Market Definition

The market includes the production and supply of malts developed through controlled processes such as roasting, kilning, and steeping to achieve unique flavors, colors, and aromas. These malts are formulated for specific brewing and distilling purposes, particularly in enhancing beer styles such as stouts, porters, and lagers.

Specialty malts are also used in food products to improve taste and texture. The market covers a range of malt types, including caramel, chocolate, and roasted malts, tailored to diverse applications. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Specialty Malt Market Overview

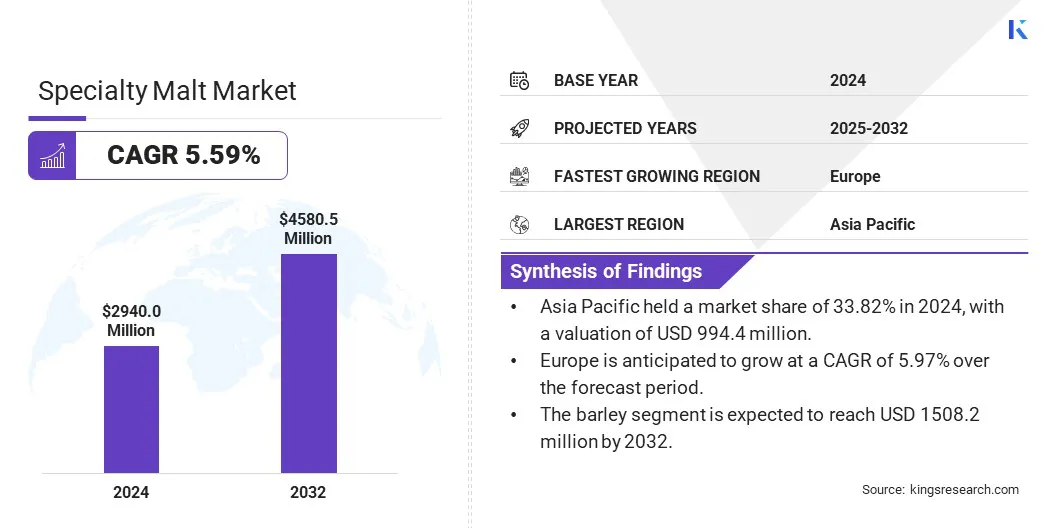

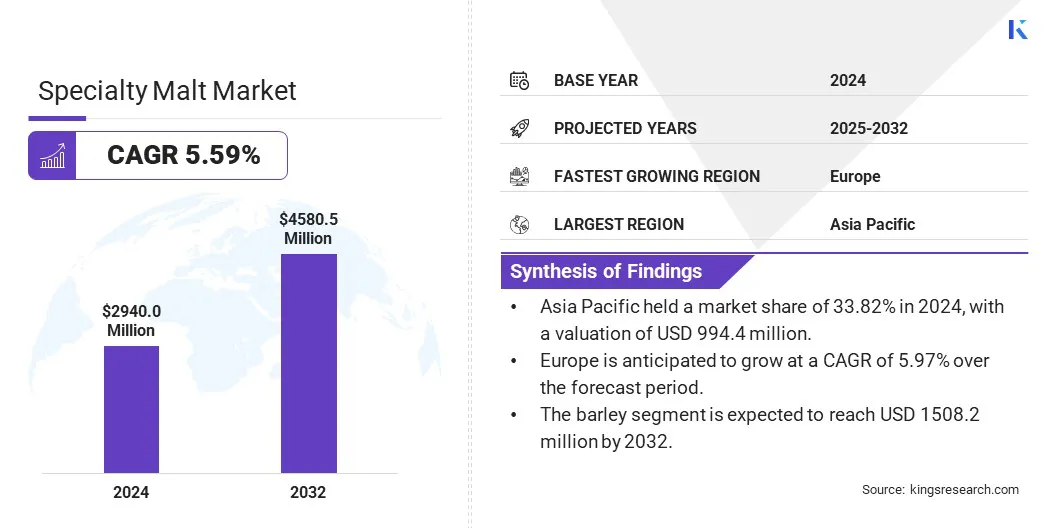

The global specialty malt market size was valued at USD 2940.0 million in 2024 and is projected to grow from USD 3091.1 million in 2025 to USD 4580.5 million by 2032, exhibiting a CAGR of 5.59% during the forecast period.

