Sports Medicine Market Size

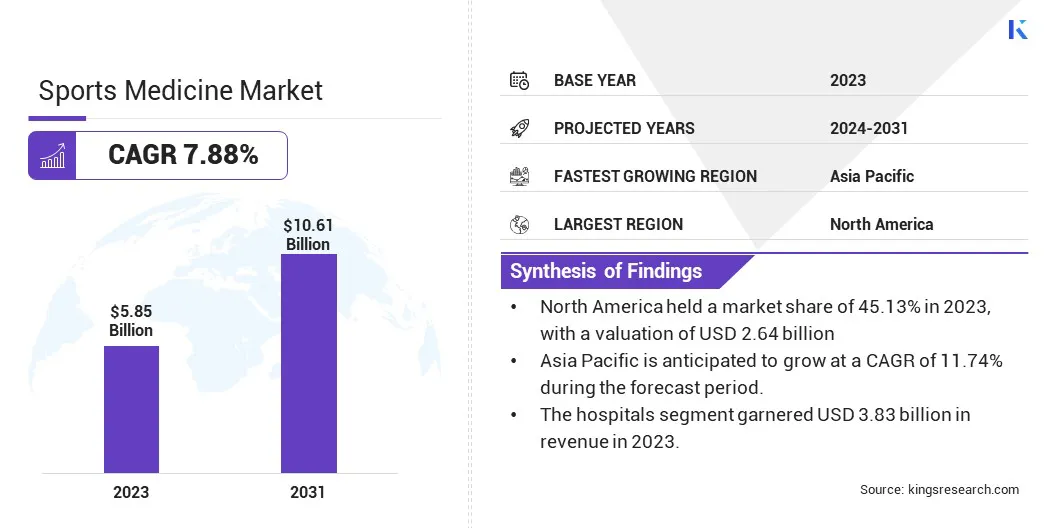

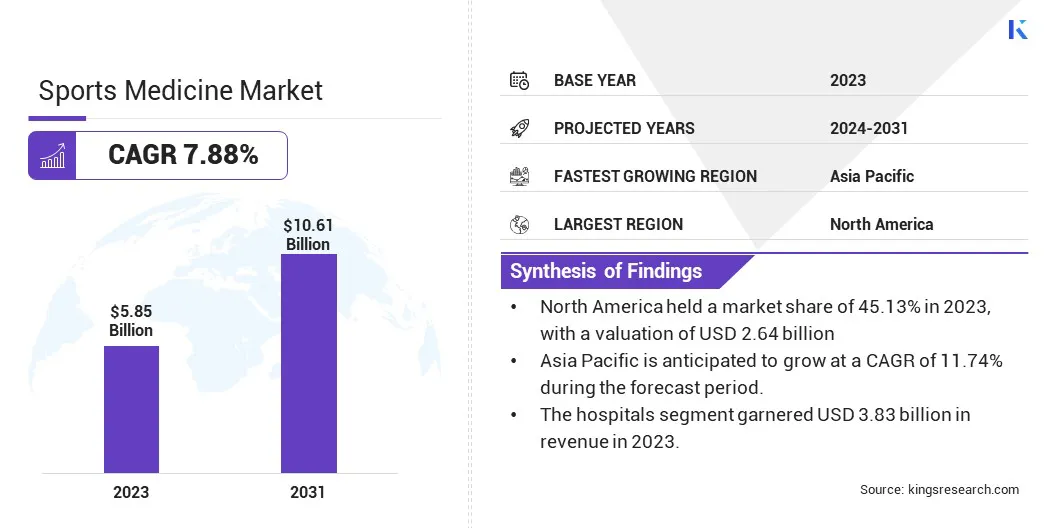

The global Sports Medicine Market size was valued at USD 5.85 billion in 2023 and is projected to reach USD 10.61 billion by 2031, growing at a CAGR of 7.88% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Smith & Nephew plc, Stryker Corporation, Johnson & Johnson, Arthrex, Inc., Zimmer Biomet Holdings, Inc., Breg, Inc., Mueller Sports Medicine, Inc., Medtronic plc, Conmed Corporation, DJO Global, Inc. and Others.

The rising participation in sports and physical activities globally is a significant factor propelling the growth of the sports medicine industry. As more individuals engage in sports, the likelihood of sports-related injuries increases, necessitating effective prevention, diagnosis, treatment, and rehabilitation solutions. This surge in the demand for sports medicine products and services spans a wide range, including orthopedic implants, rehabilitation equipment, diagnostic tools, and regenerative medicine therapies.

