Market Definition

Shredder blades are durable cutting components used in shredding machines to reduce materials such as plastics, metals, wood, rubber, and waste into smaller, manageable pieces. These blades are made from wear-resistant materials such as hardened steel or carbide to ensure strength and longevity.

Shredder blades are available in various configurations, including single shaft, double shaft, and four shaft designs for different shredding mechanisms. Shredder blades are widely used in recycling, waste management, and material processing industries to support efficient disposal, reuse, or further processing of materials.

Shredder Blades Market Overview

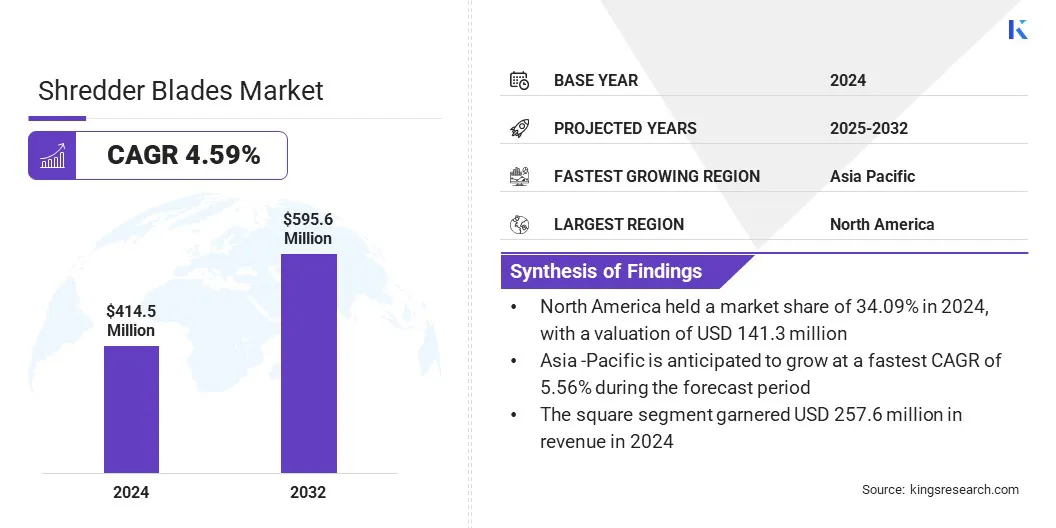

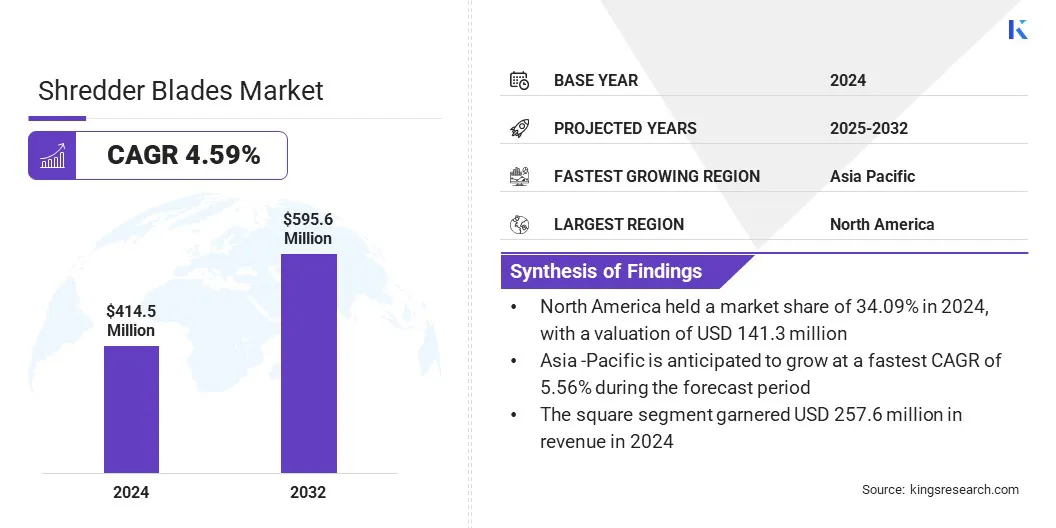

The global shredder blades market size was valued at USD 414.5 million in 2024 and is projected to grow from USD 432.7 million in 2025 to USD 595.6 million by 2032, exhibiting a CAGR of 4.59% during the forecast period.

