Semiconductor Timing IC Market Size

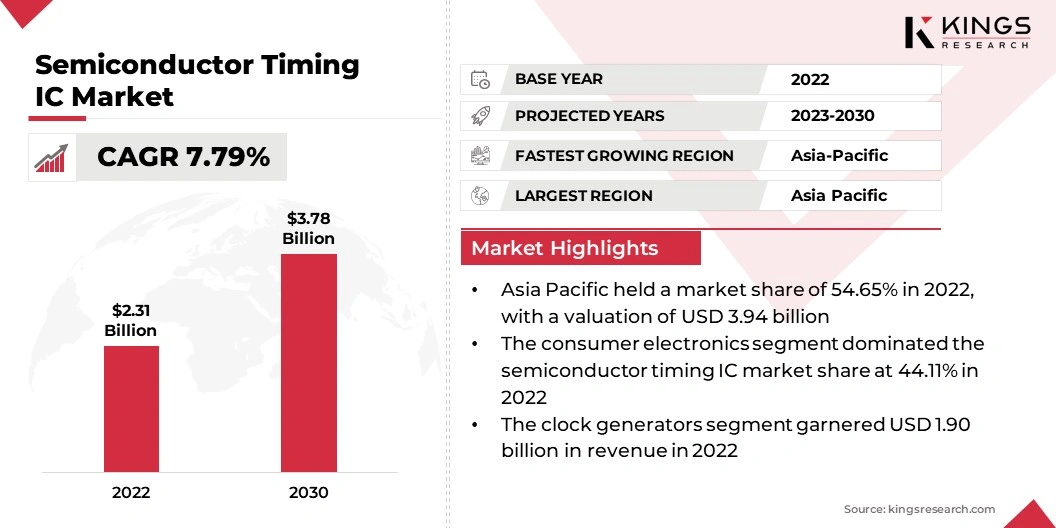

The global Semiconductor Timing IC Market size was valued at USD 7.21 billion in 2022 and is projected to reach USD 12.62 billion by 2030, growing at a CAGR of 7.79% from 2023 to 2030. In the scope of work, the report includes products offered by companies such as Integrated DNA Technologies, Inc., Silicon Laboratories, Microsemi, Texas Instruments Incorporated, Analog Devices, Inc., Infineon Technologies AG, Renesas Electronics Corporation., Semiconductor Components Industries, LLC, Diodes Incorporated, ROHM CO., LTD. and Others.

The market growth of semiconductor timing IC is being augmented by the advancements in semiconductor materials and processes leading to the production of high-performance ICs. Moreover, the adoption of cloud computing and big data analytics in the semiconductor industry as a whole is also fueling market growth for timing ICs. These trends indicate a positive outlook for the semiconductor timing IC industry in the foreseeable future.

The ongoing shortage of semiconductor materials and components could pose a risk to the growth of the semiconductor timing IC market. This shortage, caused by the pandemic, has disrupted the entire semiconductor industry, including timing ICs. Supply chain disruptions and higher costs resulting from the limited availability of semiconductors could restrict market growth.

Analyst’s Review

The semiconductor timing IC industry is growing due to several factors. These include the increasing demand for timing ICs in the automotive and telecommunications industries, as well as in consumer electronics such as smartphones and tablets. The rise of the Internet of Things (IoT) and other connected technologies is also driving growth in the industry, as these applications typically require high-precision timing solutions.

Additionally, the development of advanced semiconductor materials and processes is enabling the production of higher-performance timing ICs that can meet the requirements of these applications. The increasing adoption of cloud computing and big data analytics is also driving growth in the semiconductor industry as a whole. These trends are expected to continue in the coming years, which suggests that the semiconductor timing IC industry will continue to grow as well.

Market Definition

Semiconductors are materials that exhibit low resistance to the flow of electrical current, particularly in one direction. They are employed in basic electronic components, including diodes, transistors, and photovoltaic cells. When integrated into programmable electronic systems functioning as timers, they are specified as semiconductor timing integrated circuits.

They generate, manipulate, distribute, or control electronic system timing signals. These integrated circuits may function as a single or multi-component system and may operate as amplifiers, oscillators, timers, counters, logic gates, computer and microcontrollers, and microprocessors. They are the fundamental building blocks of modern electronic devices. The increasing popularity of electric vehicles has boosted demand for semiconductor timing integrated circuits, driving their growth in the global market.

Market Dynamics

The semiconductor timing IC market may face competition from alternative timing solutions, such as quartz crystal oscillators, which could limit the industry's growth. Quartz crystal oscillators have been a popular timing solution for decades and are widely used in a range of electronic applications. Unlike semiconductor timing ICs, which are programmable and can be used for a variety of functions, quartz crystal oscillators have a fixed frequency output which is determined by the cut and size of the crystal used in the circuit. They also have lower power requirements and can be more accurate than timing ICs.

- One example where quartz crystal oscillators have been historically preferred over timing ICs is in the field of aviation. Quartz crystal oscillators are considered the industry standard for precise timing in aviation due to their high stability and accuracy. While semiconductor timing ICs have made inroads in this field these are the factor affecting the market growth of semiconductor timing IC.

