Specialty Gases Market Size

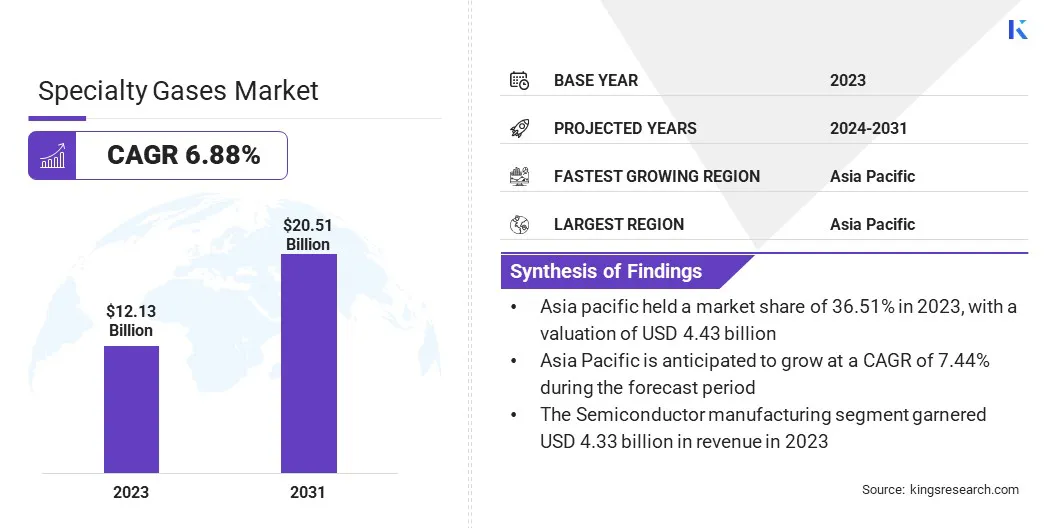

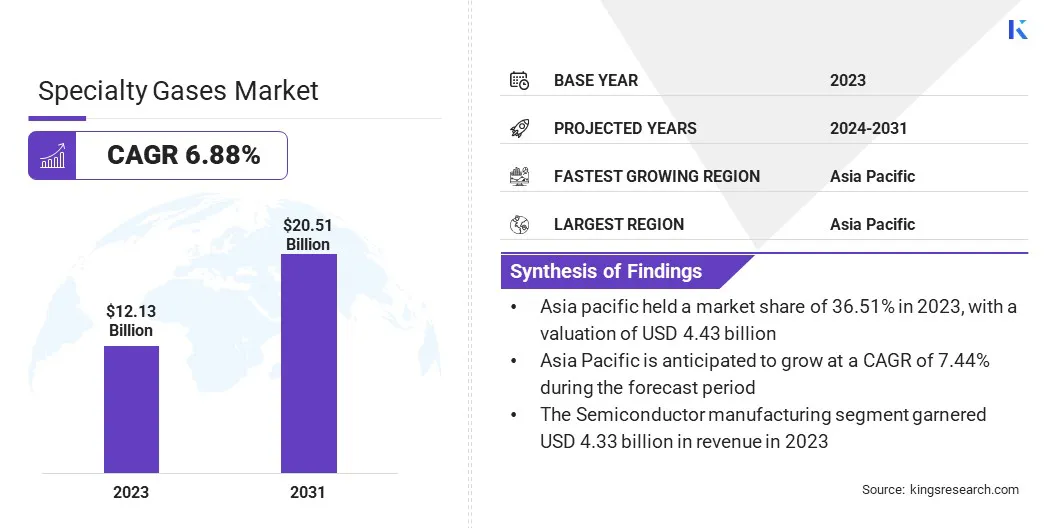

The global specialty gases market size was valued at USD 12.13 billion in 2023 and is projected to grow from USD 12.87 billion in 2024 to USD 20.51 billion by 2031, exhibiting a CAGR of 6.88% during the forecast period. Specialty gases are integral to numerous industrial processes, such as welding, cutting, and chemical synthesis, where precision and specific gas compositions are critical.

The growth of advanced manufacturing and construction industries, such as additive manufacturing and robotics, has led to the growth of the market.

