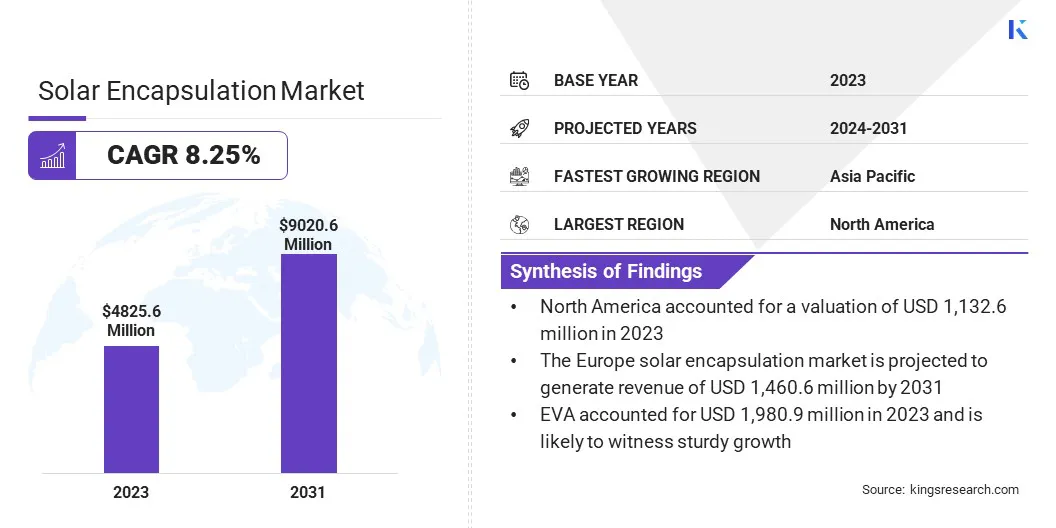

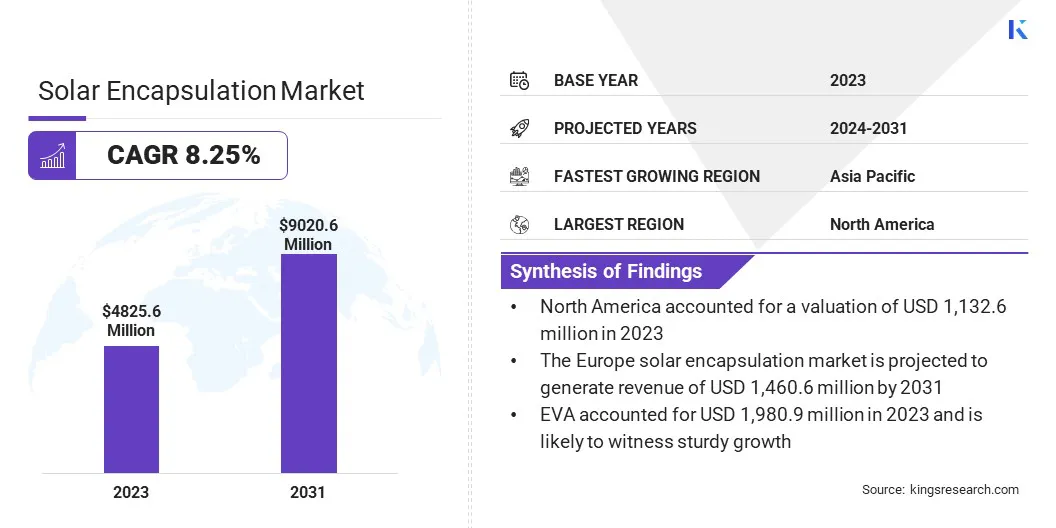

Solar Encapsulation Market Size

The global Solar Encapsulation Market size was valued at USD 4,825.6 million in 2023 and is projected to reach USD 9,020.6 million by 2031, growing at a CAGR of 8.25% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Mitsui Chemicals, Inc., First Solar, Elkem ASA, Dow, H.B. Fuller Company, 3M, DuPont, Saint-Gobain Group, RenewSys India Pvt. Ltd., Evonik Industries AG, and Others.

The increasing global focus on mitigating climate change and reducing carbon emissions is driving the adoption of renewable energy sources, including solar power. Governments worldwide are implementing supportive policies and incentives to promote solar energy deployment, thereby bolstering the demand for solar encapsulation materials.

Additionally, advancements in solar technology and encapsulation materials are enhancing the efficiency and durability of solar panels, making them more cost-effective and attractive for consumers and businesses alike. Innovations such as bifacial solar panels and improved encapsulation materials are further driving the expansion of the solar market.

Moreover, the declining costs of solar energy components, including encapsulation materials, are making the solar power landscape increasingly competitive with conventional energy sources. This trend is expected to continue as economies of scale, technological advancements, and manufacturing efficiencies further drive down costs.

