Market Definition

The market encompasses the global industry focused on the design, manufacturing, deployment, and integration of smart beacon technology. Smart beacons are compact, wireless transmitters that utilize Bluetooth Low Energy (BLE) to communicate with nearby smart devices.

The market includes hardware components, software platforms for beacon management, and associated analytical services. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Smart Beacon Market Overview

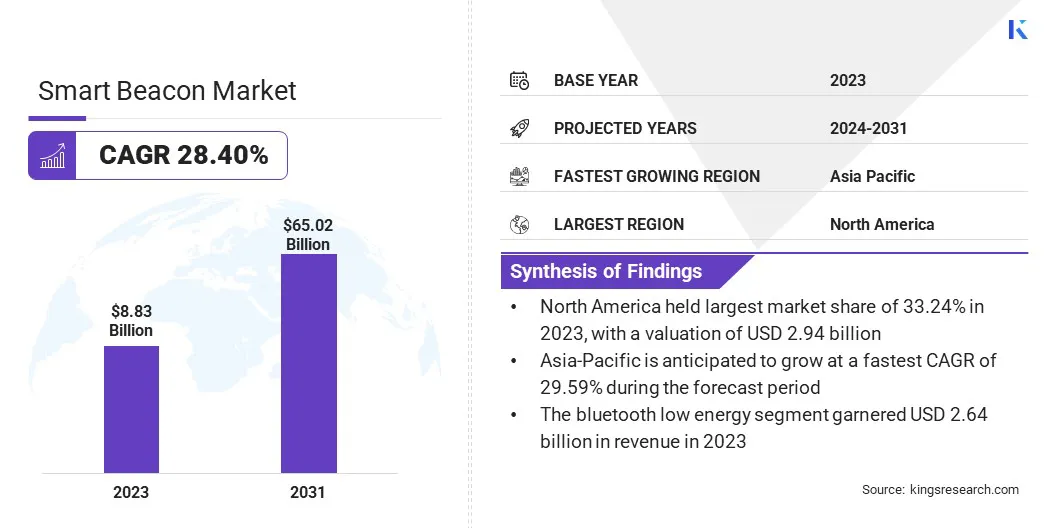

The global smart beacon market size was valued at USD 8.83 billion in 2023 and is projected to grow from USD 11.30 billion in 2024 to USD 65.02 billion by 2031, exhibiting a CAGR of 28.40% during the forecast period.

This robust expansion is primarily attributed to the increasing deployment of location-based services across key industry verticals such as retail, transportation, and healthcare.

Major companies operating in the smart beacon industry are Hewlett Packard Enterprise Development LP, Kontakt.io, Accent Advanced Systems, SLU, BlueUp Srl, HID Global Corporation, Qualcomm Technologies, Inc., Zebra Technologies Corp, KKM COMPANY LIMITED, Cisco Systems, Inc., Infillion, Sensoro Co., Ltd., IndoorAtlas, Shenzhen Feasycom Co, ELA Innovation SA, and Estimote, Inc.

Smart beacons are instrumental in enabling real-time data exchange, facilitating personalized customer engagement, and enhancing operational efficiency. The market is further supported by ongoing advancements in BLE technology and the rapid proliferation of Internet of Things (IoT) infrastructure.

- In February 2023, Nokia unveiled the Beacon 10, its inaugural Wi-Fi 6E gateway, at the Mobile World Congress in Barcelona. This tri-band device offers up to 10 Gbps Wi-Fi throughput and features 10G WAN interface, facilitating multi-gigabit connectivity for homes and businesses.

Key Highlights

- The smart beacon industry size was valued at USD 8.83 billion in 2023.

- The market is projected to grow at a CAGR of 28.40% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 2.94 billion.

- The bluetooth low energy segment garnered USD 2.64 billion in revenue in 2023.

- The retail segment is expected to reach USD 15.97 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 29.59% during the forecast period.

Market Driver

"Advancements in BLE Technology"

Recent developments in Bluetooth Low Energy (BLE) technology have markedly enhanced the performance and efficiency of smart beacons. Improvements in power consumption enable devices to function for several years on a single battery, significantly reducing maintenance efforts.

Enhanced signal range, data throughput, and transmission stability, particularly with Bluetooth 5.0 and other versions, allow for more accurate proximity detection and reliable communication in dense environments.

These advancements have improved the scalability, cost-efficiency, and technical capabilities of smart beacon deployments, making them well-suited for real-time location tracking, targeted messaging, and asset monitoring in enterprise applications.

- In June 2024, LANSITEC TECHNOLOGY CO. LTD unveiled the B003 Bluetooth Beacon, a compact device designed for tracking personal belongings and monitoring assets & staff. Featuring Bluetooth 5.0 connectivity, an audible buzzer, and low power consumption with up to 765 days of standby time, it offers an efficient and user-friendly solution for various tracking applications.

Market Challenge

"Signal Interference and Environmental Limitations"

The use of smart beacons is often hindered by signal interference and environmental constraints. BLE signals are vulnerable to physical obstructions such as walls, metal objects, and human presence, which can degrade signal strength and reduce accuracy.

Electromagnetic interference can disrupt beacon communication in environments with high wireless activity such as those with overlapping Wi-Fi or other BLE devices. Dynamic environments such as warehouses and transit hubs present variability in signal behavior, due to continuous movement and complex structural layouts.

These conditions can compromise the reliability and scalability of beacon-based systems, making strategic planning and effective interference mitigation essential for consistent performance.

Overcoming signal interference and environmental limitations requires precise planning and adaptive technology. Site surveys should be conducted to identify obstacles and optimize beacon placement.

