Market Definition

The release liner market encompasses the global industry focused on producing and supplying release liners, which are specialized backing materials coated with a release agent to facilitate easy separation from adhesive products. These liners play a critical role in packaging, medical, automotive, electronics, and labels, ensuring efficient handling and application of adhesives.

Release Liner Market Overview

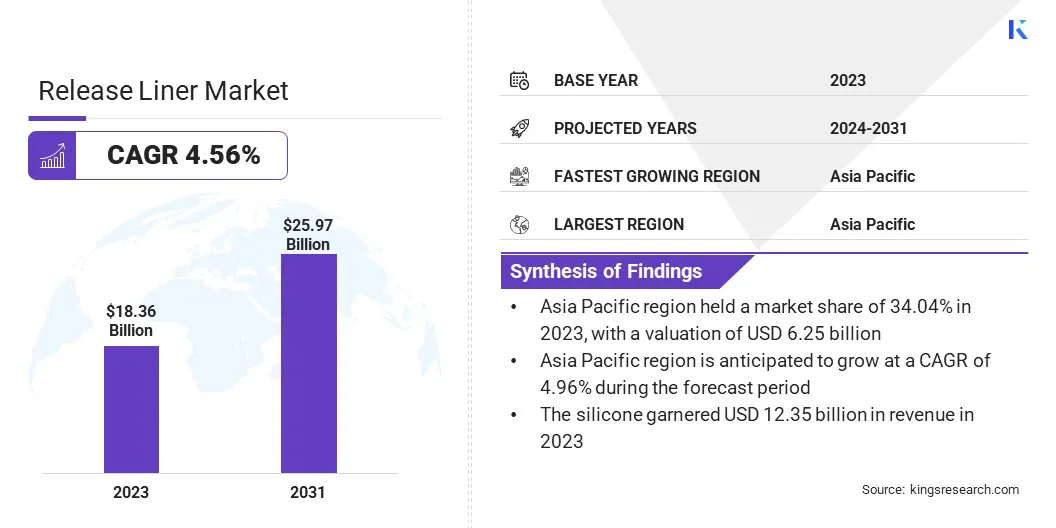

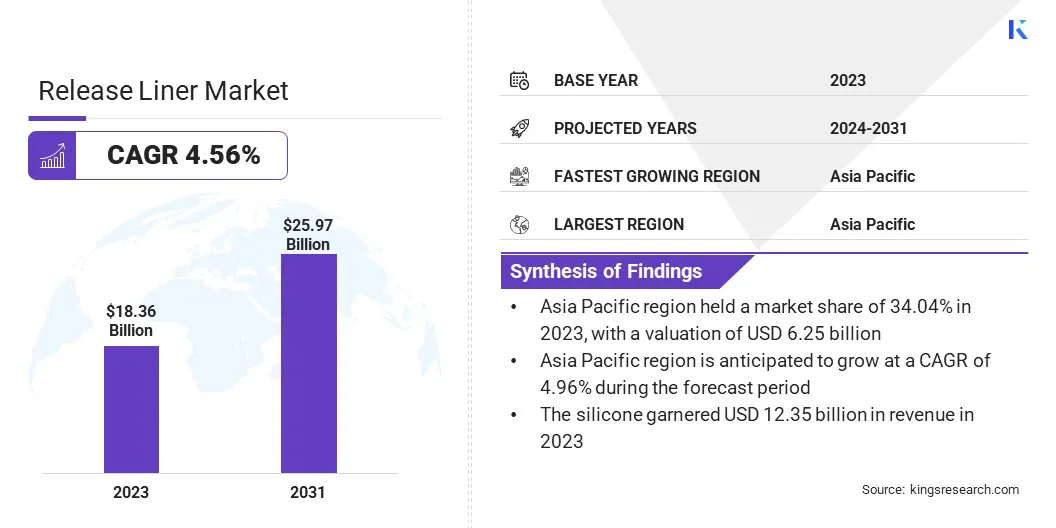

According to Kings Research, the global release liner market size was valued at USD 18.36 billion in 2023 and is projected to grow from USD 19.01 billion in 2024 to USD 25.97 billion by 2031, exhibiting a CAGR of 4.56% during the forecast period. This growth is driven by its increasing demand in packaging, medical, automotive, electronics, and labels, where release liners are essential for adhesive applications.

