Remote Towers Market Size

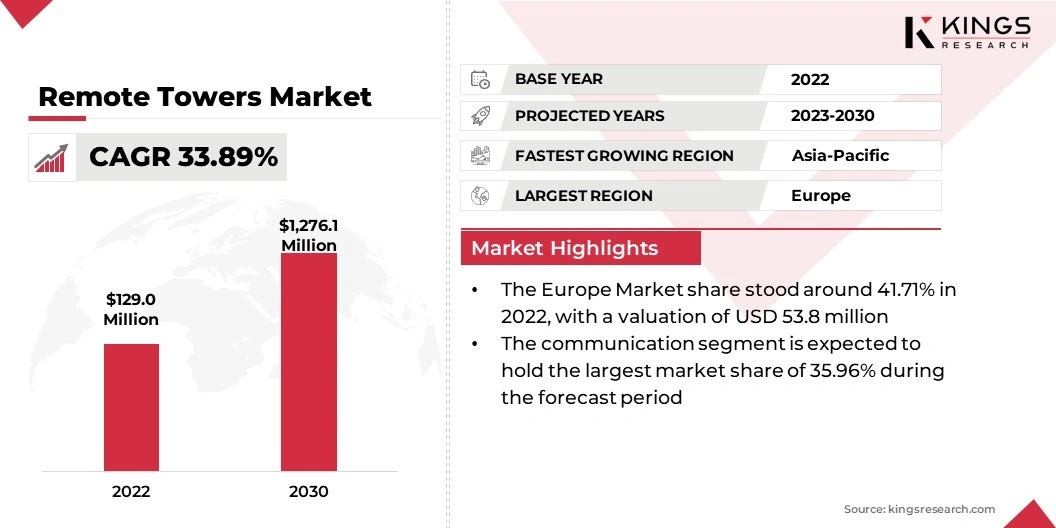

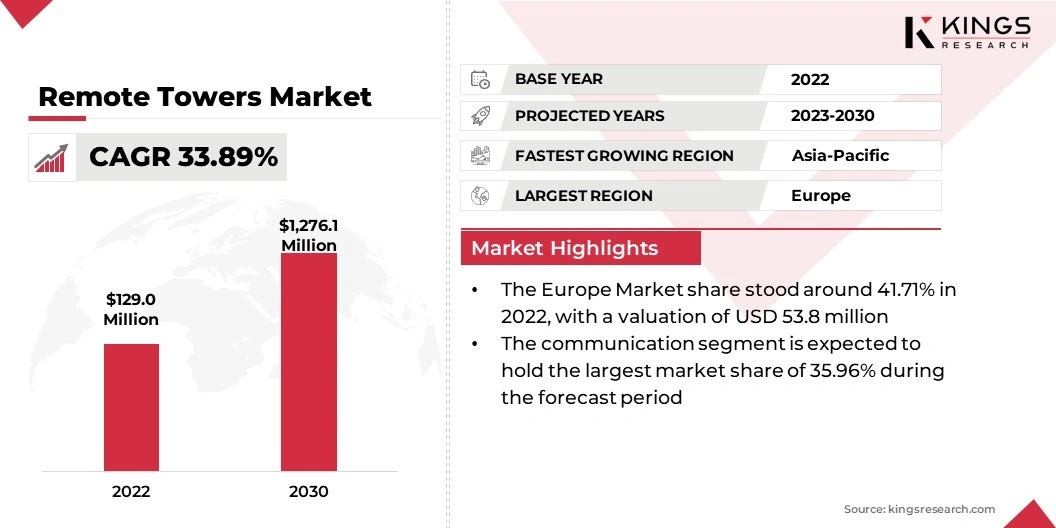

The global Remote Towers Market size was valued at USD 129.0 million in 2022 and is projected to reach USD 1,276.1 million by 2030, growing at a CAGR of 33.89% from 2023 to 2030. In the scope of work, the report includes solutions offered by companies such as Thales, Adacel Technologies Limited, Raytheon Technologies Corporation, DFS Deutsche Flugsicherung GmbH, Leidos, Saab AB, Kongsberg Defence & Aerospace, Becker Avionics GmbH, L3Harris Technologies, Inc., Searidge Technologies, Avinor AS, Leonardo S.p.A., Rohde & Schwarz, EIZO Corporation, FREQUENTIS AG and Others.

