Market Definition

The market encompasses the global trade and production of sodium hypophosphite, a chemical compound primarily used as a reducing agent in electroless nickel plating, as well as in the manufacture of flame retardants, pharmaceuticals, and food additives.

This market includes the extraction, synthesis, distribution, and sale of sodium hypophosphite in various forms and grades, catering to diverse industries such as automotive, electronics, textiles, and chemicals. The report provides insights into the core drivers of the market, supported by an in-depth evaluation of market trends and regulatory frameworks.

Sodium Hypophosphite Market Overview

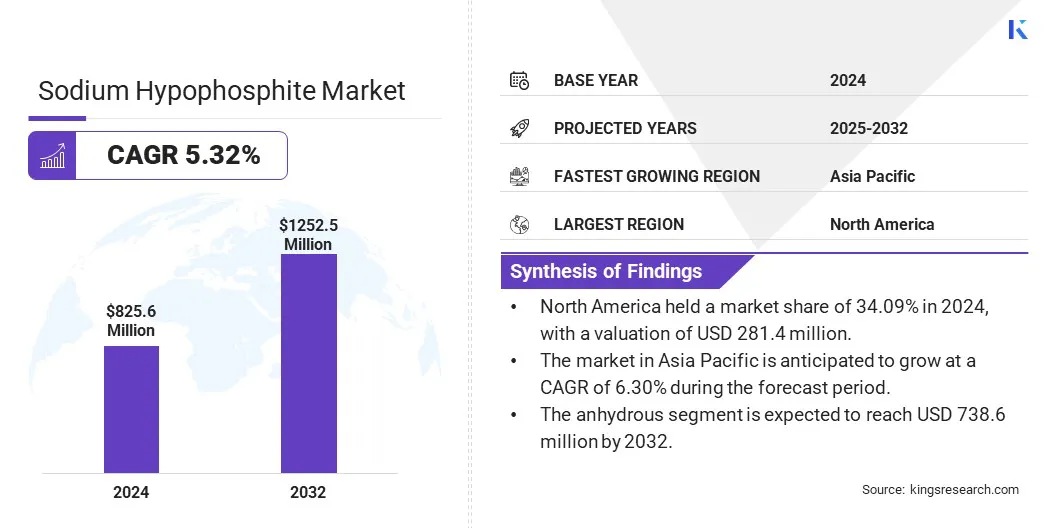

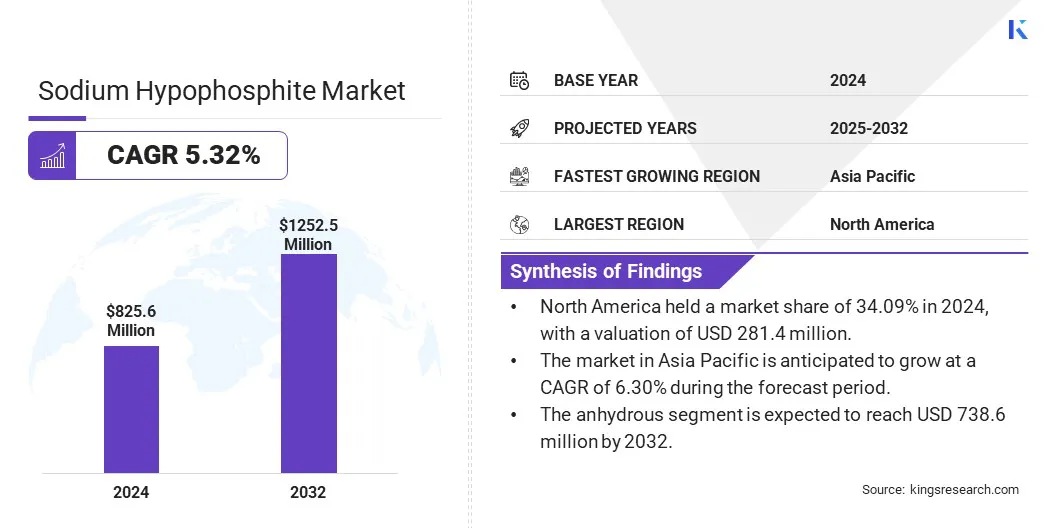

The global sodium hypophosphite market size was valued at USD 825.6 million in 2024 and is projected to grow from USD 868.5 million in 2025 to USD 1252.5 million by 2032, exhibiting a CAGR of 5.32% during the forecast period.

This growth is attributed to several factors, including the rising demand for electroless nickel plating in automotive & electronics manufacturing and the growing need for corrosion-resistant coatings in industrial applications. The compound's effectiveness as a reducing agent is enhancing process efficiency and surface quality in metal finishing operations.