Furthermore, the growing awareness of environmental sustainability and the desire for energy independence are driving the demand for distributed solar energy solutions, particularly in the residential and commercial sectors. This trend is estimated to further fuel the growth of the solar encapsulation market, as it enables individuals and businesses to generate clean energy and reduce their carbon footprint. Additionally, the implementation of strategic imperatives such as partnerships, collaborations, and other related approaches by key players operating within the market are fostering industry expansion.

Analyst’s Review

The growth of the solar encapsulation market is bolstered by technological innovations that are improving material performance, coupled with widespread adoption of solar energy across emerging market. Integration with energy storage solutions and optimization of the supply chain contribute to market growth.

Additionally, resilience to extreme weather events and circular economy initiatives are propelling the demand for encapsulation materials. These factors collectively shape a positive outlook, fostering continued growth and innovation in the market.

Market Definition

The solar encapsulation refers to the trade and value chain surrounding the materials used to protect photovoltaic (PV) cells within solar panels. This market encompasses the manufacturing, distribution, and sales of various materials that form the layers encasing the delicate solar cells. These materials primarily include encapsulants like ethylene vinyl acetate (EVA) and polyolefin elastomers (POE), along with back sheet materials such as fluoropolymers and fluorinated ethylene propylene (FPE).

The core function of solar encapsulation is to safeguard the solar cells from environmental hazards like moisture, dust, extreme temperatures, and physical impact. By creating a sealed and protective environment, encapsulation extends the lifespan and maintains the efficiency of solar panels, ensuring their optimal performance over extended periods. This solar encapsulation market plays a critical role in the overall solar energy industry by enabling the reliable and durable functioning of solar panels, which are essential for large-scale renewable energy generation.

Market Dynamics

The surging demand for renewable energy, driven by climate change concerns, and prevalent efforts to achieve energy independence has spurred governments worldwide to prioritize clean energy sources. Solar power, renowned for its sustainability, has become a frontrunner in this transition.

- Ambitious solar installation targets, such as the European Union's aim for 500 GW of solar photovoltaic capacity and India's goal of 280 GW by 2030, underscore the magnitude of this shift.

The deployment of solar photovoltaic farms and concentrated solar power, coupled with increasing product adoption in the residential and commercial sectors is fostering the demand for better and more efficient solar encapsulation components.

Furthermore, the advancement of solar encapsulation materials aimed at improving lifespan and efficiency is propelling the adoption of innovations such as thin-film solar cells. These solar cells are utilized for their lightweight and flexible characteristics relative to conventional silicon panels. As these newer technologies are gaining traction, the demand for specialized encapsulation materials capable of optimizing their performance and durability is surging.

- For instance, thin-film solar cells exhibit a distinct temperature coefficient compared to their silicon counterparts.

Manufacturers of encapsulation materials are developing innovative formulations engineered to withstand broader temperature fluctuations, thereby ensuring optimal energy conversion efficiency and longevity. This indicates a significant uptick in the production and deployment of thin-film solar technologies globally, further underscoring the crucial role of tailored encapsulation materials in advancing the capabilities and viability of these cutting-edge solar solutions.

However, the market faces challenges due to the volatility of raw material prices. The production of encapsulation materials relies on various inputs, including polymers, glass, and back sheet materials, the costs of which can fluctuate due to factors such as supply chain disruptions, currency fluctuations, and geopolitical tensions. These price fluctuations can impact manufacturing costs for solar panel producers and ultimately affect the overall profitability of solar projects.

Additionally, uncertainty surrounding trade policies and tariffs can further exacerbate price instability, posing challenges for market players in forecasting costs and maintaining competitiveness. Manufacturers are Developing strategies to mitigate the impact of raw material price volatility through diversification, supply chain resilience, and strategic partnerships to navigate this challenge in the solar encapsulation market.

Segmentation Analysis

The global market is segmented based on material, application, technology, and geography.

By Material Type

Based on material type, the market is categorized into ethylene vinyl acetate (EVA), non-EVA, and others. EVA accounted for USD 1,980.9 million in 2023 and is likely to witness sturdy growth. EVA has historically been the most widely used material for encapsulating solar panels due to its excellent optical transparency, adhesion properties, and cost-effectiveness.

EVA's optical properties allow for high light transmittance, enabling efficient energy conversion within solar panels. Its strong adhesion characteristics ensure proper bonding between the encapsulant and the solar cells, enhancing the panel's structural integrity and reliability over time. Moreover, EVA's relative affordability compared to alternative materials makes it a preferred choice for manufacturers seeking cost-effective encapsulation solutions.

Additionally, the established infrastructure for EVA production and its widespread availability contribute to its dominance in the market. Manufacturers are investing heavily in optimizing EVA formulations to meet the evolving needs of the solar industry, further solidifying its position as the preferred encapsulation material.

