Market Definition

Regulatory affairs outsourcing refers to the practice of delegating regulatory compliance tasks to third-party service providers, commonly in industries such as pharmaceuticals, biotechnology, medical devices, and healthcare.

This approach involves managing regulatory strategy development, documentation preparation, submission of applications for product approvals, compliance monitoring, and post-market surveillance. It allows organizations to focus on core activities such as research and development while ensuring compliance across diverse global markets efficiently.

Regulatory Affairs Outsourcing Market Overview

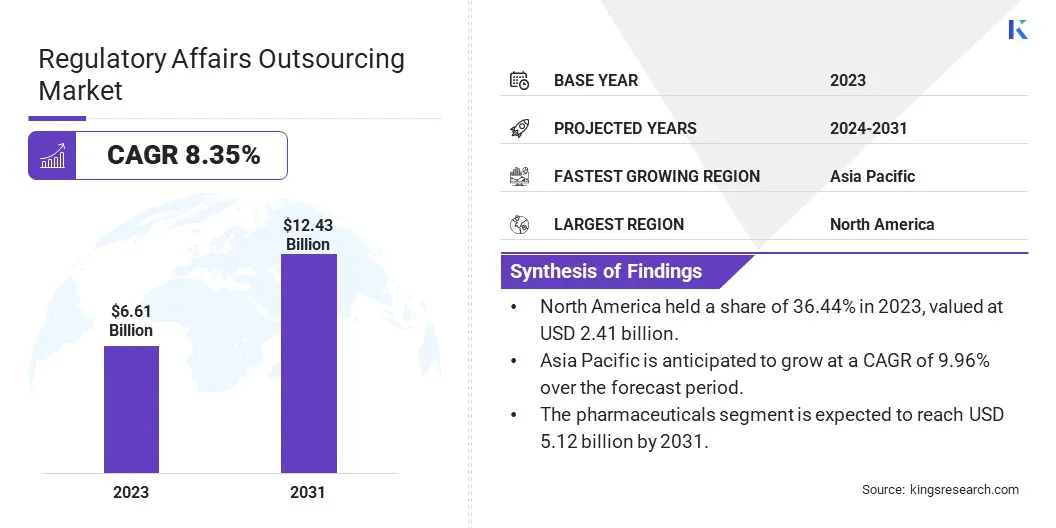

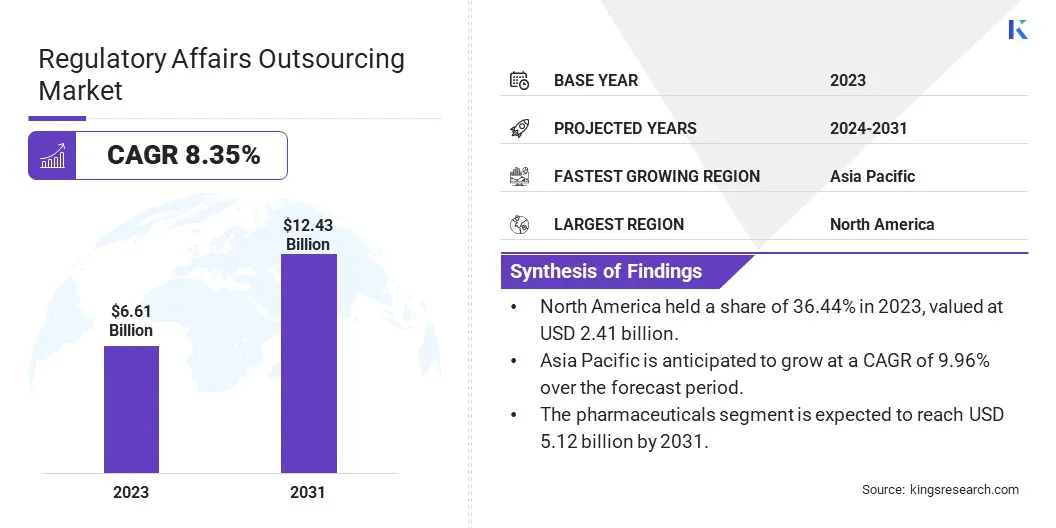

The global regulatory affairs outsourcing market size was valued at USD 6.61 billion in 2023 and is projected to grow from USD 7.09 billion in 2024 to USD 12.43 billion by 2031, exhibiting a CAGR of 8.35% during the forecast period.

