingly leveraging technological integration to modernize their procurement processes, with cloud-based deployment emerging as the preferred implementation strategy due to its scalability and cost-effectiveness.

The ongoing digital transformation is increasing the demand for intelligent and scalable sourcing solutions. Companies are seeking tools that enhance transparency, simplify procurement workflows, and adapt to evolving business needs. This shift toward data-driven and automation-enabled sourcing platforms is expected to propel the growth of the market.

In June 2025, Levelpath, an AI-native procurement platform, reported 10× improvement in sourcing efficiency for clients such as Acrisure and GATX. Key outcomes included same-day RFP launches, reduced procurement cycles, and USD 3.5 million in contract savings, showcasing the impact of its AI-native architecture, intelligent automation, and unified sourcing intelligence.

Market Challenge

Slow Adoption of Digital Procurement Platforms

A key challenge in the strategic sourcing applications market is the slow adoption of digital procurement platforms, primarily due to internal resistance to change. Many procurement teams continue to rely on legacy systems and manual processes, hindering the shift to modern sourcing tools.

This resistance often results from limited training, unfamiliar interfaces, or concerns about disrupting established workflows. As a result, companies experience delays in gaining the full benefits of their technology investments.

To overcome this challenge, organizations are integrating digital adoption platforms and contextual user guidance tools into their procurement solutions. These tools provide in-application support, interactive walkthroughs, and personalized onboarding, making it easier for users to adapt. This approach enhances user engagement and accelerates the adoption of sourcing systems, leading to improved procurement performance.

Market Trends

Notable Shift Toward Unified Source-to-Pay Platforms

The strategic sourcing applications market is experiencing a notable shift toward unified Source-to-Pay (S2P) platforms. Organizations are replacing fragmented procurement tools with integrated systems that connect sourcing, contract management, procurement, and supplier collaboration.

This integration supports consistent workflows and eliminates duplication while also improving visibility across procurement activities. With centralized control and unified data, companies can enhance compliance, increase efficiency, and respond faster to business changes.

Integrated S2P platforms also simplify system maintenance and reduce dependence on multiple vendors, resulting in reduced operational costs. These platforms help procurement teams standardize processes across global operations while allowing flexibility for category and supplier management. This shift is improving agility and transparency across procurement functions in various industries.

In February 2024, Veriscape partnered with ProcurementFlow to deliver Source-to-Pay solutions across Asia Pacific. The partnership enhances eSourcing capabilities, enabling efficient distribution of RFIs, RFPs, and RFQs to multiple suppliers, thereby streamlining procurement operations and improving supplier engagement.

Focus on Sustainability and ESG Compliance

There is a pronounced focus on sustainability within the strategic sourcing landscape, with organizations increasingly incorporating Environmental, Social, and Governance (ESG) criteria into their supplier selection and evaluation processes. This trend reflects growing stakeholder expectations and regulatory requirements for sustainable business practices.

Data-Driven Decisions and Analytics

The shift toward data-driven decisions represents a fundamental transformation in procurement methodology. Organizations are leveraging advanced analytics capabilities to gain deeper insights into spending patterns, supplier performance, and market dynamics, enabling more strategic and informed sourcing decisions.

Cloud-Based Solutions and Scalability

Cloud-based solutions continue to gain traction due to their inherent advantages in scalability, accessibility, and reduced infrastructure requirements. This trend is particularly pronounced among mid-market organizations seeking enterprise-level capabilities without significant capital investment.

Market Segmentation

By Deployment (Cloud-based, On-premises, and Hybrid): The on-premises segment earned USD 2.27 billion in 2024, primarily due to higher data control requirements and strict internal security policies among large organizations.

By Organization (Small & Medium Enterprises and Large Enterprises): The large enterprises segment held a share of 59.94% in 2024, fueled by their greater procurement volumes and higher investment capacity in advanced sourcing platforms.

By Vertical (BFSI, Government, Retail, IT & Telecommunications, Manufacturing, Energy & Utilities, Healthcare, and Others): The BFSI segment is projected to reach USD 2.74 billion by 2032, owing to its increasing focus on supplier risk management and regulatory compliance in procurement activities

Competitive Landscape

Companies operating in the strategic sourcing applications industry are adopting new approaches to strengthen their competitive position. Mergers and acquisitions have become a key strategy for expanding solution portfolios, integrating advanced technologies, and entering new markets efficiently. This enables faster innovation and broader service delivery.

Moreover, organizations are focusing on platform flexibility by adopting low-code and no-code technologies, allowing users to customize workflows and configure features with limited technical support. This improves agility, shortens implementation timelines, enhance scalability, and helps companies align their platforms with diverse procurement needs. This is leading to improved operational efficiency and meeting the demand for adaptable and streamlined sourcing solutions.

- In February 2024, Accenture acquired Insight Sourcing, a provider of strategic sourcing and procurement services. The acquisition added approximately 220 sourcing consultants to Accenture’s Sourcing & Procurement practice, enhancing its capabilities for private equity firms and clients in the consumer goods, retail, technology, and industrial sectors.

- In June 2024, Pegasystems Inc. introduced new enhancements to Pega GenAI Blueprint, including legacy transformation accelerators, live application previews, improved user interface, data model generation, enhanced collaboration, and partner-supplied templates, enabling faster and more efficient enterprise workflow design..

Top Players in Strategic Sourcing Applications Market:

- Coupa

- SAP SE

- Ivalua Inc.

- JAGGAER

- GEP

- Oracle

- Basware Oy

- Zycus Inc.

- Workday, Inc.

- Proactis Holdings Limited

- Market Dojo

- Procurify Technologies Inc.

- Vendorful

- IBM

- e2open, LLC

Recent Developments (Investment/Agreements/Product Launch)

- In May 2025, Arkestro secured a USD 36 million strategic investment to expand its AI-powered Predictive Procurement Platform, strengthen supply chain resilience, and improve cost efficiency and operational performance.

- In February 2025, Inception signed a memorandum of understanding with Fairmarkit to integrate Fairmarkit’s AI-powered autonomous sourcing technology into Inception’s procurement ecosystem. The partnership aims to enhance enterprise procurement across the Middle East and North Africa (MENA) region by improving sourcing efficiency, optimizing costs, and enabling smarter supplier and contract management through AI-driven solutions.

- In December 2024, Ivalua launched an AI-powered Intake Management solution featuring a conversational interface, real-time tracking, seamless system integration, and no-code configurability to streamline procurement request handling and enhance transparency across enterprise functions.