Major companies operating in the global release liner industry are Ahlstrom, Laufenberg GmbH, Techlan, Quanjiao Guangtai Adhesive Products Co., Ltd., Loparex, UPM-Kymmene Corporation, Dow, Sappi Group, ITASA, delfortgroup AG, Avery Dennison Corporation, Premier Coating & Converters Ltd., 3M, Gleicher Manufacturing Corporation, and Mondi.

Key Market Highlights:

- The release liner market size was valued at USD 18.36 billion in 2023.

- The market is projected to grow at a CAGR of 4.56% from 2024 to 2031.

- Asia Pacific held a market share of 34.04% in 2023, with a valuation of USD 6.25 billion.

- The double segment garnered USD 9.75 billion in revenue in 2023.

- The silicone segment is expected to reach USD 17.48 billion by 2031.

- The labels segment is expected to reach USD 7.64 billion by 2031.

- The market in Europe is anticipated to grow at a CAGR of 4.58% during the forecast period.

The rise of e-commerce and logistics has further fueled the demand for Pressure-sensitive Labels (PSLs), contributing to market expansion.

Additionally, advancements in biodegradable and recyclable liner materials are shaping market trends as companies prioritize sustainability and regulatory compliance. The market is expected to register steady growth globally, due to the growing investments in innovative liner technologies.

- In July 2024, Techlan launched its 60gsm Honey glassine, a 100% recycled release liner, delivering a 67% reduction in CO₂ footprint compared to traditional liners. This innovation highlights its commitment to sustainable and high-performance solutions, meeting the rising demand for eco-friendly release liners across various industries.

Growing Demand for PSLs

The release liner market is registering strong growth, due to the increasing demand for PSLs across multiple industries. PSLs are widely used in sectors such as food & beverages, pharmaceuticals, personal care, and logistics, due to their ease of application, durability, and strong adhesion.

The need for reliable release liners continues to rise as companies look for efficient and high-performance labeling solutions. Additionally, the role of advanced release liners becomes critical as businesses continue to automate their labeling processes for greater efficiency. The market is expected to grow steadily alongside the expanding PSL industry, due to ongoing innovations in liner materials and adhesive technologies.

Waste Generation and Environmental Impact

One of the primary challenges facing the release liner market is the issue of waste generation and environmental impact. Traditional release liners, particularly those made from silicone-coated paper and film, contribute to significant waste after their intended use.

The use of silicone coatings renders most release liners non-recyclable, thus, their disposal issues pose a sustainability challenge, especially with growing regulatory pressures for eco-friendly packaging solutions. Additionally, landfill disposal and incineration of liners contribute to carbon emissions, raising environmental concerns.

Companies in the market are focusing on developing recyclable and compostable liner materials. Silicone-free release liners, paper-based recyclable liners, and linerless labels are emerging as viable alternatives to reduce waste. Additionally, manufacturers are investing in closed-loop recycling systems, where used liners are collected, processed, and repurposed into new materials.

Advancements in Biodegradable and Recyclable Liner Materials

The release liner market is undergoing a significant transformation driven by advancements in biodegradable and recyclable liner materials. Manufacturers are investing in eco-friendly alternatives to traditional silicone-coated liners, which often pose recycling challenges.

Innovations in fiber-based liners, water-based silicone coatings, and compostable materials are gaining traction, enabling companies to reduce waste and improve the recyclability of release liners.

Leading players in the market are also developing closed-loop recycling programs, where used liners are collected, processed, and repurposed into new materials, aligning with circular economy principles.

- In May 2023, Mondi partnered with Beiersdorf to introduce recyclable release liners for wound care plasters, reinforcing sustainability in medical packaging. This innovation aligns with circular economy goals, reducing waste while maintaining product integrity and performance. The collaboration highlights the growing demand for eco-friendly solutions in the global market.