The market is driven by the rising waste generation that demands efficient size reduction solutions to manage increasing volumes of municipal and industrial waste. The market is further expanding due to the growing adoption of durable shredder blades made from advanced materials that enhance performance and minimize maintenance needs.

Key Highlights:

- The shredder blades industry size was recorded at USD 414.5 million in 2024.

- The market is projected to grow at a CAGR of 4.59% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 141.3 million.

- The carburizing steel segment garnered USD 137.8 million in revenue in 2024.

- The square segment is expected to reach USD 366.6 million by 2032.

- The single shaft segment is anticipated to witness the fastest CAGR of 4.61% over the forecast period.

- The plastic segment held a market share of 24.20% in 2024

- The waste management & recycling segment garnered USD 150.1 million in revenue in 2024

- Asia Pacific is anticipated to grow at a CAGR of 5.56% over the forecast period.

Major companies operating in the shredder blades market are KAMADUR industrial knives B.V, Saturn Machine Knives, FORDURA CHINA, Wanrooe Machinery Co., Ltd, Povelato srl, BKS Knives, Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd., ANDRITZ, Vecoplan AG, SSI Shredding Systems, ELDAN Recycling A/S, Harsons Ventures Pvt. Ltd, SHRED TOOLS INDIA, American Cutting Edge, MULTECH Machinery Corp.

Market Driver

Rising Waste Generation

A major driver in the shredder blades market is the rising generation of solid and electronic waste from households, businesses, and industrial operation. Governments and organizations face increasing pressure to manage these large volumes of solid and electronic waste efficiently to reduce the environmental impact of improper disposal and landfill accumulation.

Shredder blades enable the breakdown of bulky, mixed, and complex materials into smaller, recyclable fractions. This demand is prompting recycling and waste processing facilities to adopt high-performance blades that ensure durability, throughput, and efficiency in large-scale material recovery operations.

- In March 2024, the International Telecommunication Union (ITU) and the United Nations Institute for Training and Research (UNITAR) reported that global e-waste generation reached 62 million tonnes in 2022, growing five times faster than recycling efforts, with only 22.3% properly recycled. It is projected to hit 82 million tonnes by 2030, this surge is driving demand for high-performance shredder blades for efficient e-waste processing.

Market Challenge

Limited Standardization across Shredding Equipment

A key challenge in the shredder blades market is the limited standardization across shredding equipment. Shredder equipment manufacturers use varying blade sizes, shaft configurations, and mounting systems, which complicates compatibility and replacement. This lack of uniformity increases operational complexity for recycling and waste management facilities, requiring multiple blade types for different machines. It also raises inventory costs and prolongs maintenance downtime.

To address this challenge, market players are developing modular and adaptable blade designs that fit multiple shredder models, simplifying replacement and maintenance. Companies are standardizing mounting systems and shaft configurations to improve compatibility across different machines.

Additionally, some manufacturers are offering customizable blades that can be adjusted for specific applications such as metal recycling, tire shredding and plastic processing, reducing the need for multiple inventory types.

Market Trend

Modular Blade Designs for Easier Maintenance

A key trend in the shredder blades market is the adoption of modular blade designs to streamline maintenance and reduce operational downtime. Manufacturers are introducing segmented and bolt-on blade configurations that enable quick replacement of worn components without dismantling the entire system.

This design approach supports greater customization and extends blade life in high-throughput environments. This prompts operational efficiency across recycling and waste processing facilities by minimizing service interruptions, lowering maintenance costs, and improving overall system reliability.

Shredder Blades Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Carburizing Steel, Tool Steel, Case Hardened, Chromium Low Alloy Steel

|

|

By Design

|

Square, Hook

|

|

By Shaft

|

Single Shaft, Double Shaft, Others

|

|

By Application

|

Plastic, Rubber, Metals, Wood, E-waste, Paper & Cardboard, Others

|

|

By End User

|

Waste Management & Recycling, Food, Pharmaceuticals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material (Carburizing Steel, Tool Steel, Case Hardened, and Chromium Low Alloy Steel): The carburizing steel segment earned USD 137.8 million in 2024 due to its superior hardness, wear resistance, and cost-effectiveness for heavy-duty shredding applications.

- By Design (Square, and Hook): The square segment held 62.15% of the market in 2024, due to its robust geometry that offers better cutting force and durability across diverse materials.

