Market Definition

The market comprises hardware solutions that enable serial-based devices such as sensors, meters, barcode scanners, and industrial equipment, to connect to Ethernet or wireless networks. These servers convert serial data into IP-based communication, facilitating remote access, control, and data logging.

They are integral in legacy system integration, especially in the manufacturing, utilities, and transportation sectors. The scope includes both industrial-grade and commercial-grade servers, often embedded with protocol conversion, data buffering, and encryption capabilities. Applications span SCADA systems, industrial automation, point-of-sale systems, and medical equipment interfacing, where consistent and secure communication between devices is essential for operations.

Serial Device Server Market Overview

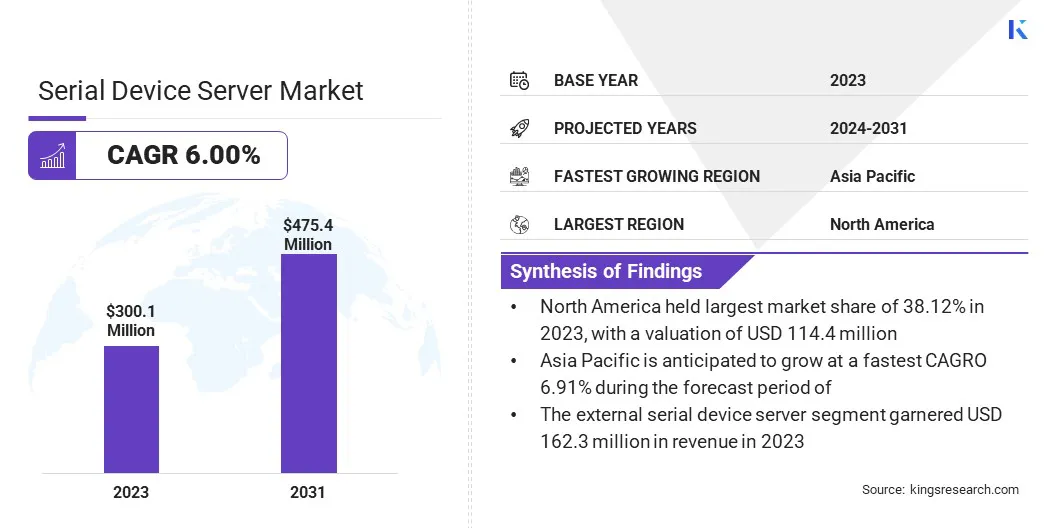

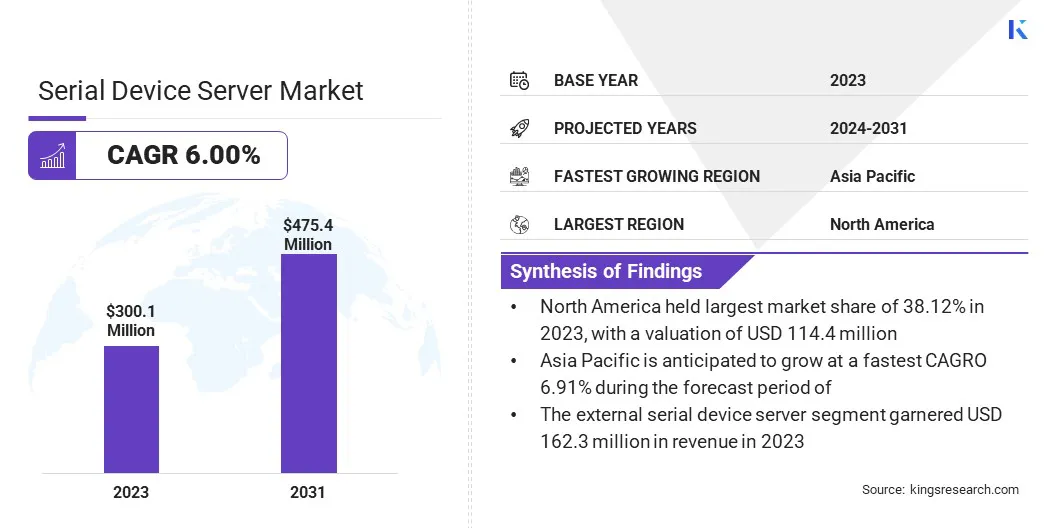

The global serial device server market size was valued at USD 300.1 million in 2023 and is projected to grow from USD 316.1 million in 2024 to USD 475.4 million by 2031, exhibiting a CAGR of 6.00% during the forecast period.

The market is primarily driven by the proliferation of Industrial IoT (IIoT) and the increasing adoption of automation across manufacturing, utilities, and logistics sectors.

These trends are creating a pressing need to connect legacy serial devices to modern IP networks for centralized monitoring and control. Serial device servers enable seamless integration, helping industries enhance operational efficiency and data accessibility without replacing existing infrastructure.

