Soy Protein Market Size

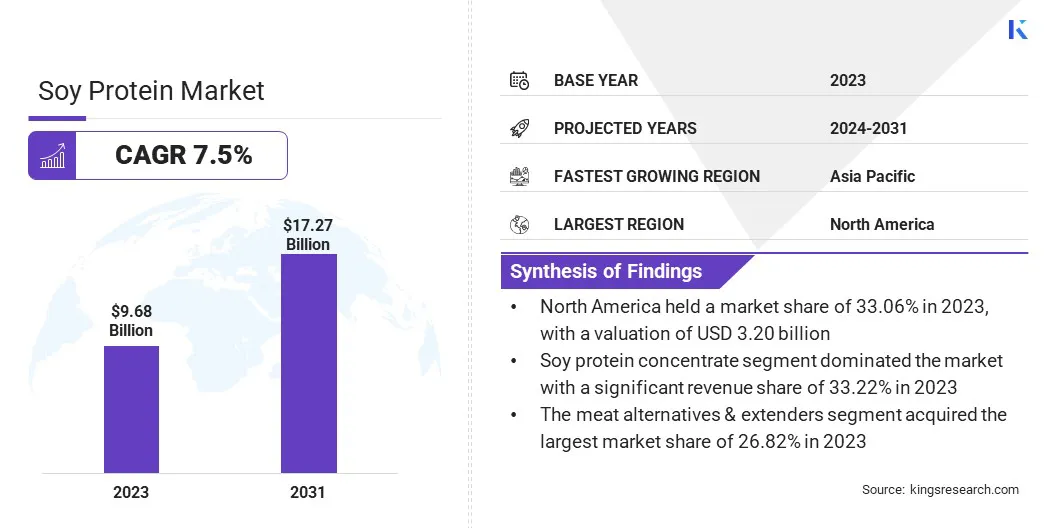

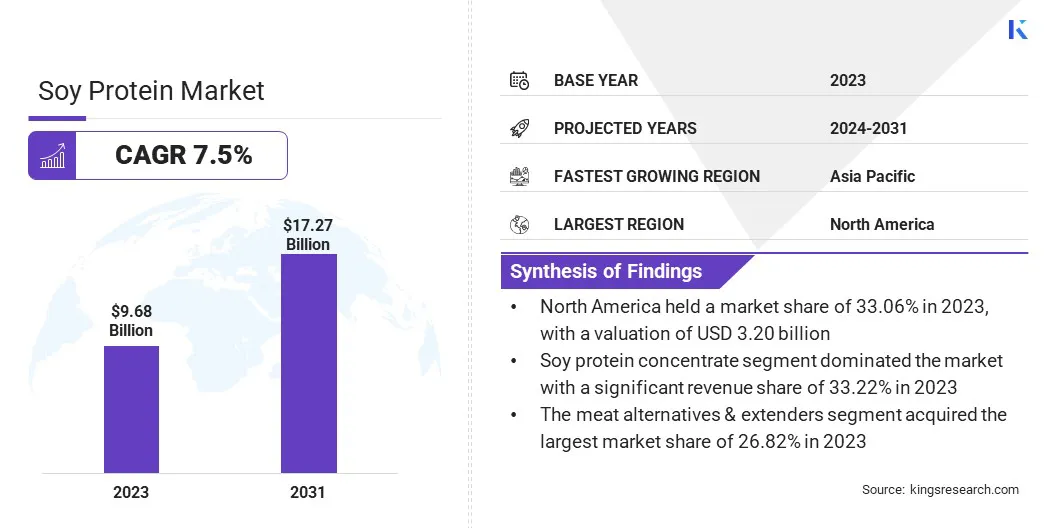

The global Soy Protein Market size was valued at USD 9.68 billion in 2023 and is projected to reach USD 17.27 billion by 2031, growing at a CAGR of 7.5% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as ADM, Cargill Inc., DowDuPont Inc., Imcopa Food Ingredients B.V., CHS Inc., Crown Soya Protein Group, Wilmer International Ltd., Foodchem, Kerry Ingredients Inc., NutraScience Corporation and Others.

