Software Composition Analysis Market Size

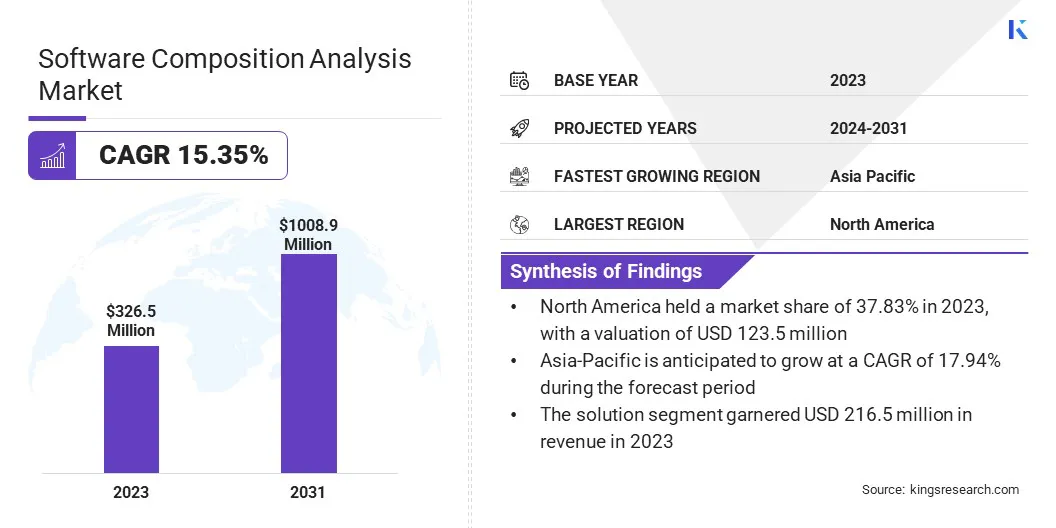

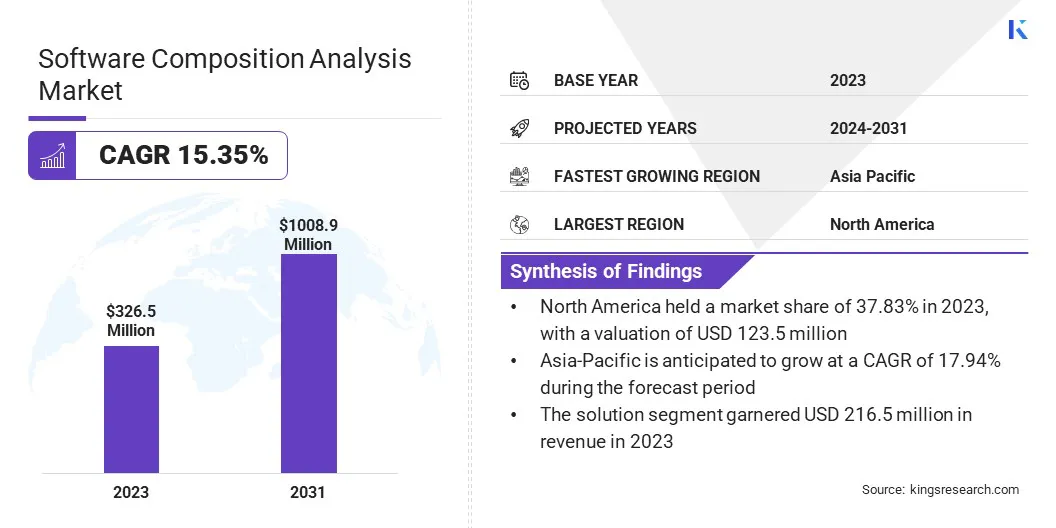

The global Software Composition Analysis (SCA) Market size was valued at USD 326.5 million in 2023 and is projected to grow from USD 371.4 million in 2024 to USD 1,008.9 million by 2031, exhibiting a CAGR of 15.35% during the forecast period. In the scope of work, the report includes solutions offered by companies such as Contrast Security, Flexera Software, GitLab B.V., JFrog Ltd, nexB Inc., Snyk Limited, Sonatype Inc., Synopsys, Inc., Veracode, FOSSA Inc. and others.

The growth of the market is driven by the surging need for security and compliance in software development, increased awareness regarding cyber threats, and the rising adoption of open-source components. The market is growing rapidly based on the increasing demand for security and compliance in software development. Companies are recognizing the importance of identifying and managing open-source components within their applications to prevent vulnerabilities.

