Market Definition

The market encompasses advanced glazing technologies that dynamically control light transmission and thermal properties in architectural, automotive, and consumer electronics applications. Key components include electrochromic, thermochromic, photochromic, and suspended particle devices integrated into smart windows, displays, and eyewear.

The market covers switchable glass panels, smart coatings, and related control systems, addressing energy efficiency, privacy, and user comfort across residential, commercial, and automotive sectors. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Smart Glass Market Overview

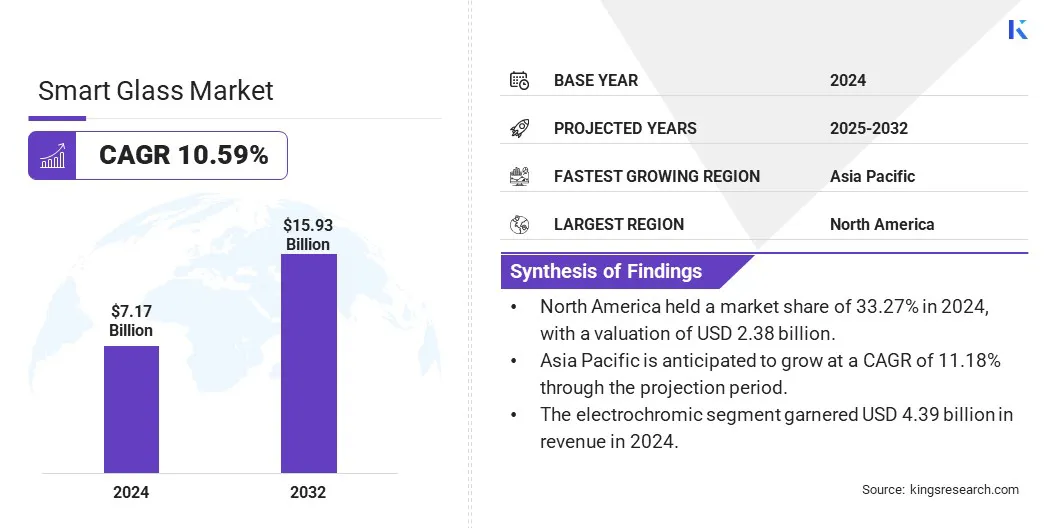

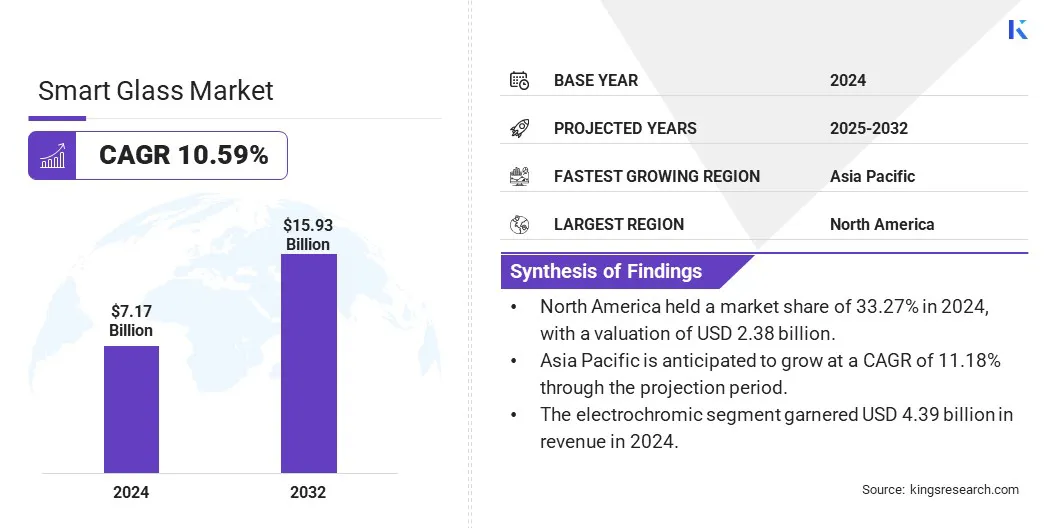

The global smart glass market size was valued at USD 7.17 billion in 2024 and is projected to grow from USD 7.87 billion in 2025 to USD 15.93 billion by 2032, exhibiting a CAGR of 10.59% during the forecast period. The growing use of smart glass in automotive, improving aesthetics, comfort, and safety, along with AI-powered glasses for the visually impaired enhancing navigation, are fueling market growth.

