Market Definition

A smart hybrid inverter is an advanced power conversion device that integrates grid-tied and off-grid functionalities, enabling seamless switching between solar panels, battery storage, and the electrical grid. It intelligently manages energy flow, optimizing power usage based on demand, availability, and cost efficiency.

Equipped with smart features like remote monitoring, real-time analytics, and adaptive charging, it enhances energy reliability and efficiency. These inverters support multiple energy sources, improve backup power capabilities, and are widely used in residential, commercial, and industrial applications to maximize renewable energy utilization while reducing dependency on conventional power sources.

Smart Hybrid Inverter Market Overview

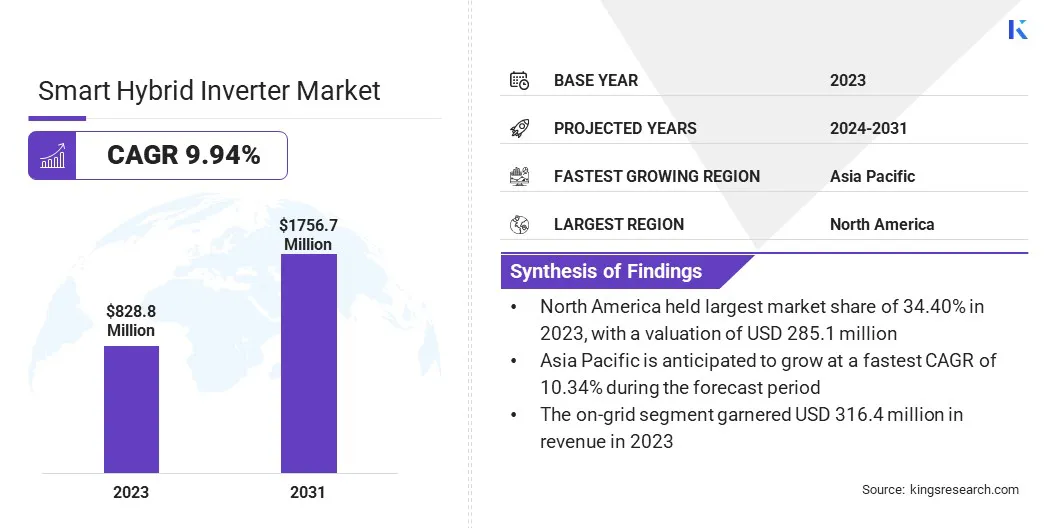

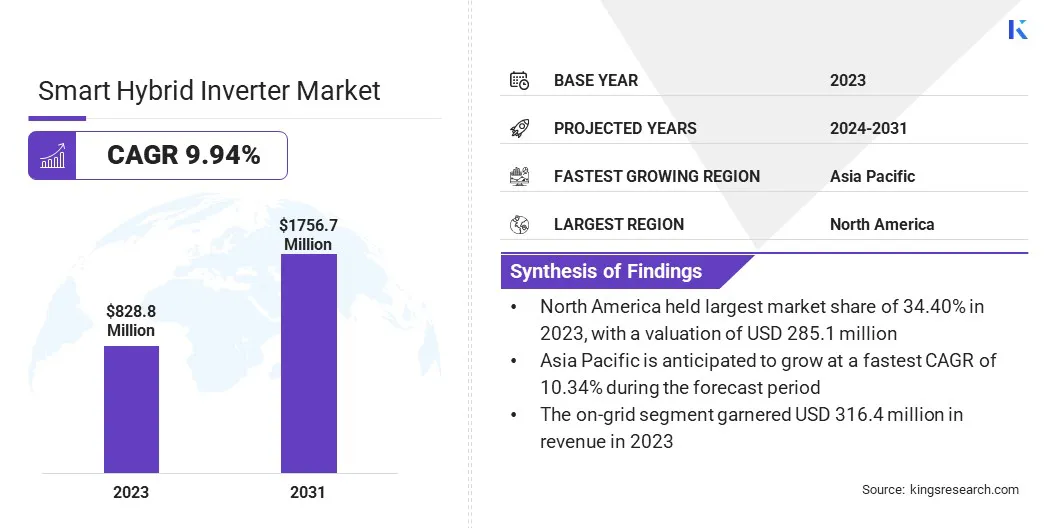

The global smart hybrid inverter market size was valued at USD 828.8 million in 2023 and is projected to grow from USD 904.7 million in 2024 to USD 1756.7 million by 2031, exhibiting a CAGR of 9.94% during the forecast period.

