Smart Materials Market Size

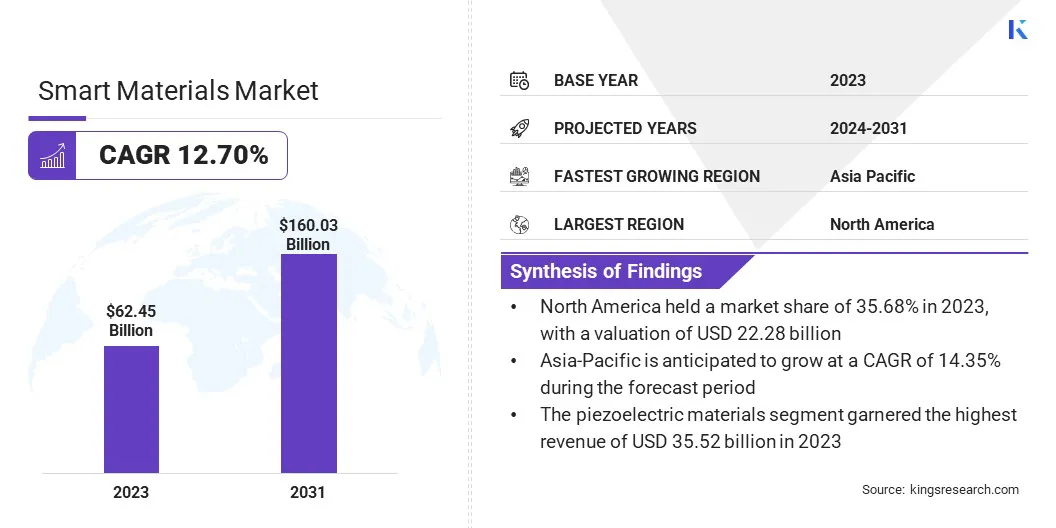

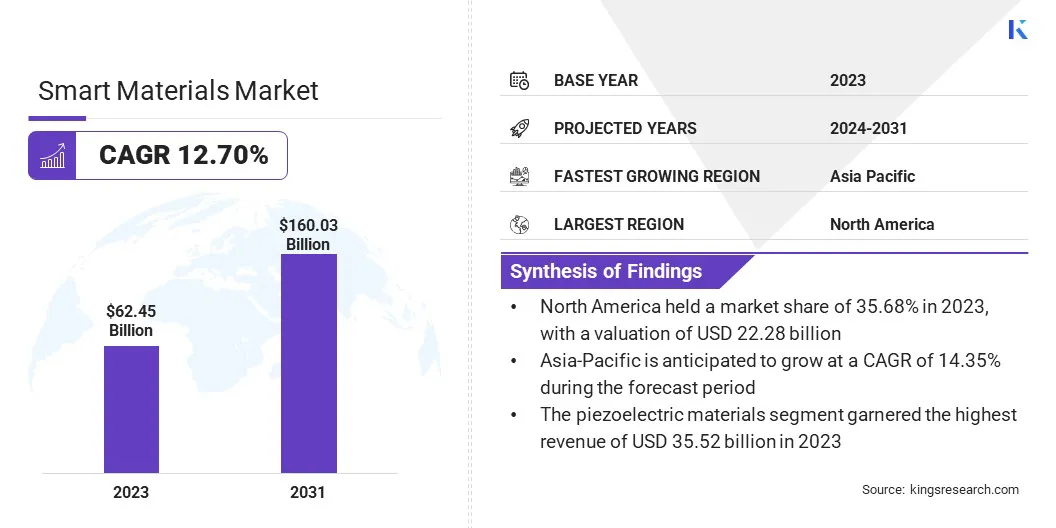

According to Kings Research, global Smart Materials Market size was recorded at USD 62.45 billion in 2023, which is estimated to be at USD 69.32 billion in 2024 and projected to reach USD 160.03 billion by 2031, growing at a CAGR of 12.70% from 2024 to 2031.

In the scope of work, the report includes solutions offered by companies such as KYOCERA Corporation, TDK Corporation, SMART MATERIAL CORP., CeramTec GmbH, APC International, Ltd., AMETEK.Inc, Findel Education Limited, Omega Piezo Technologies, Metglas Inc., Arkema, and others.

The rising integration of smart materials into medical devices improves both functionality and patient comfort, creating new avenues for minimally invasive procedures and personalized medicine, thereby driving market growth.

The smart materials market is experiencing significant growth, fueled by increasing demand for materials capable of adapting to external stimuli across various industries. These materials, also known as responsive or intelligent materials, are fostering innovation in sectors such as aerospace, automotive, healthcare, and consumer electronics.

Rapid advancements in material science and engineering are leading to the development of smart materials with unprecedented capabilities, while the integration with Internet of Things (IoT) technology is enabling the creation of intelligent systems. This advancements, supported by ongoing research and development efforts and underscored by growing environmental concerns, are expected to propel the growth of the smart materials market in the coming years.