Regulatory requirements such as GDPR and CCPA increasingly compel organizations to adopt SCA tools to ensure compliance. The rising incidence of cyberattacks and data breaches has led to the growing awareness and urgency for robust security measures. Additionally, the rapid pace of digital transformation and the widespread use of DevOps practices necessitate automated solutions to maintain secure and efficient software development cycles.

- SonicWall's 2024 Cyber Threat Report revealed a notable increase in attack volumes in 2023, with malware rising 11%, encrypted threats up 117%, and cryptojacking surging 659%. Threat actors maintained their focus on established methods rather than new tactics. The report highlighted vulnerabilities as the primary ransomware vector, with a record 28,834 CVEs published. Additionally, new phishing techniques, including QR codes and fake login pages, emerged, underscoring the need for heightened security measures.

The software composition analysis market is experiencing significant growth and these tools enable organizations to detect vulnerabilities in open-source components, ensuring that software applications are secure and compliant with regulations. This market encompasses various industries, including finance, healthcare, and retail, all of which are increasingly dependent on software for their operations.

The competitive landscape features established players and emerging startups, each offering solutions to address different aspects of software composition and security. The expansion of the market is further supported by the integration of SCA tools into broader application security platforms, providing comprehensive security solutions.

Software composition analysis (SCA) refers to the process of identifying and managing open-source components within software applications. SCA tools scan codebases to detect known vulnerabilities, license compliance issues, and potential security risks associated with third-party libraries and frameworks. These tools provide detailed reports and remediation guidance to help developers mitigate risks.

SCA is a critical component of modern software development practices, particularly in environments that prioritize security and compliance. Incorporation of SCA into their development workflows enables organizations to ensure that their software functions effectively and efficiently, while also maintaining security and compliance with relevant regulations and standards.

Analyst’s Review

The software composition analysis market is experiencing dynamic growth, with manufacturers actively focusing on integrating advanced technologies such as AI and machine learning to enhance detection capabilities. New products are being introduced that incorporate features offering real-time vulnerability monitoring and seamless integration with DevSecOps practices.

- For instance, in June 2024, Datadog, Inc. expanded its security product portfolio with new features, including Agentless Scanning, Data Security, and Code Security. Agentless Scanning enabled teams to monitor vulnerabilities in hosts, containers, and serverless functions without installing agents. Data Security assisted in identifying sensitive data at risk in Amazon S3 buckets, while Code Security offered a production-ready Interactive Application Security Testing solution with high accuracy for detecting and prioritizing code vulnerabilities.

Companies are prioritizing ease of use and minimal impact on development processes. Moreover, organizations are investing heavily in SCA tools to proactively address evolving security threats and comply with regulatory requirements. Emphasizing comprehensive training and support is likely to further facilitate smoother adoption. Additionally, continuous innovation and technological advancements are crucial for maintaining a competitive edge in this rapidly evolving market.

Software Composition Analysis Market Growth Factors

The increasing adoption of open-source software is boosting the growth of the software composition analysis market. Organizations are increasingly relying on open-source components to accelerate development and reduce costs. This trend is creating a critical need for tools that possess the ability to identify and manage these components, thereby ensuring that they are free from vulnerabilities.

SCA tools are becoming essential for maintaining software integrity and security in environments where open-source usage is prevalent. These tools help organizations manage risks associated with third-party code and comply with regulatory standards, by providing visibility into the composition of software, thereby supporting market growth.

The integration of SCA tools into existing development workflows without disrupting productivity impacts the market since developers often face resistance to adopt new tools that may slow down the development process. Overcoming this challenge involves ensuring seamless integration of SCA tools with popular development environments and continuous integration/continuous deployment (CI/CD) pipelines. Developers are providing comprehensive training and support to understand the importance and benefits of SCA tools.

Organizations are successfully incorporating SCA practices by emphasizing ease of use and minimizing the impact on development speed, thereby addressing security and compliance needs without hindering productivity.

Software Composition Analysis Market Trends

The integration of artificial intelligence (AI) and machine learning (ML) in software composition analysis (SCA) tools is a significant trend influencing the market. AI and ML are enhancing the capabilities of SCA tools by enabling more accurate detection of vulnerabilities and predictive analysis of potential risks. These technologies are improving the efficiency and effectiveness of SCA processes, allowing for faster identification and remediation of issues.

Companies are leveraging AI and ML and using SCA tools to provide deeper insights and more proactive security measures, which is crucial in the rapidly evolving landscape of software development and cybersecurity. This trend is leading to increased adoption of advanced SCA solutions across various industries.