The soy protein market is anticipated to experience robust growth in the forthcoming years, driven by increased consumer awareness of the health advantages associated with plant-based proteins. The shift toward vegetarian and vegan diets is expected to bolster the demand for soy protein offerings.

Furthermore, the growing emphasis on sustainable and eco-friendly food alternatives is propelling the adoption of soy protein, positioning it as a preferable environmental choice over animal-derived proteins. This transformation in consumer behavior presents significant commercial prospects for entities operating within the soy protein sector.

The adaptability of soy protein across diverse food applications, including meat substitutes, dairy alternatives, and protein-enriched snacks, is further contributing to its growing popularity. Furthermore, the progress in food technology has enabled producers to formulate soy protein products that effectively replicate the sensory attributes of traditional meat products, thereby enhancing consumer appeal.

The growth of the soy protein market is poised to witness continued expansion in the foreseeable future, driven by the preferences of health-conscious and environmentally aware consumers. The rising consumer awareness regarding soy protein's health and environmental benefits is projected to support market growth.

Moreover, the enhanced distribution and availability of soy protein products through mainstream retail channels and dining establishments are broadening consumer access and driving the growth of the market.

Analyst’s Review

The soy protein market is experiencing notable growth, primarily driven by an increase in consumer interest in plant-based protein substitutes. Additionally, there has been a shift toward healthier lifestyle and dietary choices, resulting in increased consumption of soy protein-based products. Moreover, growing awareness of the environmental repercussions associated with animal farming is promoting the adoption of soy protein as a more sustainable and environmentally friendly alternative.

Furthermore, the applicability of soy protein across a diverse range of food and beverage products fuels market growth. With a growing consumer base actively seeking plant-based dietary options, the demand for soy protein is anticipated to grow rapidly in the coming years.

In response to this, the key players are innovating and launching soy protein products designed to meet varied dietary requirements and consumer preferences. As the plant-based protein sector continues to expand, soy protein plays a pivotal role in catering to the increasing demand for protein sources that are both health-aligned and environmentally sustainable.

Market Definition

Soy protein, derived from soybeans, is a plant-based protein that serves as a comprehensive protein source, encompassing all essential amino acids necessary for human nutrition. It finds extensive application across an array of food products, including tofu, tempeh, and soy milk, serving as an alternative protein source for vegetarians and vegans.

Additionally, the regulatory framework of soy protein is conducted by entities such as the Food and Drug Administration (FDA), which ensures adherence to safety and quality standards for consumer consumption.

Furthermore, the potential health benefits associated with soy protein, including its role in lowering cholesterol levels and reducing heart disease risk attract the consumer base. Additional research supports its utility in weight management and enhancement of bone health. Soy protein is recognized as a versatile and beneficial nutritional element, providing a range of health advantages and culinary versatility.

Soy Protein Market Dynamics

The rising concern over animal welfare and the environmental ramifications of meat production is driving consumers towards alternative protein sources. The adaptability of soy protein in a range of food products, spanning from meat analogs to dairy substitutes, enhances its appeal to those aiming to increase their intake of plant-based foods. This shift in dietary preferences is fostering steady growth in the soy protein market.

In response to this increased consumer awareness, food manufacturers are innovating and introducing a diverse range of products tailored to the burgeoning demand for soy protein. The development spans from plant-based burgers to non-dairy ice creams, demonstrating the extensive potential for soy protein integration into various culinary offerings.

With the ongoing emphasis on sustainability and health, the demand for soy protein is anticipated to grow further in the foreseeable future. This trend towards plant-based alternatives aligns with environmental objectives and broadens the dietary choices available to consumers, marking a significant shift in consumption patterns.

However, the allergies and intolerances associated with soy protein have been a major concern for consumers, leading to a decrease in demand for soy-based products. This has resulted in limited product innovation and market expansion, as companies are hesitant to invest in a market with a reducing consumer base.

In addition, the negative publicity surrounding soy allergies has deterred potential customers from experimenting with soy protein products, thus hindering the overall growth of the market. The soy protein industry is facing challenges in reaching its full potential and tapping into a wider consumer base.

Segmentation Analysis

The global soy protein market is segmented based on type, application, vehicle types, and geography.

