Market Definition

Sales performance management involves strategies and solutions designed to monitor, evaluate, and enhance sales team effectiveness through goal setting, performance tracking, and incentive alignment. It enables organizations to improve sales productivity, optimize resource allocation, and drive revenue growth.

SPM is applied across industries in sales planning, forecasting, training, and performance-based compensation. Its adoption is increasing through digital tools, analytics platforms, and integration with enterprise performance management systems.

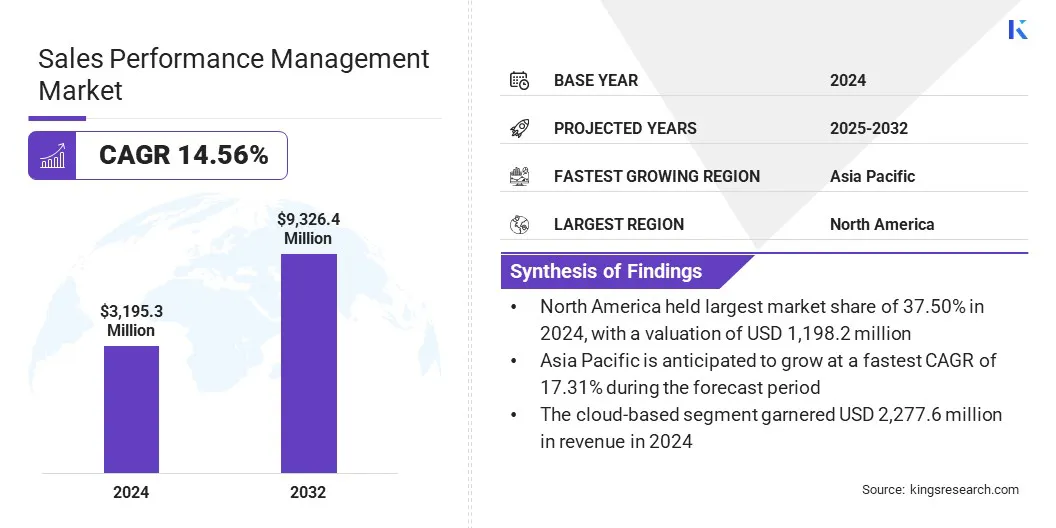

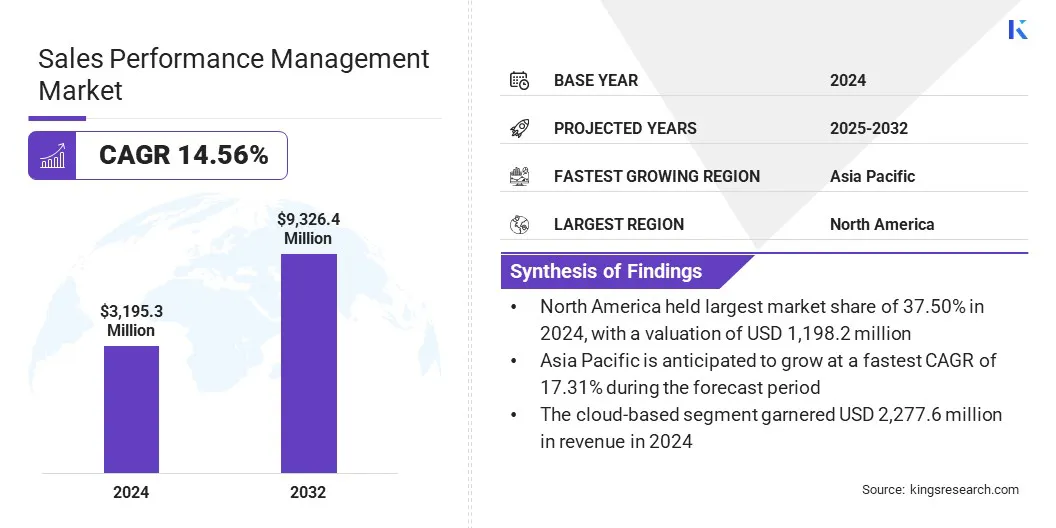

The global sales performance management market size was valued at USD 3,195.3 million in 2024 and is projected to grow from USD 3,601.5 million in 2025 to USD 9,326.4 million by 2032, exhibiting a CAGR of 14.56% during the forecast period.

This growth is driven by increasing adoption of sales performance management solutions aimed at improving revenue outcomes and maximizing sales efficiency Increasing demand from enterprises across industries is further accelerating adoption due to the focus on data-driven decision-making and performance-based incentive structures.

Key Highlights

- The sales performance management industry size was valued at USD 3,195.3 million in 2024.

- The market is projected to grow at a CAGR of 14.56% from 2025 to 2032.

