Robotic Process Automation Market Size

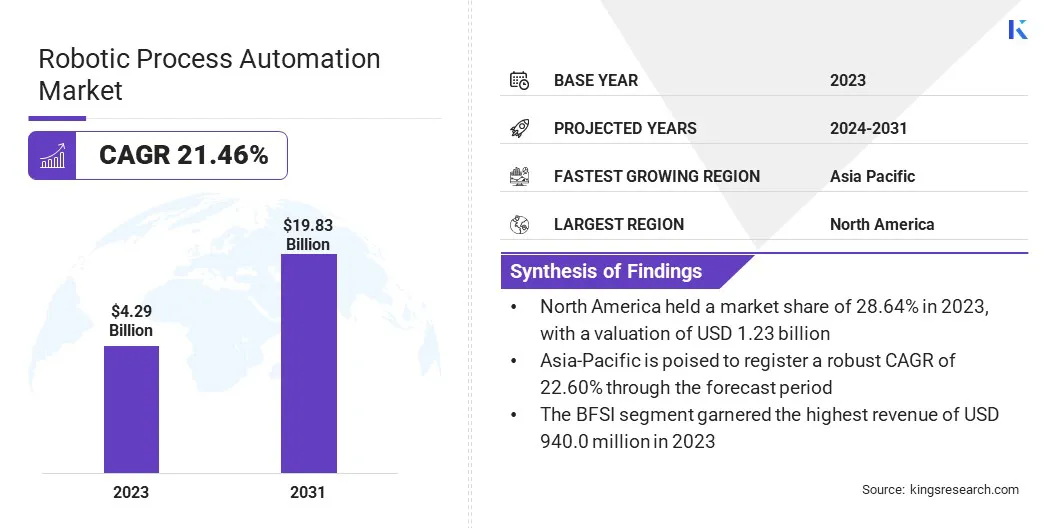

The global Robotic Process Automation (RPA) Market size was valued at USD 4.29 billion in 2023 and is projected to grow from USD 5.08 billion in 2024 to USD 19.83 billion by 2031, exhibiting a CAGR of 21.46% during the forecast period. Growing expenditure in healthcare sector and rising focus on hyperautomation are driving market expansion.

In the scope of work, the report includes solutions offered by companies such as IBM Corporation, Automation Anywhere Inc., SS&C Blue Prism, EdgeVerve Systems Limited, Pegasystems Inc., UiPath, Microsoft, Datamatics Global Services Limited, Fortra, LLC, NICE, CGI Inc. and others.

The healthcare sector presents a significant opportunity for the expansion of robotic process automation (RPA) due to its potential to streamline administrative processes, reduce operational costs, and enhance patient care. RPA can automate various repetitive and time-consuming tasks such as patient scheduling, billing, claims processing, and data entry, thereby reducing the burden on healthcare professionals and allowing them to focus more on patient-centric activities.

Additionally, RPA can improve the accuracy and efficiency of medical records management and regulatory compliance reporting, which are critical in the healthcare industry. The integration of RPA with electronic health records (EHR) systems can facilitate seamless data flow and improve the quality of patient care by providing healthcare providers with timely and accurate information.

Furthermore, as healthcare organizations increasingly adopt digital transformation strategies, the demand for scalable and efficient RPA solutions is expected to rise, creating a lucrative market for RPA vendors. By leveraging RPA, healthcare providers can achieve cost savings and enhance their service delivery and patient satisfaction, making it a compelling opportunity for robotic process automation market growth.

Robotic process automation (RPA) is a technology that uses software robots or "bots" to automate repetitive, rule-based tasks traditionally performed by human workers. These tasks can include data entry, transaction processing, and managing records, among others. RPA offers a range of solutions that enhance operational efficiency by automating routine tasks, thereby freeing up employees to focus on more strategic and value-added activities.

RPA systems are typically deployed across various industries, including finance, healthcare, retail, and manufacturing, where they can integrate seamlessly with existing IT infrastructure without the need for extensive system reconfiguration.

The deployment of RPA can be on-premises, cloud-based, or a hybrid model, providing flexibility to organizations based on their specific needs and resources. By offering scalability, accuracy, and cost-efficiency, RPA helps businesses optimize their processes, reduce errors, and achieve higher levels of productivity.

Analyst’s Review

The robotic process automation market is witnessing substantial growth, driven by the strategic initiatives of key players aimed at enhancing their market presence and expanding their product offerings.