The rising investments in the aviation industry are expected to fuel the growth of remote towers as they provide a cost-efficient solution to air traffic control. The aviation industry has been witnessing strong growth, leading to an increase in air traffic. This has created a demand for innovative and efficient air traffic control systems, such as remote towers.

Additionally, governments and aviation industry players are investing heavily in upgrading infrastructure and implementing smart airport systems to meet future growth in air travel. Remote towers provide a technologically advanced and cost-efficient solution to manage air traffic control services, making them an ideal investment for players in the aviation industry. However, one of the key challenges is ensuring reliable and secure data transmission, as remote towers rely on real-time video and audio feeds to operate.

- Remote towers have the potential to address capacity issues at big airports, and several companies are working on implementing this technology. Saab and LFV, for example, are currently working on a remote tower facility for Stockholm Arlanda Airport.

Analyst’s Review

Remote towers have become a significant trend in air traffic management over the past few years, and their popularity is expected to continue to rise in the future. The industry is witnessing an increasing level of investment in remote towers to address capacity issues and improve efficiency at airports. Various technological advancements, such as digitalization, AI, and advanced video analytics, are being used to enhance remote tower capabilities further.

Remote towers are also being implemented at military airbases to improve operational efficiency. With the increasing demand for air travel, remote towers will likely continue to be a critical trend in the aviation industry.

Market Definition

Remote towers are a modern concept where the air traffic service (ATS) at an airport is performed somewhere other than in the local control tower. Air traffic control officers can work at a remote tower center using high technology, including several high-definition cameras, to provide ATS for a single airport or multiple airports.

- Originally intended for airports with low traffic, the concept was eventually rolled out to London City Airport, a prominent international hub, in 2021. The cost-effectiveness of the RVT model is considered to be its primary advantage, but there are concerns about system redundancy.

Remote towers can be applied to a variety of air traffic control settings where traditional infrastructure is not feasible or cost-efficient. They are particularly useful for airports with low to medium traffic volumes, as they can help improve air traffic management while reducing costs. Additionally, remote towers can be beneficial for airports operating in regions with limited network infrastructure or challenging weather conditions. They can also be used at military airbases and for contingency operations. Overall, remote tower technology is versatile and can be applied in various applications, opening up numerous possibilities for the future of air traffic management.

- For instance, in May 2022, Adacel Technologies Limited renewed its subscription with the Mexican Air Force for simulation and training systems.

Remote Towers Market Dynamics

Remote towers are becoming increasingly important due to the increase in air passenger traffic, as they provide a cost-efficient solution to ensure safer and better air traffic control services. The growth in air passenger traffic has led to an increase in demand for remote towers that can efficiently manage air traffic control services in airports catering to low traffic volumes. According to a report, the remote towers market is expected to experience significant growth due to the increasing demand for air travel and the need for enhanced air traffic control systems.

The implementation of remote towers can provide a viable solution for airports with limited network infrastructure to meet the growing demand for air traffic control services. Countries with limited road and air transportation networks can particularly benefit from remote towers as they facilitate safe and efficient air travel.

Remote towers have also been effective in reducing the costs associated with on-site air traffic control towers by eliminating the requirement for costly physical infrastructure, such as tall control towers, and by allowing one operator to oversee multiple airports. Thus, remote towers can be a cost-efficient, safer, and more technologically advanced solution for air traffic control in regions with limited network infrastructure.

Segmentation Analysis

The global market is segmented based on operation, system, application, and geography.

By Operation

Based on the operation, the market is categorized into single remote virtual tower, multiple remote virtual tower, and contingency remote virtual tower. The single remote virtual tower segment accounted largest remote towers market share of 41.23% in 2022. The application of single remote virtual towers is primarily to enable efficient and cost-effective air traffic control services in locations with low air traffic levels. They can also be used as contingency options for major airports or apron control.

The technology relies on real-time video, audio feeds, object detection, and alerting functions to ensure efficient control of air traffic. Implementations of single remote virtual towers have been approved and are integrated into operations in several EASA member states.