Major companies operating in the serial device server industry are Moxa Inc., Digi International Inc., Advantech Co., Ltd., Siemens, Lantronix Inc., Perle Systems, Sealevel Systems Inc., 3onedata Co., Ltd., Atop Technologies Inc., Kyland Technology Co., Ltd., OMEGA Engineering Inc., Westermo, Silex Technology America, Inc., Sena Technologies, Inc., and Tibbo Technology Inc.

The increasing adoption of automation across manufacturing, oil & gas, logistics, and utilities is significantly influencing the growth of the market. Industrial environments often include devices that operate on serial communication. Serial device servers enable the integration of such equipment into centralized automation systems, facilitating continuous data flow, system diagnostics, and real-time decision-making across facilities.

Key Highlights:

- The serial device server industry size was valued at USD 300.1 million in 2023.

- The market is projected to grow at a CAGR of 6.00% from 2024 to 2031.

- North America held a market share of 38.12% in 2023, with a valuation of USD 114.4 million.

- The 1-Port segment garnered USD 114.4 million in revenue in 2023.

- The external serial device server segment is expected to reach USD 259.1 million by 2031.

- The wired serial device server segment secured the largest revenue share of 68.09% in 2023.

- The energy & utilities segment is poised for a robust CAGR of 8.06% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.91% during the forecast period.

Market Driver

Proliferation of Industrial IoT (IIoT)

The growth of industrial IoT is creating demand for reliable device connectivity across sectors such as energy, transportation, and infrastructure. Serial device servers help enable IIoT implementations by converting serial data into IP formats.

This allows legacy devices to feed data into cloud platforms or SCADA systems, enhancing operational intelligence. Their role in bridging data gaps is vital to the expansion of IIoT networks, thus supporting the market.

- According to the Institute of Electrical and Electronics Engineers (IEEE), the number of Internet of Things (IoT) connections is projected to surpass 23 billion by 2025, up from 15.1 billion in 2021 . Global supply chains are positioned to benefit significantly from the expansion of IoT in operations. IoT devices introduce numerous interaction points across the supply chain, enabling advanced data collection, improved factory automation, real-time GPS tracking of shipments, and more seamless communication between machines and human operators.

Market Challenge

Integration with Diverse Legacy Systems

A significant challenge limiting the growth of the serial device server market is the complexity of integrating with a wide range of legacy industrial equipment that uses varied and often proprietary serial communication protocols. These inconsistencies make standardization difficult and increase deployment costs.

Companies are focusing on developing highly adaptable serial device servers that support multi-protocol conversions, intelligent configuration tools, and enhanced compatibility with older systems. Additionally, vendors are offering remote management platforms and tailored technical support to simplify integration, reduce downtime, and ensure seamless connectivity across heterogeneous industrial environments.

Market Trend

Demand for Simplified Device Management and Deployment

The increasing complexity of industrial networks is creating a strong need for solutions that streamline device setup, configuration, and management. Organizations are seeking tools that reduce manual intervention and minimize deployment time for serial-connected devices.

This trend is driving innovation in centralized device management platforms and plug-and-play hardware design. Enhanced manageability supports scalability, reduces operational downtime, and improves network reliability, thereby accelerating the growth of the market across sectors with expanding infrastructure.

- In March 2025, Digi International unveiled significant enhancements to its product lineup, introducing an upgraded Digi Navigator and the new Digi Connect EZ with Power over Ethernet (PoE). The updated Digi Navigator offers faster device detection, intelligent prompts for driver installation, and enhanced security settings, facilitating streamlined deployment and management of both modern and legacy Digi hardware. The Digi Connect EZ with PoE simplifies networked serial communications by delivering power and data over a single Ethernet cable, reducing installation complexity and improving power efficiency.

Serial Device Server Market Report Snapshot

|

Segmentation

|

Details

|

|

By Port Type

|

1-Port, 2-Port, 4-Port, 8-Port and Above

|

|

By Device Type

|

External Serial Device Server, Embedded Serial Device Server, Wireless Serial Device Server

|

|

By Connectivity

|

Wired Serial Device Server, Wireless Serial Device Server

|

|

By Industry Vertical

|

Industrial Automation, Healthcare, Transportation & Logistics, Energy & Utilities, Telecommunications & IT, Retail & POS Systems, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Port Type (1-Port, 2-Port, 4-Port, 8-Port and Above): The 1-Port segment earned USD 114.4 million in 2023, due to its widespread use in applications requiring simple, cost-effective serial-to-Ethernet connectivity for individual legacy devices in industrial and commercial environments.

- By Device Type (External Serial Device Server, Embedded Serial Device Server, Wireless Serial Device Server): The external serial device server segment held 54.09% share of the market in 2023, due to its flexibility in deployment, ease of integration with existing equipment, and cost-effectiveness for retrofitting legacy systems without internal hardware modifications.

- By Connectivity (Wired Serial Device Server, Wireless Serial Device Server): The wired serial device server segment is projected to reach USD 319.7 million by 2031, owing to its superior reliability, stable data transmission, and widespread adoption in industrial environments where consistent and secure connectivity is critical.

