Market Definition

The aircraft refueling hose market includes specialized flexible conduits engineered to ensure safe and efficient aviation fuel transfer between storage systems and aircraft. These hoses are built to handle high pressure, extreme temperatures, and exposure to aviation fuels, maintaining durability and leak-free performance.

They play a critical role in ensuring fueling accuracy, safety compliance, and uninterrupted ground operations across commercial, military, and private aviation sectors. Applications span airport fueling systems, hydrant dispensers, mobile refuelers, and military bases, supporting both fixed-wing and rotary aircraft.

Aircraft Refueling Hose Market Overview

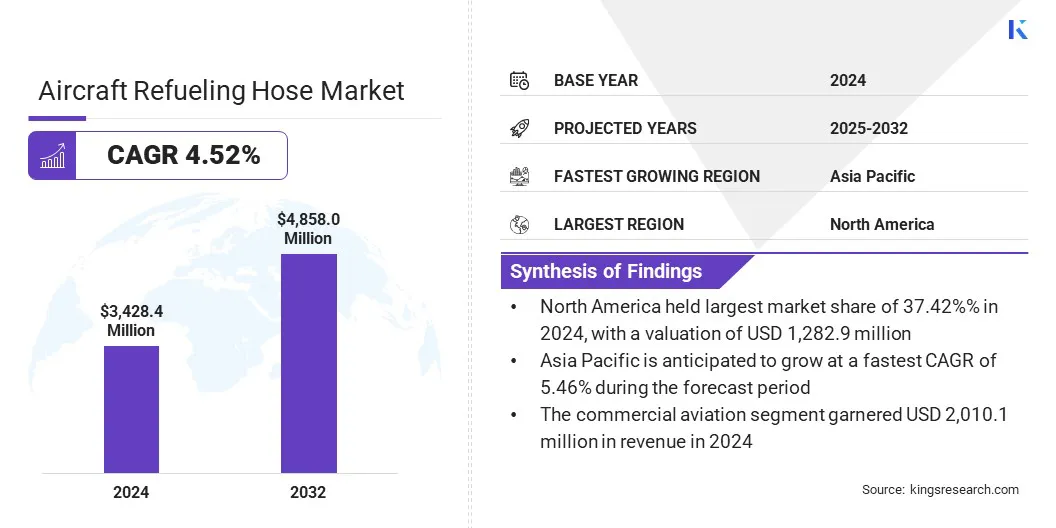

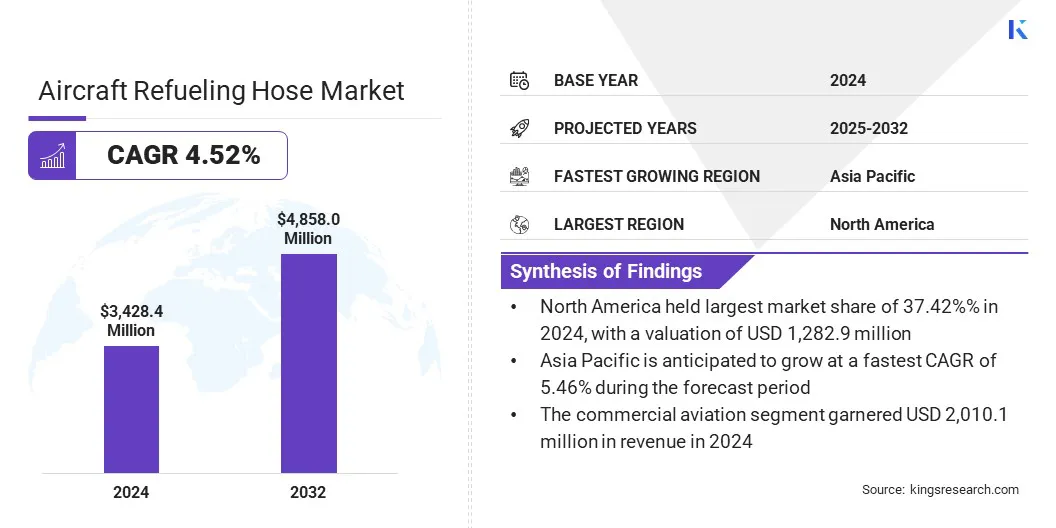

According to Kings Research, the global aircraft refueling hose market size was valued at USD 3,428.4 million in 2024 and is projected to grow from USD 3,564.0 million in 2025 to USD 4,858.0 million by 2032, exhibiting a CAGR of 4.52% over the forecast period.

