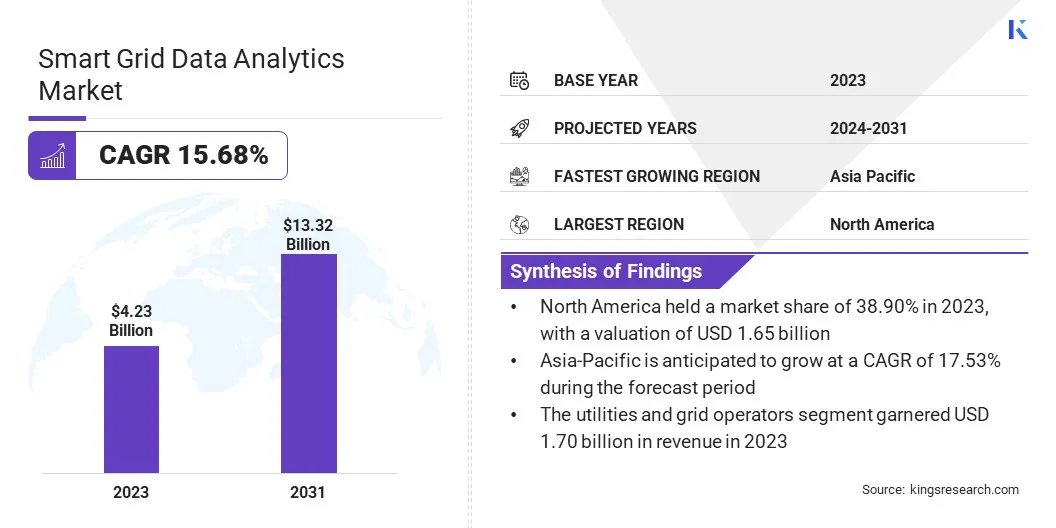

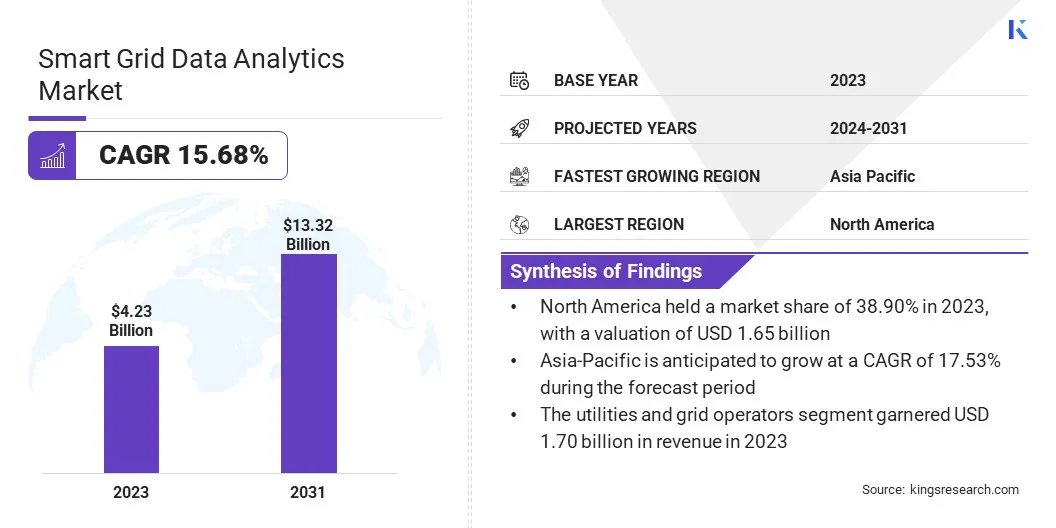

Smart Grid Data Analytics Market Size

The global Smart Grid Data Analytics Market size was valued at USD 4.23 billion in 2023 and is projected to grow from USD 4.81 billion in 2024 to USD 13.32 billion by 2031, exhibiting a CAGR of 15.68% during the forecast period. The market is rapidly evolving as utilities and energy providers increasingly adopt advanced analytics solutions to enhance operational efficiency.

The integration of AI and machine learning is enabling real-time data processing and predictive insights, which are crucial for managing complex grid systems. This technological advancement is driving market growth by improving grid reliability, reducing operational costs, and supporting the transition to more sustainable energy practices.

In the scope of work, the report includes solutions offered by companies such as Siemens, Itron Inc., AutoGrid Systems Inc., GE Vernova, IBM Corporation, SAP SE, Tantalus, SAS Institute Inc., Oracle Corporation, Uplight Inc., and others.

The smart grid data analytics market is experiencing significant growth, mainly due to the rising demand for electricity.