Companies are increasingly focusing on innovation, investing in the development of advanced RPA solutions that incorporate artificial intelligence (AI) and machine learning (ML) capabilities to offer more sophisticated and intelligent automation. Strategic partnerships and collaborations are also pivotal, as firms join forces with technology providers and industry leaders to broaden their reach and integrate complementary technologies.

- For instance, in March 2024, INDUS Holding AG acquired Gestalt Robotics, a leading robotics technology firm specializing in industrial, laboratory, and mobility automation solutions. Gestalt Robotics enhances INDUS' engineering segment with expertise in visual quality control, asset tracking, autonomous navigation, and adaptive robotics and assistance systems.

Furthermore, mergers and acquisitions are common strategies employed to gain a competitive edge and access new markets. The current growth trajectory of the RPA market is impressive, with significant adoption across various industries such as finance, healthcare, and manufacturing.

However, to sustain this growth, companies must prioritize customer-centric approaches, ensuring that their solutions are adaptable, scalable, and capable of addressing specific industry challenges. Additionally, continuous innovation and addressing the complexities of integration with existing systems will be crucial for maintaining their leadership in the evolving RPA landscape.

Robotic Process Automation Market Growth Factors

Rising focus on hyperautomation is a major driver of the robotic process automation market. It involves the combination of robotic process automation (RPA) with advanced technologies such as artificial intelligence (AI) and machine learning (ML), which is becoming a focal point in the automation landscape. This trend is driven by organizations' need to achieve comprehensive end-to-end automation of business processes.

- For instance, in February 2023, Vedanta Aluminium implemented Robotic Process Automation (RPA) in its commercial function, pioneering hyperautomation in India’s metal and mining industry. This strategic move, given its large-scale operations, vast customer base, and extensive supplier network, aims to unlock significant value for the company.

Hyperautomation extends beyond the capabilities of traditional RPA by incorporating intelligent decision-making and advanced analytics, enabling businesses to automate complex processes that require cognitive inputs. The integration of AI and ML allows for the automation of unstructured data handling, predictive analytics, and real-time decision-making, which significantly enhances operational efficiency and effectiveness.

Companies are investing in hyperautomation to streamline workflows, reduce manual intervention, and accelerate digital transformation initiatives. This approach not only optimizes resource utilization but also improves customer experiences by delivering faster and more accurate services. As hyperautomation continues to gain traction, businesses can expect to see significant improvements in productivity, scalability, and innovation, making it a crucial driver in the evolving RPA market.

The lack of a skilled workforce poses a significant challenge for the robotic process automation market, as the successful implementation and management of RPA solutions require specialized knowledge and expertise.

The lack of skilled professionals who can develop, deploy, and maintain RPA systems is a major hindrance to widespread adoption. This challenge is further exacerbated by the rapid pace of technological advancements, which demands continuous upskilling and training of the workforce.

Organizations often struggle to find and retain talent with the necessary skills in RPA development, process analysis, and IT integration, leading to delays in project timelines and increased costs. Additionally, the complexity of integrating RPA with existing systems and workflows requires a deep understanding of both the technology and the business processes it aims to automate.

To address this challenge, companies are investing in training programs, partnerships with educational institutions, and certification courses to build a competent workforce. However, the scarcity of skilled professionals remains a significant barrier that needs to be overcome to fully realize the potential of RPA in transforming business operations.

Robotic Process Automation Market Trends

The integration of artificial intelligence (AI) and machine learning (ML) is a prominent trend driving robotic process automation market progress. This synergy enhances the capabilities of RPA by enabling it to handle complex, cognitive tasks that go beyond simple rule-based processes.

AI and ML bring intelligence to RPA systems, allowing them to learn from data, make predictions, and adapt to changing conditions without explicit programming. This integration facilitates advanced data analytics, natural language processing, and image recognition, significantly broadening the scope of automation.

Businesses are leveraging this trend to automate processes that involve unstructured data, such as customer service interactions, fraud detection, and compliance monitoring. The combination of RPA with AI and ML is also leading to the development of self-learning bots that can improve their performance over time, reducing the need for human intervention and oversight.

Segmentation Analysis

The global market is segmented based on component, deployment, organization size, vertical, and geography.

By Component

Based on component, the market is categorized into software and services. The software segment captured the largest robotic process automation market share of 52.73% in 2023 mainly attributed to the increasing demand for comprehensive RPA solutions that enhance operational efficiency and productivity. The software is further classified into automated software solutions, decision support solutions, and interaction solutions.

Software solutions in the RPA market encompass a wide range of functionalities, including process automation, workflow management, and data analytics, which are essential for businesses aiming to streamline their operations and reduce manual interventions.