The market is registering growth, due to the rising adoption of renewable energy and the increasing need for efficient energy management solutions. Advancements in battery storage technology enhance the performance of hybrid inverters, making them more reliable and cost-effective.

Additionally, supportive government policies and incentives promoting solar energy integration drive the demand for hybrid inverters across residential, commercial, and industrial sectors.

Major companies operating in the global smart hybrid inverter Industry are SMA Solar Technology AG, Fronius International GmbH, Huawei Technologies Co., Ltd., SUNGROW, GoodWe Technologies Co., Ltd., KOSTAL Solar Electric GmbH, Delta Electronics, Inc., Growatt New Energy, SolaX Power, SolarEdge, LG Energy Solution, Redback Technologies, KACO new energy GmbH, Midea Group, and Generac Power Systems, Inc.

The global shift toward renewable energy is accelerating the growth of the market. Governments and organizations are investing in solar and wind energy projects to meet carbon reduction targets and improve energy security.

Smart hybrid inverters play a critical role in integrating these renewable sources with existing power infrastructure, ensuring a stable and efficient energy supply.

Businesses and residential users are leveraging hybrid inverter technology to maximize the benefits of solar energy while maintaining access to grid power. The push for sustainability and energy independence is boosting the demand for advanced hybrid inverter solutions.

- The Global Wind Energy Council's 2024 report highlights a significant achievement in the global wind energy sector, with a record 117 GW of new capacity added in 2023, marking the highest annual installation to date. To align with the targets set at COP28, the industry is expected to register substantial growth, with annual installations projected to increase from 117 GW in 2023 to a minimum of 320 GW by 2030.

Key Highlights:

- The global smart hybrid inverter market size was valued at USD 828.8 million in 2023.

- The market is projected to grow at a CAGR of 9.94% from 2024 to 2031.

- North America held a market share of 34.40% in 2023, with a valuation of USD 285.1 million.

- The on-grid segment garnered USD 316.4 million in revenue in 2023.

- The single-phase segment is expected to reach USD 1075.3 million by 2031.

- The up to 10 kW segment secured the largest revenue share of 34.19% in 2023.

- The industrial segment is poised for a robust CAGR of 10.25% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.34% during the forecast period.

Market Driver

"Growing Electric Vehicle (EV) Adoption and Charging Infrastructure Expansion"

The rapid increase in EV adoption is driving the smart hybrid inverter market. Businesses and homeowners are investing in EV charging stations that require efficient energy management systems to optimize power distribution.

Smart hybrid inverters enable the integration of solar energy and battery storage with EV charging infrastructure, reducing reliance on the grid and lowering energy costs.

The expansion of EV fleets in commercial and residential sectors is further increasing the demand for hybrid inverters that support smart charging solutions. Installations of hybrid inverters are expected to rise significantly as EV adoption continues to accelerate.

- The International Energy Agency's Global EV Outlook 2024 reported that the U.S. government committed nearly USD 50 million to support projects aimed at expanding access to convenient EV charging, aligning with its goal of establishing a national network of 500,000 public charging ports by 2030. In the Announced Pledges Scenario (APS), the number of public chargers is projected to reach 900,000 by 2030 and 1.7 million by 2035, with a significant share likely funded by private investment and extending beyond highway corridors. By 2035, this would equate to approximately 55 electric light-duty vehicles per charging point.

Market Challenge

"High Initial Investment Costs"

The smart hybrid inverter market faces a significant challenge, due to the high initial investment required for purchasing and installing advanced inverter systems. The cost of integrating hybrid inverters with battery storage solutions can be a barrier, especially for residential and small-scale commercial users.

Companies are addressing this challenge by offering flexible financing options, leasing programs, and government-backed subsidies to make hybrid inverters more accessible.

Additionally, advancements in manufacturing and economies of scale help reduce production costs, while continuous innovation in energy storage technology is improving efficiency, enhancing the long-term value proposition for consumers.

