Market Definition

The market involves the production, distribution, and sale of open-cell foams with a porous structure. This market covers applications in filtration, sound absorption, cushioning, medical devices, automotive components, and industrial processing.

The market is driven by demand from sectors such as healthcare, aerospace, consumer goods, and automotive.

Reticulated Foam Market Overview

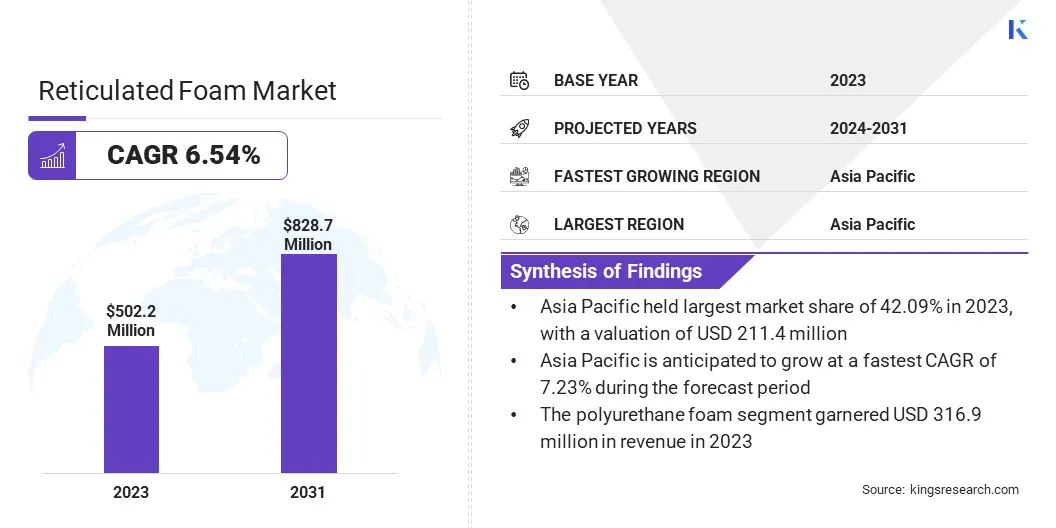

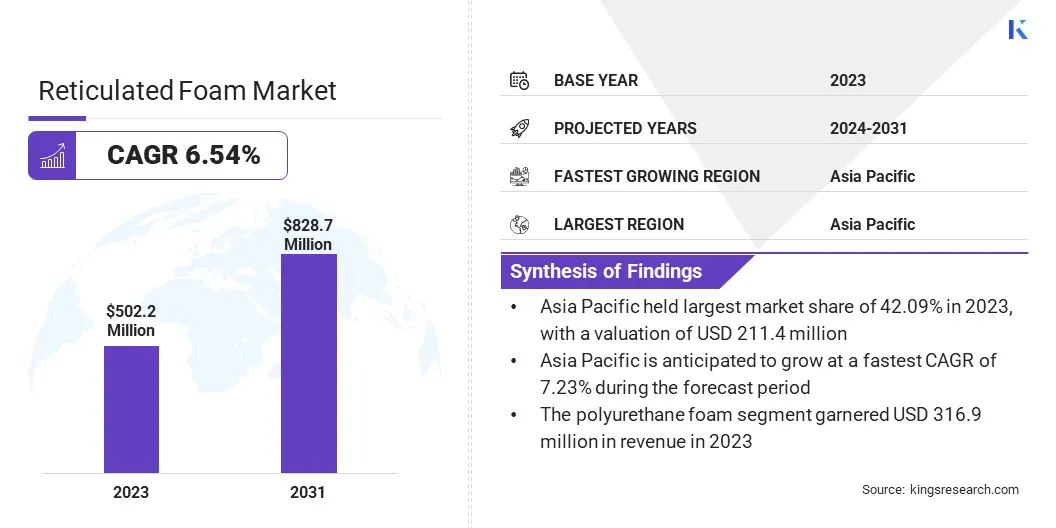

The global reticulated foam market size was valued at USD 502.2 million in 2023 and is projected to grow from USD 531.9 million in 2024 to USD 828.7 million by 2031, exhibiting a CAGR of 6.54% during the forecast period.