- In February 2023, the World Economic Forum highlighted an innovative housing development in Texas, where 3D-printer robots are being used directly on-site for construction. Located on the outskirts of Austin, this ambitious 100-home project is the result of a collaboration between Lennar, a leading U.S. homebuilder, and 3D printing pioneer ICON. The project is slated for completion by the end of 2024.

These developments highlight the growing demand for specialty gases in the construction sector.

In the scope of work, the report includes products offered by companies such as Air Products and Chemicals, Inc., Air Liquide, Messer SE & Co. KGaA, Linde plc, Taiyo Nippon Sanso Corporation, MESA Specialty Gases & Equipment, Weldstar Company, Inc., Norco Inc., Coregas, Resonac Holdings Corporation, and others.

Moreover, global investments in semiconductor manufacturing and microelectronics are fueling the demand for specialty gases used in processes like plasma etching, wafer cleaning, and doping. The rising demand for high-performance computing devices, artificial intelligence applications, and advanced communication systems further bolsters the specialty gases market growth.

Specialty gases are high-purity gases with precise chemical compositions used in specialized applications across various industries. These gases include noble gases, halogen gases, reactive gases, and gas mixtures, and are essential for various applications in healthcare, electronics, automotive, and environmental monitoring.

Specialty gases are used for calibration, analytical testing, chemical synthesis, and production processes requiring exacting conditions. Their role in enabling advanced technologies and ensuring product quality makes them critical to modern industrial and scientific advancements.

Analyst’s Review

Continuous investments in research and development are driving innovations in specialty gases, unlocking new applications across various industries.

- In April 2023, Merck unveiled an agreement with the Commonwealth of Pennsylvania to advance its semiconductor manufacturing expansion plans. This initiative aligns with Merck's "Level Up" growth program, which has committed over USD 3.16 billion to innovation and capacity-building projects by 2025. The investment aims to enhance the world’s largest integrated specialty gases facility, bolstering the growth and success of Merck’s Semiconductor Solutions business.

Such strategic expansions underscore the pivotal role of specialty gases, contributing significantly to market growth globally. Additionally, the development of cost-effective production methods and efficient delivery systems ensures accessibility. This drives wider adoption in industries that depend on precision and high-quality materials, thereby contributing to market growth.

Furthermore, the increasing adoption of smart devices, wearables, and 5G technology accelerates the demand for advanced electronic components, fostering market growth. Manufacturers are focusing on producing ultra-high-purity gases to meet stringent quality standards, ensuring consistent performance and enhancing the efficiency of modern electronics.

Specialty Gases Market Growth Factors

The expanding healthcare sector is significantly boosting the demand for specialty gases, which are essential in applications such as respiratory therapies, anesthesia, and diagnostic imaging.

- In April 2024, the World Bank Group unveiled an ambitious initiative aimed at helping countries provide quality, affordable healthcare services to 1.5 billion people by 2030. This effort is part of a broader global initiative to ensure a fundamental standard of care across every stage of life, from infancy and childhood to adolescence and adulthood.

This global commitment to healthcare accessibility is poised to further stimulate market growth, especially as investments in healthcare infrastructure rise. Specialty gases, including medical-grade oxygen, nitrous oxide, and helium, ensure critical care and support advanced procedures like magnetic resonance imaging (MRI).

Moreover, government initiatives promoting green technologies and sustainable energy sources are driving the development and use of specialty gases in areas of carbon capture and storage. Companies are investing in innovative solutions that align with global sustainability goals, further strengthening the specialty gases market.

Specialty Gases Market Trends

The increasing emphasis on renewable energy sources is boosting the demand for specialty gases required in solar panel production, wind turbine maintenance, and hydrogen fuel cell technologies.

Gases, such as argon, helium, and hydrogen, play a vital role in enhancing the efficiency and durability of renewable energy systems. Global transition to cleaner energy alternatives has led to greater investments in technologies that depend on specialty gases.

Additionally, government subsidies and initiatives aimed at reducing carbon emissions are encouraging industries to adopt green energy solutions, driving sustained growth in the specialty gases market.

The food and beverage industry is witnessing growing demand for specialty gases used in packaging, preservation, and carbonation. Modified atmosphere packaging (MAP) relies on these gases to extend product shelf life and maintain its freshness by preventing oxidation and microbial growth.

