Market Definition

The market involves the development and deployment of advanced sensor technologies designed to ensure safety in industrial environments. It includes devices that monitor and protect hazardous zones by detecting obstacles or personnel. Safety laser scanners are extensively used in factory automation, robotic systems, warehouse logistics and material handling applications.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Safety Laser Scanner Market Overview

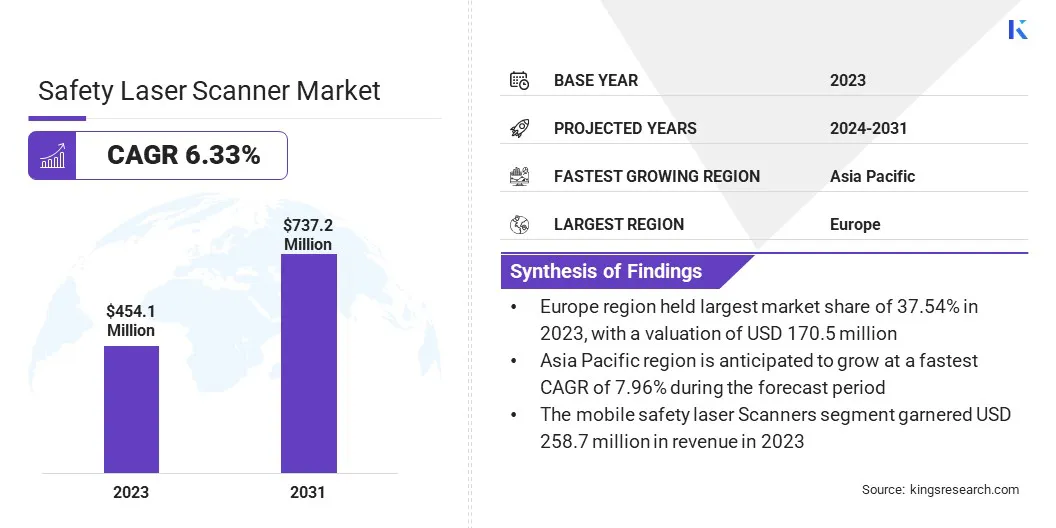

The global safety laser scanner market size was valued at USD 454.1 million in 2023 and is projected to grow from USD 479.6 million in 2024 to USD 737.2 million by 2031, exhibiting a CAGR of 6.33% during the forecast period.

The growing e-commerce sector and rising automation in logistics are driving demand for safety laser scanners. Additionally, advancements in sensor accuracy, AI integration, and compact designs are supporting market growth across the robotics.

Major companies operating in the safety laser scanner industry are Leuze, OMRON Corporation, Rockwell Automation, SICK AG, Banner Engineering Corp., Hans Turck GmbH & Co. KG, HOKUYO AUTOMATIC CO.LTD, IDEC Corporation, KEYENCE CORPORATION., Pilz GmbH & Co. KG, Arcus., Reer S.p.a., Pepperl+Fuchs, HOKUYO AUTOMATIC CO.LTD, Datasensing S.p.A., and others.

The growing adoption of robotics and autonomous systems is driving the market. Safety laser scanners play a vital role in preventing collisions and protecting workers in dynamic environments.

Their use across industries such as manufacturing, logistics, and healthcare supports safe automation, meeting the need for updated safety measures alongside evolving technologies.

- In November 2024, the International Federation of Robotics (IFR) highlighted that robot adoption in factories worldwide is accelerating rapidly. The global average robot density reached a record 162 units per 10,000 employees in 2023, more than double the 74 units recorded seven years ago.

Key Highlights:

- The safety laser scanner market size was recorded at USD 454.1 million in 2023.

- The market is projected to grow at a CAGR of 6.33% from 2024 to 2031.

- Europe held a market share of 37.54% in 2023, with a valuation of USD 170.5 million.

- The mobile safety laser scanners segment garnered USD 258.7 million in revenue in 2023.

- The short range (<5 meters) segment is expected to reach USD 397.3 million by 2031.

- The automotive segment secured the largest revenue share of 28.16% in 2023.

- The AGV/AMR navigation & collision avoidance segment is poised for a robust CAGR of 8.29% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.96% during the forecast period.

Market Driver

Smart Warehousing is Driving Increased Demand

The global market is driven by the rapid expansion of e-commerce, which fuels the need for highly automated warehouses. In these smart warehousing environments, safety laser scanners play a critical role in protecting personnel by preventing collisions and accidents involving automated guided vehicles (AGVs) and robotic pickers.