Market Trend

"Declining Costs of Solar Panels and Battery Storage"

The decreasing cost of solar photovoltaic (PV) panels and battery storage systems is making renewable energy solutions more accessible, driving the smart hybrid inverter market. Businesses and homeowners are increasingly investing in solar power generation, supported by declining hardware costs and favorable financing options.

Smart hybrid inverters enhance the efficiency of these systems by managing power conversion, battery charging, and grid interaction. The affordability of renewable energy technologies is expanding market penetration, particularly in emerging economies where cost barriers previously limited adoption. The demand for hybrid inverters is expected to rise as solar and battery prices continue to fall.

- The World in Data 2024 report highlights a significant decline in renewable energy costs, with solar photovoltaic prices dropping by 90%, onshore wind by 70%, and battery costs by over 90%. Over the past four decades, solar power has shifted from being among the most expensive electricity sources to becoming the most affordable in many countries.

Smart Hybrid Inverter Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

On-Grid, Off-Grid, Grid-Tied

|

|

By Product

|

Single-Phase, Three-Phase

|

|

By Power Rating

|

Up To 10 kW, 10–50 kW, Above 100 kW

|

|

By End User

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (On-Grid, Off-Grid, and Grid-Tied): The on-grid segment earned USD 316.4 million in 2023, due to its cost-effectiveness, seamless integration with existing power grids, and the ability to leverage net metering policies.

- By Product (Single-Phase and Three-Phase): The single-phase segment held 61.28% share of the market in 2023, due to its widespread adoption in residential applications, driven by increasing rooftop solar installations and the demand for efficient energy management solutions in households.

- By Power Rating (Up to 10 kW, 10–50 kW, 51–100 kW, and Above 100 kW): The up to 10 kW segment is projected to reach USD 597.8 million by 2031, owing to its widespread adoption in residential and small commercial applications, driven by increasing rooftop solar installations, favorable government incentives, and the rising demand for energy independence and backup power solutions.

- By End User (Residential, Commercial, and Industrial): The industrial segment is poised for significant growth at a CAGR of 10.25% through the forecast period, due to the rising adoption of energy storage solutions in manufacturing and heavy industries, where uninterrupted power supply, cost optimization, and grid independence are essential for operational efficiency and sustainability.

