Rhodium Market Size

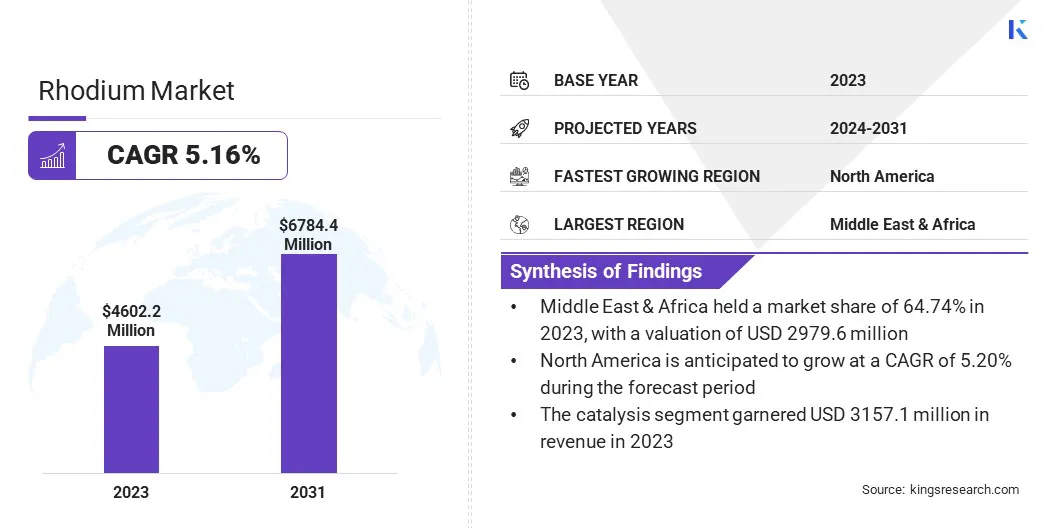

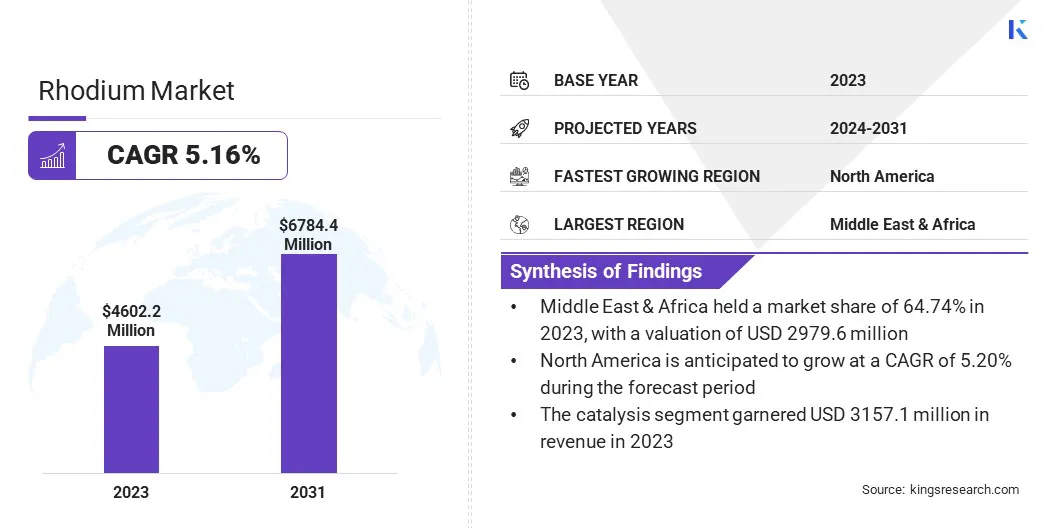

The global Rhodium Market size was valued at USD 4,602.2 million in 2023 and is projected to reach USD 6,784.4 million by 2031, growing at a CAGR of 5.16% from 2024 to 2031. Increasing industrial applications, expanding chemical manufacturing sector, and development of innovative catalysts are major factors driving the demand for rhodium and aiding its market growth.