Market growth is driven by its expanding use in non-alcoholic beverages, where malt is essential for achieving depth and body without alcohol. Additionally, innovation in malt processing techniques is improving flavor consistency and efficiency, supporting its wider adoption in craft brewing, bakery, and specialty foods.

Major companies operating in the specialty malt industry are Cargill, Incorporated, Malteurop Groupe, GrainCorp Malt, BOORTMALT, Viking Malt AB, The Soufflet Group, Simpsons Malt Limited, Muntons plc, Rahr Corporation, Axereal Group, Crisp Malting Group Ltd, Bairds Malt Limited, IREKS GmbH, Thomas Fawcett & Sons Ltd, and Canada Malting Co. Limited.

Market expansion is fueled by the global expansion of craft breweries. These breweries focus on unique flavors, small batch production, and differentiated beer styles, which require varied specialty malts such as chocolate, crystal, and roasted types.

As craft brewers emphasize ingredient quality and flavor complexity, specialty malts have become essential in product formulation. The shift in consumer preference toward craft beverages is leading to a higher demand for customized malt profiles globally.

- In December 2024, The Food Basket Brewery in Benue State, Nigeria, introduced Zeva Premium Lager Beer, a flagship product aimed at supporting economic development and job creation. The brewery utilizes locally sourced crops, such as cassava, sorghum, millet, and maize, reflecting a commitment to leveraging agricultural resources for industrial growth.

Key Highlights

Key Highlights

- The specialty malt industry size was valued at USD 2940.0 million in 2024.

- The market is projected to grow at a CAGR of 5.59% from 2025 to 2032.

- Asia Pacific held a market share of 33.82% in 2024, with a valuation of USD 994.4 million.

- The liquid segment garnered USD 1762.3 million in revenue in 2024.

- The barley segment is expected to reach USD 1508.2 million by 2032.

- The crystal segment secured the largest revenue share of 36.22% in 2024.

- The brewing segment is set to grow at a CAGR of 5.83% through the forecast period.

- The smoked segment secured the largest revenue share of 37.06% in 2032.

- Europe is anticipated to grow at a CAGR of 5.97% over the forecast period.

Market Driver

Expanding Use in Non-Alcoholic Beverages

The specialty malt market is significantly expanding due to its growing use in malt-based non-alcoholic beverages. Health-conscious consumers are turning to low-sugar and functional beverages, with malt extracts gaining traction as natural flavoring and nutrient sources.

Manufacturers are integrating specialty malts into product lines to enhance taste while maintaining a clean label. This shift is prompting beverage innovation and extending malt applications beyond traditional beer markets, thereby fueling market growth.

- In July 2024, Lewis Hamilton's non-alcoholic agave-based spirit, Almave Ámbar, was launched in the UK following its debut in Mexico. Produced from blue agave without fermentation, Almave Ámbar offers a unique flavor profile for consumers seeking non-alcoholic alternatives.

Market Challenge

Limited Availability of High-Quality Specialty Barley

A key challenge hindering the growth of the specialty malt market is the limited availability of high-quality specialty barley. Climate change, soil degradation, and regional supply shortages are affecting its production, hindering the consistent supply of premium malt.

To address this challenge, key players are investing in contract farming, supporting sustainable barley cultivation, and collaborating with local growers to improve crop quality. Breeding programs focused on developing resilient barley varieties and partnerships with agricultural research institutions are also helping secure a more reliable and high-quality supply chain for specialty malt production.

Market Trend

Innovation in Malt Processing Techniques

Continuous advancements in roasting, kilning, and enzyme treatments are enhancing the versatility and flavor profiles of specialty malts. These innovations enable maltsters to create unique color profiles, aroma intensities, and taste notes suitable for different beverages.

