Market Definition

The market encompasses companies that design and develop semiconductor chips without owning manufacturing facilities. These firms develop integrated circuits, microprocessors, system-on-chip solutions, and other devices, outsourcing production to specialized foundries.

Key segments include consumer electronics, automotive, telecommunications, industrial applications, and data centers. Market growth is driven by increasing demand for advanced electronics, innovations in AI and IoT technologies, and rising adoption of high-performance computing solutions across multiple industries.

Semiconductor Fabless Market Overview

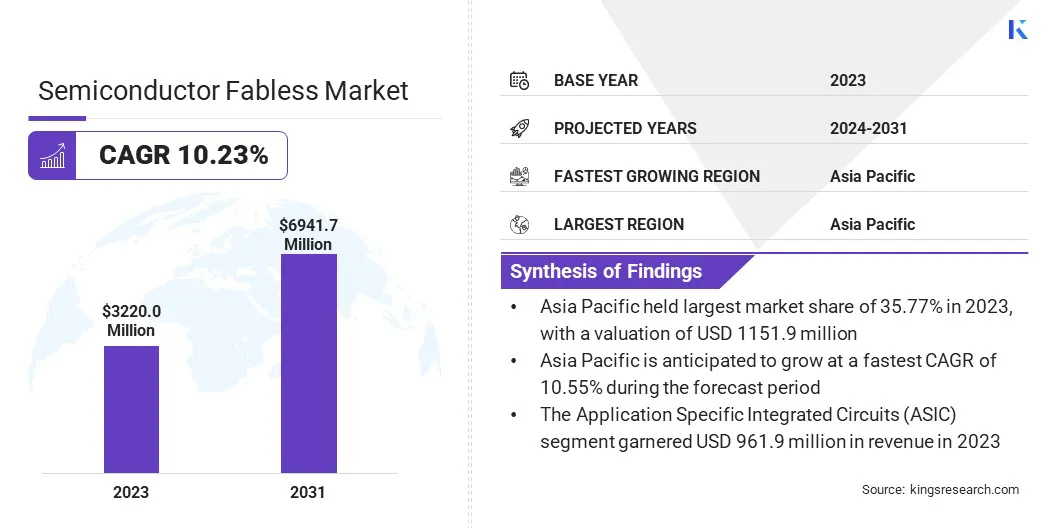

The global semiconductor fabless market size was valued at USD 3220.0 million in 2023 and is projected to grow from USD 3511.3 million in 2024 to USD 6941.7 million by 2031, exhibiting a CAGR of 10.23% during the forecast period.

This growth is fueled by increasing demand for advanced electronic devices across industries such as consumer electronics, automotive, telecommunications, and industrial automation.

Fabless companies leverage their expertise in semiconductor design to develop innovative solutions tailored to specific industry needs, focusing on enhancing performance, power efficiency, and miniaturization to meet evolving technological demands.

Major companies operating in the semiconductor fabless industry are NVIDIA Corporation, Qualcomm Technologies, Inc., Broadcom, Inc., Advanced Micro Devices, Inc., MediaTek, Marvell Technology, Inc., Novatek Microelectronics Corp., Realtek Semiconductor Corp., Samsung Electronics Co., Ltd., Monolithic Power Systems, Inc., Cirrus Logic, Inc., Renesas Electronics Corporation., Himax Technologies, Inc., BigEndian, and LSI Computer Systems, Inc.

The expanding electric vehicle (EV) sector and the rising deployment of smart devices and data centers have further amplified the demand for sophisticated semiconductor components.

Fabless companies prioritize design innovation and form strategic partnerships with dedicated foundries, enabling them to deliver power-efficient, high-performance chips. This approach allows for rapid adaptation to industry changes, supporting continuous market expansion.

Key Highlights

- The semiconductor fabless industry size was valued at USD 3220.0 million in 2023.

- The market is projected to grow at a CAGR of 10.23% from 2024 to 2031.

- Asia Pacific held a market share of 35.77% in 2023, with a valuation of USD 1151.9 million.

- The application specific integrated circuits (ASIC) segment garnered USD 961.9 million in revenue in 2023.

- The consumer electronics segment is expected to reach USD 1860.7 million by 2031.

- North America is anticipated to grow at a CAGR of 10.13% over the forecast period.

Market Driver

Foundry Collaboration and IoT-Driven Demand

The market is witnessing substantial growth, propelled by expanding collaborations between fabless semiconductor companies and foundries. These partnerships provide access to advanced process technologies essential for next-generation semiconductor solutions.

As the automotive industry integrates more digital, sensor, and mixed-signal functions, these partnerships enable fabless firms to produce high-performance automotive chips that enhance vehicle safety, comfort, and connectivity.