In the scope of work, the report includes products offered by companies such as Anglo American Platinum Ltd., Impala Platinum Holding Limited (Implats), Norilsk Nickel, Sibanye-Stillwater, Johnson Matthey, Heraeus Holding GmbH, Umicore SA, Tanaka Holdings Co., Ltd., Sumitomo Metal Mining Co., Ltd., Mitsui Mining and Smelting Co., Ltd., and Others.

Rhodium, an essential component, helps in converting nitrogen oxides (NOx) and carbon monoxide (CO) into less harmful products. Stringent emission regulations in major automobile markets like Europe, the U.S., and China are driving the demand for advanced automotive catalytic converters. These regulations that aim to lower harmful vehicle emissions, are pushing automakers to adopt advanced catalytic converter technologies.

- In January 2023, Sibanye-Stillwater’s joint venture partner ioneer at the Rhyolite Ridge lithium-boron project in Nevada, USA, received a conditional loan commitment from the United States Department of Energy (DOE) to support the development of Rhyolite Ridge. This development could enhance the supply chain for critical materials like lithium and boron, which are pivotal in supporting advanced catalytic converter technologies.

The demand for rhodium is expected to rise as governments tighten emission standards to combat air pollution and mitigate climate change. Since, rhodium is an environmentally compliant option, its use in the automotive sector emphasizes the importance of sustainable technologies in addressing global challenges.

Rhodium is a rare transition metal with a silvery-white appearance that belongs to the platinum group of metals. It possesses exceptional properties such as high resistance to corrosion and oxidation, which make it ideal primarily for catalytic converters in vehicles to reduce emissions of nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons (HC).

Rhodium also finds applications in chemical manufacturing, electronics, and jewelry. In addition, advancements in catalytic converter technologies and development of new rhodium-based catalysts are expected to add to the demand for rhodium. Furthermore, regulatory frameworks focused on reducing vehicle emissions are bolstering the adoption of rhodium in catalytic systems, thereby supporting industry expansion.

Analyst’s Review

Analyst’s Review

Key players in the market aim to secure a sustainable supply chain and invest in research and development to discover innovative applications. Manufacturers are actively working to ensure a steady supply of rhodium. They plan on meeting the rising consumer demand by collaborating with mining companies to identify new deposits and improve extraction technologies.

Additionally, key players are focused on developing next-generation rhodium-based catalysts to address specific industrial needs.

- In June 2022, LS-Nikko Copper Inc., a leading South Korean smelter specializing in electrolytic copper and rare/precious metals, began producing rhodium to address the growing demand. As rhodium is widely used for reducing emissions, this move marks a strategic effort to support its anticipated market needs.

Key players are focusing on forming strategic partnerships with automotive manufacturers and other key stakeholders to facilitate technology adoption. These strategies are enabling manufacturers to capitalize on emerging opportunities and are poised to boost market growth in the coming years.

Rhodium Market Growth Factors

Rising electric vehicle (EV) production is generating the demand for rhodium in fuel cell technology. Fuel cells with rhodium as a catalyst are gaining traction as clean energy alternatives to internal combustion engines in the transportation segment.

As governments and consumers prioritize decarbonization and sustainable mobility, the demand for fuel cell vehicles is anticipated to surge. Rhodium works as a fuel cell catalyst and facilitates the electrochemical reaction that converts hydrogen into electricity with minimal impact on the environment. Thus, the growth in EV production is slated to increase the utilization of rhodium in traditional catalytic converters and present new opportunities in fuel cell technology.

However, price volatility and speculative trading will likely create uncertainty for market participants. Limited supply of rhodium and its fluctuating demand will contribute to the price volatility, making it challenging to plan investments and predict market trends. Speculative trading exacerbates price fluctuations, as investors capitalize on short-term opportunities, potentially distorting market dynamics.

To overcome this challenge, market participants are practicing hedging and diversification to mitigate the impact of price volatility on their operations. Additionally, key players are fostering transparency and collaboration within the supply chain to enhance market stability, which is expected to drive market demand in coming years.

Rhodium Market Trends

The rhodium market is witnessing strong growth on account of the growing demand for automotive catalytic converters. Additionally, advancements in clean energy technologies are impelling rhodium's usage in fuel cells and hydrogen production. Supply constraints due to limited production and geopolitical tensions in major producing regions are influencing market dynamics.