This market is registering steady growth, fueled by increasing demand across various industries, particularly in filtration, automotive, healthcare, and consumer goods. The superior porosity and permeability of reticulated foam make it ideal for liquid and air filtration applications, leading to its widespread use in water purification systems, industrial filters, and HVAC systems.

In the automotive sector, the material is used for sound absorption, fuel filtration, and cushioning components, enhancing vehicle performance and comfort.

Major companies operating in the reticulated foam industry are Rogers Foam Corporation, Woodbridge Foam Corporation, Foamcraft, Inc., Reilly Foam Corporation, Technical Foam Services Ltd., Draka Interfoam B.V., Carpenter Co., FXI, UFP Technologies, Inc., The Vita Group, Future Foam, Inc., INOAC CORPORATION, Armacell, Filson Purification Equipment Co., LTD., and NEVEON Holding GmbH.

The healthcare industry is also a key contributor to market expansion, utilizing reticulated foam in wound care, medical filters, and surgical equipment due to its excellent fluid management properties. Additionally, the increasing focus on high-performance materials in packaging and protective cushioning solutions is fueling the market.

Advancements in manufacturing technologies, including enhanced polymer processing and customizable foam structures, continue to improve product quality and expand application possibilities, contributing to the market’s ongoing expansion.

- In August 2024, Alpinestars introduced a new high-performance motocross goggle range designed for enhanced clarity, comfort, and durability. Notably, the goggles utilize 100 PPI reticulated foam in the venting and face foam, ensuring superior airflow, moisture management, and sweat absorption—critical for rider comfort during intense motocross conditions.

Key Highlights

- The reticulated foam industry size was valued at USD 502.2 million in 2023.

- The market is projected to grow at a CAGR of 6.54% from 2024 to 2031.

- Asia Pacific held a market share of 42.09% in 2023, with a valuation of USD 211.4 million.

- The polyurethane foam segment garnered USD 316.9 million in revenue in 2023.

- The fine segment is expected to reach USD 413.5 million by 2031.

- The filtration segment is expected to reach USD 269.1 million by 2031.

- The automotive and transportation segment is expected to reach USD 206.8 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 6.69% during the forecast period.

Which application is driving the market demand?

The reticulated foam market is registering significant growth, due to increasing demand across various industries and advancements in material technology.

One of the key drivers of the market is the rising demand for high-performance filtration solutions. Reticulated foam’s open-cell structure makes it ideal for air, water, and fuel filtration applications in industries such as automotive, healthcare, and industrial manufacturing.

As industries emphasize improved efficiency and contamination control, the adoption of reticulated foam in filtration systems continues to expand. Additionally, the growing applications in cushioning and impact absorption are fueling the market.

The material’s lightweight, durable, and shock-absorbing properties make it a preferred choice for packaging, protective gear, and seating applications in aerospace, automotive, and sports industries.

- In March 2023, Green Foam introduced RETICOLDRY, highly breathable reticulated foam with a fully open-cell structure for superior airflow and moisture control. Resistant to bacteria and mold, it ensures fast water drainage and reduced drying times, making it ideal for outdoor use. RETICOLDRY is perfect for bedding, nautical furnishings, beach & pool cushions, and garden & camping furniture.

What are the negative implications of high production cost on the market?

High production costs associated with its specialized manufacturing process remain a significant hurdle in the reticulated foam market. Producing reticulated foam requires advanced techniques such as thermal or chemical reticulation, which involve precise control over materials and energy-intensive processes.

These factors contribute to elevated manufacturing expenses, making it difficult for companies to maintain competitive pricing while ensuring product quality. Additionally, raw material costs, particularly for polyurethane-based foams, fluctuate due to supply chain constraints and increasing demand.

Thus, manufacturers are investing in process optimization, automation, and material innovations to enhance efficiency and reduce costs without compromising performance.

How are innovations in manufacturing shaping the market?