The ease of integration with existing IT systems, scalability, and the ability to automate complex and repetitive tasks make software solutions highly attractive to enterprises across various industries.

Additionally, advancements in AI and machine learning have further enhanced the capabilities of RPA software, enabling more intelligent and adaptive automation. The growing trend of digital transformation and the need for cost-effective solutions to improve business processes have also significantly contributed to the dominance of the software segment.

By Deployment

Based on deployment, the robotic process automation market is classified into cloud-based and on-premises. The cloud-based segment is poised to record a staggering CAGR of 22.33% through the forecast period, reflecting the increasing preference for cloud-based RPA solutions due to their scalability, flexibility, and cost-effectiveness.

Cloud-based RPA offers several advantages over traditional on-premises deployments, including reduced infrastructure costs, faster implementation times, and the ability to easily scale up or down based on business needs. These solutions also provide seamless integration with other cloud services and applications, enhancing the efficiency of automated processes.

Moreover, the growing adoption of cloud computing and the shift toward remote working environments have further fueled the demand for cloud-based RPA, as businesses seek to ensure continuity and agility in their operations. Enhanced security features and regular updates provided by cloud service providers also make cloud-based RPA an attractive option for organizations concerned about data protection and compliance.

By Vertical

Based on vertical, the market is divided into BFSI, healthcare, retail, IT & telecommunications, manufacturing, energy & utilities, and others. The BFSI segment garnered the highest revenue of USD 940.0 million in 2023, propelled by the sector's high demand for automation solutions to enhance efficiency, reduce costs, and improve customer service.

The BFSI industry deals with vast amounts of data and numerous repetitive tasks, such as transaction processing, compliance reporting, customer onboarding, and fraud detection, which are ideal candidates for automation through RPA. The implementation of RPA in BFSI helps in reducing processing times, minimizing errors, and ensuring regulatory compliance, thereby improving operational efficiency.

Additionally, the competitive nature of the BFSI sector drives institutions to adopt innovative technologies such as RPA to differentiate their services and offer better customer experiences. The integration of RPA with advanced analytics and AI further enables financial institutions to gain deeper insights, optimize decision-making processes, and personalize customer interactions.

Robotic Process Automation Market Regional Analysis

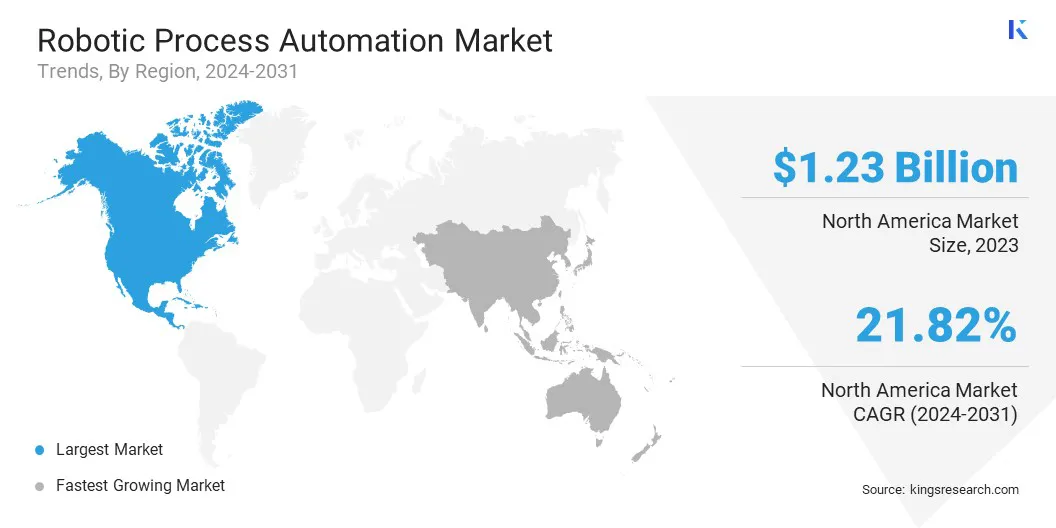

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America robotic process automation market share accounted for 28.64% and valued at USD 1.23 billion in 2023, driven by the region's early adoption of advanced technologies and strong presence of key industry players.

The robust IT infrastructure and high level of digital maturity in North America have facilitated the rapid implementation of RPA solutions across various industries, including finance, healthcare, retail, and manufacturing. Additionally, the increasing focus on optimizing business processes and enhancing operational efficiency has led many organizations to invest heavily in RPA.