- By Industry Vertical (Industrial Automation, Healthcare, Transportation & Logistics, Energy & Utilities, Telecommunications & IT, Retail & POS Systems, Others): The energy & utilities segment is poised for significant growth at a CAGR of 8.06% through the forecast period, due to its extensive reliance on legacy infrastructure that requires reliable serial-to-network connectivity for real-time monitoring, control, and automation across distributed assets.

Serial Device Server Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 38.12% share of the serial device server market in 2023, with a valuation of USD 114.4 million. The development of advanced smart grid infrastructure by utility providers across the U.S. and Canada is accelerating the demand for serial-to-IP connectivity. Substation equipment, reclosers, and remote terminal units (RTUs) commonly use serial communication. Serial device servers allow these legacy assets to connect to centralized grid control systems, supporting real-time diagnostics and outage response.

Additionally, North America has a high concentration of SCADA (Supervisory Control and Data Acquisition) systems used in sectors like water treatment, oil & gas, and power generation. Many field devices integrated into these systems still rely on serial ports. Serial device servers are essential for enabling these devices to transmit data over secure IP networks, supporting both operational efficiency and regulatory compliance.

The serial device server industry in Asia Pacific is poised for significant growth at a robust CAGR of 6.91% over the forecast period. Asia Pacific is a global center for OEM (Original Equipment Manufacturer) and EMS (Electronics Manufacturing Services) operations.

Facilities in this sector use diverse equipment from multiple vendors, often relying on serial ports, supporting the growth of the market in the region. Serial device servers provide compatibility across equipment types and simplify centralized management, which is critical in large-scale, high-speed production environments.

- In 2024, the Association for Packaging and Processing Technologies reported that Asia Pacific led the global packaging machinery market in 2022 , accounting for approximately 36% of the total global demand. The region is also projected to record the highest compound annual growth rate (CAGR) of 6% between 2023 and 2027.

Furthermore, in countries such as Australia, Malaysia, and Indonesia, energy, mining, and water projects are expanding into remote areas. These sites often rely on rugged industrial equipment with serial interfaces, boosting the market. Serial device servers with wireless capabilities and ruggedized design are being deployed to enable real-time monitoring and control in environments with limited network infrastructure.

Regulatory Frameworks

- In the U.S., electronic devices, including serial device servers, must comply with regulations set by the Federal Communications Commission (FCC). The FCC's Part 15 rules govern unintentional radiators to ensure that devices do not cause harmful interference and can tolerate a certain level of interference from other devices. Compliance is typically demonstrated through testing, and compliant devices often bear the FCC mark.

- In the European Economic Area (EEA), serial device servers must carry the CE marking, indicating conformity with relevant EU directives. The CE marking encompasses compliance with directives related to safety, EMC, and environmental protection. Manufacturers must conduct conformity assessments and maintain technical documentation to affix the CE mark.

- China mandates the China Compulsory Certification (CCC) for various products, including electronic devices like serial device servers. The CCC mark signifies that a product meets Chinese safety and EMC standards. The certification process involves product testing and factory inspections conducted by authorized Chinese certification bodies.

- In Japan, serial device servers must comply with the Radio Law and the Telecommunications Business Law, regulated by the Ministry of Internal Affairs and Communications (MIC). Products must obtain the Technical Conformity Certification, often referred to as the TELEC certification, to demonstrate compliance with technical standards for radio equipment.

Competitive Landscape:

Market players are increasingly adopting strategies centered on the development of next-generation serial device servers to meet the rising demands of data-intensive industrial and networking environments. These efforts focus on enhancing processing capabilities, scalability, and secure connectivity to support advanced applications in edge computing, AI integration, and industrial automation.

Key vendors are positioning themselves to address evolving customer requirements by investing in high-performance architectures and tailored solutions. This strategic focus is contributing significantly to the growth of the serial device server market, particularly as industries transition toward intelligent, connected infrastructure.

- In March 2025, Advantech introduced its next-generation server and network appliance solutions powered by the latest AMD EPYC Embedded 9005 Series processors. With this integration, the company is advancing the capabilities of edge computing and AI, offering robust platforms suited for 5G edge cloud infrastructure, AI-driven workloads, ML applications, and heightened data security requirements.

List of Key Companies in Serial Device Server Market:

- Moxa Inc.

- Digi International Inc.

- Advantech Co., Ltd.

- Siemens

- Lantronix Inc.

- Perle Systems

- Sealevel Systems Inc.

- 3onedata Co., Ltd.

- Atop Technologies Inc.

- Kyland Technology Co., Ltd.

- OMEGA Engineering Inc.

- Westermo

- Silex Technology America, Inc.

- Sena Technologies, Inc.

- Tibbo Technology Inc.

Recent Developments (Product Launch)

- In April 2024, Advantech launched the UBX-510SZ and UBX-510SL mini servers, designed to transform retail store operations and edge AI deployments. Equipped with Intel Xeon or 10th, 12th, and 13th generation Core i3/i5/i7 processors, the UBX-510 series is compatible with Windows Server OS, enabling retailers to optimize store management through improved computing power and application support.