Moreover, research and development efforts are focused on exploring new applications for rhodium in electronics and medical devices. These trends are driving product demand and innovation while presenting challenges related to supply chain stability and geopolitical risks.

The mining industry is observing a shift toward sustainable and ethical sourcing, driven by concerns over environmental impact and labor conditions. This shift is promoting transparency and accountability in the supply chain.

Additionally, investments in R&D are driving innovation in rhodium applications for green chemistry and clean energy enhancing sustainability and production efficiency, and fostering market growth. These trends are facilitating responsible resource management, driving technological advancements, and meeting evolving consumer preferences for environmentally friendly products.

Segmentation Analysis

The global market is segmented based on product type, application, and geography.

By Product Type

Based on product type, the market is segmented into alloys, metal, and compounds. The alloys segment secured the largest revenue share of 69.86% in 2023. This dominance is attributed to the widespread use of rhodium alloys due to their desirable properties, including high corrosion resistance, durability, and aesthetic appeal.

Industries rely on rhodium alloys to enhance the performance and longevity of their products, which impels the use of rhodium in alloy applications. Additionally, the alloys segment's dominance underscores the versatility of rhodium in catering to diverse market needs across multiple sectors, highlighting its pivotal role in various industrial processes and consumer products.

By Application

Based on application, the rhodium market is classified into catalysis, chemical manufacturing, electrical and electronics, jewelry, and others. The catalysis segment led the market in 2023, reaching a valuation of USD 3,157.1 million. Rhodium catalysts are critical in facilitating chemical transformations and reducing harmful emissions from vehicles.

As governments worldwide implement stricter emission regulations, the demand for catalytic converters equipped with rhodium catalysts is rising. Additionally, the indispensable nature of rhodium in enabling sustainable industrial processes and mitigating environmental pollution is aiding segmental growth.