The growing shift toward DevSecOps practices is another major trend reshaping the software composition analysis market landscape. DevSecOps integrates security into every stage of the software development lifecycle, emphasizing the need for continuous and automated security checks. SCA tools are increasingly being embedded into DevSecOps pipelines to ensure that open-source components are secure and compliant from the outset.

This integration is helping organizations detect and address vulnerabilities early in the development process, thereby reducing the risk of security breaches and compliance issues. The widespread adoption of DevSecOps is promoting the use of SCA tools as an essential part of modern, secure software development practices.

Segmentation Analysis

The global market is segmented based on component, deployment, organization size, industry vertical, and geography.

By Component

Based on component, the market is categorized into solution and services. The solution segment led the software composition analysis market in 2023, reaching a valuation of USD 216.5 million. This dominance is largely attributable to its ability to provide comprehensive and automated tools for identifying and managing open-source components. Organizations are prioritizing solutions that offer real-time vulnerability detection, risk assessment, and compliance management.

These solutions are increasingly preferred as they streamline the process of ensuring software security and regulatory adherence. The growing complexity of software applications and the increasing reliance on open-source components are bolstering the demand for robust SCA solutions, thereby contributing to the expansion of thise segment.

By Organization Size

Based on organization size, the market is classified into SMEs and large enterprises. The SMEs segment is anticipated to register significant growth at a robust CAGR of 16.15% through the forecast period (2024-2031). SMEs are increasingly adopting SCA tools to enhance their software security and compliance capabilities without incurring high costs.

These organizations are recognizing the importance of protecting their applications from vulnerabilities and ensuring compliance with regulatory standards. The affordability and scalability of modern SCA solutions make them particularly attractive to SMEs. As these businesses continue to digitize and expand their operations, there is a growing demand for effective and accessible SCA tools, thereby aiding the growth of the segment.

By Deployment

Based on deployment, the market is segmented into on-premises and cloud. The on-premises segment secured the largest software composition analysis market share of 63.74% in 2023. The expansion of the segment in the market is primarily spurred by companies prioritizing data security and control, promting them to opt for on-premises solutions that offer greater oversight. Regulatory requirements and industry standards further compel businesses to keep their software environments in-house to ensure compliance.

Additionally, organizations with substantial existing infrastructure are leveraging on-premises solutions to maximize their investment. The capability to customize and integrate these solutions with existing systems is another significant factor contributing to this growth. Despite the growing popularity of cloud solutions, on-premises deployments are maintaining their dominance due to these compelling advantages.

Software Composition Analysis Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America software composition analysis market accounted for a major share of around 37.83% in 2023, with a valuation of USD 123.5 million. This region's dominance is stimulated by the strong presence of numerous leading technology companies and a high adoption rate of advanced cybersecurity solutions. The stringent regulatory environment, including laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is compelling organizations to invest in robust SCA tools.

Furthermore, the increasing frequency of cyberattacks and data breaches in North America is leading to increased awareness and the rising need for comprehensive security measures, which is fueling the widespread adoption of SCA solutions across various industries.

Asia-Pacific is poised to experience substantial growth at a staggering CAGR of 17.94% through the projection period. This rapid growth is attributed to the region's expanding technology sector and increasing digital transformation initiatives. Governments and organizations in countries China, India, and Japan are investing heavily in cybersecurity to protect against rising cyber threats.

The growing adoption of open-source software and the surging need for regulatory compliance are further boosting the demand for SCA tools. Additionally, the increasing awareness regarding software security and the benefits of SCA solutions are supporting the development of the Asia-Pacific software composition analysis market.

Competitive Landscape

The software composition analysis market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Software Composition Analysis Market

Key Industry Developments

- May 2024 (Partnership): JFrog Ltd and GitHub announced a new partnership to create an integrated platform for managing EveryOps, including DevSecOps, DevOps, MLOps, and GenAI-powered applications. The collaboration focused on enhancing traceability and facilitating seamless navigation between binaries and source code, continuous integration with JFrog Artifactory and GitHub Actions, and a unified security view. This partnership provided an end-to-end experience for managing the software supply chain.

- March 2024 (Launch): GitGuardian introduced its software composition analysis tool, enhancing its code security platform. The new tool prioritized incidents based on context, scanned application dependencies to identify vulnerabilities, and guided developers in remediation throughout the software development lifecycle. Designed for fast-paced DevSecOps environments, it provided security and developer teams with a unified solution, improving incident visibility, promoting cross-team collaboration, and deepening contextual understanding.

The global software composition analysis market is segmented as:

By Component

By Deployment

By Organization Size

By Industry Vertical

- BFSI

- Healthcare

- Telecom & IT

- Automotive

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America