By Type

Based on type, the market is bifurcated into soy protein concentrate, soy protein isolate, textured soy protein, and soy flour. The soy protein concentrate segment dominated the soy protein market with a significant revenue share of 33.22% in 2023, due to its high protein content and versatility in various food applications. Manufacturers prefer soy protein concentrate over other soy protein products as it provides a more economical source of protein without compromising on quality.

Additionally, soy protein concentrate has a neutral flavor profile, making it ideal for use in a wide range of products such as plant-based meat alternatives, dairy alternatives, and nutritional supplements. Its ability to improve texture, enhance moisture retention, and extend shelf life further solidifies its position as the highly preferred choice in the market.

By Application

Based on application, the soy protein market is bifurcated into meat alternatives & extenders, protein beverages, dairy alternatives, protein bars, baked goods, nutrition supplements, and others. The meat alternatives & extenders segment acquired the largest market share of 26.82% in 2023, owing to the increasing demand for plant-based protein options among consumers.

With the increasing number of health-conscious individuals and the growing awareness of the environmental impact of meat consumption, more people are turning to soy-based products as a sustainable and nutritious alternative.

Additionally, the versatility of soy protein in mimicking the taste and texture of meat makes it a popular choice for those looking to reduce their meat intake without compromising on flavor or satisfaction. This trend is further fueled by the innovation and creativity of food companies in developing a wide range of soy-based products, from burgers and sausages to meatballs and nuggets, catering to various dietary preferences and culinary traditions.

By Nature

Based on nature, the soy protein market is bifurcated into organic and conventional. The conventional segment accounted for the largest market share of 84.76% in 2023, primarily attributed to its widespread availability and familiarity among consumers.

Numerous individuals have been consuming conventional soy products for years, including tofu, soy milk, and soy-based meat alternatives. This long-standing presence in the market has established a sense of trust and reliability among consumers, making them more likely to choose conventional soy protein over newer, less familiar options.

Additionally, conventional soy protein products are often more affordable and easier to find in grocery stores compared to alternative options, thereby contributing to their dominance in the market.

Soy Protein Market Regional Analysis

Based on region, the global soy protein market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Soy Protein Market share stood around 33.06% in 2023 in the global market, with a valuation of USD 3.20 billion, mainly driven by the robust infrastructure for soy cultivation and processing, which facilitates streamlined supply chain operations.

Moreover, there is a substantial consumer demographic in North America exhibiting a growing inclination towards plant-based protein alternatives, leading to a rise in demand for soy protein offerings.

Additionally, the region boasts a mature food industry sector that is actively engaged in the innovation of new products incorporating soy protein, aligning with evolving consumer tastes. These factors, coupled with an emphasis on sustainability and health-oriented consumption habits drive the growth of the market in the region.

Asia-Pacific is anticipated to register the highest CAGR over the forecast period due to the increasing awareness of the health benefits associated with soy protein consumption among consumers in the region.

Additionally, the growing trend toward plant-based diets and the rising demand for alternative protein sources are driving market growth in Asia-Pacific. Furthermore, the expanding food and beverage industry in countries such as China and India is creating a large market for soy protein products. This surge in demand is fueling the growth of the soy protein market in the region.

Competitive Landscape

The global soy protein market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Soy Protein Market

- ADM

- Cargill Inc.

- DowDuPont Inc.

- Imcopa Food Ingredients B.V.

- CHS Inc.

- Crown Soya Protein Group

- Wilmer International Ltd.

- Foodchem

- Kerry Ingredients Inc.

- NutraScience Corporation

Key Industry Developments

- November 2022 (Product Launch): International Flavors & Fragrances Inc. launched Supro Tex, a soy-based plant protein ingredient. With a protein content of 80%, the ingredient boasts a protein profile comparable to that of animal meat.

The Global Soy Protein Market is Segmented as:

By Type

- Soy Protein Concentrate

- Soy Protein Isolate

- Textured Soy Protein

- Soy Flour

By Application

- Meat Alternatives & Extenders

- Protein beverages

- Dairy alternatives

- Protein bars

- Baked goods

- Nutrition supplements

- Others

By Nature

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America