By utilizing advanced node technologies, fabless companies can meet the increasing demand for complex automotive electronics while ensuring cost efficiency and faster production cycles.

- In January 2025, Elmos Semiconductor SE expanded its collaboration with Samsung Foundry to strengthen its fabless manufacturing strategy. This partnership grants Elmos access to Samsung's next-generation process technologies for automotive applications, addressing the growing demand for digital, sensor, and mixed-signal semiconductor solutions in vehicles.

Furthermore, the rising adoption of IoT devices and edge computing is creating a strong demand for compact and energy-efficient semiconductor solutions. As IoT ecosystems expand across industries such as smart homes, healthcare, and industrial automation, the need for highly integrated and low-power chips capable of real-time data processing intensifies.

Compact semiconductor designs with enhanced power efficiency are vital for optimal performance, longer battery life, and improved thermal management. This demand is prompting fabless companies to innovate and meet evolving technological requirements.

Market Challenge

Supply Chain Vulnerabilities

Supply chain vulnerability significantly disrupts production timelines and impacts product availability in the semiconductor fabless market. These companies focus on chip design while relying on third-party foundries for manufacturing, making them susceptible to disruptions from geopolitical tensions, trade restrictions, or regional instabilities that limit access to manufacturing facilities.

Additionally, shortages of critical raw materials, such as silicon wafers, rare earth metals, and advanced packaging components, further hinder production.

Fluctuations in raw material availability and geopolitical uncertainties increase production delays and costs. TTo address this challenge, fabless companies are diversifying supplier networks by partnering with multiple foundries across regions, reducing reliance on single source.

They are further leveraging advanced supply chain analytics to improve demand forecasting, enabling proactive inventory management and production adjustments.

Market Trend

AI Processors and Chiplet Technology

A key trend influencing the market is the integration of AI-specific processors in space exploration and scientific missions.

These processors enhance autonomous decision-making in extreme conditions such as deep space, lunar surfaces, and Mars by optimizing power efficiency and high-performance computing. They address resource constraints and harsh conditions, improving communication, navigation, and mission control in unmanned systems.

- In February 2025, ispace, inc., a global lunar exploration company, partnered with EdgeCortix Inc., a fabless semiconductor company specializing in energy-efficient AI processing, to integrate EdgeCortix’s SAKURA-II AI-specific processors into ispace’s lunar exploration missions. This collaboration aims to enhance AI workloads in cislunar environments using EdgeCortix’s patented Dynamic Neural Accelerator (DNA) technology and MERA software framework.

Another key trend in the market is adoption of chiplet architectures, which are transforming semiconductor design. Instead of a single monolithic chip, manufacturers create smaller, specialized chiplets that integrate withing a single package. This method improves performance, flexibility, and cost-efficiency.

Chiplets enable the customization of components for applications such as data processing, artificial intelligence (AI), and high-performance computing, improving speed, power efficiency, and adaptability to evolving technological demands.

Semiconductor Fabless Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Microcontrollers (MCUs), Digital Signal Processors (DSP), Graphic Processing Units (GPUs), Application Specific Integrated Circuits (ASIC), Power Management ICs (PMICs), Others

|

|

By End Use

|

Consumer Electronics, Automotive, Industrial, Telecommunication, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Microcontrollers (MCUs), Digital Signal Processors (DSP), Graphic Processing Units (GPUs), Application Specific Integrated Circuits (ASIC), and Power Management ICs (PMICs)): The application specific integrated circuits (ASIC) segment earned USD 961.9 million in 2023 due to its high customization capabilities, making it essential for advanced computing, AI acceleration, and specialized hardware solutions.

- By End Use (Consumer Electronics, Automotive, Industrial, and Telecommunication): The consumer electronics segment held 26.74% of the market in 2023, propelled by the rising demand for smart devices, wearables, and home automation products dependent on sophisticated semiconductor designs.

Semiconductor Fabless Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific semiconductor fabless market accounted for a substantial share of 35.77% in 2023, valued at USD 1151.9 million. This dominance is reinforced by its strong manufacturing ecosystem, an extensive supply chain, and advanced technological capabilities.

The regional market benefits from well-established foundries, robust R&D infrastructure, and a skilled engineering workforce, fostering semiconductor innovation.

Regional market growth is further fostered by increasing consumer electronics adoption, expanding 5G deployment, and rising demand for automotive semiconductors. Ongoing investments in data centers, artificial intelligence (AI), and IoT applications further solifify its position as a hub for fabless semiconductor development.

