Market Definition

The market encompasses global production, distribution, and application across diverse industries such as pharmaceuticals, cosmetics, personal care, and food preservation. It reflects continuous advancements in formulation technologies and the evolving integration of salicylic acid to address the specific requirements of each sector.

The report outlines primary market growth factors, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Salicylic acid Market Overview

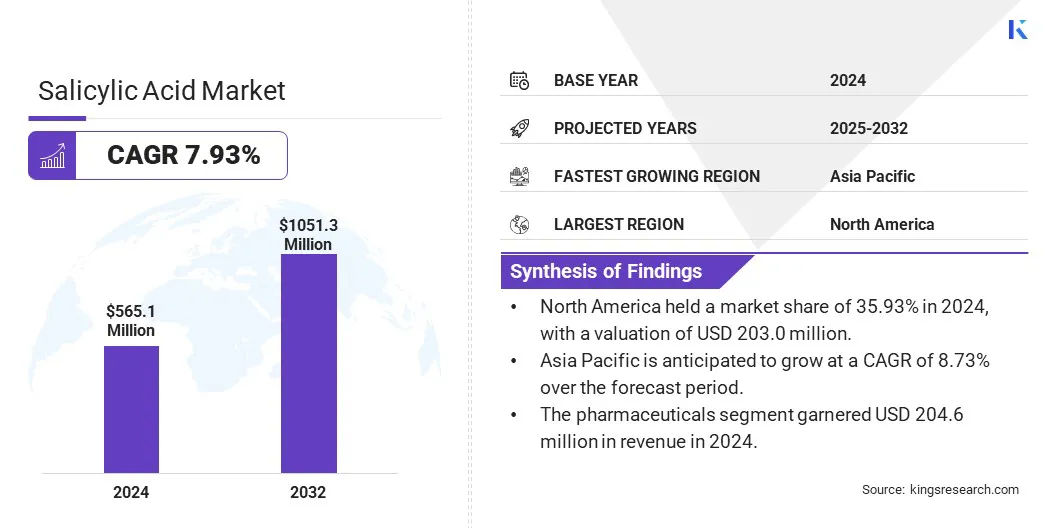

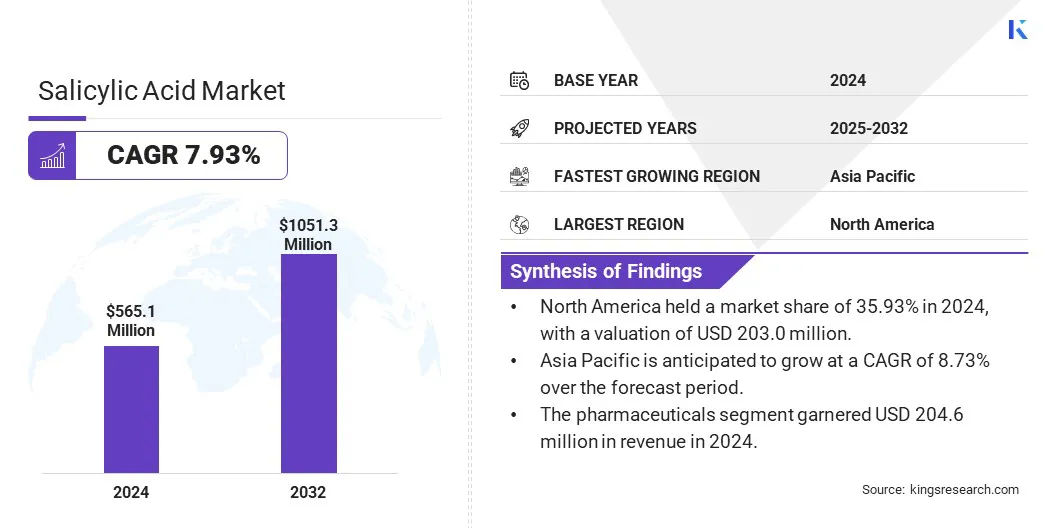

The global salicylic acid market size was valued at USD 565.1 million in 2024 and is projected to grow from USD 606.2 million in 2025 to USD 1,051.3 million by 2032, exhibiting a CAGR of 7.93% during the forecast period.