The reticulated foam market is evolving with key trends that emphasize environmental responsibility and technological advancements. Polyurethane foam recycling and circular economy efforts are gaining momentum as companies invest in closed-loop recycling processes to reduce waste and repurpose reticulated foam.

Innovations such as chemical and mechanical recycling methods are being explored to recover foam materials without compromising quality, making foam production more efficient and environmentally friendly.

- In April 2024, BASF introduced new polyurethane foam recycling solutions at UTECH, including fully recyclable PU flexible foams for furniture, automotive, and footwear. Vitra incorporated these foams into its furniture, while ZF Lifetec developed a recyclable PU steering wheel with BASF. The company also unveiled chemical recycling for PU rigid foams in refrigerators, enhancing circular economy efforts.

At the same time, advancements in manufacturing techniques to enhance foam properties are transforming the market. High-precision fabrication methods, including advanced thermal reticulation and computer-controlled processing, are improving foam durability, consistency, and performance.

These innovations enable customization of pore structures, better control over density variations, and the development of foams with specialized properties for industries such as automotive, medical, and filtration.

By integrating sustainability-driven recycling initiatives and cutting-edge production technologies, the market is positioning itself for long-term growth and innovation.

Reticulated Foam Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Polyurethane Foam, Polyethylene Foam

|

|

By Pore Size

|

Fine, Medium, Coarse

|

|

By Application

|

Filtration, Sound Absorption, Fluid Management, Cleaning Products, Other Applications

|

|

By End-use Industry

|

Automotive and Transportation, Healthcare, Consumer Goods, Aerospace and Defense, Industrial and Manufacturing

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material Type (Polyurethane Foam, Polyethylene Foam): The polyurethane foam segment earned USD 316.9 million in 2023, due to its excellent filtration efficiency, durability, and widespread use in automotive, healthcare, and industrial applications.

- By Pore Size (Fine, Medium, Coarse): The fine segment held 53.09% share of the market in 2023, due to its superior filtration capabilities, making it ideal for medical, water purification, and air filtration applications.

- By Application (Filtration, Sound Absorption, Fluid Management, Cleaning Products, Other Applications): The filtration segment is projected to reach USD 269.1 million by 2031, owing to the increasing demand for high-performance air and liquid filtration solutions in healthcare, automotive, and industrial sectors.

- By End-use Industry (Automotive and Transportation, Healthcare, Consumer Goods, Aerospace and Defense, Industrial and manufacturing): The automotive and transportation segment is projected to reach USD 206.8 million by 2031, owing to the rising use of reticulated foam in fuel filtration, sound absorption, and cushioning components to enhance vehicle performance and comfort.

What is the market scenario in Asia-Pacific and Europe region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 42.09% share of the reticulated foam market in 2023, with a valuation of USD 206.8 million. The dominance of this region is primarily driven by the strong presence of manufacturing industries, particularly in China, India, and Japan, where high demand for reticulated foam is derived from automotive, consumer goods, and industrial filtration applications.

The rapid expansion of the automotive sector, coupled with increased investments in infrastructure and water treatment projects, has further fueled the market. Additionally, the growing healthcare sector, with rising demand for medical-grade filtration and wound care products, has significantly contributed to the region’s market expansion.

The presence of key foam manufacturers and advancements in polymer technology has also supported the widespread adoption of reticulated foam in various end-use industries.

- In March 2024, Joyce introduced its new Thermal Reticulation Chamber, enhancing reticulated foam production with advanced automation and safety features. The first units, set for Sheela Foam, India, will double its reticulated foam output. Used in industrial, medical, and outdoor applications, reticulated foam offers durability and quick-dry properties through the "zapping" process.

The market in Europe is expected to register the fastest growth, with a projected CAGR of 6.69% over the forecast period. This growth is primarily attributed to the region’s increasing emphasis on sustainability, stringent environmental regulations, and a rising demand for high-performance filtration solutions in industries such as automotive, aerospace, and healthcare.

European countries, particularly Germany, France, and the UK, are investing in advanced automotive filtration and noise reduction solutions, driving the demand for reticulated foam. The aerospace and defense sector in the region also plays a crucial role in market expansion, as the need for lightweight, durable, and efficient materials continues to rise.