Smart Hybrid Inverter Market Regional Analysis

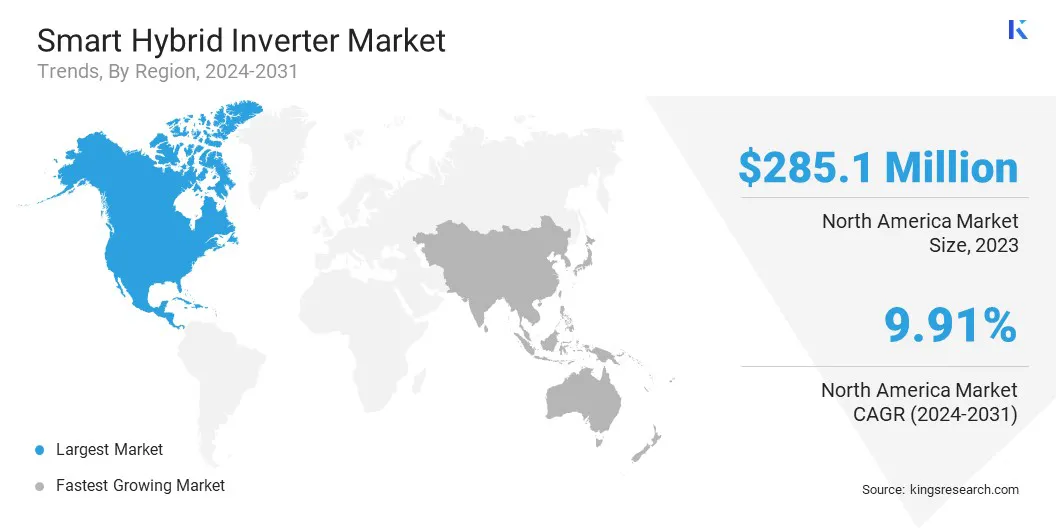

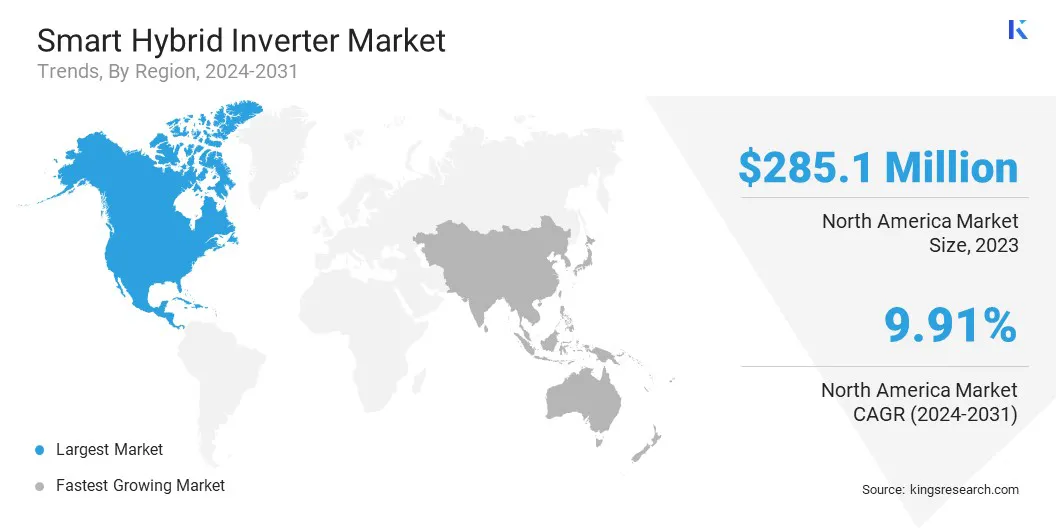

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a smart hybrid inverter market share of around 34.40% in 2023, with a valuation of USD 285.1 million. The transition to clean energy is accelerating in North America, driving the market.

Government policies and corporate sustainability initiatives are encouraging large-scale adoption of solar and wind energy, increasing the need for efficient power conversion and storage solutions.

The U.S. Inflation Reduction Act (IRA) and Canada’s Clean Electricity Regulations are supporting investments in renewable projects, creating a strong demand for hybrid inverters that optimize energy management. Hybrid inverters play a key role in integrating distributed energy resources into the grid as renewable capacity expands, enhancing system efficiency.

Furthermore, the rapid deployment of battery energy storage systems (BESS) across North America is fueling the market. Utilities, commercial facilities, and residential consumers are adopting storage solutions to enhance grid reliability, mitigate peak demand charges, and maximize the use of renewable energy.

Smart hybrid inverters enable seamless energy flow between solar panels, batteries, and the grid, ensuring optimal power management. Government incentives, such as the U.S. Investment Tax Credit (ITC) for energy storage, are further accelerating adoption. Increasing investments in grid-scale and behind-the-meter storage projects are expected to boost the demand for hybrid inverters.

The smart hybrid inverter Industry in Asia Pacific is poised for significant growth at a robust CAGR of 10.34% over the forecast period. Increasing deployment of energy storage systems across Asia Pacific is fueling the demand for smart hybrid inverters.

Amid rising electricity demand and grid constraints, utilities and industrial sectors are integrating battery energy storage to manage peak loads and ensure uninterrupted power supply.

Government incentives, such as China’s subsidies for energy storage projects and Japan’s push for battery-backed renewable systems, are accelerating the adoption of hybrid inverters. These inverters enable seamless energy flow between solar panels, batteries, and the grid, ensuring efficient power management in both on-grid and off-grid applications.

- According to the National Electricity Plan (NEP) 2023 by the Central Electricity Authority (CEA), energy storage capacity requirements are projected to reach 82.37 GWh by 2026-27. This demand is expected to rise significantly to 411.4 GWh by 2031-32. Furthermore, CEA estimates that by 2047, energy storage needs will increase to 2,380 GWh, driven by the growing integration of renewable energy to align with the net-zero emissions target set for 2070.

Additionally, the rapid growth of the EV market in Asia Pacific is creating opportunities for the market. Countries such as China, India, and South Korea are aggressively expanding EV charging infrastructure, increasing the need for efficient energy management solutions.

Smart hybrid inverters enable seamless integration of solar energy with EV charging stations, optimizing power distribution and reducing grid dependency. Supportive policies, including China’s New Energy Vehicle (NEV) incentives and India’s Faster Adoption and Manufacturing of Electric Vehicles (FAME) program, are further driving the demand for hybrid inverters in residential and commercial EV charging applications.