The market is experiencing steady growth due to its expanding use in pharmaceuticals, cosmetics, personal care, and food sectors. Growth in the food preservation sector, where salicylic acid serves as a preservative, is fueling its rising consumption.

Major companies operating in the salicylic acid industry are Thermo Fisher Scientific Inc., Merck KGaA, Graham Chemical, Spectrum Chemical, MP BIOMEDICALS, Avantor, Inc., Ing. Petr Švec - PENTA s.r.o., GFS Chemicals, Inc., Zhenjiang Gaopeng Pharmaceutical Co., Ltd., Hebei Jingye Medical Technology Co., Ltd., Shandong Xinhua Pharma, Seqens, Alta Laboratories Ltd, KANTO KAGAKU, and Junsei Chemical Co.,Ltd.

Its widespread application in acne treatment, dandruff control, and pain relief medications has significantly boosted demand. The increasing consumer preference for functional and dermatologically active ingredients in cosmetics has further propelled market expansion.

Additionally, advancements in formulation technologies and increased investment in R&D by key players to develop innovative applications are contributing to this upward trajectory across developed and emerging economies.

Key Highlights

Key Highlights

- The salicylic acid industry size was valued at USD 565.1 million in 2024.

- The market is projected to grow at a CAGR of 7.93% from 2025 to 2032.

- North America held a market share of 35.93% in 2024, with a valuation of USD 203.0 million.

- The pharmaceuticals segment garnered USD 204.6 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 8.73% over the forecast period.

Market Driver

"Rising Demand for Acne Treatment and Skincare Solutions"

The salicylic acid market is experiencing significant growth due to the increasing demand for skincare products targeting acne and other skin conditions. Salicylic acid is one of the most commonly used ingredients for acne treatment, known for its ability to penetrate the skin and unclog pores, making it a key component in effective acne treatments.

Rising awareness of skincare has led to an expanded consumer base seeking solutions for skin issues. The prevalence of acne, particularly among teenagers and young adults, further boosts the demand for salicylic acid-based products, as more people turn to these treatments for clearer and healthier skin. This growing awareness and need for targeted skincare solutions are propelling market expansion.

- In July 2024, Crown Laboratories, Inc. launched PanOxyl Acne Banishing Body Spray with 2% Salicylic Acid. The new spray features a 360-degree nozzle for easy application and is formulated with Salicylic Acid, Niacinamide, Vitamin C, Witch Hazel, and Aloe to treat and prevent body acne.

Market Challenge

"Skin Irritation and Sensitivity in Salicylic Acid Products"

A major challenge limiting the progress of the salicylic acid market is its potential to cause skin irritation and sensitivity, particularly in individuals with sensitive or dry skin. While salicylic acid is widely used for its acne-fighting properties, its exfoliating nature can cause discomfort, redness, or dryness.

To address this challenge, manufacturers are developing formulations with lower salicylic acid concentrations combined with other soothing ingredients such as niacinamide, glycerin, or ceramides. These ingredients can help strengthen the skin barrier, provide hydration, and reduce the irritation.

Market Trend

"Growing Adoption of Encapsulation Technology"

The salicylic acid market is witnessing a notable trend toward the use of encapsulation technology to enhance the delivery and sustained release. This approach allows for controlled, prolonged efficacy while minimizing skin irritation, particularly for sensitive skin.

This technology improves the stability of salicylic acid, protecting it from degradation and maximizing its effectiveness in treating acne and other skin conditions. By enhancing penetration and providing a more consistent delivery, encapsulation technology is becoming a preferred solution in the formulation of skincare products, meeting the growing demand for higher performance, and gentle skincare solutions.

- In June 2024, Flychem unveiled KOSAVA, a water-soluble encapsulated salicylic acid product, at Cosmohome Tech 2024 in New Delhi. Developed using ProbiCap technology, KOSAVA offers high-purity formulations (60% and 70%) with enhanced stability, deep skin penetration, and sustained release, aiming to improve efficacy in personal care and pharmaceutical applications while minimizing skin irritation.