The market is experiencing significant growth, driven by the increasing complexity of global regulatory frameworks and the rising demand for cost-effective compliance solutions. Additionally, expanding clinical trials, the rise of advanced therapy medicinal products, and the growing focus on post-market surveillance further fuel market expansion.

Major companies operating in the global regulatory affairs outsourcing market are Accell Clinical Research, LLC, Genpact, WuXi AppTec, Medpace, Charles River Laboratories, CRITERIUM, INC., iuvo BioScience, llc., Covance, Freyr, ICON plc, PHARMALEX GMBH., Groupe ProductLife S.A., Parexel International (MA) Corporation, Biomapas Group, Thermo Fisher Scientific Inc. (PPD), and others.

Outsourcing regulatory affairs functions contributes to a heightened focus on quality and compliance, which drives the growth of the market. Regulatory bodies are placing increasing emphasis on safety and quality standards, particularly in highly regulated industries such as healthcare and pharmaceuticals.

- In December 2023, the FDA released an updated draft guidance called "Clinical Pharmacology Considerations for Peptide Drug Products." This guidance aims to provide clearer instructions on conducting clinical studies for peptide drugs, ensuring their safety and effectiveness.

Key Highlights:

- The global regulatory affairs outsourcing market size was recorded at USD 6.61 billion in 2023.

- The market is projected to grow at a CAGR of 8.35% from 2024 to 2031.

- North America held a share of 36.44% in 2023, valued at USD 2.41 billion.

- The submission preparation and management segment garnered a revenue of USD 2.69 billion in 2023.

- The pharmaceuticals segment is expected to reach USD 5.12 billion by 2031.

- The pharmaceutical and biotechnology companies segment is anticipated to grow at the highest CAGR of 8.96% from 2024 to 2031.

- Asia Pacific is anticipated to grow at a CAGR of 9.96% over the forecast period.

Market Driver

"Growing Number of Clinical Trials Globally"

The growing number of clinical trials worldwide is boosting the growth of the regulatory affairs outsourcing market. With the increasing focus on innovation and the development of new therapies, there has been a rise in the number of clinical trials conducted globally.

- As of 2024, ClinicalTrials.gov lists a total of 520,893 studies, an increase from 477,212 in 2023, with research conducted across all 50 U.S. states and 226 countries and territories globally. Of these, 68,660 have published their results, offering valuable insights into the outcomes of various clinical trials.

Managing the regulatory aspects of these trials, including obtaining approvals, ensuring compliance with local regulations, and submitting required documentation, is complex and time-intensive.

Outsourcing partners, with their expertise in global regulatory requirements, help streamline the approval process, reduce delays, and ensure that clinical trials are conducted in accordance with the necessary regulatory standards. This increasing demand for regulatory support in clinical trials further fuels the expansion of the market.

Market Challenge

"Tackling Regulatory Compliance in Multiple Regions"

A significant factor restraining the growth of the regulatory affairs outsourcing market is the challenge of maintaining compliance with varying regulatory requirements across multiple regions. Global markets exhibit significant differences in regulations, documentation standards, and approval timelines, creating complexity for outsourced service providers.

This variability increases the risk of delays, errors, and potential non-compliance, impacting the efficiency and effectiveness of outsourced operations.

To address this challenge, companies are increasingly adopting advanced digital tools and artificial intelligence (AI) to streamline regulatory processes and ensure accuracy in documentation. Leveraging AI-powered platforms helps providers adapt to changing regulations by offering real-time updates and predictive analytics.