Major companies operating in the sodium hypophosphite industry are Nippon Chemical Industrial CO., LTD, Hubei Xingfa Chemicals Group Co., Ltd, Sigma-Aldrich Chemicals Private Limited, Otto Chemie Pvt. Ltd., Changshu Xinte Chemical Co., Ltd., Richman Chemical Inc., Central Drug House, ALPHA CHEMIKA, vizagchemical.com, Mytech, Inc., Jiangxi Fuerxin Medicine Chemical Co., Ltd, Antares Chem Private Limited, Prasol Chemicals Limited, Elnico, and ANISH CHEMICALS.

Expanding applications of sodium hypophosphite in pharmaceuticals, flame retardants, and food additives, along with increasing industrialization in emerging economies, are driving the market. Technological advancements in chemical processing and improved supply chain logistics are also contributing to the widespread adoption of sodium hypophosphite across various end-use sectors.

- In March 2025, the Multidisciplinary Digital Publishing Institute (MDPI) published a study in Molecules, presenting a novel palladium-catalyzed method for the direct diarylation of sodium hypophosphite. This method enables the efficient synthesis of diarylphosphonates with improved yields and selectivity, offering a valuable tool for the development of phosphorus-containing compounds in pharmaceuticals and materials science.

Key Highlights

- The sodium hypophosphite market size was valued at USD 825.6 million in 2024.

- The market is projected to grow at a CAGR of 5.32% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 281.4 million.

- The reducing agents segment garnered USD 299.0 million in revenue in 2024.

- The anhydrous segment is expected to reach USD 738.6 million by 2032.

- The water treatment segment is anticipated to register the fastest CAGR of 5.62% during the forecast period.

- The industrial segment garnered USD 358.5 million in revenue in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.30% during the forecast period.

Market Driver

Rising use of electroless plating in electronics and automotive industries

The rising use of electroless plating is driving the market. This is primarily fueled by the increasing demand for high-quality, corrosion-resistant coatings in the electronics and automotive industries.

Manufacturers seek to improve the durability and performance of complex components such as circuit boards, connectors, engine parts, and sensors, boosting the need for plating processes that provide uniform coatings without the limitations of traditional electroplating.

Sodium hypophosphite plays a crucial role as a reducing agent in electroless plating, enabling consistent metal deposition and enhancing coating quality. This helps industries meet stringent performance and environmental standards, while improving product reliability and lifespan.

The expanding adoption of electroless plating solutions, particularly in electric vehicles and advanced electronics, is thereby driving significant growth in the market.

Market Challenge

Emergence of Alternative Reducing Agents and Surface Treatments

One of the major challenges in the sodium hypophosphite market is the availability of alternative reducing agents and advanced surface treatment technologies.

These alternatives often offer benefits such as improved environmental profiles, enhanced efficiency, and easier handling, which can attract manufacturers seeking more sustainable or cost-effective solutions. This shift poses a threat to the demand for sodium hypophosphite, particularly in industries and regions with strict regulatory requirements and a strong focus on innovation.

Market players are investing in research and development to improve the quality and sustainability of sodium hypophosphite. They are focusing on optimizing production processes to reduce environmental impact and emphasize the compound’s proven reliability and cost-effectiveness.

Additionally, companies are working closely with end users to tailor solutions that meet specific application needs and regulatory standards, while educating customers on the benefits and safe handling of sodium hypophosphite to maintain their competitive edge.

Market Trend

Adoption of Sustainable and High-purity Sodium Hypophosphite Grades

The market is evolving in response to growing environmental concerns and the demand for higher product quality. A key trend is the advancement and market adoption of sustainable and high-purity sodium hypophosphite grades, which cater to industries with strict regulatory and performance requirements, such as pharmaceuticals, electronics, and water treatment.

These innovative formulations are designed to minimize environmental impact while ensuring superior chemical stability and purity. The focus on sustainability across global supply chains is compelling manufacturers to invest in greener production technologies and eco-friendly alternatives to traditional chemical processes.

This shift is enabling companies to meet regulatory standards, improve operational efficiency, and enhance their brand reputation. As a result, the demand for environmentally responsible and high-performance sodium hypophosphite products is expected to rise, driving long-term growth in this segment.

Sodium Hypophosphite Market Report Snapshot

|

Segmentation

|

Details

|

|

By Function

|

Reducing Agents, Catalysts & Stabilizers, Chemical Intermediates, and Others

|

|

By Form

|

Monohydrate, and Anhydrous

|

|

By Application

|

Electroplating, Water Treatment, Chemicals & Pharmaceuticals, and Others

|

|

By End Use

|

Electrical, Construction, and Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Function (Reducing Agents, Catalysts & Stabilizers, Chemical Intermediates, and Others): The reducing agents segment earned USD 299.0 million in 2024, due to its widespread use in electroless nickel plating across the electronics & automotive industries.