- By Shaft (Single Shaft, Double Shaft, and Others): The single shaft segment is projected to reach USD 229.3 million by 2032, owing to its simple design, lower maintenance, and suitability for small to medium-scale shredding tasks.

- By Application (Plastic, Rubber, Metals, and Wood): The metals segment is anticipated to witness the fastest CAGR of 4.73% over the forecast period, due to rising demand for metal recycling and industrial scrap processing.

- By End User (Waste Management & Recycling, Food, Pharmaceuticals, and Others): The waste management & recycling segment garnered USD 150.1 million in revenue in 2024, due to growing municipal solid waste generation and the push for sustainable disposal practices.

Shredder Blades Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a shredder blades market share stood at around 34.09% in 2024, with a valuation of USD 141.3 million. This dominance is attributed to strong regulatory initiatives in the region that drive recycling infrastructure upgrades and promote the adoption of advanced waste processing technologies. Governments in this region are prioritizing higher recycling rates, prompting industries to adopt modern material processing systems, thereby driving market growth.

Moreover, manufacturers in the region are aligning their operations with national sustainability targets, leading to increased demand for high-performance shredder blades. These factors are creating a steady demand for high-performance shredder blades across recycling facilities in this region.

- The U.S. Environmental Protection Agency (EPA) has set a National Recycling Goal to increase the country’s recycling rate to 50% by 2030, with the objective of improving system efficiency and advancing circular economy initiatives.

Asia Pacific shredder blades industry is set to grow at a robust CAGR of 5.56% over the forecast period. The market is experiencing steady growth due to the increasing adoption of industrial recycling practices and the rising volume of municipal and commercial waste.

Governments across the region are implementing waste reduction policies and infrastructure upgrades to manage growing environmental concerns. Rapid urbanization and expanding manufacturing sectors are generating higher volumes of recyclable materials, thereby fueling demand for efficient shredding systems.

Additionally, rising investments in domestic recycling capabilities are increasing the need for durable, high-performance blades. Countries such as China, India, and Japan are driving regional demand, supported by regulatory initiatives and growing awareness of sustainable waste processing solutions. These factors are boosting demand for advanced shredding systems and contributing to the market growth in the Asia Pacific.

Regulatory Frameworks

- In the U.S., the United States Environmental Protection Agency (EPA) regulates the market by enforcing waste management and recycling standards. The EPA oversees environmental compliance, emissions control, and proper handling of hazardous materials processed by shredders. It ensures that shredding operations and equipment, including blades, meet pollution prevention and material recovery guidelines.

- In the UK, the Environment Agency (EA) regulates the market by overseeing waste processing standards and environmental permitting. The EA ensures that shredding operations comply with waste treatment and pollution control legislation. It monitors emissions, material handling, and operational safety standards for equipment fitted with shredder blades in recycling and recovery facilities.

- In China, the Ministry of Ecology and Environment (MEE) governs the market by enforcing regulations on industrial waste treatment and pollution control. The MEE oversees operational standards for recycling facilities using shredders, ensuring equipment like blades meets environmental safety norms. It mandates emission limits, hazardous material handling, and noise control measures.

Competitive Landscape

Major players in the shredder blades industry are focusing on advanced material engineering to enhance blade durability and cutting efficiency. Manufacturers are developing customized blade geometries tailored to specific applications such as plastic recycling, tire processing, and metal shredding.

They are integrating automation in production to improve precision and reduce variability in blade quality. Additionally, players are adopting modular blade assemblies that allow for quicker replacement and lower maintenance downtime.

Key Companies in Renewable Energy Storage Market:

- KAMADUR industrial knives B.V

- Saturn Machine Knives

- FORDURA CHINA

- Wanrooe Machinery Co., Ltd

- Povelato srl

- BKS Knives

- Nanjing Huaxin Machinery Tool Manufacturing Co., Ltd.

- ANDRITZ

- Vecoplan AG

- SSI Shredding Systems

- ELDAN Recycling A/S

- Harsons Ventures Pvt. Ltd

- SHRED TOOLS INDIA

- American Cutting Edge

- MULTECH Machinery Corp

Recent Developments (Product Launch)

- In October 2024, Fornnax launched the SR-MAX2500 dual-shaft primary shredder at IFAT India for municipal solid waste processing. Based on its SR-Series platform, the new model introduces enhanced engineering and design to align with rising demand for high-capacity shredding equipment in urban waste management.

which is