Additionally, firms are investing in region-specific expertise by establishing local teams or partnerships with in-market specialists to navigate regulatory landscapes more effectively. These approaches enhance adaptability, minimize compliance risks, and improve service delivery, mitigating the impact of regulatory complexities on market growth.

Market Trend

"Regulatory Outsourcing Rises with Digital Health Trends"

The rapid expansion of digital health products and services, such as mobile health apps, wearables, and telemedicine solutions, is contributing to the growth of the regulatory affairs outsourcing market. Regulatory bodies are developing new frameworks to address the unique challenges posed by digital health innovations.

These products often require a different approach to regulatory compliance, including data privacy concerns, cybersecurity standards, and novel clinical trial requirements.

- In December 2023, the FDA released final guidance on the use of digital health technologies (DHTs) for data acquisition in clinical research. This updated guidance outlines the FDA's current perspective on the relationship between device regulations and DHTs in clinical research, provides details on validating specific DHTs, and outlines expectations for record retention and inspections.

Companies developing digital health solutions are turning to outsourcing firms with expertise in this field to navigate evolving regulations

Regulatory Affairs Outsourcing Market Report Snapshot

| Segmentation |

Details |

| By Service |

Regulatory Consulting, Legal Representation, Submission Preparation and Management, Quality and Compliance, Others |

| By Application |

Pharmaceuticals, Medical Device, Biologics, Others |

| By End-User |

Pharmaceutical and Biotechnology Companies, Medical Device Manufacturers, Contract Research Organizations (CROs) |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Service (regulatory consulting, legal representation, submission preparation and management, quality and compliance, and others): The submission preparation and management segment generated a revenue of USD 2.69 billion in 2023 due to its critical role in ensuring timely and accurate documentation for regulatory compliance, expediting product approvals across diverse markets.

- By Application (pharmaceuticals, medical device, biologics, and others): The pharmaceuticals segment held a notable share of 42.98% in 2023, primarily fueled by the increasing complexity of drug development processes and stringent regulatory requirements.

- By End-User (pharmaceutical and biotechnology companies, medical device manufacturers, and contract research organizations (CROs)): The pharmaceutical and biotechnology companies segment is projected to reach a valuation of USD 6.16 billion by 2031, largely attributed to the high demand for expert services to manage complex regulatory requirements and accelerate drug approvals.

Regulatory Affairs Outsourcing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America regulatory affairs outsourcing market accounted for a notable share of around 36.44% in 2023, valued at USD 2.41 billion. The region's well-established pharmaceutical and biotechnology industries are propelling this expansion. The increasing volume of drug approvals, clinical trials, and continuous innovation in therapeutics requires expert regulatory services to navigate complex approval processes.

- For instance, in 2024, the FDA’s Center for Drug Evaluation and Research (CDER) approved 50 novel drugs. This category includes drugs with new active ingredients and those with previously approved active ingredients, now approved for treating different conditions or new patient populations.

The demand for specialized regulatory affairs outsourcing is increasing as companies seek to meet the stringent regulatory requirements, such as those of the FDA, while accelerating product development timelines

Asia Pacific is projected to grow at the fastest CAGR of 9.96% over the forecast period. The pharmaceutical and biotechnology sectors in Asia-Pacific are experiencing rapid growth, fueled by increased R&D investments, advancements in biopharmaceuticals, and a expanding healthcare market.

With a growing number of biotech and pharmaceutical companies in the region, there is a growing demand for regulatory expertise.

- In January 2023, GenScript’s biologics subsidiary, ProBio, completed its third fundraising round in less than two years, securing USD 224 million. The funds aims to support working capital, business expansion, and growth initiatives, positioning ProBio to meet the evolving regulatory needs in China's expanding pharmaceutical and biotechnology sectors.