Moreover, the growing emphasis on leading healthy and active lifestyles amplifies the need for sports medicine interventions to support individuals in maintaining their physical well-being. As a result, mounting global participation in sports acts as a catalyst for the continuous growth and evolution of the sports medicine industry, driving innovation and investment in the sector.

Analyst’s Review

The adoption of regenerative medicine approaches such as stem cell therapy and tissue engineering in treating sports-related injuries marks a significant advancement poised to revolutionize treatments within the sports medicine industry. These innovative techniques hold the potential to enhance healing processes and improve long-term outcomes for athletes and active individuals.

Furthermore, the integration of wearable devices, artificial intelligence (AI), and telemedicine platforms into sports medicine practices is expected to lead to transformative changes in the management and prevention of injuries.

With the ability to remotely monitor the health metrics of the athletes, deliver personalized rehabilitation programs, and implement real-time injury prevention strategies, these technological advancements are poised to shape the future of sports medicine delivery. By leveraging these revolutionary factors, the sports medicine market is likely to experience substantial growth in the following years.

Market Definition

Sports medicine is a multidisciplinary field dedicated to the prevention, diagnosis, treatment, and rehabilitation of injuries and conditions related to sports and physical activities. Its applications are wide-ranging, covering various aspects of healthcare tailored specifically to athletes and active individuals.

One primary application of sports medicine involves injury prevention through techniques such as pre-participation screenings, biomechanical assessments, and injury risk assessments. Additionally, sports medicine professionals play a crucial role in diagnosing sports-related injuries through imaging modalities such as MRI, CT scans, and ultrasound, as well as clinical evaluations.

Treatment strategies in sports medicine encompass a spectrum of interventions, including physical therapy, orthopedic surgery, pharmacological interventions, and regenerative medicine techniques such as platelet-rich plasma (PRP) therapy and stem cell treatments. Rehabilitation programs designed by sports medicine specialists aim to optimize recovery, restore function, and prevent future injuries through targeted exercises, manual therapy, and neuromuscular re-education.

Regulatory aspects of sports medicine vary across regions, with regulations governing medical devices, pharmaceuticals, and healthcare professionals involved in sports medicine practice.

Compliance with regulatory standards ensures the safety, efficacy, and quality of sports medicine products and services, safeguarding the health and well-being of athletes and active individuals. Additionally, regulatory bodies may oversee professional licensure, accreditation, and continuing education requirements for practitioners in the field, maintaining standards of competency and ethical conduct within the sports medicine industry.

Sports Medicine Market Dynamics

Technological advancements in orthopedic implants and minimally invasive surgical techniques are significant factors propelling the growth of the sports medicine market. These innovations have transformed the landscape of orthopedic surgery, offering more precise, less invasive, and faster recovery options for patients.

Advanced materials, such as titanium alloys and biocompatible polymers, have improved the durability and biocompatibility of orthopedic implants, leading to better outcomes and longer implant lifespans. Similarly, minimally invasive surgical techniques, such as arthroscopy, have revolutionized the treatment of sports-related injuries. These methods allow surgeons to access and repair damaged tissues through smaller incisions, resulting in reduced trauma, and quicker recovery times.

As a result, patients can return to their active lifestyles sooner, thereby driving demand for these advanced surgical approaches and contributing to the overall growth of the sports medicine market. Moreover, increasing awareness of sports-related injuries and the importance of preventive care serve as another key factor fueling the adoption of sports medicine solutions.

Athletes, coaches, parents, and healthcare professionals are increasingly educating themselves about the risks associated with sports participation and the need for proactive measures to prevent injuries. This heightened awareness has led to the implementation of injury prevention programs, pre-participation screenings, and biomechanical assessments in sports settings.

Moreover, initiatives promoting proper training techniques, equipment usage, and warm-up routines have gained significant traction, thus reducing the incidence and severity of sports-related injuries.

The high costs associated with sports medicine procedures and equipment pose a significant barrier to access, especially in developing regions where financial resources are limited. Advanced treatment options such as regenerative medicine therapies and minimally invasive surgeries often come with substantial expenses, making them inaccessible to a significant portion of the population in these regions.

Additionally, stringent regulatory requirements and reimbursement challenges in certain geographies present obstacles to market growth and innovation in the sports medicine sector. Complying with regulatory standards and navigating reimbursement processes can be complex and resource-intensive, particularly for smaller companies and startups.

