Sapphire Market Size

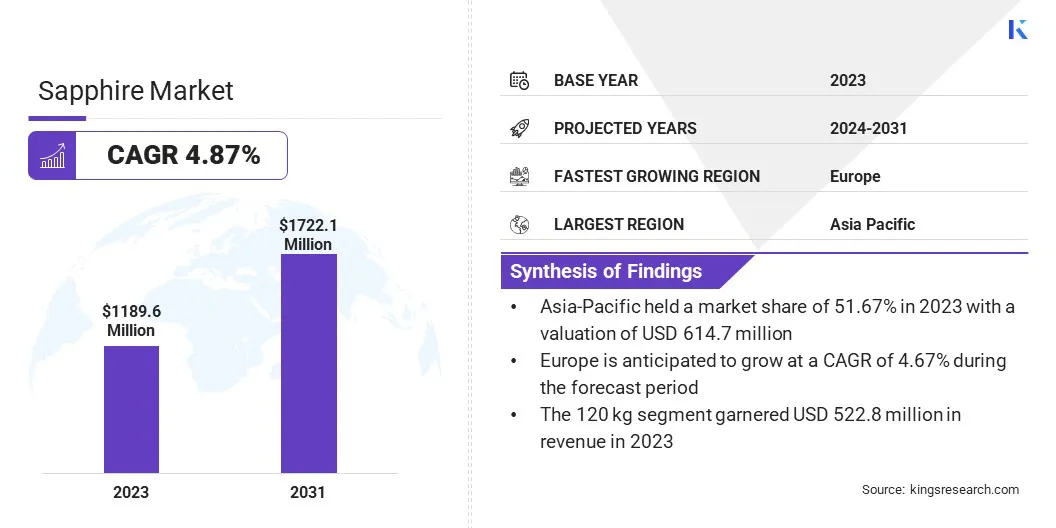

Global Sapphire Market size was recorded at USD 1,189.6 million in 2023, which is estimated to be at USD 1,234.1 million in 2024 and projected to reach USD 1,722.1 million by 2031, growing at a CAGR of 4.87% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Guizhou Haotian Optoelectronics Co., Ltd., HC SemiTek Corporation, Luxium Solutions, Mindrum Precision, Monocrystal, Orbray Co., Ltd., Rubicon Technology, Thermal Technology, DAI-ICHI DENTSU LTD., KYOCERA Corporation, and others.

The growth of the sapphire industry is driven by its extensive use in various high-tech applications. The increasing demand for LED production, which utilizes sapphire substrates, is significantly boosting market development. Additionally, the growth of the semiconductor industry, where sapphire wafers are essential, further propels demand. The material's superior hardness and scratch resistance make it highly desirable for use in consumer electronics, particularly in watch faces and smartphone screens.

Moreover, advancements in manufacturing technologies have reduced production costs, making sapphire more accessible and thereby increasing its market penetration. The sapphire market has experienced substantial growth in recent years, driven by its critical applications across multiple industries. The Asia-Pacific region, particularly China and Japan, holds a significant market share due to the strong presence of major electronics manufacturers.

Furthermore, North America and Europe contribute significantly to market expansion, propelled by technological advancements and a high demand for consumer electronics. Continuous research and development activities are expected to further expand the application areas of sapphire, thereby ensuring steady market growth.

Sapphire, a crystalline form of aluminum oxide (Al2O3), is valued for its exceptional hardness and high thermal conductivity. In industrial applications, synthetic sapphire is predominantly used owing to its consistent quality and widespread availability. It serves as a crucial material in the production of substrates for LED lights, semiconductor wafers, and durable windows for optical devices. Sapphire's physical properties, such as transparency to a wide range of wavelengths and resistance to chemical corrosion, make it an indispensable material in various high-tech and industrial applications. This versatility fosters its sustained demand in the global market.

Analyst’s Review

In the sapphire industry landscape, manufacturers are strategically focusing on enhancing production efficiency and product quality. These efforts include implementing advanced manufacturing technologies and exploring new methods for growing synthetic sapphire crystals. Additionally, there is a trend toward the development of innovative sapphire-based products, encompassing larger substrates designed for LED panels and high-performance components tailored for aerospace and defense applications. These initiatives reflect the industry's commitment to meeting evolving market demands and fostering continued growth.

Sapphire Market Growth Factors

The rising demand for sapphire in the consumer electronics industry is aiding market growth. Sapphire is increasingly used in the manufacturing of smartphone screens, watch faces, and camera lenses due to its superior hardness and scratch resistance. As consumers seek more durable and reliable devices, manufacturers are incorporating sapphire into their products to enhance durability and performance. This trend is particularly pronounced in premium devices, where quality and longevity are key selling points.

- Continuous advancements in sapphire manufacturing technologies are making it more cost-effective, thereby fostering increased adoption across various consumer electronics segments.

The high production cost associated with sapphires poses a significant challenge to market growth, limiting its widespread adoption. The complex and energy-intensive process of growing synthetic sapphire crystals contributes to these costs. To overcome this challenge, the industry is focusing on improving production efficiency and developing innovative manufacturing techniques. Advancements such as the use of less expensive raw materials, automation, and enhanced crystal growth methods are helping reduce costs.

Additionally, the economies of scale resulting from increased production volumes is contributing to a reduction in prices, making sapphire more accessible for various applications.

Sapphire Market Trends

The increasing use of sapphire in wearable technology is a key trend in the market. Companies are leveraging sapphire's durability and scratch resistance to enhance the lifespan and aesthetic appeal of smartwatches and fitness trackers. This trend is further fueled by rising consumer demand for robust, long-lasting devices that can withstand daily wear and tear. As wearable technology continues to gain popularity, the integration of sapphire is becoming a standard practice among leading manufacturers, providing a competitive edge in the market and meeting the growing demands for quality and durability.