By Application

Based on application, the market is classified into rooftop solar, ground-mounted solar, and floating solar. Rooftop solar dominated the solar encapsulation market, accounting for a 42.06% revenue share in 2023. Rooftop solar installations have gained popularity globally due to their numerous advantages, which is driving significant demand for encapsulation materials tailored to this specific application.

Rooftop solar installations offer several benefits, including utilizing unused roof space, reducing dependency on grid electricity, and lowering energy dependency on grids for residential, commercial, and industrial consumers. This widespread adoption is fueled by supportive government policies, incentives, and net metering programs aimed at promoting renewable energy generation at the consumer level.

Moreover, the modular nature of rooftop solar systems allows for scalability and flexibility, making them suitable for various types of buildings and locations, from single-family homes to large commercial complexes. This versatility is boosting the growth potential of the market for encapsulation materials tailored to rooftop installations.

By Technology

Based on technology, the solar encapsulation market is bifurcated into crystalline silicon PV modules and thin-film PV modules. The Crystalline silicon PV modules segment is projected to experience a notable CAGR of 9.51% over 2024-2031. Crystalline silicon PV technology has been the cornerstone of the solar industry for decades, accounting for the majority of global solar installations.

Crystalline silicon PV modules offer high efficiency and reliability, which makes them a preferred choice for a wide range of applications, including residential, commercial, and utility-scale solar projects. Their proven performance, stability, and long-term durability instill confidence among investors, developers, and end-users, driving widespread adoption.

Furthermore, the maturity and economies of scale achieved in crystalline silicon PV manufacturing have led to continuous cost reductions, making solar energy increasingly competitive with conventional energy sources. This cost competitiveness, coupled with technological advancements in silicon wafer production and cell efficiency, is further strengthening the dominance of crystalline silicon PV modules in the market.

Solar Encapsulation Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America. The Asia Pacific Solar Encapsulation Market share stood around 36.01% in 2023 in the global market, with a valuation of USD 1737.7 Million.

North America stands as a prominent region in the global market, driven by a combination of supportive government policies, technological advancements, and increasing environmental consciousness. North America accounted for a valuation of USD 1,132.6 million in 2023. Government initiatives such as the Investment Tax Credit (ITC) and other federal and state incentives have spurred solar installations, fostering a robust demand for encapsulation materials.

- According to the Solar Energy Industries Association (SEIA), the US installed more than 30 gigawatts (GW) of solar capacity in 2023, marking a year-on-year growth of more than 51% as compared to 2022.

Furthermore, technological innovations, such as bifacial solar panels and smart encapsulation materials, are gaining traction in North America, enhancing the efficiency and durability of solar installations. Partnerships between industry players and research institutions, such as the National Renewable Energy Laboratory (NREL) in the U.S., are driving R&D efforts for the development of next-generation encapsulation materials tailored to the region's climatic conditions and energy needs. With ambitious renewable energy targets set by governments and corporations alike, North America is poised to witness growth in the market.

The Europe solar encapsulation market is projected to generate revenue of USD 1,460.6 million by 2031 supported by progressive policies, robust infrastructure, and a strong commitment to renewable energy transition.

- The European Union's Green Deal and the European Green Deal Investment Plan aim to accelerate the deployment of renewable energy sources, including solar power, to achieve climate neutrality by 2050.

As a result, countries like Germany, Spain, and the Netherlands have witnessed significant investments in solar installations, driving the demand for encapsulation materials. Additionally, initiatives such as the European Technology and Innovation Platform for Photovoltaics (ETIP PV) foster collaboration between industry stakeholders to advance PV technology and address challenges in encapsulation material development.

Moreover, Europe's emphasis on sustainability and circular economy principles is driving the adoption of eco-friendly encapsulation materials and recycling practices, further shaping the regional market landscape. With ambitious renewable energy targets and a conducive policy environment, Europe is foreseen to remain a frontrunner in the global market, poised to experience sustained growth and innovation.

Competitive Landscape

The solar encapsulation market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are estimated to create new opportunities for market growth.

The key players in the Solar Encapsulation Market are:

- Mitsui Chemicals, Inc.

- First Solar

- Elkem ASA

- Dow

- H.B. Fuller Company

- 3M

- DuPont

- Saint-Gobain Group

- RenewSys India Pvt. Ltd.

- Evonik Industries AG

Key Industry Developments

- July 2023 (Expansion) - First Solar, a major producer of thin-film solar panels, announced its plans to invest USD 1.1 billion in building its fifth manufacturing facility in the United States. This facility was to have a planned annual production capacity of 3.5 GW. It was intended to contribute to First Solar's total production capacity of 14 GW in the United States and 25 GW worldwide.

The global Solar Encapsulation Market is segmented as:

By Material Type

- Ethylene Vinyl Acetate (EVA)

- Non-EVA

- Others

By Application

- Rooftop Solar

- Ground-Mounted Solar

- Floating Solar

By Technology

- Crystalline Silicon PV Modules

- Thin-Film PV Modules

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America