As a result, the sports medicine market expansion and the introduction of new technologies may be slower in regions where regulatory hurdles are more pronounced, limiting the availability of cutting-edge sports medicine solutions and widening the gap in healthcare disparities between developed and developing regions.

Segmentation Analysis

The global market is segmented based on sports type, product type, end-user, and geography.

By Sports Type

Based on sports type, the sports medicine market is segmented into team sports, individual sports, combat sports, extreme sports, and water sports. The water sports segment is poised to record significant growth in the upcoming years due to increasing participation in activities such as swimming, surfing, kayaking, and water polo.

Additionally, the rising popularity of water-based recreational activities among individuals seeking outdoor and fitness experiences further boosts segment growth. With advancements in sports medicine catering to the unique injury risks associated with water sports, this segment is projected to reach a valuation of USD 1.23 billion by 2031.

By Product Type

Based on product type, the sports medicine market is classified into body reconstruction, body support and recovery, accessories, and others. The accessories segment is anticipated to experience rapid growth between 2024 and 2031, achieving a robust CAGR of 12.03%. This expansion is mainly attributed to the increasing adoption of wearable devices, such as fitness trackers and smartwatches, among athletes and fitness enthusiasts to monitor performance and prevent injuries.

Additionally, the demand for supportive gear such as braces, compression garments, and protective equipment is rising, driven by the growing emphasis on injury prevention and performance optimization in sports and fitness activities. As a result, the accessories segment is poised to witness substantial expansion in the foreseeable future, catering to the evolving needs of athletes and active individuals worldwide.

By End-User

Based on end-user, the sports medicine market is classified into hospitals, ambulatory surgical centers (ASCs), and physiotherapy centers. The hospitals segment dominated the market in 2023, generating the highest revenue of USD 3.83 billion. This growth can be attributed to several factors, including the availability of advanced medical facilities, specialized sports medicine departments, and comprehensive healthcare services offered by hospitals.

Moreover, hospitals often serve as primary referral centers for the treatment of sports-related injuries, attracting patients seeking specialized care from orthopedic surgeons, sports medicine physicians, and rehabilitation specialists. As a result, the hospital segment commanded a significant share of the market due to its extensive infrastructure and expertise in managing sports injuries and conditions.

Sports Medicine Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Sports Medicine Market share stood around 45.13% in 2023 in the global market, with a valuation of USD 2.64 billion. The region boasts a robust healthcare infrastructure, with advanced medical facilities and specialized sports medicine clinics spread across the region.

Additionally, the region has a high prevalence of sports participation, with a large population actively engaged in various athletic activities, thereby driving the demand for sports medicine products and services. Furthermore, North America is home to numerous key players in the sports medicine market, including leading pharmaceutical companies, medical device manufacturers, and healthcare providers, which is contributing to the region's market dominance.

With a strong emphasis on sports and fitness, coupled with access to advanced healthcare systems and industry expertise, North America continues to lead the global sports medicine industry.

Asia Pacific is poised to emerge as the fastest-growing market globally, with an impressive CAGR of 11.74% over the forecast period. The rapid urbanization and rising disposable incomes in countries across the region are fueling increased participation in sports and recreational activities, driving demand for sports medicine products and services.

Additionally, growing awareness of the importance of physical fitness and the rising incidence of sports-related injuries are spurring investment in sports medicine facilities, equipment, and research. Furthermore, advancements in healthcare infrastructure and technology are facilitating greater accessibility to sports medicine interventions, thereby propelling regional market growth.

Competitive Landscape

The sports medicine market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Widely adopted strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are positively influencing the market outlook.

List of Key Companies in Sports Medicine Market

Key Industry Developments

- March 2023 (Partnership): Inova Health System formed a new sports medicine partnership with D.C. United, a Major League Soccer team. This collaboration aimed to enhance player care through Inova's expertise in sports medicine, providing specialized services and support to the team. The partnership underscored Inova's commitment to advancing sports medicine and promoting athlete well-being within the professional soccer community.

- March 2023 (Partnership): Mueller Sports Medicine announced its third year of partnership with the PFATS Foundation Give Back Program. The collaboration aimed to provide essential sports medicine equipment and resources to high school athletic programs across the United States, ensuring athlete safety and well-being.

The global Sports Medicine Market is segmented as:

By Sports Type

- Team Sports

- Individual Sports

- Combat Sports

- Extreme Sports

- Water Sports

By Product Type

- Body Reconstruction

- Body Support and Recovery

- Accessories

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Physiotherapy Centers

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.