Major companies operating in the smart glass industry are Gauzy Ltd and Entities, Saint-Gobain Glass India., AGC Inc., GENTEX CORPORATION, Corning Incorporated, Nippon Sheet Glass Co., Ltd, view, Inc., Xinyi Glass Holdings Limited., RESEARCH FRONTIERS INC., Diamond Glass, Central Glass Co., Ltd., fuyaogroup.com., ChromoGenics, Privetek., and Max INC..

Increasing demand for energy-efficient buildings is boosting the adoption of smart glass technology. Smart glass enhances thermal regulation and daylight control, reducing energy use for heating, cooling, and lighting. Growing emphasis on sustainable construction standards and stringent energy regulations is accelerating market expansion.

Prominent real estate and infrastructure developers are incorporating smart glass solutions to attain green building certifications and lower operational costs, fueling market growth in commercial and residential sectors globally.

- In June 2024, the World Economic Forum highlighted that low-emissivity glass enhances building efficiency by reducing energy consumption and improving occupant comfort in commercial buildings.

Key Highlights:

- The smart glass market size was recorded at USD 7.17 billion in 2024.

- The market is projected to grow at a CAGR of 10.59% from 2025 to 2032.

- North America held a market share of 33.27% in 2024, with a valuation of USD 2.38 billion.

- The electrochromic segment garnered USD 4.39 billion in revenue in 2024.

- The transportation segment is expected to reach USD 7.66 billion by 2032.

- The switches segment is anticipated to witness the fastest CAGR of 11.29% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 11.18% through the projection period.

Market Driver

Increasing Adoption of Smart Glass in Automotive Sector Driving Market Growth

Rising adoption of smart glass in the automotive sector is fueling market growth. The market benefits from enhanced vehicle aesthetics, improved passenger comfort, and advanced functionalities such as glare reduction and privacy control.

Increasing consumer demand for innovative and premium automotive features, combined with regulatory emphasis on safety and energy efficiency, is prompting manufacturers to incorporate smart glass technologies across various vehicle segments globally.

- In April 2025, Gauzy Ltd. achieved a strategic implementation of its smart glass technology in approximately 75% of the glazing on Mercedes-Benz’s Vision V show car. This deployment utilizes Gauzy’s integrated SPD and PDLC dual-technology solution, enhancing vehicle privacy, comfort, and digital environment capabilities. The Vision V represents Mercedes-Benz’s first commercial application of this combined smart glass technology, reinforcing the partnership and Mercedes-Benz’s commitment to innovation in automotive glazing solutions.

Market Challenge

High Production Costs and Limited Consumer Awareness

The smart glass market faces significant challenges due to high production costs and limited consumer awareness, which hinder widespread adoption across key sectors. Additionally, concerns regarding durability and integration complexity constrain market growth.

To address these issues, manufacturers are investing heavily in advanced material technologies to reduce costs and enhance product longevity. Strategic partnerships with technology firms are being formed to improve system interoperability and user experience. Concurrently, targeted marketing campaigns aim to educate end-users about the benefits and applications of smart glass.

Market Trend

Integration of AI in Smart Glasses Expanding Applications in Assistive Technology

Artificial Intelligence (AI)-powered smart glasses for the visually impaired represent a notable trend in the market. These solutions incorporate real-time audio feedback and computer vision to support navigation and object identification.

This trend reflects a broader shift toward integrating AI with wearable technology, emphasizing enhanced functionality and expanding applications within the assistive technology segment.

- For instance, in April 2023, SHG Technologies launched India’s first AI-powered Smart Vision Glasses for the visually impaired. The device enables navigation, object detection, facial recognition, and multilingual text reading without requiring internet connectivity.

Smart Glass Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Electrochromic, Polymer Dispersed Liquid Crystal (PDLC), Suspended Particle Devices (SPD), Thermochromics, Photochromic

|

|

By Application

|

Architectural(Residential Buildings, Commercial Buildings), Transportation(Automotive, Aircraft, Marine) Consumer Electronics, Power Generation

|

|

By Control Mode

|

Rheostats, Switches, Remote, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Electrochromic, Polymer Dispersed Liquid Crystal (PDLC), Suspended Particle Devices (SPD), Thermochromics, and Photochromic): The electrochromic segment earned USD 4.39 billion in 2024 due to its superior energy efficiency, cost-effectiveness, and ability to provide dynamic light and heat control, which aligns with increasing demand for sustainable building solutions.