Market growth is primarily driven by the increasing demand for reliable and high-performance aircraft refueling hoses that ensure safe and efficient fuel transfer. Rising adoption of advanced hose materials, pressure-resistant designs, and leak-proof technologies is enhancing operational safety and fueling industry expansion.

Key Market Highlights:

- The aircraft refueling hose industry size was valued at USD 3,428.4 million in 2024.

- The market is projected to grow at a CAGR of 4.52% from 2025 to 2032.

- North America held a market share of 37.42% in 2024, valued at USD 1,282.9 million.

- The composite hose segment garnered USD 1,453.0 million in revenue in 2024.

- The aftermarket segment is expected to reach USD 3,128.3 million by 2032.

- The commercial aviation segment is anticipated to witness the fastest CAGR of 4.81% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.46% through the projection period.

Major companies operating in the aircraft refueling hose market are Trelleborg Group, Husky Corporation, Eaton, Polyhose, Continental AG, Saint-Gobain, ELAFLEX HIBY GmbH & Co. KG, Aero-Hose, Corp, Delafield Corporation, Aljac Fuelling Components Ltd., GARSITE, AEROFLEX, TIPCO Technologies, Icon Aerospace Technology, Becker & Associates, and Dixon Valve & Coupling Company, LLC.

Growing investments in airport infrastructure, commercial aviation, and defense aviation are supporting the deployment of modern refueling systems. Additionally, ongoing innovations by manufacturers in hose durability, flexibility, and compliance with stringent aviation safety standards are contributing to the market growth.

- In April 2025, Continental inaugurated a high-pressure hydrogen hose production facility in Korbach, Germany, investing approximately USD 3.50 million. The facility will produce hoses for the hydrogen value chain, including transportation, storage, and refueling for vehicles, ships, and aircraft.

Why does rising air traffic & fleet expansion boost demand for refueling hoses?

Rising air traffic and expanding aircraft fleets are driving the demand for high-performance refueling hoses that ensure safe, efficient, and reliable fuel transfer. These hoses are engineered to withstand high pressure, extreme temperatures, and exposure to aviation fuels.

Airports, commercial airlines, and military operators are increasingly deploying advanced hose systems to support frequent refueling operations and maintain stringent safety standards. Expansion of airport infrastructure, coupled with increasing regulatory and operational requirements, is driving the adoption of durable and advanced refueling hoses across the aviation sector.

How does limited technological standardization pose a challenge for the market?

Limited technological standardization is a major challenge in the aircraft refueling hose market. Hoses often differ in size, design, pressure ratings, and compatibility across various aircraft types and refueling systems, making it difficult for operators to adopt uniform solutions.

Maintaining multiple hose variants or adapters increases operational complexity, requires higher inventory levels, and raises overall costs. Smaller airports and operators with limited resources may find it particularly challenging to implement consistent maintenance, training, and replacement protocols.

Variations in hose specifications also slow down refueling operations, affect efficiency, and can create safety concerns when personnel handle incompatible or aging hoses. These factors limit the ability of operators to streamline operations and reduce operational expenditures.

To overcome this, manufacturers can develop hoses with universal compatibility and modular designs, while industry collaboration on common standards can improve interoperability. Standardized connectors and adaptable couplings further reduce complexity and enhance operational efficiency.

How are advancements in hose materials & engineering impacting the market?

Advancements in hose materials and engineering are driving significant improvements in aircraft refueling operations. Modern hoses constructed from high-strength polymers and composite materials offer enhanced durability, flexibility, and resistance to high pressure, temperature fluctuations, and chemical exposure.

These attributes ensure safer, more efficient fuel transfer across commercial and military aircraft, supporting uninterrupted flight operations and regulatory compliance.

Airlines, airport operators, and defense organizations benefit from reduced maintenance requirements, longer service life, and improved handling efficiency. Innovations in hose design and material technology further optimize fuel flow, minimize operational downtime, and enable reliable performance in demanding aviation environments.

Increasing adoption of these advanced hoses is positioning them as essential components in modern refueling infrastructure, enhancing operational safety, efficiency, and long-term reliability across the aviation sector.

- In February 2023, Robinson Helicopter Company introduced an FAA-approved pressure refueling system for the R66 turbine helicopter. The system, offered as an $18,000 option, allowed refueling at up to 50 gallons per minute.