As automation in logistics and warehousing continues to expand, the demand for safety laser scanners is increasing to ensure efficient, secure operations, thereby driving market growth.

- In March 2025, Photoneo and Jacobi Robotics partnered to deliver AI-powered robotic automation for warehouses. The collaboration combines Photoneo’s 3D vision systems with Jacobi’s AI robotics software, enabling warehouses to automate complex processes, reduce labor costs, and improve operational efficiency.

Market Challenge

Overcoming Cost Barriers

A significant challenge in the safety laser scanner market is the high cost of advanced systems, which limits adoption among small and medium-sized enterprises. The complexity and integration requirements of these scanners further increase their cost, making it challenging for some businesses to validate the return on investment.

To address these challenges, key players are investing in research and development to create more cost-effective technologies. They are also exploring scalable manufacturing processes to reduce production expenses. Additionally, many companies are offering flexible pricing models like leasing and subscription services to make safety laser scanners more affordable for smaller businesses.

Market Trend

Technological Advancements and Product Innovation

A key trend in the market is the ongoing wave of product launches and technological innovations. Companies are focusing on enhancing sensor accuracy, extending detection range, and improving connectivity to meet evolving industry requirements.

Notable developments include compact models designed for space-constrained environments and AI-powered features that enable real-time decision-making. These advancements are enhancing safety, reducing operational costs, and increasing efficiency, positioning innovation as a central theme across sectors such as robotics, logistics, and manufacturing.

- In February 2025, Leuze launched the RSL 200, the smallest safety laser scanner on the market. Its exceptionally compact design and advanced connectivity technology enable unmatched sensor integration possibilities. This powerful device ensures reliable protection for machines, systems, Automated Guided Vehicles (AGVs), and Autonomous Mobile Robots (AMRs). The RSL 200 features a three-meter operating range and a 275-degree scanning angle.

Safety Laser Scanner Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Mobile Safety Laser Scanners, Stationary Safety Laser Scanners

|

|

By Range

|

Short Range (<5 meters), Medium Range (5–10 meters), Long Range (>10 meters)

|

|

By End-Use Industry

|

Automotive, Food & Beverage, Healthcare & Pharmaceuticals, Consumer Electronics, Logistics & Warehousing, Aerospace, Metals & Machinery

|

|

By Application

|

Access Protection, Area Protection, AGV/AMR Navigation & Collision Avoidance

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Mobile Safety Laser Scanners, Stationary Safety Laser Scanners): The mobile safety laser scanners segment earned USD 258.7 million in 2023 due to its critical role in enabling safe navigation and collision avoidance for autonomous and mobile robotic systems in dynamic industrial environments.

- By Range (Short Range (<5 meters), Medium Range (5–10 meters), Long Range (>10 meters): The short range (<5 meters) segment held 53.76% of the market in 2023, due to its suitability for compact industrial environments where close-proximity safety monitoring is essential for equipment, personnel, and automated systems.

- By End-Use Industry (Automotive, Food & Beverage, Healthcare & Pharmaceuticals, Consumer Electronics, Logistics & Warehousing, Aerospace, Metals & Machinery): The automotive segment is projected to reach USD 206.4 million by 2031, owing to its high level of automation and strict safety standards, which drive the demand for precise, real-time safety solutions in manufacturing and assembly processes.

- By Application (Access Protection, Area Protection, AGV/AMR Navigation & Collision Avoidance): The AGV/AMR navigation & collision avoidance segment is poised for significant growth at a CAGR of 8.29% through the forecast period, attributed to the growing deployment of autonomous mobile systems in warehouses and factories, where reliable obstacle detection and safe navigation are critical for operational efficiency and worker safety.

