Stationary Fuel Cells Market Size

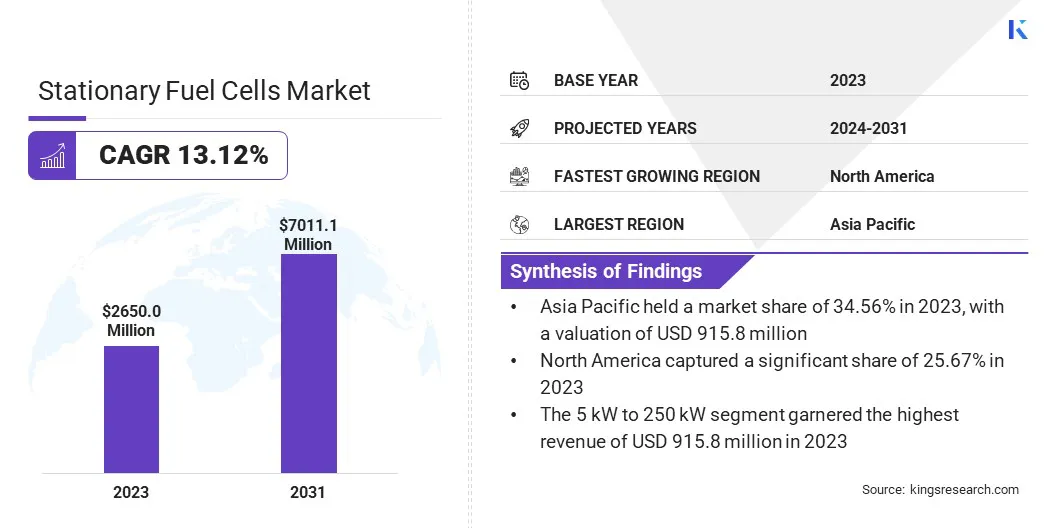

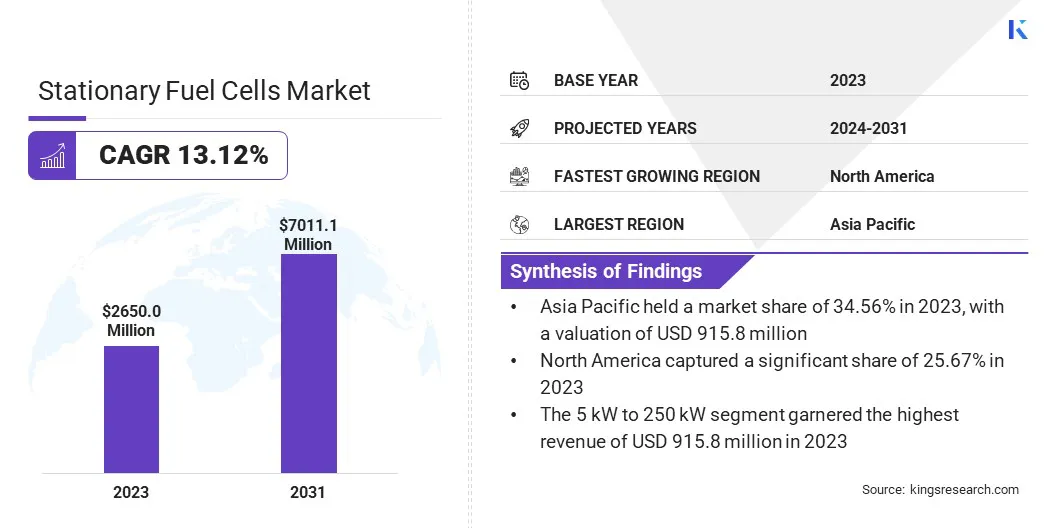

Global Stationary Fuel Cells Market size was recorded at USD 2,650.0 million in 2023, which is estimated to be at USD 2,957.6 million in 2024 and projected to reach USD 7,011.1 million by 2031, growing at a CAGR of 13.12% from 2024 to 2031. The global stationary fuel cells market is witnessing robust growth, primarily driven by increasing emphasis on clean and sustainable energy solutions.

In the scope of work, the report includes products offered by companies such as Ballard Power Systems, Toshiba Energy Systems & Solutions Corporation, Bloom Energy, Plug Power Inc., Doosan Fuel Cell Co., Ltd, Fuji Electric Co., Ltd., SFC Energy AG, DENSO CORPORATION, MITSUBISHI HEAVY INDUSTRIES, LTD., AISIN CORPORATION, and others.

