Market Definition

Soft wall military shelters are lightweight, rapidly deployable structures designed to enhance operational flexibility across diverse environments. They are built from durable materials such as polymer fabrics, composites, and aluminum to ensure strength and mobility.

These shelters serve a wide range of functions, including accommodation units, command centers, medical facilities, storage, and repair stations. Widely used by the army, navy, air force, and special operations forces, they enable efficient deployment and sustained military readiness in dynamic operational conditions.

Soft Wall Military Shelter Market Overview

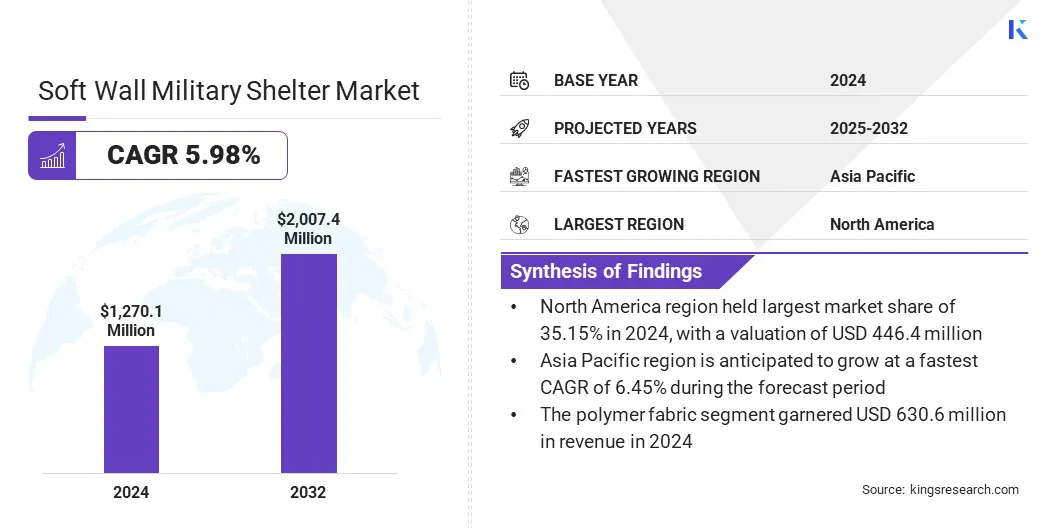

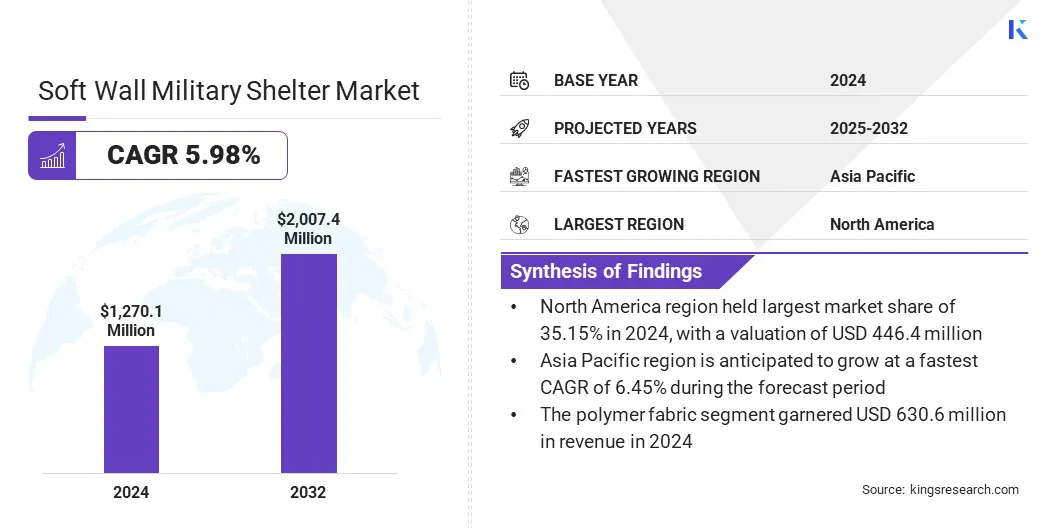

The global soft wall military shelter market size was valued at USD 1,270.1 million in 2024 and is projected to grow from USD 1,336.7 million in 2025 to USD 2,007.4 million by 2032, exhibiting a CAGR of 5.98% during the forecast period.