Using beacons with adjustable transmission power and advanced signal filtering helps improve accuracy in challenging environments. Real-time monitoring tools enable dynamic calibration and quick resolution of signal issues.

In high-interference areas, combining BLE with complementary technologies such as Wi-Fi triangulation or ultra-wideband (UWB) can enhance reliability. Regular maintenance and recalibration are also essential to ensure consistent performance and scalability.

Market Trend

"Proliferation of IoT Ecosystems"

The growth of IoT ecosystems is accelerating the adoption of smart beacons by enabling seamless interaction between connected devices. Smart beacons play a vital role in enhancing real-time data exchange, contextual awareness, and automation across sectors.

In smart buildings, they support energy optimization and space management, while in industrial environments, they enable asset tracking and operational efficiency. Their interoperability within IoT networks makes them ideal for scalable, data-driven applications, driving the evolution of intelligent infrastructure and personalized, location-based services.

- In January 2023, Telefónica S.A. partnered with FlashLED to launch the 'FlashLED SOS V16' smart beacon using NB-IoT connectivity. The device enhances road safety by transmitting vehicle location data to Spain’s traffic authority and will become mandatory by 2026 under new regulations.

Smart Beacon Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Bluetooth Low Energy, Long-term Evolution, RFID, WiFi, Near Field Communication, Others

|

|

By End User

|

Retail, Public Gatherings & Spaces, Travel & Hospitality, Transportation & Logistics, Aviation, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Bluetooth Low Energy, Long-term Evolution, RFID, WiFi, Near Field Communication, Others): The bluetooth low energy segment earned USD 2.64 billion in 2023, due to its low power consumption, cost-effectiveness, and widespread compatibility with mobile devices.

- By End User (Retail, Public Gatherings & Spaces, Travel & Hospitality, Transportation & Logistics, Aviation, Healthcare, Others): The retail segment held 24.45% share of the market in 2023, due to the increasing adoption of smart beacons for personalized marketing, in-store navigation, and enhanced customer engagement.

Smart Beacon Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America smart beacon market share stood around 33.24% in 2023, with a valuation of USD 2.94 billion. This dominance is attributed to the early adoption of advanced technologies, strong presence of key market players, and high investment in smart infrastructure across sectors such as retail, transportation, and healthcare.

The region also benefits from widespread smartphone penetration and well-established IoT ecosystems, which support the seamless integration of beacon-based solutions.

The smart beacon industry in Asia-Pacific is poised for significant growth at a robust CAGR of 29.59% over the forecast period. Asia-Pacific is registering rapid growth in the market, driven by rapid urbanization, increasing digital transformation initiatives, and expanding smart city projects across countries such as China, India, Japan, and South Korea.

Rising consumer adoption of smartphones, coupled with government support for IoT and smart infrastructure development, is creating a favorable environment for beacon deployment.

The retail and e-commerce sectors in the region are actively adopting smart beacon technology to improve customer engagement, streamline operations, and support data-driven strategies.

Regulatory Frameworks

- In the European Union (EU), the General Data Protection Regulation (GDPR) regulates the collection, storage, and use of personal data, including location-based information. It mandates that organizations obtain explicit user consent for data processing and ensure transparency, security, and accountability in their handling of personal data.

- In California, the California Consumer Privacy Act (CCPA) governs how businesses handle the personal information of consumers. It grants consumers the right to know what data is collected, opt out of data sales, and request data deletion, thereby ensuring user control over beacon-enabled tracking and marketing activities.

- In Australia, the Privacy Act 1988, amended by the Notifiable Data Breaches (NDB) scheme, governs the handling of personal information. Organizations must ensure secure data processing and report any breaches that are likely to cause serious harm.

Competitive Landscape

The smart beacon industry is highly competitive and fragmented, with numerous international and regional players striving to strengthen their market position through technological innovation, strategic partnerships, and product differentiation.

Companies in the smart beacon market are focusing on expanding their product portfolios, enhancing beacon capabilities with AI and analytics, and integrating their solutions with broader IoT ecosystems. Mergers, acquisitions, and collaborations are common strategies employed by these market players to gain a competitive edge and broaden their geographic reach.

- In July 2024, blukii unveiled a new Bluetooth beacon integrating Atmosic Technologies' ATM33 system-on-chip (SoC), achieving the longest battery life in its class. This beacon is designed for applications such as asset tracking, indoor navigation, and environmental monitoring, minimizing maintenance needs and enhancing sustainability.

List of Key Companies in Smart Beacon Market:

- Hewlett Packard Enterprise Development LP

- Kontakt.io

- Accent Advanced Systems, SLU

- BlueUp Srl

- HID Global Corporation

- Qualcomm Technologies, Inc.

- Zebra Technologies Corp

- KKM COMPANY LIMITED

- Cisco Systems, Inc.

- Infillion

- Sensoro Co., Ltd.

- IndoorAtlas

- Shenzhen Feasycom Co

- ELA Innovation SA

- Estimote, Inc

Recent Developments (Partnerships / Product Launches)

- In October 2024, Nokia introduced the Beacon 19, a tri-band Wi-Fi 7 mesh gateway offering up to 19 Gbps of Wi-Fi capacity. This device is designed to meet the increasing demands of applications such as streaming, online gaming, and smart home services.

- In January 2024, Acal BFi partnered with Atmosic Technologies to promote ultra-low-power, energy-harvesting IoT solutions that reduce battery reliance. Devices such as beacons, asset trackers, wearables, and peripherals will benefit from Atmosic’s enhanced efficiency and extended battery life.