Government initiatives aimed at reducing carbon emissions and promoting renewable energy sources are fueling the adoption of stationary fuel cells across various industries. Moreover, advancements in fuel cell technology, such as improved efficiency and durability, are enhancing the attractiveness of these systems for stationary power generation applications. Key opportunities lie in the expansion of fuel cell infrastructure, particularly in emerging economies where there is a need to improve energy access and reliability.

Stationary fuel cells are electrochemical devices that convert chemical energy from fuels such as hydrogen, natural gas, or biogas into electricity and heat through an efficient and environmentally friendly process. These systems are utilized for power generation across residential, commercial, and industrial settings, offering reliable and decentralized power solutions. Their applications contribute to energy security, grid stability, and sustainability objectives worldwide.

The global stationary fuel cells market encompasses the manufacturing, distribution, and utilization of these systems, incorporating various fuel cell technologies such as proton exchange membrane fuel cells (PEMFC), solid oxide fuel cells (SOFC), and molten carbonate fuel cells (MCFC). This market serves a diverse range of end-users and applications, addressing the needs of different sectors for efficient and sustainable power generation.

Analyst’s Review

The global stationary fuel cells market is poised to witness significant growth in the upcoming years, mainly attributed to by increasing demand for clean energy solutions, government initiatives promoting renewable energy adoption, and advancements in fuel cell technology.

Key players in the market, such as Bloom Energy, FuelCell Energy, Plug Power Inc., and Ballard Power Systems among others, are focusing on strategic partnerships, product innovation, and geographical expansion to capitalize on emerging opportunities. These companies are investing in research and development to enhance the efficiency and affordability of stationary fuel cell systems, while also leveraging their expertise to address specific market segments and customer needs.

Stationary Fuel Cells Market Growth Factors

The increasing focus on clean energy solutions, fueled by rising environmental concerns and stringent emissions regulations, is propelling the demand for stationary fuel cells in the global energy landscape. As governments and industries are prioritizing sustainability goals, stationary fuel cells are emerging as an attractive option due to their high efficiency and low emissions profile.

Furthermore, the rising demand for distributed power generation is fueling the adoption of stationary fuel cells, particularly in remote areas or critical infrastructure where grid connectivity may be limited or unreliable. Stationary fuel cells offer decentralized power solutions that operate independently or in combination with existing grid infrastructure, providing reliable electricity supply even in off-grid locations. Their scalability and modular design enhance their versatility, enabling tailored solutions to meet diverse power demands.

For instance, in remote communities or off-grid facilities, such as telecommunications towers or military bases, stationary fuel cells offer a dependable source of electricity, thereby reducing reliance on conventional generators. Moreover, their ability to provide both electricity and heat makes them suitable for combined heat and power applications, maximizing energy efficiency and reducing environmental impact.

However, the high initial cost of stationary fuel cells poses a challenge to wider adoption, especially for smaller-scale applications. This cost barrier may deter some potential customers from investing in stationary fuel cells, despite their long-term benefits in efficiency, reliability, and environmental sustainability.

To mitigate these challenges, key players are developing innovations in fuel cell technology, thereby reducing manufacturing costs and enhancing the affordability of these systems. Economies of scale are being achieved through increased production and larger market penetration. Additionally, companies are exploring alternative materials and advanced manufacturing techniques to reduce costs.

Stationary Fuel Cells Market Trends

The evolving landscape of the stationary fuel cells market is characterized by the integration of stationary fuel cells with renewable energy sources such as solar and wind. By combining fuel cell technology with intermittent renewables, hybrid power systems are created, offering a more reliable energy solution.

For instance, Bloom Energy has developed microgrid solutions that integrate its fuel cells with solar panels to provide an uninterrupted power supply, thereby enhancing grid stability and resilience.

Additionally, the rise of on-site hydrogen production, facilitated by advancements in technologies such as electrolysis, is propelling market expansion. This development is particularly relevant for remote locations or areas with limited hydrogen infrastructure, where stationary fuel cells operate more self-sufficiently.

Furthermore, there is a noticeable shift toward solid oxide fuel cell (SOFC) technology in the market. SOFCs are gaining traction due to their high efficiency, fuel flexibility, and scalability for larger power applications.

Segmentation Analysis

The global stationary fuel cells market is segmented based on capacity, end user, application, and geography.