This growth is driven by the growing demand for rapidly deployable shelters that offer quick setup and operational flexibility. The market is further influenced by technological advancements in air-inflated fabric structures, which enhance thermal insulation, structural strength, and reduce manpower requirements.

Key Highlights:

- The soft wall military shelter industry size was recorded at USD 1,270.1 million in 2024.

- The market is projected to grow at a CAGR of 5.98% from 2025 to 2032.

- North America held a share of 35.15% in 2024, valued at USD 446.4 million.

- The mobile shelters segment garnered USD 619.2 million in revenue in 2024.

- The polymer fabric segment is expected to reach USD 976.9 million by 2032.

- The accommodation units segment is projected to generate a revenue of USD 501.7 million by 2032.

- The army segment is expected to reach USD 925.4 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.45% over the forecast period.

Major companies operating in the soft wall military shelter market are BIG TOP MANUFACTURING, INC., HDT Global, AKS Industries, Inc., Celina Tent, Inc., Outdoor Venture Corporation, UTILIS, Rubb Industries AS., Weatherhaven Global Resources Ltd., CAMSS Shelters, HTS TENTIQ GmbH, Rapid Deployable Systems, LLC, LITEFIGHTER GEAR, Dynamic Air Shelters, UTS Systems, and CAMEL EXPEDITIONARY.

Companies are developing decontamination shelter systems that feature rapid setup, integrated filtration, and chemical-resistant materials to ensure effective containment in hazardous environments. These solutions address the growing demand for deployable shelters supporting military, emergency response, and disaster management operations.

The integration of modular designs and environmental control systems enhances safety, operational efficiency, and readiness, boosting wider adoption across defense and emergency response applications.

Market Driver

Growing Demand for Rapidly Deployable Shelters

The expansion of the soft wall military shelter market is fueled by the increasing need for quickly deployable and easily assembled shelters. Military operations require the rapid establishment of bases, command centers, and medical facilities in remote or conflict-prone areas, emphasizing the importance of deployable and reliable shelter solutions.

In response, manufacturers are developing modular, lightweight, and durable shelters that reduce setup time while maintaining structural integrity and performance. Armed forces increasingly prioritize such shelters that enhance mobility, operational readiness, and rapid response in diverse environments.

Market Challenge

Limited Deployment Infrastructure in Remote Regions

A major challenge impeding the progress of the soft wall military shelter market is the limited infrastructure in remote or inaccessible deployment areas. Transporting, assembling, and maintaining shelters in such locations is logistically complex and costly.

To overcome this challenge, manufacturers are developing lightweight, modular, and easily transportable designs that can be deployed with minimal equipment. Companies are also providing specialized training and support to defense personnel to ensure rapid setup and operational efficiency in challenging terrains.

Market Trend

Technological Advancements in Air-Inflated Fabric Structures

The soft wall military shelter market is experiencing a significant shift toward technological advancements in air-inflated fabric structures. These shelters can be rapidly deployed and inflated with minimal manpower, reducing setup time in operational scenarios.

The design improvements enhance thermal insulation and structural stability, making the shelters suitable for extreme weather conditions, including arctic and high-altitude regions. This trend is prompting defense forces worldwide to adopt more versatile and efficient deployable shelter solutions, improving operational readiness and flexibility.

Soft Wall Military Shelter Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment Type

|

Mobile Shelters, Semi-Permanent Deployment, Permanent Deployment

|

|

By Material

|

Polymer Fabric, Composite Materials, Aluminum

|

|

By Application

|

Accommodation Units, Command Centers, Medical Facilities, Storage & Logistics, Repair Facilities

|

|

By End User

|

Army, Navy, Air Force, Special Operations Forces

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment Type (Mobile Shelters, Semi-Permanent Deployment, and Permanent Deployment): The mobile shelters segment earned USD 619.2 million in 2024, mainly due to rising demand for rapidly deployable solutions in forward operating bases (FOBs) and temporary missions.

- By Material (Polymer Fabric, Composite Materials, and Aluminum): The polymer fabric segment held a share of 49.65% in 2024, fueled by its lightweight structure, durability, and cost-effectiveness compared to alternatives.

- By Application (Accommodation Units, Command Centers, Medical Facilities, Storage & Logistics, and Repair Facilities): The accommodation units segment is projected to reach USD 501.7 million by 2032, owing to the increasing need for scalable living facilities during extended deployments.