Safety Laser Scanner Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

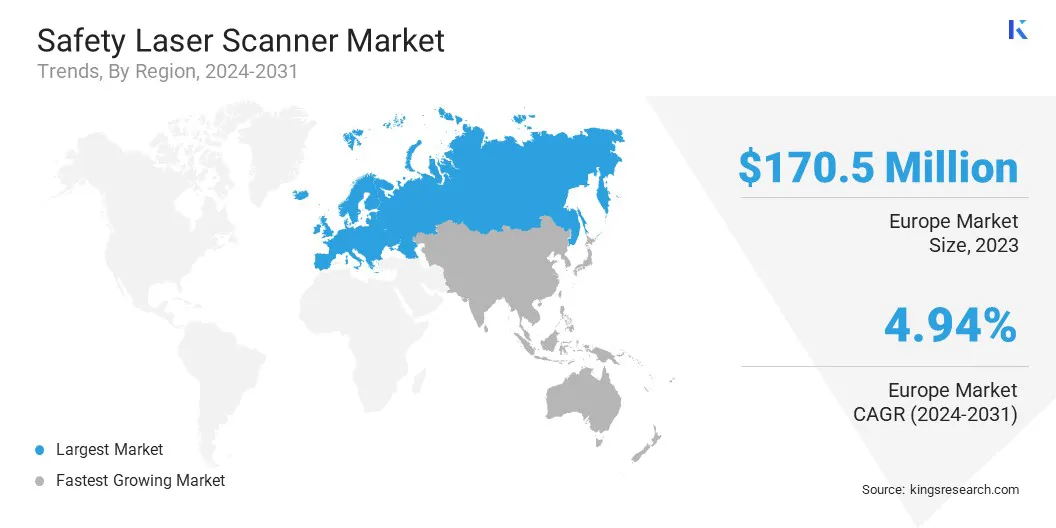

The Europe safety laser scanner market share stood at around 37.54% in 2023, with a valuation of USD 170.5 million. This dominance is attributed to significant investment in industrial R&D and robotics safety, backed by EU-funded programs. These investments drive progress in scanning technology and support the efficient integration of safety systems within automated operations.

European manufacturers are leveraging these advancements to develop high-performance safety solutions that meet strict regulatory standards, driving market growth across sectors such as automotive, manufacturing, and logistics automation.

- In March 2024, Nomagic, a developer of intelligent robotics for e-commerce and retail warehouses, received an USD 8 million loan from the European Investment Bank (EIB) to boost its research and development (R&D). This is aimed at advancing Nomagic’s automation technologies, improving its competitive position, and enabling the development of a broader product portfolio.

Asia Pacific is poised for significant growth at a robust CAGR of 7.96% over the forecast period. This growth is fueled by rapid industrialization, greater automation, and widespread robotics adoption in the manufacturing, logistics, and automotive sectors.

The region’s growing e-commerce industry and government investments in smart manufacturing drive the demand for advanced safety solutions. Additionally, favorable regulations and cost-effective production methods further accelerate the adoption of safety laser scanners in the region.

Regulatory Frameworks

- In Europe, the EU Machinery Directive 2006/42/EC establishes safety requirements for machinery and safety components, such as laser scanners, ensuring their safe use in industrial applications. It mandates that all machinery, including automated systems, comply with health and safety standards.

- In Asia Pacific, China’s GB/T 15706-2008 is a national standard that focuses on machinery safety and provides guidelines that impact the use of safety devices, such as laser scanners, in industrial machinery and automated systems.

Competitive Landscape

The safety laser scanner market is driven by ongoing innovation and regular product launches, with industry leaders introducing advanced solutions that emphasize greater accuracy, improved sensor technology, and smooth robotics integration.

These innovations meet the rising demand for safety solutions in sectors such as automotive, logistics, and manufacturing. As the market grows, companies are prioritizing enhanced performance, increasing competition, and advancing safety technology to meet evolving industry needs.

- In July 2023, Hexagon launched a modular 3D laser scanner called Absolute Scanner AS1-XL, for large surface inspections. Compatible with laser trackers and portable measuring arms, it uses SHINE technology to capture precise 3D data at high speeds. The scanner is designed for inspecting large surfaces and deep cavities in applications like aerospace panels, marine propellers, and automotive castings.

List of Key Companies in Safety Laser Scanner Market:

- Leuze

- OMRON Corporation

- Rockwell Automation

- SICK AG

- Banner Engineering Corp.

- Hans Turck GmbH & Co. KG

- HOKUYO AUTOMATIC CO.LTD

- IDEC Corporation

- KEYENCE CORPORATION.

- Pilz GmbH & Co. KG

- Arcus.

- Reer S.p.a.

- Pepperl+Fuchs

- HOKUYO AUTOMATIC CO.LTD

- Datasensing S.p.A.

Recent Developments (New Product Launch)

- In October 2024, Datasensing expanded its safety laser scanner lineup by introducing new models with PROFIsafe and PROFINET command integration. These fieldbus models enhanced the existing product range, providing increased flexibility in configuration and processing within the same robust housing. Features like Dynamic Reference Points and local digital I/O management made these models particularly suited for intralogistics and industrial manufacturing applications.

, even on challenging surfaces