- In February 2024, the Minister of State for Electronics & IT, Skill Development and Entrepreneurship, announced two Karnataka-based futureDESIGN semiconductor fabless companies under the SemiconIndia Design Linked Incentive (DLI) Scheme. These companies specialize in chipsets and solutions for the communication and med-tech sectors.

North America market is expected to register the fastest CAGR of 10.13% over the forecast period. This growth is fostered by increasing investments in emerging technologies that require advanced semiconductor solutions. The region's expanding data center industry, propelled by the rise of cloud computing services, is accelerating the adoption of high-performance semiconductors.

North America hosts several leading fabless semiconductor companies that specialize in designing cutting-edge solutions for automotive, telecommunications, and aerospace sectors.

Moreover, the rising adoption of electric vehicles and autonomous driving systems in North America has increased the demand for specialized semiconductor solutions that support vehicle connectivity, battery management systems, and advanced driver-assistance systems (ADAS).

Regulatory Frameworks

- In the United States, fabless semiconductor companies must comply with the Export Administration Regulations (EAR), governed by the Bureau of Industry and Security (BIS) under the U.S. Department of Commerce, which regulates the export of semiconductor designs and intellectual property.

- In Europe, the semiconductor industry, including fabless companies, adheres to the EU Dual-Use Regulation, governing the export of sensitive technologies with civilian and military applications. The European Chips Act strengthens supply chains and promotes R&D investments, supporting innovation in fabless semiconductor design.

- In Japan, the Foreign Exchange and Foreign Trade Act (FEFTA) regulates semiconductor exports to safeguard national security. Fabless firms must comply with Japan's Strategic Goods Control framework when when transferring technology.

Competitive Landscape

Companies operating in the semiconductor fabless industry priortize efficient, customized semiconductor solutions to meet the increasing demand for advanced technologies across sectors such as consumer electronics, automotive, telecommunications, and data centers.

The rising adoption of AI, machine learning, and 5G networks is intensifying competition, prompting a focus on high-performance, power-efficient, and compact chip designs.

Companies are adopting chiplet architecture for modular integration, improving scalability and flexibility. Expanding applications in electric vehicles (EVs), autonomous systems, smart devices, and industrial automation are prompting market participants to develop tailored solutions to address these evolving needs.

Moreover, increasing demand for customized semiconductor solutions in edge computing, healthcare, and connected devices is compelling firms to diversify their product portfolios. Additionally, strategic collaborations with foundries, IP core providers, and software solution firms are critical for accelerating innovation and ensuring seamless integration with end-user applications.

- In November 2024, MACOM Technology Solutions Holdings, Inc. acquired ENGIN-IC, Inc., a fabless semiconductor company specializing in advanced Gallium Nitride monolithic microwave integrated circuits and integrated microwave assemblies. This acquisition is expected to enhance MACOM's design expertise, strengthen its ability to serve target markets, and expand its market share, particularly in sectors such as defense, communications, and microwave technologies.

List of Key Companies in Semiconductor Fabless Market:

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Broadcom, Inc.

- Advanced Micro Devices, Inc.

- MediaTek

- Marvell Technology, Inc.

- Novatek Microelectronics Corp.

- Realtek Semiconductor Corp.

- Samsung Electronics Co., Ltd.

- Monolithic Power Systems, Inc.

- Cirrus Logic, Inc.

- Renesas Electronics Corporation.

- Himax Technologies, Inc.

- BigEndian

- LSI Computer Systems, Inc.

Recent Developments (Acquisitions/Partnerships/Agreements/New Project Launch)

- In March 2025, Mobix Labs, a fabless semiconductor company specializing in connectivity solutions, acquired RaGE Systems, a Massachusetts-based leader in radio frequency (RF) design and manufacturing services. This strategic acquisition a strengthens Mobix Labs’ capabilities in 5G communications, mmWave imaging, and Software-Defined Radio systems while expanding its customer base and technology portfolio.

- In February 2025, Japan-based EdgeCortix Inc. was selected by the Saudi Ministry of Investment to join the National Semiconductor Hub (NSH) program. As part of this, EdgeCortix will establish a subsidiary in Riyadh, supporting Saudi Arabia's Vision 2030 goals to boost semiconductor innovation and talent development.

- In February 2025, the Ministry of SMEs and Startups (MSS) launched the Fabless Startup Comprehensive Support Project to nurture fabless startups in South Korea. This initiative will select 30 fabless startups across development, growth, and scale-up stages, providing financial aid, design assets, and corporate collaboration opportunities.

- In January 2025, Keysight Technologies, Inc. and KD, Inc. partnered to develop a Transmitter Distortion Figure of Merit measurement for Multigigabit Optical Automotive Ethernet. This advancement enhances signal integrity validation and improves compliance testing in next-generation automotive networks.