Market Definition

A solid state drive (SSD) is a type of storage device that uses flash memory to store data. The market encompasses a wide range of SSD types, including internal and external drives, targeting applications in consumer electronics, enterprise data centers, industrial systems, and gaming. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the market growth.

Solid State Drive Market Overview

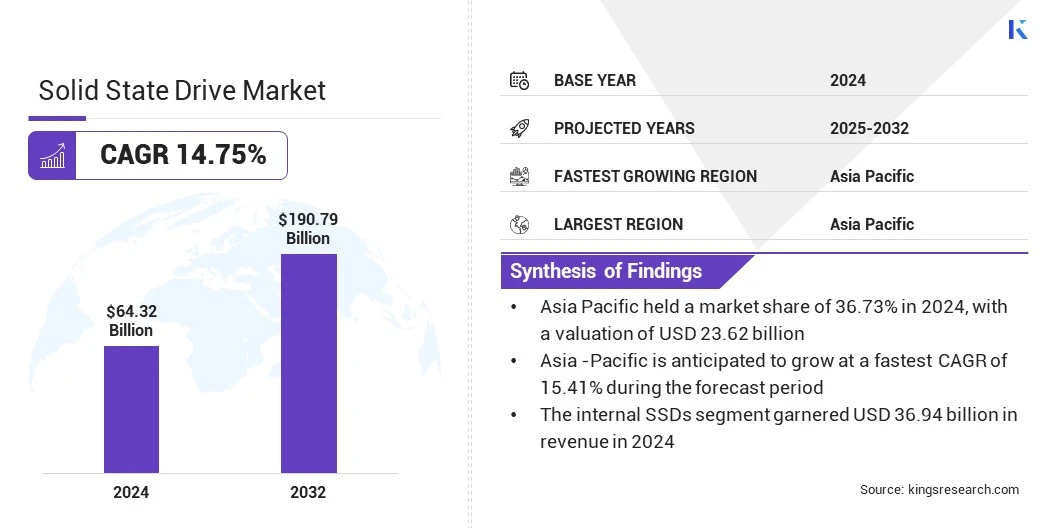

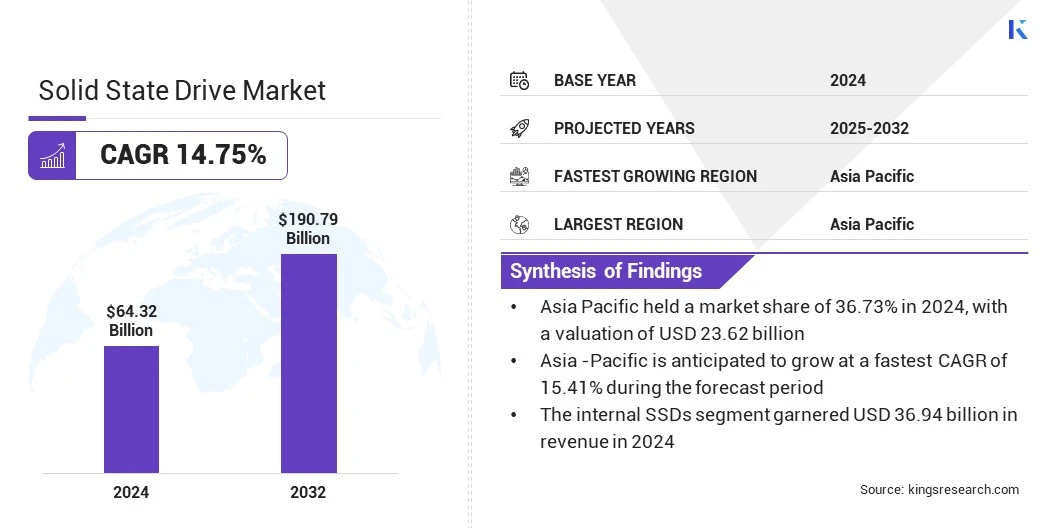

The global solid state drive market size was valued at USD 64.32 billion in 2024 and is projected to grow from USD 72.81 billion in 2025 to USD 190.79 billion by 2032, exhibiting a CAGR of 14.75% during the forecast period.