Salicylic acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Application

|

Pharmaceuticals, Food & Beverages, Cosmetics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Application (Pharmaceuticals, Food & Beverages, Cosmetics, and Others): The pharmaceuticals segment earned USD 204.6 million in 2024 due to the extensive use of salicylic acid in dermatological treatments and over-the-counter medications for skin and pain-related conditions.

Salicylic Acid Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America salicylic acid market accounted for a substantial share of 35.93% in 2024, valued at USD 203.0 million. This dominance is propelled by the high demand for salicylic acid in the pharmaceutical and skincare sectors.

The North America salicylic acid market accounted for a substantial share of 35.93% in 2024, valued at USD 203.0 million. This dominance is propelled by the high demand for salicylic acid in the pharmaceutical and skincare sectors.

North America has a well-established healthcare infrastructure, contributing to the widespread use of salicylic acid in over-the-counter acne treatments, anti-inflammatory drugs, and pain relief products.

Furthermore, the strong presence of leading skincare brands and dermatological companies in the U.S. is leading to increased consumption. A growing focus on advanced skincare formulations, coupled with increasing consumer awareness of self-care and wellness, has solidified North America’s leading market position.

The Asia Pacific salicylic acid industry is expected to register the fastest CAGR of 8.73% over the forecast period. The rising demand for salicylic acid in both pharmaceutical formulations and personal care products, particularly in acne and dandruff treatments, is fueling this expansion.

The region's strong e-commerce sector is further enhancing the accessibility of salicylic acid-based products, making them available to a wider audience. Moreover, the increasing focus on dermatological health and wellness has contributed to a surge in demand for personal care items, supporting regional market progress.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates salicylic acid and is currently evaluating its long-term safety in cosmetics.

- In Europe, salicylic acid is regulated under the EU Cosmetics Regulation, which ensures that cosmetic products containing salicylic acid meet safety and labeling standards. The European Medicines Agency (EMA) also monitors the use of salicylic acid.

Competitive Landscape

The global salicylic acid industry is characterized by key players employing strategies such as continuous investment in research and development to improve product formulations for various applications.

Companies are expanding their product portfolios to include salicylic acid in a wider range of pharmaceutical, personal care, and skincare products. Strategic partnerships and acquisitions help strengthen market presence and ensure robust supply chains.

Additionally, many players are focusing on enhancing their online presence and leveraging e-commerce to meet rising demand. Sustainability initiatives, including eco-friendly production methods and responsible sourcing, are becoming crucial for maintaining competitiveness in the market.

List of Key Companies in Salicylic Acid Market:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Graham Chemical

- Spectrum Chemical

- MP BIOMEDICALS

- Avantor, Inc.

- Ing. Petr Švec - PENTA s.r.o.

- GFS Chemicals, Inc.

- Zhenjiang Gaopeng Pharmaceutical Co., Ltd.

- Hebei Jingye Medical Technology Co., Ltd.

- Shandong Xinhua Pharma

- Seqens

- Alta Laboratories Ltd

- KANTO KAGAKU

- Junsei Chemical Co.,Ltd.

Recent Developments (Product Launches)

- In September 2024, Cetaphil launched its first chemical exfoliation product line, the Gentle Exfoliating series, in collaboration with Gen-Z influencer Katie Fang. The new line features a triple-acid blend, including Salicylic Acid, Mandelic Acid, and Gluconolactone, designed for daily use on sensitive skin.

- In April 2024, Allergan Aesthetics launched Acne Clarifying Treatment and Pore Purifying Gel Cleanser. These products offer effective acne care that supports the skin barrier. The Acne Clarifying Treatment includes 2% encapsulated salicylic acid, niacinamide, and bakuchiol, while the Pore Purifying Gel Cleanser is formulated with salicylic acid, antioxidants, and soothing botanicals such as aloe and chamomile.

Key Highlights

Key Highlights The North America salicylic acid market accounted for a substantial share of 35.93% in 2024, valued at USD 203.0 million. This dominance is propelled by the high demand for salicylic acid in the pharmaceutical and skincare sectors.

The North America salicylic acid market accounted for a substantial share of 35.93% in 2024, valued at USD 203.0 million. This dominance is propelled by the high demand for salicylic acid in the pharmaceutical and skincare sectors.