Additionally, advancements in manufacturing processes, along with a growing focus on eco-friendly and recyclable foam products are further propelling the market in Europe.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the environmental impact of reticulated foam manufacturing, particularly concerning emissions and hazardous chemicals.

- In Europe, the European Chemicals Agency (ECHA) enforces regulations under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework to control the use of chemical substances in reticulated foam production.

- In China, the Ministry of Ecology and Environment (MEE) regulates the environmental impact of foam manufacturing, including emissions and waste disposal.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates industrial production standards for reticulated foam. The Ministry of the Environment (MOE) enforces environmental compliance, while the Pharmaceuticals and Medical Devices Agency (PMDA) ensures safety standards for foam used in medical applications.

- In India, the Central Pollution Control Board (CPCB) under the Ministry of Environment, Forest and Climate Change (MoEFCC) regulates emissions and environmental impact from foam manufacturing.

Competitive Landscape

The global reticulated foam market is characterized by continuous advancements in material technology, growing demand across multiple industries, and a strong focus on sustainability. Manufacturers are actively investing in product innovation, enhancing the properties of reticulated foam to improve durability, filtration efficiency, and versatility for various applications.

Strategic partnerships, mergers, and acquisitions are playing a crucial role in expanding market reach and strengthening production capabilities. Companies are increasingly focusing on customization, developing specialized foam solutions for high-performance applications in automotive filtration, medical-grade products, and industrial processing.

Additionally, ongoing research and development efforts are leading to improved manufacturing techniques, optimizing cost-effectiveness while maintaining high-quality standards. With the market evolving, the emphasis remains on sustainability, innovation, and tailored solutions to meet the growing needs of diverse end-use industries.

- In June 2023, Carpenter Co. acquired Recticel N.V.’s Engineered Foams Division, including the former Foam Partner and Otto Bock operations, making it the world’s largest vertically integrated manufacturer of polyurethane foams. This acquisition expands Carpenter’s global footprint, product offerings, and innovation capabilities, particularly in sustainability and foam recycling.

Top Companies in Reticulated Foam Market:

- Rogers Foam Corporation

- Woodbridge Foam Corporation

- Foamcraft, Inc.

- Reilly Foam Corporation

- Technical Foam Services Ltd.

- Draka Interfoam B.V.

- Carpenter Co.

- FXI

- UFP Technologies, Inc.

- The Vita Group

- Future Foam, Inc.

- INOAC CORPORATION

- Armacell

- Filson Purification Equipment Co., LTD.

- NEVEON Holding GmbH

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Circularise announced a major milestone in polyurethane (PU) foam recycling through its involvement in the Circular Foam project. The initiative, led by Covestro and key industry partners, aims to enhance the circularity of rigid PU foam used in construction, appliances, and insulation. Circularise developed Digital Product Passports (DPPs) to improve traceability and transparency in PU foam recycling, enabling secure data sharing across the value chain.

- In November 2024, JLR, in collaboration with Dow and Adient, achieved a breakthrough in closed-loop recycling of PU seat foam. The initiative, developed at JLR’s Circularity Lab, aims to reintegrate recycled seat foam into new luxury vehicle seats, significantly reducing emissions and waste. PU foams, known for their durability, are challenging to recycle, but this innovation enables a secure, low-carbon supply chain.

- In April 2024, Huntsman launched its new SHOKLESS PU foam systems designed to enhance the protection of Electric Vehicle (EV) batteries. These lightweight, durable foams provide thermal and structural protection at the cell, module, and pack levels while offering fast processability. The SHOKLESS portfolio includes a range of low- to high-density foams compatible with various PU dispensing processes.

- In November 2023, Carpenter Co. acquired the flexible foam assets of NCFI’s Consumer Products Division, strengthening its position as the world’s largest vertically integrated manufacturer of PU foams . The acquisition expands Carpenter’s Engineered Foams business, integrating NCFI’s advanced foam solutions for furniture, mattresses, aerospace, marine, and medical industries.