- By Form (Monohydrate, and Anhydrous): The anhydrous segment held 60.18% share of the market in 2024, due to its higher stability, longer shelf life, and suitability for industrial applications requiring moisture-sensitive formulations.

- By Application (Electroplating, Water Treatment, Chemicals & Pharmaceuticals, and Others): The electroplating segment is projected to reach USD 412.4 million by 2032, owing to the rising demand for corrosion-resistant and high-performance metal coatings in the automotive, electronics, and aerospace industries.

- By End Use (Electrical, Construction, and Industrial): The construction segment is anticipated to grow at a CAGR of 5.44% during the forecast period, due to infrastructure development and the growing use of treated metal components for enhanced durability & corrosion resistance in building materials.

Sodium Hypophosphite Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.09% share of the sodium hypophosphite market in 2024, with a valuation of USD 281.4 million. The region’s dominance is attributed to the strong presence of advanced manufacturing industries such as electronics, automotive, and aerospace, which extensively use electroless plating processes requiring sodium hypophosphite.

Moreover, environmental regulations and increasing demand for high-purity and sustainable chemical solutions further fuel the market in this region. Additionally, North America benefits from significant investments in research and development, fostering continuous innovation in chemical manufacturing and application technologies.

Furthermore, the concentration of key industry players and well-established supply chains supports consistent product availability and quality, strengthening the region’s position as a leading consumer in the global market.

- In February 2023, the American Chemical Society (ACS) published a study in The Journal of Organic Chemistry presenting a novel nickel-catalyzed method for directly attaching two aromatic groups to sodium hypophosphite. This method improves the efficiency and selectivity of synthesizing diarylphosphonates, which are important in pharmaceuticals and materials science.

The sodium hypophosphite industry in Asia-Pacific is poised for significant growth at a robust CAGR of 6.30% over the forecast period. This growth is supported by rapid industrialization, expanding manufacturing hubs, and increasing investments in automotive & electronics sectors across the region.

Governments are implementing policies aimed at boosting chemical production capabilities and encouraging sustainable industrial practices, thereby fostering a favorable environment for market growth. The rising adoption of advanced surface treatment and plating technologies is further driving the demand for high-quality sodium hypophosphite products in Asia-Pacific.

Additionally, the presence of a large skilled workforce and increasing focus on research & development activities are contributing to the regional market expansion.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates chemicals like sodium hypophosphite under the Toxic Substances Control Act (TSCA), which mandates the assessment, reporting, and management of chemical substances to minimize environmental and health risks.

- In the European Union (EU), sodium hypophosphite is regulated under the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework, which requires manufacturers and importers to evaluate and communicate risks associated with chemicals.

- In Japan, sodium hypophosphite is regulated under the Chemical Substances Control Law (CSCL), requiring pre-market risk evaluation to protect health and the environment. The Industrial Safety and Health Act also sets standards for safe chemical handling in workplaces.

Competitive Landscape

The sodium hypophosphite market is characterized by a competitive landscape, featuring a blend of established global chemical manufacturers, regional suppliers, and emerging specialty chemical producers.

Companies are focusing on developing high-purity, sustainable, and application-specific grades of sodium hypophosphite to meet the diverse requirements of industries such as automotive, electronics, pharmaceuticals, and water treatment. Leading players are heavily investing in research & development to improve production efficiency, reduce environmental impact, and enhance product performance.

Strategic collaborations with downstream industries, technology providers, and raw material suppliers are enabling companies to expand their market reach and innovate in formulation and manufacturing processes.

The increasing demand for environmentally friendly and high-quality chemical solutions is intensifying competition, with market participants prioritizing innovation, regulatory compliance, and customer-centric product development to address evolving industrial standards and sustainability goals.

- In January 2023, Arkema finalized the sale of its phosphorus derivatives business, Febex, to Prayon. Febex produces chemicals like sodium hypophosphite used in electronics and pharmaceuticals. This divestment allows Arkema to focus on its core areas, while Prayon strengthens its position in phosphorus chemistry and expands into the electronics market in Europe.

List of Key Companies in Sodium Hypophosphite Market:

- Nippon Chemical Industrial CO., LTD

- Hubei Xingfa Chemicals Group Co., Ltd

- Sigma-Aldrich Chemicals Private Limited

- Otto Chemie Pvt. Ltd.

- Changshu Xinte Chemical Co., Ltd.

- Richman Chemical Inc

- Central Drug House

- ALPHA CHEMIKA

- vizagchemical.com

- Mytech, Inc.

- Jiangxi Fuerxin Medicine Chemical Co., Ltd

- Antares Chem Private Limited

- Prasol Chemicals Limited

- Elnico

- ANISH CHEMICALS