Rhodium Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

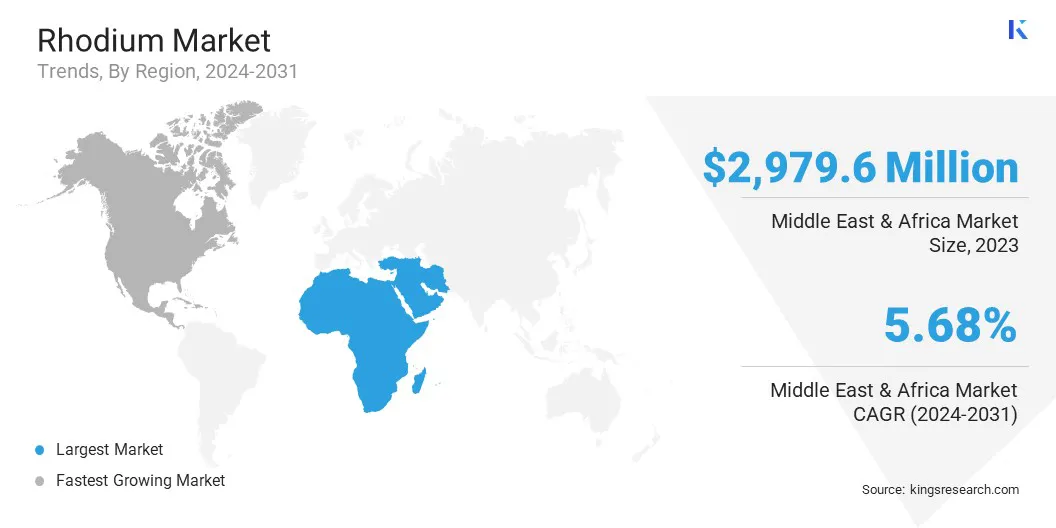

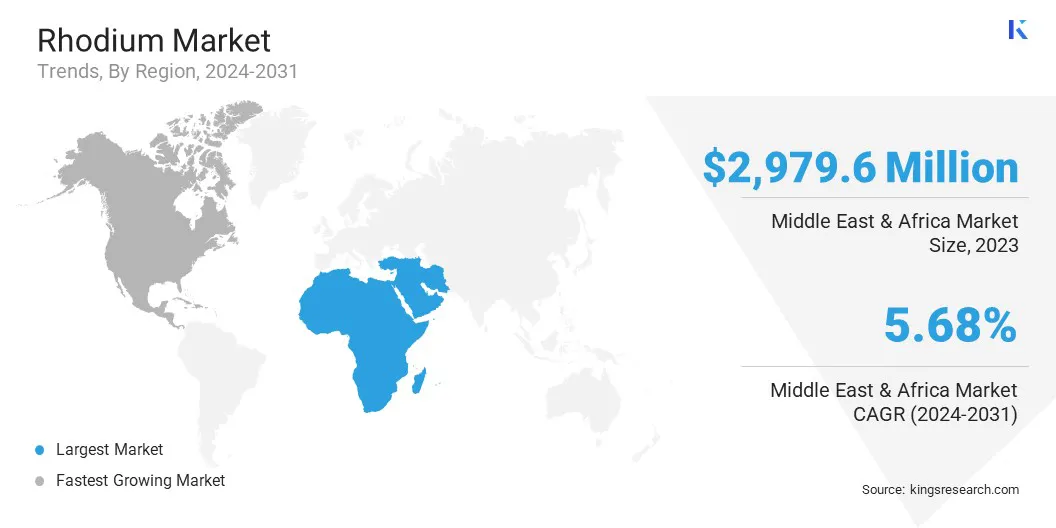

Middle East & Africa Rhodium Market share stood around 64.74% in 2023 in the global market, with a valuation of USD 2979.6 million. The presence of substantial rhodium reserves, particularly in South Africa, is aiding regional market growth. Robust industrial activity in mining, automotive manufacturing, and chemical processing, among other sectors, propels the demand for rhodium-based catalysts and compounds.

Middle East & Africa Rhodium Market share stood around 64.74% in 2023 in the global market, with a valuation of USD 2979.6 million. The presence of substantial rhodium reserves, particularly in South Africa, is aiding regional market growth. Robust industrial activity in mining, automotive manufacturing, and chemical processing, among other sectors, propels the demand for rhodium-based catalysts and compounds.

Additionally, favorable government policies and investment initiatives aimed at promoting economic diversification and industrial development are bolstering regional market growth. With ongoing infrastructure projects and an increasing focus on sustainable development, the region is poised to maintain its leading position in the market in the foreseeable future.

The North America rhodium market is expected to grow at a strong CAGR of 5.20% throughout the forecast period, driven by factors such as a well-established automotive industry and stringent emission regulations. These regulations are increasing the demand for rhodium-based catalytic converters to help reduce vehicle emissions. Furthermore, rising investments in clean energy initiatives, especially in fuel cell technology, are boosting the use of rhodium as a catalyst.

- In October 2023, Lifezone Metals Limited signed a term sheet with a subsidiary of Glencore plc to undertake a recycling project focused on platinum, palladium, and rhodium (PGMs) in the USA. This project will utilize Lifezone Metals’ advanced hydrometallurgical technology ("Hydromet") to enhance recycling processes for these key metals.

Moreover, a strong emphasis on innovation and technological advancements, supported by a favorable regulatory environment, facilitates the development of new applications for rhodium across diverse industries in the region. Furthermore, the region's stable economic conditions and growing consumer awareness regarding environmental sustainability contribute to the adoption of rhodium-based solutions.

Competitive Landscape

The global rhodium market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Rhodium Market

- Anglo American Platinum Ltd.

- Impala Platinum Holding Limited (Implats)

- Norilsk Nickel

- Sibanye-Stillwater

- Johnson Matthey

- Heraeus Holding GmbH

- Umicore SA

- Tanaka Holdings Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Mitsui Mining and Smelting Co., Ltd.

Recent Development:

- July 2023 (Product Launch): Reade International Corp. announced the launch of a new product, AM TZM Powder, a fully alloyed TZM powder, as a part of its Additive Manufacturing Powder product line.

The Global Rhodium Market is Segmented as:

By Product Type

By Application

- Catalysis

- Chemical Manufacturing

- Electrical and Electronics

- Jewelry

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America