Enhanced control over processing variables allows producers to meet the evolving requirements of brewers and distillers. This technical progress is expanding product portfolios and supporting growth in premium segments of the market.

- In April 2024, Crisp Malt (UK) and Admiral Maltings (USA) collaborated to floor-malt Haná barley, an heirloom Czech variety, in California. This transatlantic project involved adapting traditional malting methods to local conditions, including extended germination and a "low and slow" kilning process. The resulting malt exhibited unique sensory characteristics, such as floral aromas and cracker-like notes, offering brewers a distinctive ingredient for classic lager styles.

Specialty Malt Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Dry, Liquid

|

|

By Source

|

Barley, Wheat, Rye, Others

|

|

By Type

|

Crystal, Roasted, Dark, Others

|

|

By Application

|

Brewing, Distilling, Baking, Others

|

|

By Flavor

|

Aromatic, Coffee, Smoked, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Form (Dry and Liquid): The liquid segment earned USD 1762.3 million in 2024 due to its ease of blending, consistent quality, and wide acceptance in beverage formulations, particularly in brewing and non-alcoholic drinks.

- By Source (Barley, Wheat, Rye, and Others): The barley segment held a share of 33.24% in 2024, due to its optimal enzyme content, high extract yield, and widespread suitability for diverse brewing and food applications.

- By Type (Crystal, Roasted, Dark, and Others): The crystal segment is projected to reach USD 1654.8 million by 2032, owing to its widespread use in enhancing flavor, color, and body in a variety of beer styles.

- By Application (Brewing, Distilling, Baking, and Others): The brewing segment is set to grow at a CAGR of 5.83% through the forecast period, largely attributed to its consistent demand for diverse malt profiles that enhance flavor, color, and aroma in craft and premium beer production.

Specialty Malt Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific specialty malt market share stood at around 33.82% in 2024, valued at USD 994.4 million. This dominance is reinforced by the rapid expansion of independent craft breweries across the region. Young consumers in urban areas increasingly prefer artisanal beers with unique flavor profiles.

The Asia Pacific specialty malt market share stood at around 33.82% in 2024, valued at USD 994.4 million. This dominance is reinforced by the rapid expansion of independent craft breweries across the region. Young consumers in urban areas increasingly prefer artisanal beers with unique flavor profiles.

To meet this demand, breweries are using specialty malts to create rich textures, deeper color, and signature tastes. Moreover, several countries in the Asia Pacific region are investing in local malting plants to reduce reliance on imports and meet the quality needs of growing brewing sectors.

The development of regional malt houses is helping supply fresh, customized specialty malts at competitive prices. Access to locally sourced and processed malts is boosting the adoption of new malt grades by breweries and food companies, thus influencing regional market.

- In July 2024, Beerfest Asia, held in Singapore, featured over 600 brews, including more than 160 making their local debut. Notably, Singapore-based breweries such as Rye & Pint and Sunbird Brewing Company introduced innovative flavors such as Fortune Blossom Moutai Ale and Pulut Hitam Imperial Stout, reflecting the region's dynamic craft beer landscape.

The Europe specialty malt industry is estimated to grow at a CAGR of 5.97% over the forecast period. Europe’s long-standing brewing culture creates a strong foundation for specialty malt usage.

Traditional beer styles such as stouts, porters, and bocks require specific malt types such as black, crystal, and Munich malts. Brewers are increasingly innovating within these styles to meet evolving consumer preferences, using specialty malts to enhance flavor complexity and richer color.

Furthermore, European food manufacturers are increasingly incorporating specialty malts into premium bakery goods, cereals, and confectionery items. These ingredients provide natural coloring, subtle sweetness, and improved texture. Specialty malts also serve functional benefits such as enhanced Maillard reactions and extended shelf life, further boosting adoption across the region.