- According to the International Energy Agency (IEA), global electricity demand is expected to increase by 5,900 terawatt-hours (TWh) under the Stated Policies Scenario (STEPS) and by over 7,000 TWh under the Announced Pledges Scenario (APS) by 2030. This surge is equivalent to adding the combined current electricity demand of the United States and the European Union.

As utilities seek to efficiently manage this rising demand, smart grid data analytics is becoming crucial for optimizing grid performance, improving reliability, and developing more effective energy management strategies.

Smart grid data analytics refers to the process of analyzing vast amounts of data generated by smart grid systems to optimize energy distribution, enhance grid reliability, and improve operational efficiency. This involves the use of advanced analytical tools and techniques to interpret data from various sources, including smart meters, sensors, and other grid devices.

By leveraging data analytics, utilities can monitor grid performance in real-time, forecast maintenance needs, and respond to outages more promptly. Additionally, these analytics facilitate better demand forecasting, load balancing, and integration of renewable energy sources, thereby contributing to a more resilient and efficient energy grid.

Analyst’s Review

Increasing initiatives by key players, such as deploying advanced smart meters and management systems, are supporting growth and modernization in the market.

- For instance, in December 2022, Siemens disclosed its intention to supply 175,000 smart meters and a cutting-edge distribution management system to the Damietta region in the Nile Delta. This project, valued at over USD 42 million, was assigned to the North Delta Electricity Distribution Company (NDEDC) as part of a comprehensive grid modernization and enhancement effort.

Increasing investments and strategic initiatives undertaken by key industry players are fostering the growth of the smart grid data analytics market. These efforts are enhancing grid efficiency, enabling better performance monitoring, and supporting predictive maintenance. As the demand for reliable and efficient energy distribution continues to rise, such initiatives are contributing significantly to expansion and innovation in the market.

Smart Grid Data Analytics Market Growth Factors

The rising emphasis on energy efficiency and sustainability is leading to the widespread adoption of smart grid data analytics among utilities and energy providers. As organizations aim to reduce energy consumption and lower their carbon footprint, they are increasingly relying on data analytics to enhance performance monitoring and predictive maintenance.

Advanced analytics allow for more accurate assessments of energy usage patterns, identify inefficiencies, and predict potential issues before they arise. This proactive approach optimizes energy management and supports sustainability goals. The growing focus on these practices is further contributing to market growth.

Integrating disparate data sources and legacy systems poses significant challenges to the development of the smart grid data analytics market, thereby complicating data management and analysis. Additionally, rising concerns regarding data security and high implementation costs hinder market growth.

Key players are mitigating these challenges by developing unified, interoperable platforms that streamline data integration and enhance system compatibility. They are further investing heavily in advanced cybersecurity measures to protect data and address privacy concerns. To manage high costs, companies are offering scalable, cloud-based solutions that provide flexible and cost-effective analytics capabilities, thus promoting market expansion.

Smart Grid Data Analytics Industry Trends

The growing deployment of smart grid infrastructure is propelling market growth, supported by increased demand for advanced data analytics solutions. As smart grids generate extensive data through various sources, the need for real-time analytics is surging.

Companies are investing heavily in cutting-edge technologies to process and analyze this data, which is optimizing energy distribution and enhancing grid reliability. This trend is fueling market expansion, as utilities and energy providers are increasingly adopting sophisticated analytics tools to manage the complexities of modern energy systems and improve operational efficiencies.

The proliferation of Internet of Things (IoT) devices and sensors within smart grids is generating vast amounts of data, leading to an increasing focus on analytics to handle and interpret this information effectively. As these devices continuously provide real-time insights into energy consumption, equipment status, and system performance, the demand for advanced analytics solutions capable of processing and analyzing large datasets is rising.

Utilities are leveraging these analytics to gain actionable insights, optimize grid operations, and enhance decision-making processes. This ongoing trend is augmenting market growth as organizations are investing progressively in technologies to maximize the benefits of their smart grid infrastructure.

Segmentation Analysis

The global market is segmented based on end use, analytics type, component, deployment, and geography.

By End Use

Based on end use, the market is categorized into utilities and grid operators, industrial consumers, residential consumers, renewable energy providers, and heavy duty vehicles. The utilities and grid operators segment led the smart grid data analytics market in 2023, reaching a valuation of USD 1.70 billion.

Utilities and grid operators are increasingly adopting advanced analytics to manage the complexities of modern energy systems, optimize energy distribution, and improve operational performance. This segment benefits from growing investments in smart grid infrastructure and a rising emphasis on predictive maintenance and real-time data analysis.