Carbon dioxide is widely utilized in beverage carbonation, while nitrogen ensures stable storage conditions. The surge in demand for ready-to-eat and packaged foods, along with advancements in cold chain logistics, has further propelled the need for specialty gases, helping businesses meet consumer preferences for quality and convenience while driving market expansion.

Segmentation Analysis

The global market has been segmented based on type, end-user, and geography.

By Type

Based on type, the market has been segmented into ultra-high purity gases, noble gases, halogen gases, and others. The ultra-high purity gases segment led the specialty gases market in 2023, reaching the valuation of USD 4.64 billion, due to their critical role in advanced manufacturing processes, particularly in industries such as semiconductor production, pharmaceuticals, and biotechnology.

These gases are essential for applications requiring precise chemical reactions and minimal contamination. Additionally, as industries start focusing on automation, precision, and innovation, the demand for ultra-high purity gases continues to rise, positioning this segment as a key driver of market growth.

By End-User

Based on end-user, the market has been classified into semiconductor industry, healthcare industry, automotive industry, chemical industry, and others. Of these segments, the semiconductor industry segment is poised for significant growth at a robust CAGR of 8.70% over the forecast period.

Specialty gases, such as nitrogen, hydrogen, and argon, are essential for processes like etching, deposition, and wafer cleaning, which ensure high precision and reliability in semiconductor manufacturing.

With the increasing demand for electronic devices, driven by advancements in artificial intelligence, 5G, and the Internet of Things (IoT), the need for advanced semiconductors continues to grow, further elevating the demand for specialty gases. The industry's continuous technological innovations and expansions also contribute to the segment's dominance.

Specialty Gases Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific specialty gases market share stood around 36.51% in 2023 in the global market, with a valuation of USD 4.43 billion. Asia Pacific is a global hub for electronics manufacturing, with countries like China, South Korea, and Taiwan leading in semiconductor and display panel production.

Specialty gases such as nitrogen trifluoride and silane are critical to ensure high precision and performance in these processes. The region’s strong focus on 5G technology, artificial intelligence, and advanced consumer electronics further amplifies demand, driving specialty gases market growth.

- According to a May 2024 report by the Asian Development Bank, East and Southeast Asia are responsible for more than 80% of the global semiconductor production, playing a vital role in the advancement of artificial intelligence and the growth of the global tech industry.

Moreover, the rapid industrialization and infrastructure development across emerging economies such as China, India, and Indonesia are driving the demand for specialty gases in construction, automotive, and metallurgy segments. These gases play a crucial role in welding, cutting, and chemical processes, ensuring efficiency and quality in industrial applications.

Europe is poised for significant growth at a robust CAGR of 7.10% over the forecast period. Europe’s commitment to achieving carbon neutrality by 2050 is accelerating the adoption of specialty gases in renewable energy applications and emission control technologies.

Government subsidies and policies promoting sustainable industrial practices are significantly contributing to market expansion. Additionally, Europe’s strong emphasis on scientific research and innovation, supported by funding from programs like Horizon Europe, is driving the adoption of specialty gases in analytical testing and laboratory research.

High-purity gases are essential for experiments requiring controlled environments, particularly in material science and environmental studies.

Competitive Landscape

The global specialty gases market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Specialty Gases Market

- Air Products and Chemicals, Inc.

- Air Liquide

- Messer SE & Co. KGaA

- Linde plc

- Taiyo Nippon Sanso Corporation

- MESA Specialty Gases & Equipment

- Weldstar Company, Inc.

- Norco Inc.

- Coregas

- Resonac Holdings Corporation.

Key Industry Developments

- June 2023 (Collaboration): Linde signed multiple contracts with Wanhua Chemical Group to expand its collaboration at several key locations in China. Under these long-term agreements, Linde will supply industrial gases to Wanhua's chemical production facilities via the recently acquired air separation units (ASUs).

- April 2023 (Partnership): Air Liquide strengthened its specialty gases capabilities in India through the acquisition of EffecTech, a specialist company providing accredited calibration and testing services. This move allows Air Liquide India to broaden its portfolio, enabling the supply of accurate and dependable gas mixtures to both existing and new customers.

The global specialty gases market has been segmented:

By Type

- Ultra-high Purity Gases

- Noble Gases

- Halogen gases

- Others

By End-User

- Semiconductor Industry

- Healthcare Industry

- Automotive Industry

- Chemical Industry

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America