Outsourcing regulatory affairs allows these companies to manage the complexities of local and international regulations, improving their ability to introduce innovative drugs and therapies to the market, thereby enhancing their competitive positioning.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. FDA guidelines for drug development and approval are constantly evolving. Significant updates often occur with new legislation or agency guidance. The 21st Century Cures Act (2016) introduced several provisions aimed at expeditating drug development and approval, including breakthrough therapy designations and accelerated approval pathways.

- The European Medicines Agency (EMA) regulates drug approvals through a centralized system that allows pharmaceutical products to be marketed across all EU member states. EMA’s stringent guidelines for clinical trials, pharmacovigilance, and manufacturing quality ensure the safety and efficacy of medicinal products.

- The Medicines and Healthcare Products Regulatory Agency (MHRA) enforces drug approval and clinical trial regulations in the UK. After Brexit, the UK established a seperate regulatory framework from the EU, with a focus on ensuring products meet UK-specific standards.

- The Pharmaceuticals and Medical Devices Agency (PMDA) enforces stringent regulations for clinical trials, drug approvals, and post-market surveillance in Japan. Compliance with Good Clinical Practice (GCP) and Good Manufacturing Practice (GMP) is mandatory. Partnering with regulatory experts helps organizations navigate PMDA guidelines, facilitating timely approval and effecient market access in Japan’s highly regulated environment.

- The Central Drugs Standard Control Organization (CDSCO) regulates drug approvals and clinical trials under the Drugs and Cosmetics Act. In response to stringent clinical trial and approval requirements, several companies partner with service providers to effectively navigate these regulations.

Competitive Landscape

The global regulatory affairs outsourcing market is characterized by a number of participants, including both established corporations and rising organizations. Key players in the market are increasingly focusing on partnerships and collaborations with various stakeholders, including non-profit membership associations, contract research organizations (CROs), technology providers, and biopharmaceutical firms. These collaborations aim to streamline regulatory processes, enhance compliance capabilities, and leverage advanced technologies for efficient data management.

- In January 2025, WuXi AppTec joined the Pharmaceutical Supply Chain Initiative (PSCI) as a Supplier Partner, demonstrating its dedication to responsible business practices and supply chain resilience. This strategic collaboration aligns with the company's focus on enhancing operational sustainability and compliance. By adhering to PSCI principles, the company reinforces its position as a trusted partner in delivering high-quality, ethically sourced solutions, and contributing to the expansion of outsourcing services in the pharmaceutical sector.

By aligning with non-profit associations, companies gain access to industry insights and policy advocacy, while partnerships with CROs enable expertise in clinical trial management and regulatory submissions.

List of Key Companies in Regulatory Affairs Outsourcing Market

- Accell Clinical Research, LLC

- Genpact

- WuXi AppTec

- Medpace

- Charles River Laboratories

- CRITERIUM, INC.

- iuvo BioScience, llc

- Covance

- Freyr

- ICON plc

- PHARMALEX GMBH.

- Groupe ProductLife S.A.

- Parexel International (MA) Corporation

- Biomapas Group

- Thermo Fisher Scientific Inc. (PPD)

Recent Developments

- In January 2023, AmerisourceBergen Corporation announced the successful merger with PharmaLex Holding GmbH. Through this agreement, PharmaLex’s expertise in regulatory affairs, development consulting, and quality management and compliance services enhances AmerisourceBergen’s position as the preferred partner for biopharmaceutical companies.

- In April 2023, PharmaLex Group announced its merger with Cpharm, a leading provider of pharmacovigilance and medical services in Australia and New Zealand. This merger enhnaces PharmaLex's regional presence, leveraging Cpharm’s expertise in drug and device vigilance.

- In May 2023, ProductLife Group (PLG) acquired Cilatus Group companies, specializing in Chemistry, Manufacturing & Controls (CMC) and Qualified Person (QP) services. This strategic move aims to enhance PLG's capabilities, enabling the company to offer more comprehensive support to its clients across CMC development, quality assurance, and regulatory affairs.