By System

Based on the system, the market is divided into airport equipment, remote tower modules, and network solutions. The airport equipment segment dominated the remote towers market share with 44.38% in 2022. Remote tower technology relies on specific airport equipment, including high-resolution cameras, sensors, and hardware, to ensure efficient control of air traffic.

Some of the equipment used in remote tower technology includes airfield lighting, navigational aids, automated weather observing systems, and other specialized video analytics and object detection systems.

By Application

Based on the application, the remote towers market is categorized into communication, information, flight control, surveillance & visualization. The communication segment is expected to hold the largest market share of 35.96% during the forecast period. Communication systems used in remote tower technology include data communication networks between the local airport and the remote location, which transmit real-time video and audio feeds. Other communication systems used include voice communication control systems (VCCS), IP-based radio systems, and integrated communication systems (ICS).

In summary, communication systems are crucial in remote tower technology, and the industry is expected to see significant growth in this area in the future. Moreover, remote towers integrate various advanced communication systems to ensure reliable and efficient air traffic control services.

Remote Towers Market Regional Analysis

Based on regional analysis, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Europe Remote Towers Market share stood around 41.71% in 2022 in the global market, with a valuation of USD 53.8 million. Germany has been actively involved in developing and implementing remote towers, with multiple companies providing additional services in the country. The German air navigation service provider DFS has partnered with FREQUENTIS DFS AEROSENSE to build a Remote Tower Centre for two German airports.

- For instance, in March 2023, Indra, a Spanish firm specializing in technology and consulting, got a contract to implement its digital remote tower technology for HungaroControl at Budapest airport.

Moreover, few companies are focusing on supplies for the armed forces, which is augmenting remote towers market development.

- For instance, in April 2022, Saab achieved accreditation under the Air Traffic Management (ATM) Equipment Approved Organization Scheme (AAOS) by the UK Military Aviation Authority, which allows the company to develop, supply, install, and maintain ATM equipment for customers in the UK Ministry of Defence as per the guidelines of Regulatory Article 1027.

Competitive Landscape

The remote towers market report will provide valuable insight with an emphasis on the consolidated nature of the global market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions. Development and investments involve a range of strategic initiatives including investments in R&D activities, new manufacturing facilities, and supply chain optimization.

List of Key Companies in Remote Towers Market

- Thales

- Adacel Technologies Limited

- Raytheon Technologies Corporation

- DFS Deutsche Flugsicherung GmbH

- Leidos

- Saab AB

- Kongsberg Defence & Aerospace

- Becker Avionics GmbH

- L3Harris Technologies, Inc.

- Searidge Technologies

- Avinor AS

- Leonardo S.p.A.

- Rohde & Schwarz

- EIZO Corporation

- FREQUENTIS AG

Key Industry Developments

- In March 2023 (Collaboration): Adacel Technologies Limited and Estonian Air Navigation Services (EANS) announced that the REVAL ATS digital tower system, which was developed in collaboration with EANS, has achieved a significant milestone. The system, deployed at Tartu Airport in Estonia, has received an aeronautical equipment certificate from the Estonian Transport Administration.

- In March 2023 (Collaboration): Rohde & Schwarz has equipped the North Macedonian ANSP with state-of-the-art VoIP technology. The ANSP of the Republic of North Macedonia, M-NAV GOJSC, selected CERTIUM VCS by Rohde & Schwarz to update the communication systems with the latest technology available in the market.

- In January 2023 (Expansion): EIZO Corporation has declared the creation of a fully owned subsidiary, namely EIZO Private Limited, located in Mumbai, Maharashtra, India, with the focus of extending the company's sales and marketing operations throughout the region.

- In September 2021 (Partnership): Becker Avionics and Iris Automation have formed a strategic partnership aimed at enhancing the situational awareness of general aviation pilots and improving the safety of uncrewed aerial vehicles (UAVs). As part of this collaboration, the two companies work together with a focus to develop an optional safety equipment system that can detect and alert pilots of potential threats posed by nearby aircraft.

The Global Remote Towers Market is segmented as:

By Operation

- Single Remote Virtual Tower

- Multiple Remote Virtual Tower

- Contingency Remote Virtual Tower

By System

- Airport Equipment

- Remote Tower Modules

- Network Solutions

By Application

- Communication

- Information

- Flight Control

- Surveillance

- Visualization

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America