- By Application (Architectural, Transportation, Consumer Electronics, and Power Generation): The transportation segment held a share of 46.51% in 2024, attributed to the growing adoption of smart glass in vehicles for enhanced passenger comfort, energy savings, and improved safety features.

- By Control Mode (Rheostats, Switches, and Remote): The switches segment is projected to reach USD 5.12 billion by 2032, due to its reliability, ease of use, and cost-effectiveness, making it the preferred control mode for both residential and commercial applications.

Smart Glass Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America smart glass market share stood at around 33.27% in 2024, valued at USD 2.38 billion. This dominance is attributed due to the strong presence of key industry players prioritizing technological advancements.

The regional market benefits from substantial investment in research and development, fostering continuous innovation in wearable AR devices. Additionally, rapid adoption across diverse sectors, including fitness, enterprise, and consumer markets, accelerates market growth.

- In November 2023, Vuzix Corporation expanded its Ultralite OEM PlatformSM by launching Ultralite SAR smart glasses, designed for sports and fitness users. The device integrates advanced augmented reality features to enhance real-time performance tracking and user engagement during workouts.

The Asia-Pacific smart glass industry is set to grow at a robust CAGR of 11.18% over the forecast period. This growth is propelled by increasing technological adoption and expanding industrial applications.

Rapid urbanization, rising disposable incomes, and growing investments in AR and wearable technologies contribute significantly to regional market expansion. Additionally, the presence of emerging manufacturers and government initiatives promoting digital transformation bolster this growth.

Regulatory Frameworks

- In the U.S., the American National Standards Institute (ANSI) sets safety standards for smart glass. For instance, ANSI Z97.1 governs safety glazing materials in buildings, ensuring impact resistance, durability, and overall safety.

- In China, the market is governed by GB standards emphasizing product quality, safety, and performance. Notably, GB/T 8484-2008 outlines technical specifications for switchable glass, while other GB standards cover safety, strength, thermal insulation, and optical characteristics, forming a thorough regulatory framework.

- In Japan, smart glass products with electrical components, including electrochromic and thermochromic glass, must comply with the Electrical Appliance and Material Safety Law (DENAN Law). This law mandates safety measures against fire and electric shock. Manufacturers and importers must obtain PSE mark certification before marketing these products in Japan.

Competitive Landscape

The smart glass market’s competitive landscape is characterized by frequent product introductions and technological advancements. Leading companies are emphasizing innovation, expanded features, and varied use cases to strengthen their market positions.

Significant investments in research and development, along with strategic partnerships, are accelerating the rollout of cutting-edge smart glass products. This prompts players to enhance functionality, cost-effectiveness, and tailored solutions to address shifting customer and industry requirements.

- In September 2024, Meta introduced Orion, its most advanced AR glasses to date. Orion combines the design and comfort of traditional eyewear with cutting edge augmented reality features, representing breakthroughs across multiple areas of modern computing technology.

List of Key Companies in Smart Glass Market:

- Gauzy Ltd and Entities

- Saint-Gobain Glass India.

- AGC Inc.

- GENTEX CORPORATION

- Corning Incorporated

- Nippon Sheet Glass Co., Ltd

- View, Inc.

- Xinyi Glass Holdings Limited.

- RESEARCH FRONTIERS INC.

- Diamond Glass

- Central Glass Co., Ltd.

- ChromoGenics

- Privetek.

- Max INC.

Recent Developments (Partnerships/ Product Launches)

- In November 2024, Vuzix Corporation launched the Vuzix Z100 smart glasses, featuring a heads-up information display and seamless Bluetooth connectivity with Android and iOS devices via the updated Vuzix Connect app (version 1.7), enabling real-time notifications and messaging.

- In October 2024, Gauzy Ltd. was appointed strategic supplier by Ferrari, initiating serial production of its Suspended Particle Device (SPD) Smart Glass technology for Ferrari’s premium SUV. This marks Ferrari’s first mass production use of smart glass, incorporated into the vehicle's panoramic roof.

- In September 2024, EssilorLuxottica extended its long-term partnership with Meta Platforms to develop multiple generations of smart eyewear. The partnership has produced two generations of Ray-Ban branded smart glasses, driving wearable adoption and redefining consumer experiences.