- North America held a share of 37.50% in 2024, valued at USD 1,198.2 million.

- The solutions segment garnered USD 2,028.0 million in revenue in 2024.

- The cloud-based is expected to reach USD 7,098.4 million by 2032.

- The small and medium enterprises (SMEs) segment is anticipated to witness the fastest CAGR of 15.67% over the forecast period.

- The banking, financial services, and insurance (BFSI) segment garnered USD 772.0 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 17.31% through the projection period.

Major companies operating in the sales performance management market are Anaplan, Inc., beqom, Varicent, Iconixx, NiCE, Oracle, SAP SE, Xactly, Salesforce, Inc., Incentivate, Performio, IBM, Optymyze, SPOTIO, Inc., and CaptivateIQ, Inc.

Expanding deployment of cloud-based platforms, advanced analytics, and automation tools is promoting broader implementation across North America, and Asia Pacific. Additionally, ongoing technological innovations, strategic partnerships, and integration with enterprise performance management systems are supporting market expansion.

- In June 2025, Everstage launched Everstage Planning, extending its offerings from Incentive Compensation Management to a comprehensive Sales Performance Management (SPM) solution. The platform integrates territory, quota, and capacity planning with incentive compensation. It provides tools for financial modeling, quota allocation, and real-time impact analysis, aligning sales strategies with business objectives.

Market Driver

Growing Focus on Sales Performance Optimization

The growth of the sales performance management market is primarily fueled by organizations’ increasing focus on enhancing sales productivity and revenue outcomes. Adoption of structured frameworks, cloud-based platforms, and analytics solutions is promoting investments in performance tracking, incentive management, and process optimization.

For instance, the U.S. General Services Administration (GSA) announced a OneGov agreement with Amazon Web Services (AWS) in August 2025, providing up to USD 1 billion in direct incentive credits to federal civilian agencies to accelerate cloud migration and adoption of AI technologies.

Consequently, enterprises across industries are increasingly leveraging these solutions to improve decision-making, align sales strategies, and achieve business objectives. Continued emphasis on digital transformation, advanced analytics, and AI-driven insights is also promoting technological innovation and broader deployment, positioning sales performance management as a critical tool for organizational growth.

Market Challenge

Challenges in Legacy System Integration

Integrating legacy systems poses significant challenges to the adoption of sales performance management solutions across organizations. Outdated technologies, fragmented data, and a lack of interoperability between enterprise resource planning and customer relationship management systems lead to implementation delays, higher operational costs, and the need for extensive customization.

Enterprises seeking to optimize sales operations must address technical constraints, ensure data consistency, and coordinate across multiple departments. Limited expertise in integration and system migration further slows adoption and reduces efficiency.

To address these issues, organizations are investing in middleware solutions, system upgrades, and structured integration strategies. These initiatives aim to streamline connectivity, enhance data flow, and enable effective utilization of sales performance management platforms.

Market Trend

Integration of Artificial Intelligence & Advanced Analytics

The sales performance management market is experiencing a notable trend toward increasing demand for solutions that boost sales productivity and revenue. AI and advanced analytics are being integrated into platforms to provide real-time insights, performance forecasting, and optimized incentive management, while cloud-based deployments enable scalable and flexible implementation. This trend is further supported by organizations’ focus on data-driven decision-making and digital transformation initiatives to remain competitive.

Enterprises, technology providers, and analytics specialists are increasingly adopting AI-powered tools, predictive models, and integrated performance platforms to improve sales effectiveness. Continuous advancements in analytics and AI technologies are expected to enhance decision-making, boost productivity, and foster market growth over the forecast period.

- In August 2025, Xactly introduced AI Agents on its Intelligent Revenue Platform for Sales Performance Management (SPM). The AI Agents enable Go-to-Market teams to automate revenue processes and develop applications using natural language or sketches. Utilizing Xactly’s pay and performance dataset and unified business logic, the solution streamlines workflows, enhances operational efficiency, and enables SPM teams to optimize sales processes and overall business performance.

|

Segmentation

|

Details

|

|

By Component

|

Solutions, and Services

|

|

By Deployment Mode

|

On-Premise, and Cloud-Based

|

|

By Organization Size

|

Large Enterprises, and Small and Medium Enterprises (SMEs)

|

|

By Vertical

|

Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) & Telecom, Manufacturing, Consumer Goods & Retail, Healthcare & Life Sciences, Energy & Utilities, Travel & Hospitality, and Other Verticals

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solutions and Services): The solutions segment earned USD 2,028.0 million in 2024, largely attributed to growing demand for tools that enhance sales productivity, performance tracking, and incentive management across industries.