The market is driven by the rapid expansion of cloud computing and hyperscale data centers, which are increasing the demand for high-capacity and high-speed solid state drives, as enterprises prioritize faster data access, lower latency and energy-efficient storage to support continuous uptime and seamless digital service delivery.

The market is further driven by the growing adoption of SSDs in consumer electronics such as laptops, gaming consoles, and smartphones, as SSDs provides faster boot times, quieter operation and improved durability compared to traditional hard disk drives.

Key Highlights:

- The solid state drive industry size was valued at USD 64.32 billion in 2024.

- The market is projected to grow at a CAGR of 14.75% from 2025 to 2032.

- Asia Pacific held a market share of 36.73% in 2024, with a valuation of USD 23.62 billion.

- The internal SSDs segment garnered USD 36.94 billion in revenue in 2024.

- The 120GB - 320GB segment is expected to reach USD 73.08 billion by 2032.

- The market in Europe is anticipated to grow at a CAGR of 15.06% over the forecast period.

Major companies operating in the market are ADATA Technology Co., Ltd, SAMSUNG, Sandisk Corporation, CORSAIR, Micron Technology, Inc, Kingston Technology Europe Co LLP, Seagate Technology LLC, Shenzhen Kingspec Electronics Technology Co., Ltd, SK hynix Inc., Sabrent, Transcend Information Inc., ATP Electronics Inc., KIOXIA Holdings Corporation, PNY Technologies Inc., and TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION.

The solid state drive is registering rapid expansion, driven by increasing smartphone penetration and affordable internet access. This growing demand is accelerating the need for high-performance storage solutions such as SSDs, which ensure faster game load times, smoother performance, and enhanced user experiences.

- According to a report by the Foundation for Economic Growth and Welfare, the online gaming market is registering substantial growth, with the revenue of the Indian online gaming market projected to reach USD 2.4 billion by FY2029, reflecting a robust 20 percent CAGR from 2017 to 2029. The increasing need for faster load times, reduced latency, and smooth gaming performance is encouraging gamers and developers to adopt SSDs over traditional storage devices.

Market Driver

Rising Demand for High-performance SSDs

The rising demand for high-performance SSDs to support data center operations and AI workloads is driving the solid-state drive market. Organizations seek faster, more efficient data processing to support complex applications.

Modern workloads such as real-time analytics, artificial intelligence, and high-frequency transactions require ultra-low latency and high throughput, which traditional storage solutions cannot deliver. Advanced SSDs are meeting these needs by offering superior read and write speeds, improved energy efficiency, and enhanced reliability, making them essential components in optimizing data center operations and enabling scalable, next-generation computing environments.

- In July 2024, Micron launched the 9550 SSD, designed to handle critical workloads such as AI, OLTP, high-frequency trading, and performance-intensive databases. The 9550 integrates Micron’s proprietary controller, NAND, DRAM, and firmware. It delivers sequential read speeds of 14.0 Gbps and write speeds of 10.0 Gbps, with up to 33% faster workload completion times in AI tasks and 35% lower SSD energy consumption.

Market Challenge

High Cost Per Gigabyte Compared to HDDs

The solid state drive market faces a major challenge in the form of high cost per gigabyte compared to traditional Hard Disk Drives (HDDs), which hinders widespread adoption, especially in cost-sensitive markets.

Despite offering superior performance such as faster data access, lower latency, and better energy efficiency, SSDs remain far more expensive, particularly for high-capacity storage applications. This cost disparity becomes a critical factor for businesses and consumers operating under budget constraints or in price-sensitive regions.

Market players are increasingly adopting advanced NAND technologies, such as QLC (quad-level cell) and transitioning to 3D NAND architectures, to boost storage density while reducing production costs. Manufacturers are streamlining controller designs and optimizing firmware to improve cost efficiency while maintaining high performance.

