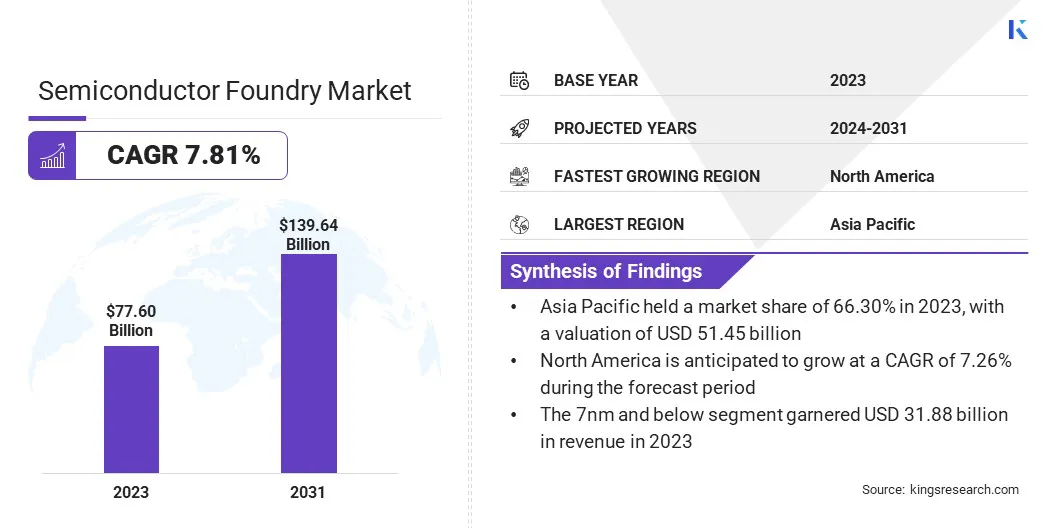

Semiconductor Foundry Market Size

The global Semiconductor Foundry Market size was valued at USD 77.60 billion in 2023 and is projected to grow from USD 82.49 billion in 2024 to USD 139.64 billion by 2031, exhibiting a CAGR of 7.81% during the forecast period. The rising proliferation of consumer electronics, particularly smartphones, laptops, and tablets, is driving the growth of the market.

In the scope of work, the report includes services offered by companies such as Taiwan Semiconductor Manufacturing Company, Samsung Electronics Co., Ltd., GlobalFoundries Inc., United Microelectronics Corporation, SMIC, Hua Hong Semiconductor Limited, Tower Semiconductor Ltd., Powerchip Semiconductor Manufacturing Corporation, Vanguard International Semiconductor Corporation, DB HiTek Co., Ltd, and others.

Moreover, the global rollout of 5G technology is bolstering the expansion of the semiconductor foundry market. The demand for faster data transfer and low-latency communication requires advanced semiconductor solutions. Foundries are tasked with developing chips that support high-speed 5G networks and infrastructure.

Additionally, the integration of 5G into various applications, such as IoT, autonomous vehicles, and smart cities, highlights the pressing need for sophisticated semiconductor components.

- According to a March 2024 report by 5G Americas global 5G connections surged 1.76 billionin 2023, reflecting a 66% increase with an addition of 700 million connections. Additionally, global IoT subscriptions reached 3.1 billion, while smartphone subscriptions totaled 6.6 billion in 2023. Projections indicate that by 2026, IoT subscriptions are expected to reach 4.5 billion and smartphone subscriptionsto 7.4 billion

A semiconductor foundry, also known as a chip foundry, is a specialized manufacturing facility dedicated to producing integrated circuits (ICs) and semiconductor devices based on designs provided by external clients. Foundries handle the fabrication of silicon wafers and the intricate processes required to create transistors and other components.

They cater to fabless semiconductor companies, which design chip design and outsource production, as well as integrated device manufacturers (IDMs) that both design and manufacture their own chips. Foundries play a crucial role in the global electronics industry, fostering innovation and meeting the growing demand for advanced semiconductor technology.

Analyst’s Review

Semiconductor foundries are increasingly integrating cutting-edge technologies such as extreme ultraviolet (EUV) lithography into their production processes, which is essential for manufacturing advanced semiconductor devices.

EUV lithography enables the creation of smaller, more intricate chip features, a critical requirement for achieving higher performance and lower power consumption in modern electronics. By adopting EUV, foundries enhance their ability to produce next-generation chips with superior precision and efficiency.

- In April 2024, Intel Foundry installed the industry's first commercial High Numerical Aperture (High NA) Extreme Ultraviolet (EUV) lithography scanner at its R&D facility in Hillsboro, Oregon. The TWINSCAN EXE:5000 High NA EUV tool, provided by lithography leader ASML, is expected to enable Intel to achieve unparalleled scalability and precision in chip manufacturing. This advanced technology allows Intel to manufacture chips with cutting-edge capabilities and features, which are crucial forfostering innovation in emerging technologies such as AI.