By Capacity

Based on capacity, the market is categorized into less than 1 kW, 1 kW to 5 kW, 5 kW to 250 kW, 250 kW to 1 MW, and more than 1 MW. The 5 kW to 250 kW segment garnered the highest revenue of USD 915.8 million in 2023. The segment encompasses a range of applications across residential, commercial, and small-scale industrial sectors, offering versatile solutions for distributed power generation needs.

Additionally, the 5 kW to 250 kW capacity range strikes a balance between power output and scalability, making it suitable for a variety of end-user requirements while maintaining cost-effectiveness. Furthermore, advancements in fuel cell technology have improved the efficiency and reliability of systems within this capacity range, thereby enhancing their appeal to customers seeking dependable and clean energy solutions.

By End User

Based on end users, the market is divided into transportation, defense, oil & gas, utilities, and others. The transportation segment accounted for the largest market share of 43.89% in 2023. The transportation sector is increasingly adopting clean and sustainable energy solutions to mitigate environmental impact and comply with stringent emissions regulations. Stationary fuel cells offer a viable alternative to traditional transportation fuels, providing efficient and low-emission power for various applications such as electric vehicles, buses, and trains.

Moreover, advancements in fuel cell technology have improved their performance and affordability, making them increasingly attractive to transportation stakeholders. Additionally, government incentives and policies aimed at promoting clean transportation bolster the demand for stationary fuel cells in the transportation sector, thus contributing to segmental growth.

By Application

Based on application, the market is categorized into combined heat and power (CHP), prime power, and uninterrupted power supply (UPS). The combined heat and power (CHP) segment is projected to witness the highest growth at a CAGR of 14.48% between 2024 and 2031. Combined heat and power systems offer a highly efficient and cost-effective solution for the simultaneous generation of electricity and useful heat, making them attractive to a wide range of industries and applications.

Industries such as manufacturing, healthcare, and residential complexes benefit from the energy savings and environmental advantages provided by CHP systems powered by stationary fuel cells. Additionally, government incentives and policies aimed at promoting energy efficiency and reducing emissions drive the adoption of CHP systems, creating favorable market conditions for stationary fuel cells in this segment.