Additionally, they are focusing on developing high-capacity, energy-efficient SSD modules tailored for enterprise environments. These advancements aim to offer more competitive pricing and operational value, reducing the cost gap with HDDs and supporting broader adoption across cost-sensitive markets.

Market Trend

Adoption of PCIe Gen 5.0 and NVMe protocols

The solid state drive market is registering a surge in the adoption of advanced interfaces such as PCIe Gen 5.0 and NVMe protocols, fueled by user demand for faster data transfer speeds and higher bandwidth for increasingly complex computing tasks.

These technologies are enabling SSDs to deliver ultra-high sequential read/write performance, which is essential for workloads such as 4K video editing, real-time AI processing, and next-gen gaming. Their growing integration into both consumer and enterprise systems is setting a new benchmark for storage efficiency and responsiveness.

- In March 2025, Samsung launched the 9100 PRO SSD with PCIe 5.0, offering read speeds up to 14,800 MB/s and write speeds up to 13,400 MB/s. With improved power efficiency, thermal management, and capacities up to 8TB, it supports AI workloads, content creation, and gaming across various devices.

Solid State Drive Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Internal SSDs, External SSDs

|

|

By Storage Capacity

|

Under 120 GB, 120GB - 320GB, 320GB - 500GB, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Internal SSDs and External SSDs): The internal SSDs segment earned USD 36.94 billion in 2024, due to their growing integration in laptops, desktops, and enterprise servers, driven by the demand for faster boot times, efficient multitasking, and improved durability over traditional hard drives.

- By Storage Capacity (Under 120 GB, 120GB - 320GB, 320GB - 500GB, and Others): The 120gb - 320gb segment held 45.32% share of the market in 2024, owing to its widespread use in budget and mid-range computing devices, balancing affordability with sufficient storage for operating systems and everyday applications.

Solid State Drive Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for a solid state drive market share of around 36.73% in 2024, with a valuation of USD 23.62 billion. The region's stronghold in the SSD market is primarily fueled by its strong manufacturing ecosystem. This well-established infrastructure provides a solid foundation for SSD production, allowing companies to efficiently manufacture and distribute their products.

Strategic consolidation and integration activities in the region are boosting R&D capabilities, allowing players to innovate and develop new SSD technologies. This consolidation also reinforces the region's leadership in NAND flash memory production, which is the core component of SSDs.

The growing demand for SSDs across various sectors is further supporting the market growth in Asia Pacific. Consumer electronics, such as laptops, desktops, and gaming consoles, are increasingly adopting SSDs for their superior performance and reliability.

Enterprise data centers are also driving the demand for SSDs, as they seek to improve storage efficiency and reduce latency. This consistent demand across consumer and enterprise segments is contributing to the steady growth of the solid state drive industry in Asia Pacific.

- In March 2025, SK hynix acquired Intel’s NAND business Solidigm at USD 8.85 billion. NAND flash memory is the primary storage technology used in SSDs. The deal included critical assets such as NAND intellectual property, R&D infrastructure, and key personnel, enabling full integration of Solidigm into SK hynix. This strategic move aims to strengthen SK hynix’s position in the SSD market by enhancing its innovation capabilities and consolidating its presence in the global NAND flash memory sector.

The solid state drive industry in Europe is set to grow at a robust CAGR of 15.06% over the forecast period. This growth is attributed to the regional focus on digital infrastructure and the expansion of cloud ecosystems in the region.

The region is witnessing robust investments in high-performance data centers that require fast, reliable, and power-efficient storage solutions for supporting advanced workloads and ensuring seamless cloud operations. The growing focus on integrating green technologies such as energy-efficient SSD architectures with the IT infrastructure is further strengthening the market across the region.

Additionally, strong governmental support is fostering an environment where advanced SSD technologies can be implemented and scaled across sectors such as cloud computing, healthcare, finance, and industrial automation, thereby fueling the market in the region.