Release Liner Market Report Snapshot

|

Segmentation

|

Details

|

|

By Coating

|

Single, Double

|

|

By Material

|

Silicone, Non-silicone

|

|

By Application

|

Labels, Graphics, Tapes, Industrial, Medical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Coating (Single and Double): The double segment earned USD 9.75 billion in 2023, due to its superior durability, enhanced adhesive performance, and wide applicability across industries such as automotive, electronics, medical, and industrial manufacturing.

- By Material (Silicone and Non-silicone): The silicone segment held 67.24% share of the market in 2023, due to its excellent release properties, chemical resistance, and ability to perform under extreme temperatures.

- By Application (Labels, Graphics, Tapes, and Industrial): The labels segment is projected to reach USD 7.64 billion by 2031, owing to the expanding e-commerce industry, increasing demand for product labeling in consumer goods, and stringent labeling regulations in pharmaceuticals & food packaging.

Release Liner Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a release liner market share of around 34.04% in 2023, with a valuation of USD 6.25 billion. This region is registering rapid industrialization, urbanization, and an expanding manufacturing sector, driving the demand for PSLs, tapes, and specialty coatings.

The booming e-commerce industry, particularly in China, India, and Southeast Asia, is fueling the need for high-performance labeling and packaging solutions, further accelerating market growth.

Additionally, sustainability initiatives and government regulations on waste management are prompting manufacturers to develop recyclable and biodegradable release liners. The presence of key industry players and rising investments in advanced coating technologies contribute to the market dominance in Asia Pacific.

- In 2024, according to the India Brand Equity Foundation,India's e-commerce market is projected to surge from USD 123 billion to USD 292.3 billion by 2028, which is driving the demand for efficient packaging, labeling, and logistics solutions, creating significant growth opportunities for the market and related industries.

The release liner industry in Europe is poised to grow at a significant CAGR of 4.58% over the forecast period, driven by strict environmental regulations, rising demand for sustainable packaging, and expansion of key industries such as food & beverages, healthcare, and automotive.

The region is a pioneer in sustainability initiatives, with regulatory bodies enforcing stringent policies on recyclability and waste reduction. This has accelerated the shift toward silicone-free, linerless, and biodegradable release liner solutions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates release liners used in food packaging and medical applications to ensure safety and compliance with material standards.

- In Europe, the European Food Safety Authority (EFSA) regulates release liners used in food packaging to ensure consumer safety and material compliance. Under Regulation (EC) No 1935/2004, release liner materials must not transfer harmful substances into food, maintaining high safety and quality standards.

Competitive Landscape:

The global release liner market is characterized by a large number of participants, including both established corporations and emerging organizations . Leading companies focus on enhancing product performance, sustainability, and recyclability to align with evolving industry regulations and customer preferences.

Investments in R&D, digital printing technologies, and linerless solutions are leading to market differentiation. Additionally, companies are engaging in mergers, acquisitions, and capacity expansions to strengthen their global footprint and supply chain efficiencies.

The market is also registering increasing collaborations between manufacturers, raw material suppliers, and end users to accelerate the development of high-performance and eco-friendly release liners.

With rising demand for sustainable solutions, companies are actively exploring biodegradable coatings, solvent-free adhesives, and fiber-based liners to reduce environmental impact. Furthermore, advancements in silicone coating technologies, Pressure-sensitive Adhesives (PSAs), and UV-cured release liners are enhancing product durability and efficiency.

Key Companies in Release Liner Market:

- Ahlstrom

- Laufenberg GmbH

- Techlan

- Quanjiao Guangtai Adhesive Products Co., Ltd.

- Loparex

- UPM-Kymmene Corporation

- Dow

- Sappi Group

- ITASA

- delfortgroup AG

- Avery Dennison Corporation

- Premier Coating & Converters Ltd.

- 3M

- Gleicher Manufacturing Corporation

- Mondi

Recent Developments (New Product Launch)

- In February 2025, SATO Corporation launched a silicone-coated release liner recycling program, transforming 19 tons of waste annually into a valuable resource at its Kitakami Operations facility in Japan. This initiative aligns with sustainability goals, reducing CO2 emissions and setting a benchmark for eco-friendly innovation in the global release liner market.