Stationary Fuel Cells Market Regional Analysis

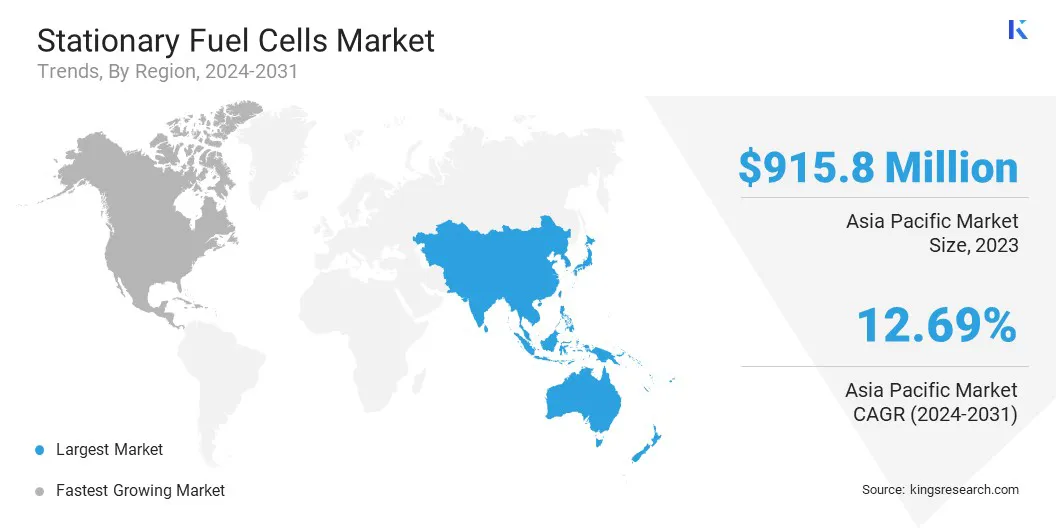

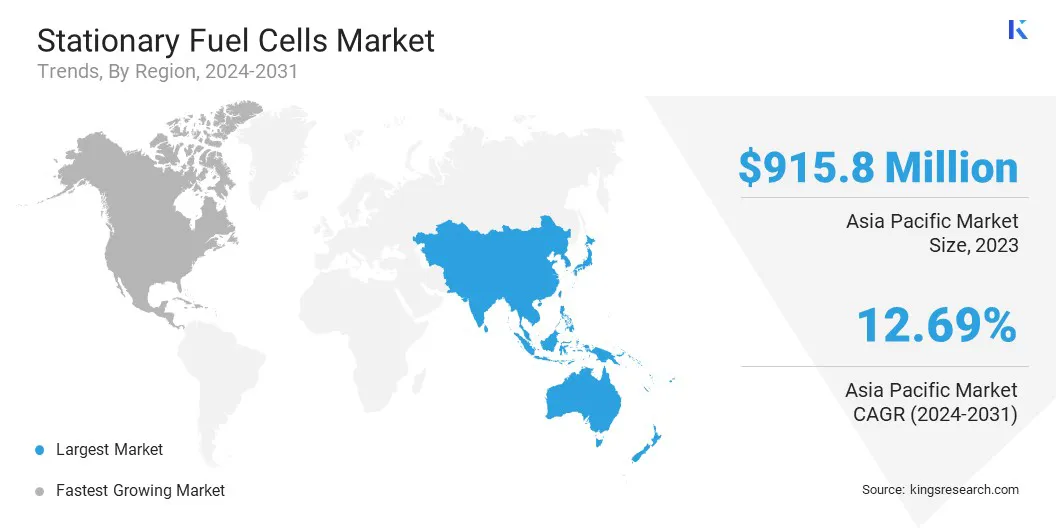

Based on region, the global stationary fuel cells market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Stationary Fuel Cells Market share stood around 34.56% in 2023 in the global market, with a valuation of USD 915.8 million. Rapid economic growth observed in countries such as China and India has led to a surge in energy demand, which necessitates clean and efficient solutions to meet this growing need. Stationary fuel cells are emerging as a promising solution, offering reliability and efficiency, especially in areas with limited grid infrastructure.

- For instance, China's ‘14th Five-Year Plan’ prioritizes clean energy development, highlighting the potential for fuel cells to address energy demands sustainably.

Moreover, government investments in hydrogen infrastructure across various Asian countries are poised to significantly boost the adoption of stationary fuel cells. Initiatives such as Japan's "Basic Hydrogen Strategy" aim to establish a hydrogen society by promoting the development of hydrogen production, storage, and transportation networks, which are critical for fuel cell deployment.

North America captured a significant share of 25.67% in 2023. The adoption of stationary fuel cells is bolstered by the region's increasing focus on grid resiliency, driven by a rise in extreme weather events leading to power outages. Stationary fuel cells are increasingly recognized as a dependable and clean alternative, particularly suitable for critical infrastructure and remote locations, resulting in enhancing grid resiliency and mitigating the impact of disruptions.

Moreover, North America benefits from abundant natural gas resources, which serve as a readily available fuel source for solid oxide fuel cell (SOFC) technology. This abundant supply of natural gas enables the widespread adoption of SOFCs, thereby contributing to the growth of the regional market.

Furthermore, the early adoption of new technologies positions the region favorably in the stationary fuel cells market. This early adoption advantage presents companies with opportunities to establish a foothold and potentially emerge as leaders in specific market segments, thereby stimulating growth and innovation in the North America stationary fuel cells industry.

Competitive Landscape

The global stationary fuel cells market report will provide valuable insight with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Stationary Fuel Cells Market

- Ballard Power Systems

- Toshiba Energy Systems & Solutions Corporation

- Bloom Energy

- Plug Power Inc.

- Doosan Fuel Cell Co., Ltd

- Fuji Electric Co., Ltd.

- SFC Energy AG

- DENSO CORPORATION

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- AISIN CORPORATION

Key Industry Developments

- November 2023 (Partnership): Yokogawa Electric Corporation and TECO 2030 ASA collaborated and signed an investment deal. The collaboration aimed to enhance hydrogen fuel cell technology and identify business prospects in maritime transportation and other industrial domains.

The Global Stationary Fuel Cells Market is Segmented as:

By Capacity

- Less than 1 kW

- 1 kW to 5 kW

- 5 kW to 250 kW

- 250 kW to 1 MW

- More than 1 MW

By End User

- Transportation

- Defense

- Oil & Gas

- Utilities

- Others

By Application

- Combined Heat and Power (CHP)

- Prime Power

- Uninterrupted Power Supply (UPS)

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America