Market Definition

The market encompasses tools and systems that are used for testing semiconductor devices for performance, functionality, and reliability. It includes automated test equipment (ATE), wafer probing systems, and burn-in equipment. The market serves applications across consumer electronics, automotive, telecommunications, and industrial sectors.

It covers services for testing integrated circuits, system-on-chip devices, and memory chips, ensuring quality assurance, yield optimization, and compliance with technical standards. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Semiconductor Test Equipment Market Overview

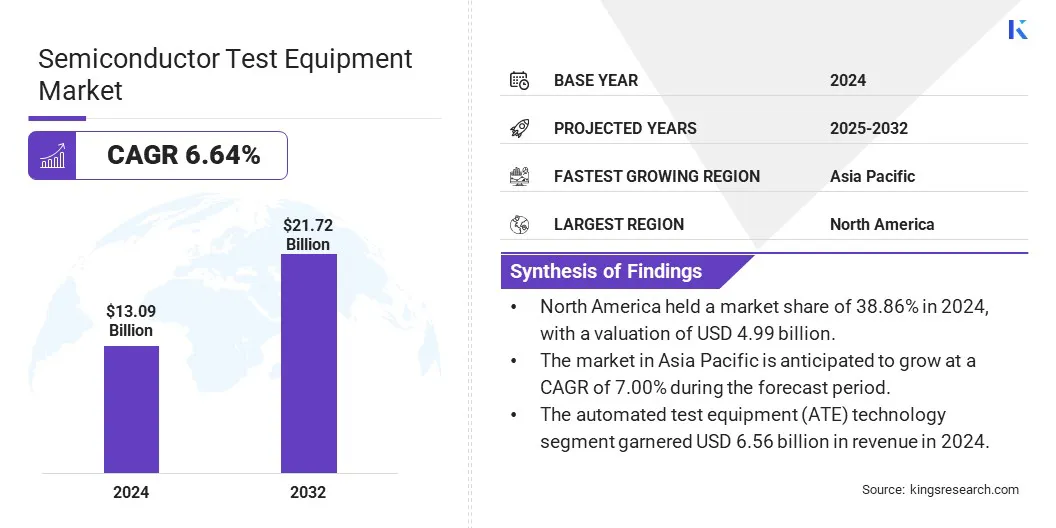

The global semiconductor test equipment market size was valued at USD 13.09 billion in 2024 and is projected to grow from USD 13.85 billion in 2025 to USD 21.72 billion by 2032, exhibiting a CAGR of 6.64% during the forecast period. The rising demand for advanced ADAS, infotainment, powertrain, and wide-bandgap semiconductors drives the growth of the market.

Major companies operating in the semiconductor test equipment industry are ADVANTEST CORPORATION, Hitachi High-Tech India Private Limited, Teradyne Inc., MICRONICS JAPAN CO., LTD., SPEA S.p.A., Nemko, Microtest S.p.A., Cohu, Inc, Marvin Test Solutions, Inc., Astronics Corporation., Shibasoku Co.,Ltd., FormFactor., NATIONAL INSTRUMENTS CORP., Aemulus Corporation Sdn. Bhd., and Wentworth Laboratories, Inc.

The growing adoption of advanced packaging technologies, such as 3D ICs and the system-in-package (SiP) technology, accelerates the demand for specialized semiconductor test equipment. These innovations increase interconnect density and functional integration, which requires highly accurate testing to identify defects and ensure signal integrity.

Consequently, semiconductor manufacturers are investing in cutting-edge test solutions to maintain yield efficiency and meet evolving performance benchmarks.

Key Highlights:

- The semiconductor test equipment market size was valued at USD 13.09 billion in 2024.

- The market is projected to grow at a CAGR of 6.64% from 2025 to 2032.

- North America held a market share of 38.86% in 2024, with a valuation of USD 4.99 billion.

- The automated test equipment (ATE) technology segment garnered USD 6.56 billion in revenue in 2024.

- The analog & digital ICS segment is expected to reach USD 7.08 billion by 2032.

- The package testing segment secured the largest revenue share of 57.43% in 2024.

- The telecom & industrial segment is poised for a robust CAGR of 7.14% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.00% during the forecast period.

Market Driver

Rising Adoption of Automotive Electronics

The rise in demand for advanced driver-assistance systems (ADAS), infotainment, and powertrain control units in vehicles is accelerating the need for high-performance semiconductor devices.

This significantly boosts the market, as manufacturers require precise and efficient testing solutions to ensure reliability and compliance. The automotive sector’s digital transformation drives innovation and volume growth in semiconductor testing technologies.