- By End User (Army, Navy, Air Force, and Special Operations Forces): The army segment is projected to reach USD 925.4 million by 2032, propelled by large-scale procurement programs and higher operational requirements across varied terrains.

Soft Wall Military Shelter Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America soft wall military shelter market share stood at 35.15% in 2024, valued at USD 446.4 million. This dominance is reinforced by strict regulations on temporary structures and anchoring standards for army operations, compelling manufacturers to develop shelters that meet rigorous safety and performance standards. Compliance with these standards ensures consistent procurement and replacement cycles, supporting the region’s market dominance.

- In March 2024, the U.S. Army Corps of Engineers updated its manual to include specific regulations for temporary facilities. The update requires a Construction Site Plan detailing the location, dimensions, and anchoring methods for temporary structures. Structures such as trailers for offices, housing, or storage must use rods, cables, or steel straps to secure to ground anchors and comply with wind, seismic, and local standards. Temporary facilities near overhead electrical lines must also be properly bonded and grounded.

The Asia-Pacific soft wall military shelter industry is poised to grow at a significant CAGR of 6.45% over the forecast period. The growth is propelled by the rising defense budgets in countries such as India, China, and Japan, which enable large-scale procurement of advanced military infrastructure.

Increased funding allows governments to invest in modern, deployable shelters that support troop accommodation, command operations, and medical facilities in diverse terrains. This financial commitment boosts the adoption of soft wall military shelters and attracts both domestic and international manufacturers to expand production and deployment capabilities in the region.

- In December 2024, the Ministry of Defence (MoD) released its Year End Review, reporting an allocation of USD 75 billion in the Union Budget for FY 2024-25, the highest among all ministries. This represents an increase of 18.43% over FY 2022-23 and 4.79% higher than FY 2023-24. Of the total allocation, 27.66% is allocated to capital expenditure, 14.82% to revenue expenditure on sustenance and operations, 30.66% to pay and allowances, 22.70% to defense pensions, and 4.17% to civil organizations under MoD.

Regulatory Frameworks

- In the U.S., the Department of Defense regulates soft wall military shelters under MIL-PRF and MIL-STD specifications, which define performance, safety, and material standards for deployable structures. These standards ensure that shelters can withstand harsh climatic conditions and remain interoperable with other defense systems.

- In Europe, NATO Standardization Agreements (STANAGs) guide the design, interoperability, and quality requirements for soft wall military shelters used by allied forces. These agreements ensure that shelters meet common defense specifications, which support joint operations and cross-border deployment among NATO member states.

- In India, the Defence Research and Development Organisation (DRDO) sets design and performance guidelines for soft wall military shelters used by the armed forces. These frameworks emphasize thermal insulation, modularity, and ease of transport to ensure shelters can be deployed efficiently in diverse terrains, including high-altitude regions and desert environments.

Competitive Landscape

Key players operating in the soft wall military shelter industry are focusing on developing shelters for extreme cold weather environments. They are enhancing insulation materials and reinforcing structural components to maintain stability and thermal efficiency in sub-zero temperatures.

Companies are designing modular, rapidly deployable systems that can be customized for polar, high-altitude, and arctic operations. They are conducting extensive field trials in collaboration with defense agencies to validate performance under harsh conditions. Additionally, firms are integrating advanced heating, ventilation, and energy management solutions to ensure operational readiness in remote and severe climates.

Top Key Companies in Soft Wall Military Shelter Market:

- BIG TOP MANUFACTURING, INC.

- HDT Global

- AKS Industries, Inc.

- Celina Tent, Inc.

- Outdoor Venture Corporation

- UTILIS

- Rubb Industries AS.

- Weatherhaven Global Resources Ltd.

- CAMSS Shelters

- HTS TENTIQ GmbH

- Rapid Deployable Systems, LLC

- LITEFIGHTER GEAR

- Dynamic Air Shelters

- UTS Systems

- CAMEL EXPEDITIONARY

Recent Developments (Acquisitions)

- In January 2024, UTS Systems, LLC acquired Hercules Manufacturing, a certified Perkins engine dealer and supplier of generators, heaters, and trailer-mounted support systems. The acquisition integrates Hercules’ manufacturing capabilities with UTS’s rapid-deployable military shelter systems and environmental control products. Hercules’ Massillon, Ohio facility will continue to serve as a hub for equipment manufacturing and engineering innovation.