Moreover, the development of emerging technologies, including quantum computing and edge computing, is significantly contributing to the expansion of the semiconductor foundry market. Quantum computing necessitates specialized chips to handle complex computations, while edge computing requires high-performance processors for real-time data processing.

Semiconductor foundries are essential in manufacturing the advanced chips needed for these innovative technologies, thereby supporting market growth.

Semiconductor Foundry Market Growth Factors

Government initiatives and investments in semiconductor manufacturing are crucial factors bolstering market growth. Countries are increasingly recognizing the strategic importance of domestic semiconductor production and are providing financial incentives and support.

Initiatives such as the CHIPS Act in the U.S. and similar programs in Europe and Asia are aimed at boosting local manufacturing capabilities. These investments help reduce reliance on foreign suppliers and promote the development of new foundry facilities.

- In May 2024, the Chinese government announced the launch of its third state-backed investment fund to expand the semiconductor industry. This fund, with a capital of USD 47.5 billion, was detailed in a filing with a government-operated company registry.

Moreover, the growth of data centers and cloud computing services is supporting the development of the semiconductor foundry market. Data centers require high-performance chips to manage large volumes of data and support cloud-based applications. The rise in digital services and cloud infrastructure increases the demand for semiconductors, thereby boosting market growth.

However, geopolitical tensions and trade restrictions pose a significant challenge to the development of the market. Trade disputes, export controls, and tariffs disrupt global supply chains, limit access to essential technologies, and create market uncertainties. These issues can impede the smooth flow of materials and technology required for semiconductor manufacturing.

To address these challenges and sustain market growth, companies are diversifying their supply chains to reduce dependency on any single region or supplier, thereby mitigating the impact of trade disruptions. They are further investing in local production capabilities and establishing regional manufacturing hubs to enhance supply chain resilience.

By implementing these measures, foundries aim to minimize the adverse effects of geopolitical tensions and ensure continued expansion of the market.

Semiconductor Foundry Industry Trends

The automotive sector's shift toward electric vehicles (EVs) and autonomous driving systems significantly impacts the semiconductor foundry market. Modern vehicles require an array of semiconductor components, including sensors, processors, and power management ICs.

The development of EVs and advanced driver-assistance systems (ADAS) creates demand for chips that ensure energy efficiency, safety, and performance. The growing emphasis on smart and connected vehicles further highlights the need for specialized semiconductor solutions.

- According to the International Energy Agency's Global EV Outlook 2024, nearly 14 million new electric vehicles were registered worldwide in 2023, increasing the total to 40 million. This represents a 35% year-on-year increase, with 2023 sales surpassing those of 2022 by 3.5 million vehicles.

Additionally, the semiconductor industry’s transition to miniaturization and advanced process technology is generating a substantial demand for foundries. As semiconductor devices become smaller and grow more complex, the need for cutting-edge manufacturing processes increases.

Advancements in process nodes, such as 7nm, 5nm, and 3nm technologies, enable the production of chips with higher performance and lower power consumption. Semiconductor foundries invest in developing and implementing these advanced technologies to meet the evolving demands of various applications.

Segmentation Analysis

The global market has been segmented based on technology node, foundry, application, and geography.

By Technology Node

Based on technology node, the market has been segmented into 7nm and below, 10nm–20nm, 20nm–45nm, and 45nm and above. The 7nm and below segment led the semiconductor foundry market in 2023, reaching a valuation of USD 31.88 billion. With the growing demand for high-performance computing, artificial intelligence, and advanced mobile devices, semiconductor manufacturers are increasingly focusing on these smaller nodes.

Chips produced at 7nm and below offer higher transistor density, which leads to faster processing speeds and reduced power consumption. This is crucial for meeting the performance requirements of modern application such as AI accelerators and 5G infrastructure, thereby boosting segmental growth.

By Foundry

Based on foundry, the semiconductor foundry industry has been bifurcated into pure play foundry and IDMs. The pure play foundry segment secured the largest revenue share of 73.89% in 2023. Pure-play foundries specialize exclusively in semiconductor manufacturing, without engaging in design.

This business model allows them to focus solely on optimizing their manufacturing processes, achieving high levels of efficiency, and investing in cutting-edge technologies. By concentrating on fabrication, pure-play foundries can scale production rapidly and cater to a broad range of clients, including fabless semiconductor companies that design chips without manufacturing them.

By Application

Based on application, the market has been divided into telecommunication, automotive, consumer electronics, industrial, healthcare, and others. The automotive segment is set to witness significant growth at a robust CAGR of 10.46% through the forecast period.

Modern vehicles increasingly rely on advanced semiconductor components for various applications, including electric powertrains, autonomous driving systems, and in-car entertainment. The shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) requires sophisticated chips for battery management, sensor fusion, and real-time processing. Additionally, the transition to connected vehicles and smart automotive technologies increases the demand for high-performance semiconductors.