- In March 2025, Honda Cars India Ltd. (HCIL) reached a major milestone, with 50,000 ADAS-equipped Honda vehicles in operation across India.

Market Challenge

Navigating Complexity and Cost Pressures in Semiconductor Test Equipment

The semiconductor test equipment market faces significant challenges, due to increasing device complexity and shrinking node sizes, which demand higher precision and faster testing cycles. Additionally, increasing production costs and the need for advanced automation intensify the workload.

Manufacturers are investing heavily in research and development to develop innovative test solutions that incorporate AI-driven analytics, enhanced parallel testing capabilities, and modular architectures. These advancements enable improved throughput and accuracy while reducing the time-to-market.

Strategic collaborations and the integration of Industry 4.0 technologies further support scalability and affordability, positioning companies to meet evolving market demands effectively.

Market Trend

Advanced Testing in Wide-bandgap Semiconductor Manufacturing

The market is shifting toward the widespread integration of advanced testing solutions tailored for wide-bandgap semiconductor manufacturing.

This shift reflects the growing focus on precision, efficiency, and yield improvement in testing processes. The trend underscores industry prioritization of validation methods for supporting the expanding deployment of high-performance and wide-bandgap semiconductor devices.

- In December 2024, Advantest Corporation introduced the CREA MT Series testers, featuring the HA1100 die prober, designed to optimize yields of wide-bandgap devices. The system utilizes Programmable Contact Interface (PCI) technology, which lowers the risk of damage and reduces equipment downtime.

Semiconductor Test Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Equipment Type

|

Automated Test Equipment (ATE), Burn-In Test Equipment, Wafer Probers, System-Level Test Equipment, Others

|

|

By Device Type

|

Memory Chips, Microcontrollers, Analog & Digital ICs, Power Devices & Sensors

|

|

By Application

|

Wafer Testing, Package Testing, Final Test, Others

|

|

By End User

|

Consumer Electronics, Automotive, Telecom & Industrial, Aerospace & Healthcare

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Equipment Type (Automated Test Equipment (ATE), Burn-In Test Equipment, Wafer Probers, System-Level Test Equipment, and Others): The automated test equipment (ATE) segment earned USD 6.56 billion in 2024, owing to its critical role in enabling high-throughput and the accurate and cost-effective testing of complex semiconductor devices, which meet the growing demand for quality and reliability.

- By Device Type (Memory Chips, Microcontrollers, Analog & Digital ICs, and Power Devices & Sensors): The power devices & sensors segment held 32.45% share of the market in 2024, due to the increasing adoption of power-efficient technologies and IoT applications that drive high demand for precise and reliable testing of critical components.

- By Application (Wafer Testing, Package Testing, Final Test, and Others): The package testing segment is projected to reach USD 12.47 billion by 2032, on account of the growing need for quality assurance and validation of complex semiconductor packages in advanced electronic devices.

- By End User (Consumer Electronics, Automotive, Telecom & Industrial and Aerospace & Healthcare): The telecom & industrial segment earned USD 4.20 billion in 2024, due to the rising demand for high-performance and durable semiconductor components driven by the expansion of 5G infrastructure and industrial automation.

Semiconductor Test Equipment Market Regional Analysis

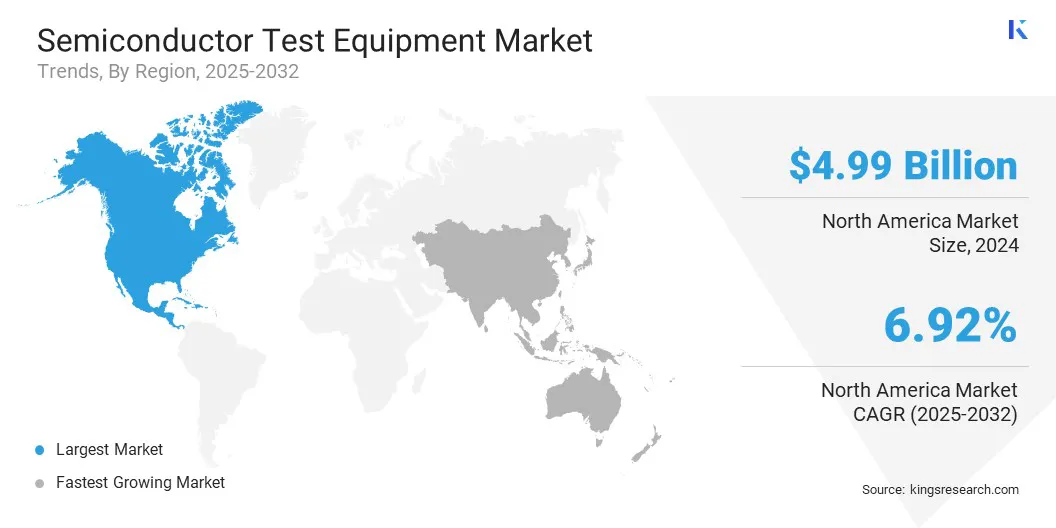

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 38.86% share of the semiconductor test equipment market in 2024, with a valuation of USD 4.99 billion. This dominance is attributed to the rapid expansion of 5G infrastructure and strong investments in advanced communication technologies. The presence of leading semiconductor manufacturers and robust R&D activities is further accelerating regional growth.