- In September 2023, At the 2025 CEBC (Central European Brewing Convention) in Budapest, Viking Malt presented Sprau, a malted broad bean product designed for both brewing and food applications. Sprau enhances hop aroma in beers and serves as a sustainable ingredient in plant-based foods, aligning with Europe's focus on eco-friendly and versatile malt products.

Regulatory Frameworks

- The specialty malt industry in the United States is regulated by the Food and Drug Administration (FDA) and the Alcohol and Tobacco Tax and Trade Bureau (TTB). The FDA enforces the Federal Food, Drug, and Cosmetic Act (FFDCA) to ensure food safety, ingredient approval, and proper labeling. The TTB oversees malt used in brewing and distilling, focusing on ingredient disclosure, classification, and taxation. Compliance with good manufacturing practices is mandatory for all malt producers.

- Specialty malt production in the European Union (EU) falls under the General Food Law Regulation (EC 178/2002), ensuring food safety and traceability. Food hygiene is regulated under Regulation (EC) No 852/2004, while consumer information must comply with Regulation (EU) No 1169/2011. Organic specialty malts must meet standards set by Regulation (EC) No 834/2007. These rules collectively promote safety, accurate labeling, and sustainability in malt production across EU member states.

- In China, the specialty malt industry is regulated by the State Administration for Market Regulation (SAMR) and governed by the National Food Safety Standard GB 7101-2015. These rules set strict limits on moisture content, contaminants, and purity levels for malt used in brewing and food processing. Labeling and hygiene standards are rigorously enforced to ensure consumer safety. Imports must comply with China’s customs and food safety inspection requirements.

- Japan regulates specialty malts under the Food Sanitation Act, overseen by the Ministry of Health, Labour and Welfare (MHLW). The act covers safety standards, ingredient controls, and labeling. Specialty malts marketed as organic must comply with the Japanese Agricultural Standards (JAS). These regulations maintain high safety and quality levels in malt production and ensure transparency for consumers and manufacturers.

Competitive Landscape

Major players in the specialty malt industry are adopting strategies such as setting up advanced malting facilities in emerging regions, partnering with global brewers to secure long-term demand, and shifting toward locally sourced barley to reduce dependency on imports and logistics costs. These approaches help improve production efficiency, ensure raw material availability, and strengthen regional supply networks.

- In March 2025, Soufflet Malt announced a USD 108 million investment to build a new malting facility in South Africa, in partnership with Heineken. The plant aims to produce nearly 100,000 tonnes of malt annually, replacing the import of 4,500 containers of barley with locally sourced barley to streamline the supply chain.

List of Key Companies in Specialty Malt Market:

- Cargill, Incorporated

- Malteurop Groupe

- GrainCorp Malt

- BOORTMALT

- Viking Malt AB

- The Soufflet Group

- Simpsons Malt Limited

- Muntons plc

- Rahr Corporation

- Axereal Group

- Crisp Malting Group Ltd

- Bairds Malt Limited

- IREKS GmbH

- Thomas Fawcett & Sons Ltd

- Canada Malting Co. Limited

Recent Developments (Expansion/Product Launch)

- In November 2024, Boortmalt expanded its Minch Malt production facility in Athy, County Kildare, increasing capacity by 20,000 metric tons. The upgrade includes advanced malting equipment and enhanced processing efficiency to meet rising consumer demand and support growth in the premium Irish malt market.

- In September 2023, Boortmalt launched the Atlantis Malt Series, featuring innovative Tritordeum malt specialties. This new range is designed to offer unique flavors and characteristics for brewers seeking novel ingredients to differentiate their products.

Key Highlights

Key Highlights The Asia Pacific specialty malt market share stood at around 33.82% in 2024, valued at USD 994.4 million. This dominance is reinforced by the rapid expansion of independent craft breweries across the region. Young consumers in urban areas increasingly prefer artisanal beers with unique flavor profiles.

The Asia Pacific specialty malt market share stood at around 33.82% in 2024, valued at USD 994.4 million. This dominance is reinforced by the rapid expansion of independent craft breweries across the region. Young consumers in urban areas increasingly prefer artisanal beers with unique flavor profiles.