The market for semiconductor timing ICs is expected to experience significant growth. These circuits are critical components in a variety of applications, including wearables, IoT devices, and communication systems. For example, in the automotive industry, timing ICs are used in engine management systems, safety features, and infotainment systems, among other applications. They are also integral components in medical devices, aerospace equipment, and military applications. With their wide range of applications and importance in modern technology, the semiconductor timing IC market is set to expand considerably in the coming years.

Segmentation Analysis

The global market is segmented based on application, product, and geography.

By Application

Based on the application, the market is categorized into consumer electronics, network, and telecom, automotive, and others. the consumer electronics segment dominated the semiconductor timing IC market share at 44.11% in 2022. The vital role played by semiconductor timing integrated circuits (ICs) in managing and controlling electric current flow is the primary reason why they are extensively used in consumer electronics. These ICs are highly versatile and can be programmed to support a diverse range of functions, including power management, timing, and counting, among others.

They feature prominently in various applications, including wearables, smartphones, tablets, fitness devices, and communication systems. With the increase in demand for these electronic devices, the market for semiconductor timing ICs is on an upward trajectory.

By Product

Based on the product, the market is segmented into clock generators, real-time clocks, multiple outputs, clock generators, crystal oscillators, synthesizers, and jitter attenuators. The clock generators segment generated the highest revenue of USD 1.9 billion in 2022. Clock generators are essential components in semiconductor timing integrated circuits, responsible for producing stable and precise signals that synchronize circuit functionality effectively.

They are commonly used to guarantee optimal operation in devices featuring digital signal processing or communication systems and generate pulses with specific frequencies that meet the requirements of various applications. For instance, in a digital audio device, a well-calibrated clock generator produces precise clock pulses at specific frequencies, ensuring accurate digital signal conversion.

Semiconductor Timing IC Market Regional Analysis

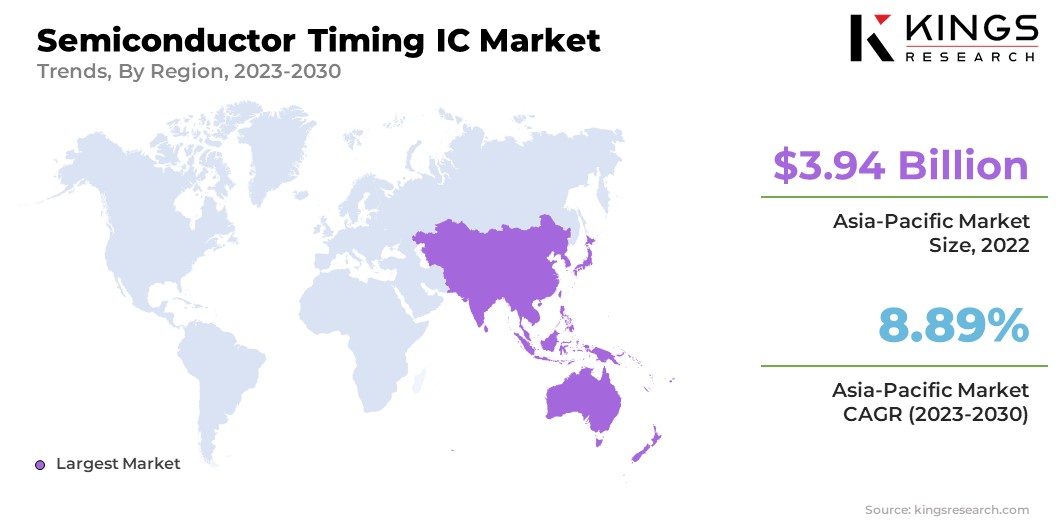

Based on regional analysis, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia Pacific Semiconductor Timing IC Market share stood around 54.65% in 2023 in the global market, with a valuation of USD 3.94 billion. The Asia Pacific region is the leading consumer of integrated circuits globally. However, the utilization of semiconductor timing integrated circuits is more widespread in the Asia Pacific region than in other parts of the world which is expected to boost the market growth.

- Additionally, China is one of the major players in the Asia Pacific region accounting for a market share of 43.60% in 2022 and is growing at a CAGR of 9.92% from 2023 to 2030.

Competitive Landscape

The semiconductor timing IC market report will provide valuable insight with an emphasis on the consolidated nature of the global market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions. Expansion & investments involve a range of strategic initiatives including investments in R&D activities, new manufacturing facilities, and supply chain optimization.

List of Key Companies in Semiconductor Timing IC Market

- Integrated DNA Technologies, Inc.

- Silicon Laboratories

- Microsemi

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation.

- Semiconductor Components Industries, LLC

- Diodes Incorporated

- ROHM CO., LTD.

Key Industry Developments

- May 2023 (Expansion): Bosch Group, a German multinational corporation, acquired TSI Semiconductors, a chip manufacturing company in California, and plans to invest around USD 1.5 billion in expanding the production of silicon carbide (SiC) chips utilized in Electric Vehicles (EVs) in the United States

- April 2023 (Act Pass): The European Union's governing body has come to a consensus to approve the Chips Act, amounting to USD 47 billion in funds, which has generated investments of USD 100 billion from private and public sources since its initial announcement.

The Global Semiconductor Timing IC Market is segmented as:

By Application

- Consumer Electronics

- Network and Telecom

- Automotive

- Others

By Product

- Clock Generators

- Real Time Clock

- Multiple Output Clock Generators

- Crystal Oscillators

- Synthesizers

- Jitter Attenuators

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America