- For instance, in September 2023, Rockwell Automation acquired Clearpath Robotics Inc.. This move strengthened Rockwell's expertise in industrial automation, positioning it at the forefront of deploying Autonomous Mobile Robots (AMRs) and advancing the connected enterprise.

The presence of a highly skilled workforce and significant investments in research and development are further bolstering the region's leadership in the RPA market. Moreover, regulatory compliance requirements and the need for cost reduction in business operations accelerated the adoption of RPA in sectors such as BFSI and healthcare.

Asia-Pacific robotic process automation market is poised to grow at the highest CAGR of 22.60% over the review timeline, backed by the region's increasing adoption of RPA solutions, which is driven by rapid economic growth and digital transformation initiatives.

- For instance, in March 2024, Coca-Cola Singapore and the Agency for Science, Technology and Research (A*STAR) unveiled a customized collaborative robotic solution for automating assembly and packing lines at Coca-Cola's Singapore plant. Developed with A*STAR's ARTC, this innovation reduces manual labor, boosts productivity, and enables production technicians to acquire higher value-added skills.

Countries such as China, India, Japan, and South Korea are witnessing a surge in the demand for automation technologies as businesses seek to enhance productivity and reduce operational costs. The expanding IT and BPO sectors in these countries are significant contributors to the growing adoption of RPA.

- For instance, in January 2024, Datamatics achieved a significant milestone with the inclusion of its TruBot RPA solution in the NHS Shared Business Services (SBS) framework. This strategic move enabled over 2,100 UK public sector organizations to utilize TruBot RPA from the Datamatics Intelligent Automation Platform for automating various processes.

Additionally, government initiatives supporting digitalization and smart city projects are propelling the uptake of RPA across various industries, including manufacturing, logistics, healthcare, and financial services.

The large and diverse workforce in Asia-Pacific, coupled with the need to manage high volumes of repetitive tasks efficiently, is making RPA an attractive solution for businesses in the region. Furthermore, the increasing focus on improving customer service and rising competition among enterprises to achieve operational excellence are expected to drive the adoption of RPA solutions at an accelerated pace.

Competitive Landscape

The robotic process automation market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Robotic Process Automation Market

- IBM Corporation

- Automation Anywhere Inc.

- SS&C Blue Prism

- EdgeVerve Systems Limited

- Pegasystems Inc.

- UiPath

- Microsoft

- Datamatics Global Services Limited

- Fortra, LLC

- NICE

- CGI Inc.

Key Industry Developments

- May 2024 (Partnership): ABB Robotics signed an MoU with Seoul-based food processing company Pulmuone Co., Ltd. to develop automation solutions for laboratory-grown foods. Pulmuone, the owner of brands such as Nasoya and Monterey Gourmet Foods, is advancing a new generation of cell-cultivated seafood products.

- March 2024 (Launch): Datamatics announced the pricing for its GenAI version of the TruCap+ Intelligent Document Processing (IDP) product. As a pioneer in the IDP software space, Datamatics offers transparent and accessible pricing, ensuring accurate and predictable costs for customers.

- August 2023 (Partnership): GP Batteries, a leading global supplier of primary and rechargeable batteries, integrated SAP Robotic Process Automation to improve its operational efficiency and agility. This initiative was aimed to automate and streamline business development and customer service processes, reducing manual effort and enhancing productivity.

- June 2023 (Collaboration): Automation Anywhere and Google Cloud announced an enhanced partnership leveraging generative AI and intelligent automation to expedite AI adoption across enterprises. Automation Anywhere integrates Google Cloud’s large language models (LLMs) through Vertex AI, enhancing its Automation Success Platform with new generative AI capabilities. This collaboration expands automation possibilities in various business functions such as HR, finance, IT, and supply chain management, offering customers innovative solutions and unlocking new automation use cases.

- May 2023 (Launch): SS&C Technologies introduced SS&C Blue Prism Process Intelligence 2.0, an advanced AI-driven process and task mining solution. Utilizing ABBYY Timeline 6.0, the platform accelerates process discovery by up to 80%. Integrated with SS&C Blue Prism Chorus BPM, it supports continuous process optimization and scalability, empowering businesses to efficiently manage and enhance operational outcomes.

The global robotic process automation market is segmented as:

By Component

- Software

- Automated Software Solutions

- Decision Support Solutions

- Interaction Solutions

- Services

- Managed Service

- Professional Service

By Deployment

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Vertical

- BFSI

- Healthcare

- Retail

- IT & Telecommunications

- Manufacturing

- Energy & Utilities

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America