Aircraft Refueling Hose Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Composite Hose, Stainless Steel Hose, Rubber Hose, and Others

|

|

By Sales Channel

|

Original Equipment Manufacturer (OEM), and Aftermarket

|

|

By End Use

|

Commercial Aviation, Military Aviation, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Composite Hose, Stainless Steel Hose, Rubber Hose, and Others): The composite hose segment earned USD 1,453.0 million in 2024, primarily due to its superior flexibility, durability, and resistance to high pressure and chemical exposure.

- By Sales Channel (Original Equipment Manufacturer (OEM), and Aftermarket): The aftermarket held a share of 63.28% of the market in 2024, due to the growing need for replacement hoses, maintenance services, and upgrades across commercial and military aircraft fleets.

- By End Use (Commercial Aviation, Military Aviation, and Others): The commercial aviation segment is projected to reach USD 2,914.2 million by 2032, owing to increasing air travel demand and the expansion of airline fleets worldwide.

What is the aircraft refueling hose market scenario in North America and the Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aircraft refueling hose market share stood at 37.42% in 2024, valued at USD 1,282.9 million. This dominance is attributed to the high volume of air travel, extensive airport networks, and a well-established defense aviation sector.

Continuous government investments in airport modernization, expansion of passenger and cargo facilities, and upgrades to ground support systems are driving regional demand for advanced refueling solutions. Increasing fleet sizes among commercial airlines and growing military aviation operations further contribute to the need for reliable and durable hoses.

The adoption of high-performance materials, pressure-resistant designs, and safety-compliant systems ensures efficient fuel transfer and minimizes operational downtime. Additionally, stringent regulatory standards for fuel handling and maintenance practices are increasing the deployment of technologically advanced refueling hoses, thereby driving market growth across North America.

Asia Pacific aircraft refueling hose industry is set to grow at a CAGR of 5.46% over the forecast period. This growth is driven by increasing air travel, expanding airline fleets, and the rapid development of airport infrastructure across the region.

Rising adoption of high-performance refueling hoses with improved durability, pressure resistance, and chemical stability is enhancing operational efficiency and safety. Investments in new airports, modernization of existing terminals, and expansion of cargo and passenger facilities are further supporting market expansion in this region.

Additionally, manufacturers are focusing on technological innovations, lightweight materials, and modular designs to improve hose performance and ease of maintenance.

Regulatory emphasis on aviation safety and fuel handling standards, combined with growing military and commercial aviation activities, is reinforcing the deployment of advanced refueling solutions, positioning Asia Pacific as a key growth region in the global hose market.

Regulatory Frameworks

- In the U.S., SAE AMS3389A regulates synthetic rubber aircraft fueling hoses. It specifies performance requirements for hoses used in aviation fuel servicing, ensuring safety and reliability in fueling operations.

- In the UK, EI 1529 regulates aircraft fueling hoses and assemblies. It outlines performance requirements and test procedures to ensure the safety and functionality of fueling equipment.

Competitive Landscape

Companies in the global aircraft refueling hose market are maintaining competitiveness by investing in advanced materials, pressure-resistant designs, and safety-compliant engineering. They are expanding product portfolios across commercial, military, and private aviation applications to meet stringent performance, durability, and regulatory requirements.

Market participants are expanding their portfolios with lightweight, modular, and chemically resistant hose variants to cater to diverse operational requirements. Additionally, they are establishing regional production facilities, forming strategic partnerships, and collaborating with ground support equipment providers to strengthen supply chain efficiency and market presence.

Companies are also offering technical support, maintenance services, and training programs to enhance operational reliability, minimize downtime, and maintain a competitive edge in the growing global market.

List of Key Companies in Aircraft Refueling Hose Market:

- Trelleborg Group

- Husky Corporation

- Eaton

- Polyhose

- Continental AG

- Saint-Gobain

- ELAFLEX HIBY GmbH & Co. KG

- Aero-Hose, Corp

- Delafield Corporation

- Aljac Fuelling Components Ltd.

- GARSITE

- AEROFLEX

- TIPCO Technologies

- Icon Aerospace Technology

- Becker & Associates

- Dixon Valve & Coupling Company, LLC

Recent Developments

- In September 2025, the Royal Thai Air Force placed an order for the Airbus A330 Multi Role Tanker Transport Plus (MRTT+), becoming the launch customer for the next-generation aircraft. Based on the A330neo platform, the MRTT+ featured hose-and-drogue and boom refueling systems, a VVIP cabin, and a medical evacuation kit. Military conversion was scheduled at the A330 MRTT Centre in Getafe, Spain, in 2026.