- In May 2024, Google invested USD 1.1 billion for the expansion of its data center campus in Hamina, Finland. The initiative included a collaboration with Haminan Energia to reuse data center heat for district heating, reinforcing Finland’s role in Europe’s digital infrastructure and driving the demand for high-performance SSDs in large-scale, energy-efficient data environments.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) is the primary authority overseeing compliance for electronic and IT hardware, including SSDs. SSD manufacturers and importers must adhere to BIS certification under the Electronics and Information Technology Goods (Requirements for Compulsory Registration) Order. The BIS ensures that SSDs meet safety, quality, and electromagnetic compatibility (EMC) standards before they are allowed in the Indian market.

- In the U.S., the Federal Trade Commission (FTC) serves as the central authority regulating fair competition and consumer protection across all technology markets, including SSDs. The FTC monitors business practices to prevent monopolistic behavior, deceptive marketing, and anti-competitive mergers or acquisitions in the SSD supply chain.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates the production, sale, and import of SSDs. MIIT sets technical standards, industrial policies, and data security requirements that SSD manufacturers must follow. It ensures compliance with national regulations around cybersecurity, semiconductor integration, and intellectual property.

Competitive Landscape

Major players in the solid state drive industry are enhancing product capabilities by integrating advanced NAND technologies, a type of flash memory that is widely used in solid-state drives to deliver high-capacity, power-efficient solutions tailored for hyperscale environments.

They are focusing on developing next-generation flash modules that offer greater storage density, reduced latency, and streamlined architecture to support large-scale data operations.

Additionally, key players are optimizing performance while minimizing energy consumption and positioning their product offerings as scalable for modern data-intensive workloads across cloud and AI-driven infrastructures.

- In January 2025, Pure Storage expanded its strategic collaboration with Micron Technology to develop future DirectFlash Module products using Micron’s G9 QLC NAND. This initiative aims to deliver high-capacity, energy-efficient SSD solutions for hyperscalers by combining advanced NAND technology with Pure Storage’s data platform, enabling massive storage density, low latency, and architectural simplification across enterprise-scale deployments.

List of Key Companies in Solid State Drive Market:

- ADATA Technology Co., Ltd

- SAMSUNG

- Sandisk Corporation

- CORSAIR

- Micron Technology, Inc

- Kingston Technology Europe Co LLP

- Seagate Technology LLC

- Shenzhen Kingspec Electronics Technology Co., Ltd

- SK hynix Inc.

- Sabrent

- Transcend Information, Inc

- ATP Electronics, Inc.

- KIOXIA Holdings Corporation

- PNY Technologies Inc.

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION.

Recent Developments (Product Launch)

- In March 2025, Advantech launched the SQFlash EDSFF and EU-2 PCIe Gen.5 x4 SSDs, targeting next-generation enterprise and data center applications. These SSDs, built on advanced form factors like E1. S and U.2, offer read speeds up to 14,000 MB/s and write speeds up to 8,500 MB/s. Designed for high-speed performance, hot plug support, and thermal efficiency, the new solutions address the growing demand for scalable and reliable storage in AI, real-time analytics, and high-performance computing environments.

- In February 2025, MiPhi launched the Storm 1100X external SSD in India. Targeted at creators, gamers, and professionals, the Storm 1100X offers read speeds of 1100 MB/s. Compatible with Windows, macOS, and Linux, the SSD aims to deliver high-speed, portable storage across a broad range of devices and operating systems.

- In January 2024, Samsung launched the SSD 990 EVO, a high-performance, power-efficient NVMe internal storage device targeting everyday gaming, business, and creative workflows. Offering sequential read speeds up to 5,000 MB/s and write speeds up to 4,200 MB/s, the SSD 990 EVO delivers up to 43% better performance and 70% improved power efficiency over its predecessor, reinforcing Samsung’s commitment to advancing consumer SSD technology.