- By Deployment Mode (On-Premise and Cloud-Based): The cloud-based segment held a share of 71.28% in 2024, due to its scalability, real-time accessibility, and lower implementation costs compared to on premise solutions.

- By Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)): The large enterprises segment is projected to reach USD 5,445.8 million by 2032, owing to their higher adoption of advanced sales performance management solutions to optimize productivity, manage complex sales teams, and drive revenue growth.

- By Vertical (Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) & Telecom, Manufacturing, Consumer Goods & Retail, Healthcare & Life Sciences, Energy & Utilities, Travel & Hospitality, and Other Verticals): The consumer goods & retail segment anticipated to grow at a CAGR of 15.46% through the projection period, fueled by the need to enhance sales efficiency, streamline incentive programs, and leverage data-driven insights for competitive advantage.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America sales performance management market share stood at 37.50% in 2024, valued at USD 1,198.2 million. High digital maturity, strong presence of leading technology providers, and increasing adoption of cloud-based and AI-driven solutions are propelling this growth. Enterprises are leveraging advanced platforms to optimize sales processes, enhance incentive management, and enable data-driven decision-making.

Strategic initiatives, including partnerships, technology upgrades, and innovative analytics tools, further strengthen growth prospects. Enhanced integration capabilities, mobile accessibility, and real-time performance tracking reinforce North America’s position as a key hub for sales performance management.

- In September 2024, U.S.-based Xactly launched Xactly Next, a composable Intelligent Revenue Platform unifying existing solutions with three new modules: Plan, Design, and Manage. The platform provides agile workflows, real-time collaboration, and advanced analytics, allowing organizations to customize Sales Performance Management (SPM) solutions. By integrating data from multiple sources, Xactly Next aligns sales strategies with evolving business goals and supports adaptation to dynamic market conditions.

Asia Pacific sales performance management industry is set to grow at a CAGR of 17.31% over the forecast period. This growth is fueled by rapid digital transformation, increasing adoption of cloud-based platforms, and rising emphasis on data-driven decision-making across enterprises. Investments in AI-enabled analytics, mobile solutions, and integrated performance management tools are strengthening the region’s technological capabilities.

The expansion of competitive industries such as technology, retail, telecommunications, and financial services, growing demand for efficient sales operations, and the need to optimize revenue generation are creating opportunities for adoption. Additionally, advancements in real-time performance tracking, predictive analytics, and seamless system integration are accelerating implementation, aiding regional market expansion.

Regulatory Frameworks

- In the European Union, the General Data Protection Regulation (GDPR) regulates the collection, storage, and processing of personal data. It ensures data privacy and security, requiring sales performance management solutions to implement robust data protection measures and obtain consent for handling employee and customer information.

- In the U.S., the Revenue Recognition Standard (ASC 606) governs recognition of revenue from contracts with customers. It ensures that commissions and sales incentives are calculated and reported in compliance with accounting standards.

- In Singapore, the Personal Data Protection Act (PDPA) regulates the collection, use, and disclosure of personal data. It mandates that SPM solutions protect personal information and obtain proper consent from individuals.

Competitive Landscape

Companies operating in the sales performance management industry are maintaining competitiveness through investments in cloud-based platforms, AI-powered analytics, and advanced performance tracking solutions. They are focusing on enhancing sales productivity, optimizing incentive management, and improving operational efficiency to meet growing demand across industries.

Key players are broadening their portfolios to include integrated performance management, predictive analytics, and mobile-enabled solutions, supported by strategic partnerships, acquisitions, and technology collaborations.

The regional market is witnessing increased collaboration among enterprises, technology providers, and consulting firms to accelerate solution adoption and streamline deployment. Additionally, companies are enhancing system integration, real-time monitoring, and data-driven insights, while leveraging automation and predictive modeling to maintain a competitive edge.

- In May 2024, Kyndryl implemented SAP SuccessFactors Sales Performance Management (SPM), replacing legacy systems. Adoption of Incentive Management and Territory and Quota tools streamlined compensation and planning processes, centralized sales data, improved efficiency, increased transparency, and ensured regulatory compliance.

Top Key Companies in Sales Performance Management Market:

- Anaplan, Inc.

- beqom

- Varicent

- Iconixx

- NiCE

- Oracle

- SAP SE

- Xactly

- Salesforce, Inc.

- Incentivate

- Performio

- IBM

- Optymyze

- SPOTIO, Inc.

- CaptivateIQ, Inc.

Recent Developments (Launch)

- In August 2025, CaptivateIQ launched an AI-powered platform unifying sales planning and incentive compensation. The platform allows revenue teams to model headcount, allocate quotas, and manage commissions within a single system, supporting real-time adjustments and data-driven decisions. By integrating predictive analytics and centralized data, the solution streamlines workflows and improves alignment between sales strategies and financial objectives.