- June 2022: Stanford engineers introduced tiny robots for precise drug delivery, a game-changer in healthcare. This innovation highlights the expanding role of smart materials in medical applications, offering the potential for targeted treatments with minimal side effects. This advancement signifies a notable improvement in healthcare accessibility, underscoring the market's potential for further growth and innovation.

Smart materials are a class of materials engineered with properties that enable them to dynamically respond to external stimuli or changes in environmental conditions. These materials possess the ability to alter their physical or chemical properties, shape, or behavior in a controlled manner when subjected to specific triggers such as temperature, light, pressure, electric fields, or magnetic fields.

Smart materials exhibit unique characteristics such as self-healing, shape memory, piezoelectricity, or conductivity, allowing them to adapt and perform optimally under varying circumstances.

These materials find applications across diverse industries, including aerospace, automotive, healthcare, consumer electronics, and construction, where their responsive nature offers significant advantages in terms of performance, efficiency, and functionality. The development and utilization of smart materials represent a key area of innovation and research in material science and engineering, thereby fostering advancements in various technological fields.

Analyst’s Review

The integration of Industry 4.0 with additive manufacturing (AM) technology represents a transformative shift in the manufacturing landscape. Despite facing challenges such as limited mass production capabilities and the handling of large-sized products, ongoing research efforts are poised to overcome these barriers and leverage potential of AM for mass customization and personalized manufacturing.

Key players in the industry are prioritizing this innovation by investing in research and development initiatives, forging strategic partnerships, and promoting the adoption of AM technology in commercial manufacturing.

Through the integration of cutting-edge technologies such as IoT, data analytics, and automation, these companies are driving efficiency, scalability, and reliability in AM processes. Moreover, their focus on materials innovation is expanding the range of materials that are compatible with AM, thereby enhancing its applicability across various industries.

Smart Materials Market Growth Factors

The increasing demand for advanced medical devices and implants is significantly propelling the growth of the smart materials market. As the healthcare sector continuously seeks to improve patient outcomes and the efficacy of medical treatments, smart materials are emerging as critical components in innovative medical solutions.

Materials such as shape memory alloys and piezoelectric materials are leading this emerging trend. Shape memory alloys, for instance, are utilized in stents that has the ability to expand in response to body temperature, providing a less invasive and more efficient way to open blocked arteries.

Moreover, piezoelectric materials are used in sensors and actuators, playing a crucial role in medical imaging devices and diagnostic equipment. These materials enable real-time monitoring and precise control of medical procedures, thereby enhancing the overall effectiveness of medical interventions. As the population ages and the prevalence of chronic diseases rises, the demand for such advanced medical technologies is expected to grow, contributing to the expansion of the market.

- As of May 2024, the FDA has added 191 new AI/ML-enabled medical devices on its authorized list, increasing the total count to 882. Among these additions, 151 devices received final decisions between August 2023 and March 2024, with an additional 40 devices from prior periods identified using refined methods. This underscores the rapid adoption of AI and machine learning in healthcare, showcasing ongoing regulatory advancements and a commitment to innovation in the smart materials market.

The significant initial costs associated with research, development, and production is expected to impede the market growth. The intricate processes involved in engineering smart materials with specific functionalities often require substantial investment in specialized equipment, expertise, and resources. Additionally, scaling up production to meet increased demands may incur prohibitive costs, thereby hindering widespread adoption across diverse industries.

- key players in the market are actively focusing on establishing collaboration and strategic partnerships.

By partnering with research institutions, universities, and government agencies, companies gain access to funding, expertise, and facilities, thus accelerating research and development efforts and sharing both risks and costs. Collaborations further facilitate knowledge exchange and access to complementary technologies, enabling companies to enhance their product offerings and penetrate new markets more efficiently.

Smart Materials Market Trends

The integration of smart materials and IoT technology is fostering innovation across multiple fields, enabling the development of smarter, highly responsive, and more efficient systems.

The integration of smart materials in the aerospace industry is revolutionizing performance, safety, and efficiency. Applications such as shape memory alloys for adaptive components, piezoelectric materials for vibration control, self-healing materials for maintenance reduction, and electroactive polymers for morphing structures are stimulating innovation.

Smart composites enable real-time structural health monitoring, while thermochromic and photochromic materials enhance thermal management. Magnetorheological fluids improve landing gear and vibration damping. These advancements optimize operations and offer significant cost savings, positioning smart materials as essential in the aerospace sector, thereby driving market expansion.

The growing trend toward sustainable and eco-friendly smart materials is fueled by the global emphasis on environmental stewardship. Researchers are increasingly focusing on creating materials that offer advanced functionalities while minimizing environmental impact. This includes biodegradable smart materials and those made from renewable resources, thus reducing waste and conserving natural resources.