Semiconductor Foundry Market Regional Analysis

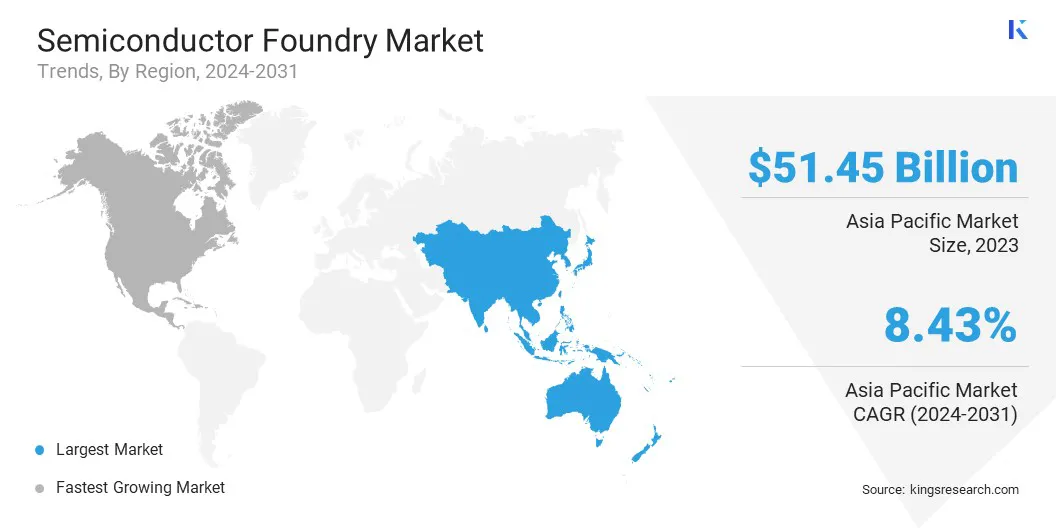

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific semiconductor foundry market accounted for a share of around 66.30% in 2023, with a valuation of USD 51.45 billion. The Asia-Pacific region, particularly Taiwan, South Korea, and China, is home to some of the world’s largest and most advanced semiconductor manufacturers, including industry leaders such as TSMC, Samsung, and SMIC. Their dominance in semiconductor manufacturing positions the Asia-Pacific region as a leading region for semiconductor foundries.

- According to the Asian Development Bank, East Asia and Southeast Asia, account for over 80% of global semiconductor manufacturing. Japan is home to several of the largest companies that provide critical equipment and materials for the semiconductor industry, while the People’s Republic of China is the world leader in photovoltaic cell production, a key segment within the broader semiconductor sector.

Asia-Pacific emerges as a major global hub for consumer electronics production, with countries such as China, South Korea, and Japan leading in the manufacture of smartphones, laptops, and other devices. This dominance generates substantial demand for semiconductors, supporting the growth of the Asia-Pacific semiconductor foundry market.

- A 2024 report from the China Chamber of Commerce for Import and Export of Machinery and Electronic Products highlights China's rise as a global center for consumer electronics and household appliances. In 2023, China led the Asia-Pacific market, securing around 48% of total sales. The report further emphasizes China's strong export performance, accounting for 42% of global export shares in 2022, reflecting its significant presence in international markets.

North America is set to experience notable growth at a robust CAGR of 7.26% over the forecast period. North America hosts several leading fabless semiconductor companies, including Qualcomm, NVIDIA, AMD, and Broadcom, specializing in chip design and innovation.

These companies rely on external foundries for manufacturing, creating a strong demand for advanced semiconductor fabrication. The region's prominence in chip design, coupled with partnerships with global foundries, contributes to the expansion of the semiconductor industry in North America.

Furthermore, the U.S. government’s commitment to strengthening domestic semiconductor manufacturing through initiatives such as the CHIPS and Science Act is contributing significantly to regional market growth. The act allocates significant funding to boost semiconductor research, development, and production. This government-backed support creates favorable conditions for investment and expansion of the North America market.

Competitive Landscape

The global semiconductor foundry industry report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Semiconductor Foundry Market

Key Industry Developments

- August 2024 (Business Expansion): Taiwan Semiconductor Manufacturing Co. (TSMC)commenced construction of its first European semiconductor plant in Dresden, Germany, investing USD 11 billion. This facility aims to strengthen Europe's chip supply andexpand the company's regional presence.

- September 2023 (Business Expansion): GlobalFoundries officially opened a new facility in Singapore, to enhance the company's production capabilities and bolster its position in the semiconductor market. The facility is anticipated to focus on advanced manufacturing technologies to meet the growing demand for chips across various sectors, including automotive and consumer electronics.

The global semiconductor foundry market is segmented as:

By Technology Node

- 7nm and Below

- 10nm-20nm

- 20nm-45nm

- 45nm and Above

By Foundry

By Application

- Telecommunication

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America