Regulatory Frameworks

- The U.S. smart hybrid inverter market is primarily regulated by the National Electrical Code (NEC), which sets standards for electrical installations, including inverters. The Federal Energy Regulatory Commission (FERC) oversees grid interconnections, ensuring that inverters comply with grid reliability and safety standards. Additionally, the Institute of Electrical and Electronics Engineers (IEEE) provides guidelines, such as IEEE 1547, which outline the interconnection and interoperability requirements for distributed energy resources with the grid.

- The EU has established the Low Voltage Directive (LVD) and the Electromagnetic Compatibility (EMC) Directive, which set safety and performance standards for electrical equipment, including inverters. The European Committee for Electrotechnical Standardization (CENELEC) develops harmonized standards, such as EN 50549, which specify requirements for the connection of generating plants, including inverters, to the distribution network.

- Germany's smart hybrid inverter regulations are among the most stringent, focusing on grid stability and the integration of renewable energy. The VDE-AR-N 4105 standard outlines technical requirements for the connection of generation systems to the low-voltage network, ensuring that inverters meet specific performance and safety criteria.

- In China, the National Energy Administration (NEA) regulates the inverter market, issuing standards that emphasize efficiency and safety. The GB/T 19964 standard specifies technical requirements for photovoltaic systems connected to the grid, including inverter performance and testing protocols.

- In India, the Central Electricity Authority (CEA) in India issues regulations governing the installation and operation of inverters. The CEA (Technical Standards for Connectivity of Distributed Generation Resources) Regulations outline the technical and safety requirements for connecting distributed generation resources, including inverters, to the grid.

Competitive Landscape:

The global smart hybrid inverter market is characterized by several participants, including established corporations and rising organizations. Market players are implementing strategies such as expanding production facilities to strengthen their manufacturing capabilities and meet the rising demand for smart hybrid inverters.

This expansion enables companies to enhance production efficiency, reduce lead times, and cater to a broader customer base. Additionally, increasing investment in state-of-the-art facilities supports technological advancements and innovation in inverter design, improving overall product performance. Market participants can capitalize on the growing adoption of renewable energy solutions by scaling up production, thereby driving the market.

- In November 2023, SOFAR, a leading global provider of PV and energy storage solutions, completed the first phase of its advanced manufacturing facility in Huizhou, China. Equipped with state-of-the-art technology, the facility enhances production efficiency, enabling faster manufacturing of high-quality solar inverters and energy storage systems. Once fully operational, the facility is expected to achieve an annual production capacity exceeding 3 million units, including 2 million grid-connected inverters, 600,000 hybrid inverters, and 600,000 batteries, reinforcing SOFAR's position in the renewable energy market.

List of Key Companies in Smart Hybrid Inverter Market:

- SMA Solar Technology AG

- Fronius International GmbH

- Huawei Technologies Co., Ltd.

- SUNGROW

- GoodWe Technologies Co., Ltd.

- KOSTAL Solar Electric GmbH

- Delta Electronics, Inc.

- Growatt New Energy

- SolaX Power

- SolarEdge

- LG Energy Solution

- Redback Technologies

- KACO new energy GmbH

- Midea Group

- Generac Power Systems, Inc.

Recent Developments (Product Launch)

- In December 2024, GoodWe introduced the ET G2 Series in Australia and New Zealand, a 6-15kW three-phase high-voltage hybrid inverter designed to address the evolving energy demands of modern households. This latest addition provides homeowners with a reliable and efficient solution to optimize energy consumption, reinforcing the company's commitment to advancing smart energy solutions in the region.

- In October 2023, Sungrow unveiled its latest high-powered residential single-phase hybrid inverters, SH8.0RS and SH10RS, at All Energy Australia 2023. Featuring a streamlined multi-layer high-protection design and compatibility with large-capacity SBR/SBH batteries, these inverters enable households to efficiently store and utilize clean energy, ensuring reliable backup power for homes.

- In June 2023, LG Energy Solution introduced a new hybrid inverter system designed to cater to the diverse energy needs of European households. Developed in response to the increasing demand from installers and homeowners, the inverter is available in both high-voltage (HV) and low-voltage (LV) configurations, offering greater flexibility and efficiency in residential energy management.