These materials maintain high performance and durability, finding applications in packaging, and construction, among others. The rising emphasis on sustainability meets the growing consumer and regulatory demand for greener products, positioning eco-friendly smart materials as essential for future technological advancements and market growth.

Segmentation Analysis

The global smart materials market is segmented based on product type, application, end-use industry, and geography.

By Product Type

Based on product type, the market is categorized into piezoelectric materials, shape memory materials, electrostrictive materials, magnetostrictive materials, and others. The piezoelectric materials segment garnered the highest revenue of USD 35.52 billion in 2023. This notable growth is mainly propelled by several factors such as the surge in demand for miniaturized sensors, the focus on energy harvesting technologies, and advancements in healthcare diagnostics and imaging.

Piezoelectric materials encompass ceramics such as lead zirconate titanate (PZT), polymers, and composites, each exhibiting the piezoelectric effect, wherein mechanical stress generates an electrical charge or conversely. This unique characteristic positions them as an ideal for sensing, actuating, and energy conversion applications. Piezoelectric materials find extensive utilityacross various industries.

For instance, in electronics, they are utilized in power pressure sensors, accelerometers, and ultrasonic transducers, while in healthcare, they facilitate medical imaging devices such as ultrasound probes and bone implants. Furthermore, the proliferation of IoT devices, smart infrastructure projects, and automotive electrification initiatives contributes to the expansion of the segment.

By Application

Based on application, the market is divided into transducers, actuators & motors, sensors, structural materials, and others. The actuators & motors segment captured the largest smart materials market share of 49.89% in 2023.

Actuators such as piezoelectric, shape memory alloy (SMA), and electroactive polymers (EAP) play a fundamental role in enabling precise motion control systems across various industries. These smart actuators are employed across diverse sectors, including aerospace and defense for agile maneuvering, automotive for enhanced performance, and healthcare for advanced prosthetics and surgical robotics.

The expansion of the segment is further stimulated by the surging demand for precision, efficiency, and miniaturization across various industries. Key smart materials such as shape memory alloys (SMAs), piezoelectric materials, and electroactive polymers (EAPs) are essential for high-performance actuators and motors used in automotive adaptive systems, aerospace morphing wings, and healthcare devices. Technological advancements and the rise of Industry 4.0 further boost the growth of the segment.

By End-Use Industry

Based on end-use industry, the smart materials market is categorized into industrial, defense & aerospace, automotive, consumer electronic, healthcare, and others. The defense & aerospace segment garnered the highest revenue of USD 20.27 billion in 2023.

The continuous adoption of smart materials across various platforms including aircraft, spacecraft, missiles, and defense systems is supporting the progress of the segment. The growing emphasis on lightweight materials to enhance fuel efficiency and performance, coupled with the need for superior safety and reliability is slated to boost segmental growth.

Key smart materials such as shape memory alloys, piezoelectric materials, and self-healing polymers find widespread use in critical applications including structural components, propulsion systems, avionics, and protective gear. In addition, ongoing advancements in material science, additive manufacturing, and collaborative research efforts offer opportunities for innovation and segmental expansion.

Smart Materials Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Smart Materials Market share stood around 35.68% in 2023 in the global market, with a valuation of USD 22.28 billion. This notable growth is largely attributed to the region's advanced technologyical infrastructure, significant R&D investment, and high industrial demand. The region sees robust growth due to its leadership in innovation and widespread adoption across the aerospace, automotive, healthcare, and consumer electronics industries.

- The presence of major players such as General Electric, 3M, DuPont, and Honeywell further contribute to domestic market growth, supported by a vibrant ecosystem of startups.

In addition, expanding applications in emerging fields such as wearable technology and renewable energy offer significant opportunities for regional market development.

Asia-Pacific is anticipated to witness the highest growth, depicting a robust CAGR of 14.35% over the forecast period. The region's robust industrial growth, coupled with rapid urbanization and technological advancements in sectors such as nanotechnology and robotics, fuels the demand for smart materials.

Major economies such as China, Japan, and South Korea lead in research and development investments, thereby gaining competitive edge in the market. Moreover, trends in miniaturization and efficiency improvements in the electronics and automotive sectors further boost the adoption of smart materials in the region.

Competitive Landscape

The smart materials market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Smart Materials Market

- KYOCERA Corporation

- TDK Corporation

- SMART MATERIAL CORP.

- CeramTec GmbH

- APC International, Ltd.

- Inc

- Findel Education Limited

- Omega Piezo Technologies

- Metglas Inc.

- Arkema

Key Industry Developments

- October 2023 (collaboration): Arkema collaborated with industry leaders such as EOS, HP, and Stratasys to enhance sustainability and performance in additive manufacturing materials. Specifically, its bio-sourced Rilsan Polyamide 11 saw a significant reduction in carbon footprint across all grades globally. This marked an improvement of approximately 70% compared to traditional polyamide resins made from fossil-based raw materials and conventional energy sources.