Additionally, the increasing demand for high-performance computing and IoT applications drives the need for advanced testing solutions. Favorable government initiatives and a mature technological ecosystem position North America as the primary hub for semiconductor innovation and testing.

- According to 5G Americas.org, North America is at the forefront of 5G adoption, with 289 million connections, which now cover 77% of the region’s population. Meanwhile, the growth of the Internet of Things (IoT) remains strong, with 438 million new connections added in 2024, pushing the global total to a remarkable 3.6 billion.

The semiconductor test equipment industry in Asia Pacific is poised for significant growth at a robust CAGR of 7.00% during the forecast period. This growth is attributed to the rapid expansion of semiconductor fabrication facilities and robust demand across consumer electronics and automotive sectors.

The region's growth is further supported by strategic government initiatives, increased capital expenditure in advanced manufacturing, and the increase in adoption of technologies such as 5G and AI. These factors drive substantial investments in high-precision and automated testing solutions, which reinforce the region’s accelerated market growth.

Regulatory Frameworks

- In the United States, the Export Administration Regulations (EAR) govern the export, re-export, and transfer of semiconductor test equipment that may involve sensitive or dual-use technologies. Compliance with these regulations is mandatory, and export licenses may be required when dealing with certain countries or entities identified as national security concerns, including China, Russia, and Iran.

- In Japan, the export of advanced semiconductor test equipment and related technologies is regulated under the Foreign Exchange and Foreign Trade Act (FEFTA). This legislation imposes stringent export controls, especially for countries under international sanctions or where there is a risk that the exported items could be used for military applications. The framework is designed to uphold national security and comply with international non-proliferation commitments.

Competitive Landscape

The competitive landscape of the semiconductor test equipment market is characterized by strategic partnerships and collaborations among leading market participants. These companies focus on technology integration, expanding product portfolios, and enhancing service capabilities to drive innovation and meet evolving customer demands.

Collaborative efforts also aim to strengthen supply chains, optimize cost structures, and accelerate time-to-market. Such collaborations are critical in maintaining a competitive advantage and supporting sustainable growth in the rapidly advancing market.

- In January 2025, Teradyne, Inc. partnered with Infineon Technologies AG to advance power semiconductor testing. Teradyne will acquire part of Infineon’s Automated Test Equipment (ATE) team in Regensburg. This partnership enhances Teradyne’s roadmap while Infineon benefits from ongoing support, flexibility, and Teradyne’s scale.

List of Key Companies in Semiconductor Test Equipment Market:

- ADVANTEST CORPORATION

- Hitachi High-Tech India Private Limited

- Teradyne Inc.

- MICRONICS JAPAN CO., LTD.

- SPEA S.p.A.

- Nemko

- Microtest S.p.A.

- Cohu, Inc

- Marvin Test Solutions, Inc.

- Astronics Corporation.

- Shibasoku Co.,Ltd.

- FormFactor.

- NATIONAL INSTRUMENTS CORP.

- Aemulus Corporation Sdn. Bhd.

- Wentworth Laboratories, Inc.

Recent Developments (M&A/Product Launch)

- In November 2024, the Microtest Group obtained approval from the U.S. government to acquire Focused Test, a company that specializes in silicon carbide (SiC) and gallium nitride (GaN) microchip testing. This acquisition enhanced Microtest’s expertise in advanced semiconductor testing and facilitated its growth into the North and Central American markets.

- In July 2024, Boston Semi Equipment introduced a new test site module for its Zeus gravity feed test handler for supporting high-voltage and partial discharge applications. Its micro-chamber design enables isolation testing up to 24kV peak and is compatible with the existing Zeus high-voltage handlers through a field upgrade kit.

- In March 2024, Hitachi High-Tech Corporation launched the LS9300AD, a system for inspecting both sides of non-patterned wafers. It combines dark-field laser scattering and the new DIC technology for detecting low-aspect defects. The system reduces inspection costs and improves yields with high sensitivity and high-throughput wafer inspection capabilities.