As energy demand increases and sustainability goals become more pressing, utilities and grid operators are leveraging data analytics to support grid modernization and ensure reliable service, thus fueling segmental expansion.

By Analytics Type

Based on analytics type, the market is categorized into descriptive analytics, predictive analytics, diagnostic analytics, and prescriptive analytics. The predictive analytics segment captured the largest market share of 40.12% in 2023.

By employing sophisticated algorithms and machine learning techniques, predictive analytics enables utilities to anticipate and mitigate issues before they occur, thereby reducing downtime and maintenance costs.

This growth is further stimulated by the increasing need for efficient energy management and the expanding integration of renewable energy sources, both of which require advanced forecasting capabilities. As utilities continue to invest in smart grid technologies, the demand for predictive analytics is expected to rise.

By Component

Based on component, the market is categorized into software and services. The software segment is expected to garner the highest revenue of USD 8.21 billion by 2031. This segment encompasses a wide range of applications, including energy management systems, advanced metering infrastructure, and distribution management systems, all designed to enhance grid efficiency and reliability.

The surge in smart grid deployments and the integration of IoT devices are generating massive volumes of data, highlighting the pressing need for sophisticated software solutions to facilitate effective analysis and decision-making. As utilities strive to optimize grid operations and reduce energy losses, the demand for smart grid software is expected to surge.

By Deployment

Based on deployment, the market is categorized into cloud-based and on-premises. The cloud-based segment is expected to garner the highest smart grid data analytics market share of USD 72.35% billion by 2031.

The scalability, flexibility, and cost-efficiency of cloud-based solutions are leading to their widespread adoption among utilities and grid operators. These solutions enable real-time data processing, advanced analytics, and seamless integration with various smart grid components.

- In November 2022, Siemens Smart Infrastructure partnered with SEW, a leading cloud platform provider renowned for its expertise in digital customer and workforce experiences within the utility sector. This collaboration aimed to support utility providers globally, enhance the experiences of utility smart meter users, and facilitate the transition toward a renewable energy future.

Furthermore, the increasing focus on digital transformation and the need for enhanced cybersecurity measures are propelling the shift toward cloud-based platforms. Key market players are investing heavily in cloud infrastructure and services to offer robust, scalable, and secure analytics solutions, thus fostering the growth of the segment.

Smart Grid Data Analytics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America smart grid data analytics market share stood around 38.90% in 2023 in the global market, with a valuation of USD 1.65 billion. Utility companies in the region are actively implementing data analytics solutions to enhance grid reliability, improve energy efficiency, and reduce operational costs. The growing shift toward renewable energy integration and stringent regulatory requirements are promoting the adoption of smart grid technologies.

Additionally, advancements in machine learning and artificial intelligence are enabling more sophisticated data analysis, which is critical for predictive maintenance and real-time decision-making. These trends are expected to contribute to the growth of the regional market.

Asia-Pacific is anticipated to witness fastest growth at a staggering CAGR of 17.53% over the forecast period. Nations such as China, India, Japan, Australia, and South Korea are witnessing the widespread adoption of smart grid technology in response to rising power consumption.

- According to the International Energy Agency (IEA), Southeast Asia's energy consumption has been increasing at an annual rate of approximately 3% over the past two decades. This trend is expected to continue until 2030 under the Stated Policies Scenario (STEPS).

Additionally, initiatives such as the collaboration between LITE-ON and NTU Singapore to develop energy-efficient smart grid and smart home technologies are fueling regional market expansion. These efforts are enhancing energy management and attracting significant investments, thereby stimulating the growth of the Asia-Pacific market.

Competitive Landscape

The global smart grid data analytics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Smart Grid Data Analytics Market

- Siemens

- Itron Inc.

- AutoGrid Systems Inc.

- GE Vernova

- IBM Corporation

- SAP SE

- Tantalus

- SAS Institute Inc.

- Oracle Corporation

- Uplight Inc.

Key Industry Development

- January 2024, (Product Launch): Tantalus Systems launched the Tantalus Grid Modernization Platform (TGMP), featuring TRUSync, an advanced grid data management system. TGMP was designed to assist utilities in supporting their grid modernization efforts, incorporating a smart grid architecture that included connected devices, communications networks, grid data management, applications, and analytics.

The global smart grid data analytics market is segmented as:

By End Use

- Utilities and Grid Operators

- Industrial Consumers

- Residential Consumers

- Renewable Energy Providers

- Heavy Duty Vehicles

By Analytics Type

- Descriptive Analytics

- Predictive Analytics

- Diagnostic Analytics

- Prescriptive Analytics

By Component

By Deployment

By Organization Size

- Small and Medium Businesses

- Large Enterprises

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America