The surging adoption of sapphire in the aerospace and defense sectors is fostering sapphire market growth. This is attributed to sapphire's exceptional hardness, thermal stability, and optical clarity, making it ideal for various applications, including sensor windows, missile domes, and advanced optical systems. The demand for high-performance materials that can withstand harsh environments and extreme conditions is further propelling this trend.

- As technological advancements persist in these sectors, the utilization of sapphire is proliferating, primarily boosted by the rising need for reliable, durable, and high-precision components that enhance the overall performance and safety of aerospace and defense systems.

Segmentation Analysis

The global market is segmented based on product, application, and geography.

By Product

Based on product, the market is categorized into 30 kg, 60 kg, 85 kg, and 120 kg. The 120 kg segment led the sapphire industry in 2023, reaching a valuation of USD 522.8 million. The expansion of the segment in the sapphire market is attributed to the increasing demand for larger sapphire substrates, bolstered by the growing adoption of larger LED panels in displays and lighting applications.

Moreover, advancements in manufacturing processes have made it more feasible to produce larger sapphire crystals, thereby meeting the requirements of various industries. Additionally, the segment offers opportunities for economies of scale, leading to cost efficiencies for manufacturers. These factors collectively contribute to the dominance of the 120 kg segment.

By Application

Based on application, the sapphire market is classified into high brightness LED manufacture, special industrial, and others. The high brightness LED manufacture segment is poised to witness significant growth, registering a CAGR of 5.35% through the forecast period (2024-2031). This notable growth is primarily fostered by the rising demand for energy-efficient lighting solutions. This demand is notably prominent, particularly in commercial and residential sectors, thus increasing the adoption of high brightness LEDs, that require sapphire substrates.

Furthermore, ongoing technological advancements are leading to the development of more efficient and cost-effective LED manufacturing processes, resulting in the rising demand. Additionally, supportive government initiatives promoting energy conservation and sustainability are contributing to the transition toward LED lighting, thereby boosting the demand for sapphire substrates. These factors collectively contribute to the growth of the high brightness LED manufacture segment.

Sapphire Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

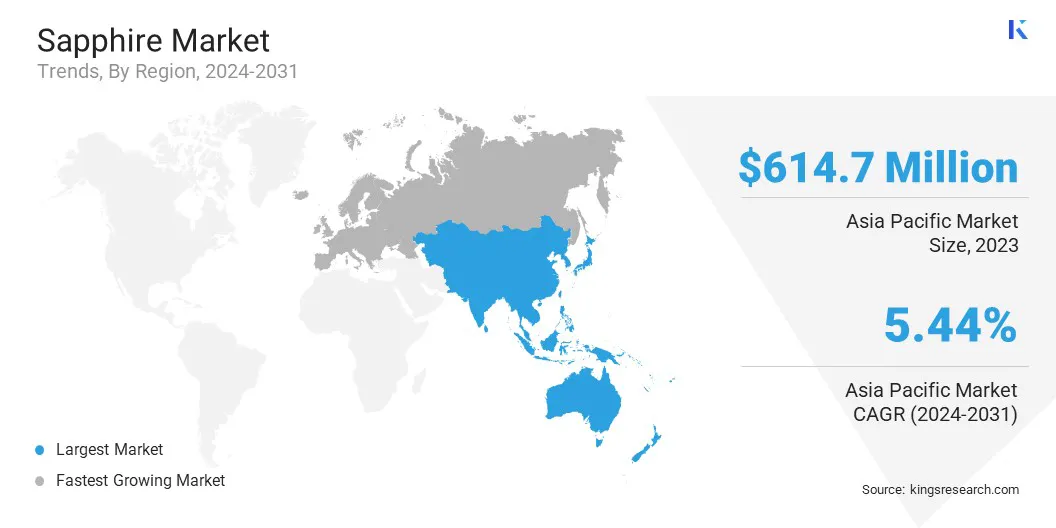

The Asia-Pacific Sapphire Market share stood around 51.67% in 2023 in the global market, with a valuation of USD 614.7 million. This dominance is majorly attributed to the region's status as a home to major electronics manufacturing hubs, particularly in countries such as China, Japan, and South Korea. These countries generate substantial demand for sapphire substrates in LED production and semiconductor manufacturing processes. Additionally, favorable government policies, infrastructure development, and skilled labor availability contribute to the region's dominance.

Moreover, strong economic growth and increasing consumer spending in emerging markets across Asia-Pacific are propelling the demand for consumer electronics, thereby sustaining the need for sapphire substrates. These factors collectively position Asia-Pacific as the leading region in the sapphire market.

Europe is poised to witness steady growth, recording a CAGR of 4.67% over the forecast period. This considerable growth is majorly fueled by the region's growing focus on sustainable development and energy efficiency initiatives, leading to an increased demand for sapphire substrates in LED lighting and renewable energy applications.

Additionally, Europe's robust automotive sector, coupled with increasing investments in electric vehicles, creates opportunities for sapphire's use in automotive lighting and power electronics. Moreover, technological advancements and collaborations between European companies and research institutions foster innovation in sapphire-based technologies, thereby supporting regional market growth.

Competitive Landscape

The sapphire market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Sapphire Market

- Guizhou Haotian Optoelectronics Co., Ltd.

- HC SemiTek Corporation

- Luxium Solutions

- Mindrum Precision

- Monocrystal

- Orbray Co., Ltd.

- Rubicon Technology

- Thermal Technology

- DAI-ICHI DENTSU LTD.

- KYOCERA Corporation

The Global Sapphire Market is Segmented as:

By Product

By Application

- High Brightness LED Manufacture

- Special Industrial

- Other

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America